Uncertainties surrounding the continuing Ukraine-Russia war, multi-decade-high inflation, and supply chain disruptions since the beginning of the year have led to bearish investor sentiment, resulting in massive sell-offs. Also, last month has been extremely brutal for the major stock market indexes, with S&P 500 and Dow Jones declining 8.8% and 4.9%, respectively, posting the worst April since 1970.

Moreover, the Federal Reserve’s May monetary policy meeting to raise interest rates is expected to trigger market volatility further. As the market will likely remain under pressure in the near term, investing in large-cap stocks could help dodge the short-term fluctuations. Their broader market reach and pricing power help them generate steady returns irrespective of the market movement.

That’s why today we’re highlighting 3 exciting stocks from our Top 10 Large-Cap screen, which is just 1 of the 10 screens in our POWR Screens 10 service (more on that below). We think it could be wise to invest in fundamentally sound large-cap stocks Kroger Co. (KR - Get Rating), América Móvil, S.A.B. de C.V. (AMX - Get Rating), and Abbott Laboratories (ABT - Get Rating). They are also rated Strong Buy in our proprietary POWR Ratings system.

Kroger Co. (KR - Get Rating)

With a market capitalization of $39.03 billion, KR functions as a retailer in the United States. The company operates combination food and drug stores which offer natural food and organic sections, pharmacies, general merchandise, pet centers, fresh seafood, and organic produce, multi-department stores which provides apparel, home fashion and furnishings, outdoor living, electronics, automotive products, and toys, marketplace stores, and price impact warehouses.

Last month, KR and Bed Bath & Beyond Inc. (BBBY), a renowned omnichannel retailer for home, baby, and wellness products, announced the launch of the company’s e-commerce experience. This e-commerce venture enabled by KR’s marketplace has increased several thousand items from Bed Bath & Beyond and buybuy BABY. The curated digital experience is segregated into easily shoppable categories to help customers find exactly what they need quickly.

KR’s sales increased 7.5% year-over-year to $33.05 billion during the fourth quarter ended January 29, 2022. The operating profit amounted to $965 million compared to an operating loss of $158 million in the prior-year quarter. The company’s net earnings amounted to $566 million compared to a net loss of $77 million, while its EPS amounted to $0.75 compared to a loss per share of $0.10 in the previous period.

The consensus EPS estimate of $1.25 represents a 5.1% improvement year-over-year during the first quarter ending April 2022. Analysts expect KR’s revenue to increase 2.9% year-over-year to $42.49 billion during the first quarter ending April 2022. In addition, the company has an impressive earnings history as it surpassed the consensus EPS estimate in all of the trailing four quarters.

The company’s shares have surged 19.2% year-to-date and 34.8% over the past six months.

KR’s POWR Ratings reflect this promising outlook. The company has an overall rating of A, which translates to Strong Buy in our proprietary rating system. The POWR Ratings assess stocks by 118 different factors, each with its own weighting.

The stock also has an A grade for Growth and a B for Value and Quality. Within the A-rated Grocery/Big Box Retailers industry, it is ranked #5 of 39 stocks.

To see additional POWR Ratings for Sentiment, Stability, and Momentum for KR, click here.

América Móvil, S.A.B. de C.V. (AMX - Get Rating)

Headquartered in Mexico City, Mexico, AMX renders telecommunications services in Latin America and internationally. The company offers wireless and fixed voice services, including airtime, local, domestic, and international long-distance services, and network interconnection services. It has a market capitalization of $62.33 billion.

During the first quarter ended March 2022, AMX’s total revenue increased 2.4% year-over-year to Mex$211.23 billion. ($10.34 billion). Its EBIT increased 6.1% year-over-year to Mex$39.84 billion ($1.95 billion), while its net income amounted to Mex$30.80 billion ($1.51 billion). The cash and cash equivalent stood at Mex$176.43 billion ($8.63 billion) for three months ended March 2022.

Analysts expect AMX’s revenue to increase 4.1% year-over-year to $44.62 billion for the year ending December 2023. The consensus EPS estimate of $0.40 for the second quarter ended September 2022 represents a 67.5% improvement year-over-year. Moreover, the company has an impressive earnings history as it surpassed the consensus EPS estimate in all of the trailing four quarters.

The stock has gained 35.87 over the past year and 15.6% over the past nine months.

It is no surprise that AMX has an overall A rating, which equates to Strong Buy in our POWR Ratings system. AMX has a B grade for Stability, Growth, and Value. Among the 47 stocks in the A-rated Telecom – Foreign industry, it is ranked #1.

Click here to see the additional POWR Ratings for AMX (Momentum, Quality, and Sentiment).

Abbott Laboratories (ABT - Get Rating)

Along with its subsidiaries, ABT discovers, develops, manufactures, and sells health care products worldwide. Established Pharmaceutical Products, Diagnostic Products, Nutritional Products, and Medical Devices are the four operational segments. It has a market capitalization of $200.16 billion.

Last month, ABT announced the launch of an upgraded version of its NeuroSphere myPath digital health app with improved functionality that will assist doctors more closely track their patients as they trial Abbott neurostimulation devices to address their chronic pain. This upgrade is a part of ABT’s commitment to connected care technology and has the motive to put people in control of their health and enable better communication with their doctors.

During the first quarter ending March 31, 2022, ABT’s net sales increased 13.8% year-over-year to $11.90 million. The operating earnings grew 38.1% from its year-ago value to $2.91 billion, while the net earnings improved 36.5% from its prior-year quarter to $2.45 billion. The company’s EPS rose 37% year-over-year to $1.37.

The consensus EPS estimate of $4.95 for the year ending December 2023 represents a 2.1% improvement year-over-year. In addition, the company has an impressive earnings history as it surpassed the consensus EPS estimate in all of the trailing four quarters. The stock has declined 5.6% over the past month.

ABT’s strong fundamentals are reflected in its POWR Ratings. The stock has an overall A rating, which equates to Strong Buy in our POWR Ratings system. The stock also has an A grade for Sentiment and a B grade for Stability and Quality. In the Medical – Devices & Equipment industry, it is ranked #2 of 156 stocks.

In total, we rate ABT on eight different levels. Beyond what we’ve stated above, we have also given ABT grades for Growth, Value, and Momentum. Get all the ABT ratings here.

Want more stocks like these?

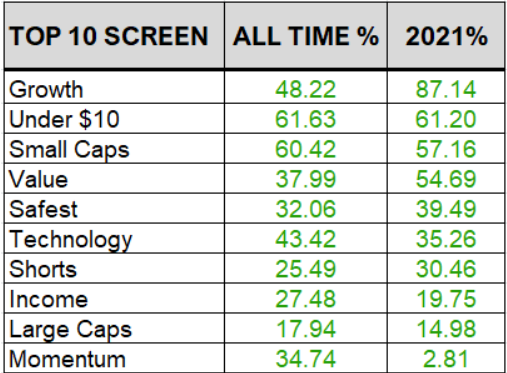

These three stocks are just a fraction of what you will find in our coveted Top 10 Large-Cap strategy. And the value large-cap strategy is just a fraction of what you get with our popular service; POWR Screens 10.

POWR Screens provides 10 market beating strategies with exactly 10 stocks each. Truly something for every investor with verified performance.

Learn More About POWR Screens 10 >>

Want More Great Investing Ideas?

KR shares were trading at $53.89 per share on Monday afternoon, down $0.07 (-0.13%). Year-to-date, KR has gained 19.61%, versus a -12.99% rise in the benchmark S&P 500 index during the same period.

About the Author: Spandan Khandelwal

Spandan's is a financial journalist and investment analyst focused on the stock market. With her ability to interpret financial data, she aims to help investors evaluate the fundamentals of a company before investing. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| KR | Get Rating | Get Rating | Get Rating |

| AMX | Get Rating | Get Rating | Get Rating |

| ABT | Get Rating | Get Rating | Get Rating |