The Middleby Corporation (MIDD - Get Rating) in Elgin, Ill., is a global food service sector leader. The company creates and manufactures a wide range of products for commercial food service, food processing, and private kitchens. It was designated a Forbes World’s Best Employer in 2022, and the company is a charitable partner to groups combating food insecurity.

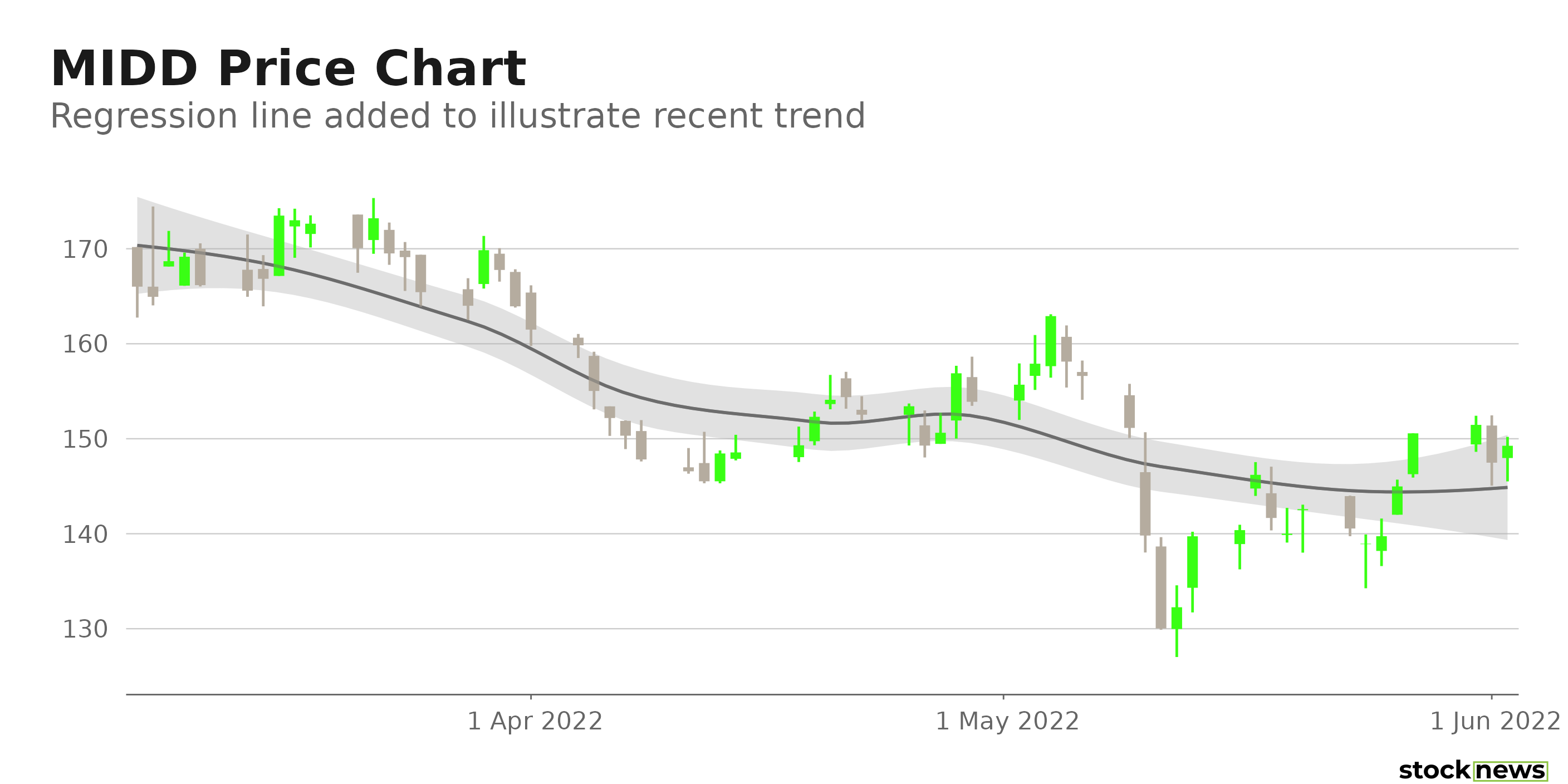

The company’s shares are down 11.4% in price over the past year and 24.2% year-to-date to close yesterday’s trading session at $149.16.

MIDD is set to benefit from strong demand for its products and solutions and investments in product innovation and technical advancement measures. But it has been battling with increased prices and expenses in recent quarters. In the first quarter, the company’s cost of sales and selling, general, and administrative expenditures climbed 37.7% and 33%, respectively, on a year-over-year basis.

Here is what could shape MIDD’s performance in the near term:

Mixed Profitability

MIDD’s 36.2% trailing-12-month gross profit margin is 22.8% higher than the 29.5% industry average. Its trailing-12-month ROA and ROC are 38.4% and 16.8% higher than their respective industry averages. However, its 0.59% trailing-12-month asset turnover ratio is 25.9% lower than its 0.8% industry average. Also, its trailing-12-month CAPEX/Sales multiple and levered FCF margin are 46.5% and 25.4% lower than their respective industry averages.

Premium Valuation

In terms of forward Price/Book, the stock is currently trading at 2.92x, which is 12.9% higher than the 2.58x industry average. Also, its 2.62x forward EV/Sales is 62% higher than the 1.62x industry average. Furthermore, MIDD’s 1.96x forward Price/Sales is 53.3% higher than the 1.28x industry average.

Consensus Rating and Price Target Indicate Potential Upside

Of the four Wall Street analysts that rated MIDD, three rated it Buy, and one rated it Hold. The 12-month median price target of $180.75 indicates a 21.2% potential upside. The price targets range from a low of $160.00 to a high of $201.00.

POWR Ratings Reflect Uncertainty

MIDD has an overall C rating, which equates to a Neutral in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. MIDD has a C grade for Stability and Quality. Its 1.56 stock beta is in sync with the Stability grade. In addition, the company’s mixed profitability is consistent with the Quality grade.

Among the 63 stocks in the C-rated Home Improvement & Goods industry, MIDD is ranked #47.

Beyond what I have stated above, one can view MIDD ratings for Growth, Value, Momentum, and Sentiment here.

Bottom Line

While its strategic growth plans, investment in innovative products, and digital innovation will drive its growth, continuing supply chain, labor, logistical issues, and high costs may jeopardize its performance in the quarters ahead. In addition, the stock is currently trading below its 50-day and 200-day moving averages of $151.40 and $174.14, respectively, indicating a downtrend. So, we think investors should wait before scooping up its shares.

How Does Middleby Corporation (MIDD) Stack Up Against its Peers?

While MIDD has an overall C rating, one might want to consider its industry peer, Acuity Brands Inc. (AYI - Get Rating), which has an overall A (Strong Buy) rating, and Builders FirstSource Inc. (BLDR - Get Rating) and Haverty Furniture Companies Inc. (HVT - Get Rating) which has an overall B (Buy) rating.

Note that BLDR is one of the few stocks handpicked by our Chief Growth Strategist, Jaimini Desai, currently in the POWR Growth portfolio. Learn more here.

Want More Great Investing Ideas?

MIDD shares were unchanged in premarket trading Friday. Year-to-date, MIDD has declined -24.19%, versus a -11.85% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| MIDD | Get Rating | Get Rating | Get Rating |

| AYI | Get Rating | Get Rating | Get Rating |

| BLDR | Get Rating | Get Rating | Get Rating |

| HVT | Get Rating | Get Rating | Get Rating |