MicroStrategy Incorporated (MSTR - Get Rating) in Tysons Corner, Va., is an enterprise analytics software and services provider. The company’s offerings include MicroStrategy, an enterprise platform that supplies a modern analytics experience. It also offers MicroStrategy Support that helps customers and improves the overall experience.

MSTR has invested significantly in Bitcoin over the past two-years. The company has shifted its focus to Bitcoin as opposed to software development. Furthermore, in March, MSTR used a $205 million borrowing through a three-year term loan to accumulate more digital currency. The company has become essentially a Bitcoin-play because its original business is unable to repay all its debt.

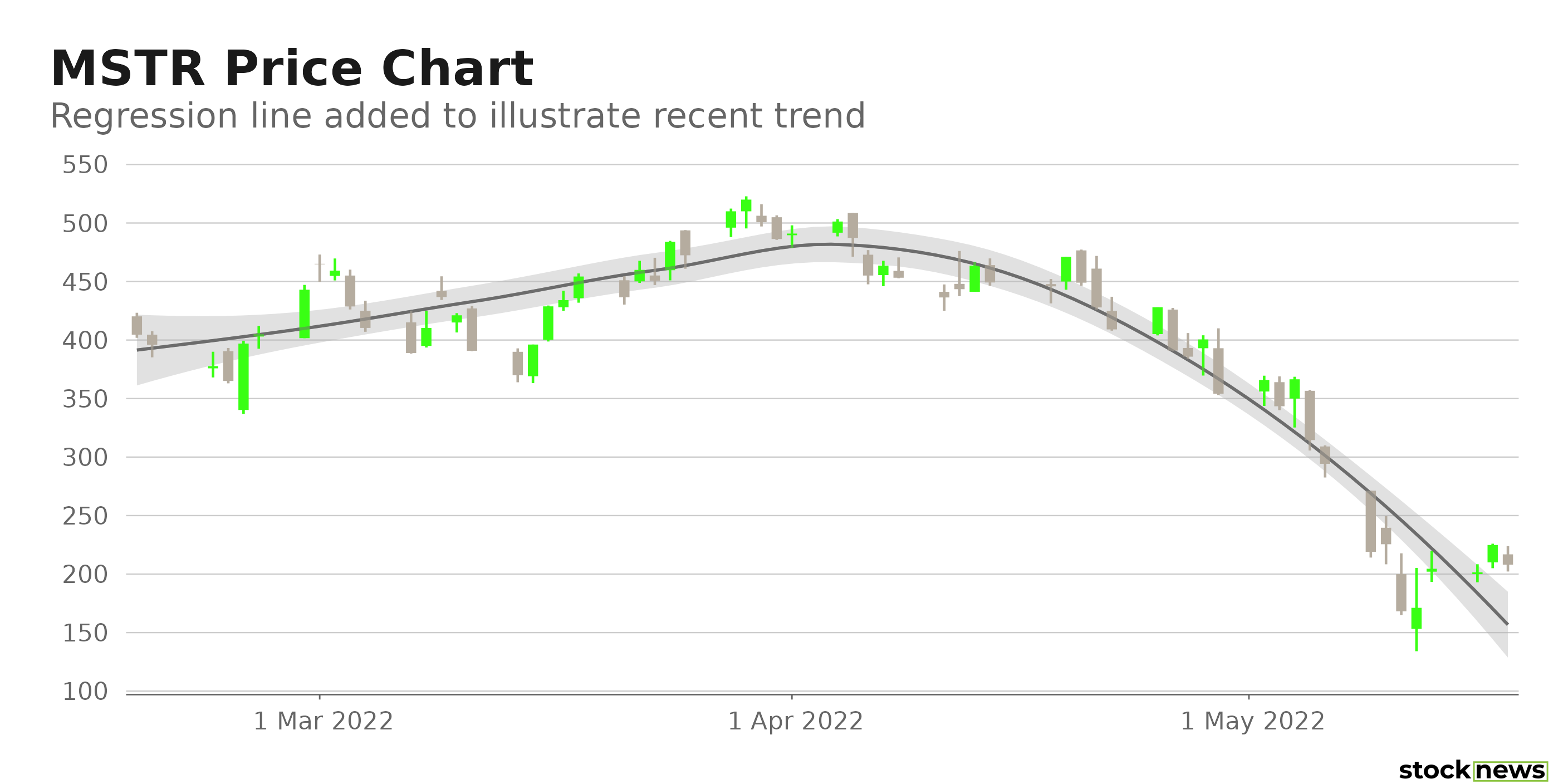

MSTR’s stock has declined 58.7% in price year-to-date and 49.9% over the past month to close yesterday’s trading session at $224.87. The stock is currently trading 74.8% lower than its 52-week high of $891.38. However, it has gained 11.6% in price intraday.

Here are the factors that could affect MSTR’s performance in the near term:

Bleak Financials

For its fiscal first quarter, ended March 31, MSTR’s total revenues decreased 2.9% year-over-year to $119.28 million. Its net loss rose 18.8% from the prior-year period to $130.75 million, while its loss per share increased 1.6% from the same period in the prior year to $11.58. Its non-GAAP net loss and non-GAAP net loss per share came in at $117.67 million and $10.42, respectively.

Analysts Expect EPS to Decline

The consensus EPS estimate of $0.19 for its fiscal quarter ending June 30, 2022, indicates an 89% year-over-year decrease. Furthermore, the Street’s $1.39 EPS estimate for the quarter ending Sept. 30, 2022, reflects a 23% decline from the prior-year quarter.

Analysts expect its EPS to decrease 93.6% from the prior year to $1.90 for its fiscal year 2022. And the Street expects its revenue from the same year to decline 0.9% year-over-year to $506.12 million.

Stretched Valuations

In terms of its forward EV/Sales, MSTR is currently trading at 9.13x, which is 230.4% higher than the 2.76x industry average. The stock’s 6,272.52 forward EV/EBITDA multiple is 52,351.5% higher than the 11.96 industry average. And in terms of its forward EV/EBIT, it is trading at 249.21x, which is 1,509.6% higher than the 15.48x industry average.

Lean Profit Margins

MSTR’s 9.18% trailing 12-month EBITDA margin is 31.94% lower than the 13.49% industry average. Its negative 109.68% trailing 12-month net income margin of a is substantially lower than the 5.83% industry average.

The stock’s negative 90.59% and 15.29% respective trailing 12-month ROE and ROA compare to their respective industry averages of 7.86% and 3.72%. Its 0.18% trailing 12-month ROTC is 83.05% lower than the 4.80% industry average.

POWR Ratings Reflect Bleak Prospects

MSTR’s POWR Ratings reflect this bleak outlook. The stock has an overall rating of D, which equates to Sell in our proprietary rating system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

MSTR has a Sentiment grade of F, which is in sync with its bleak analyst sentiments. The stock has a D grade for Quality, consistent with its lean profitability margins. It also has a Stability grade of D, which is justified by its five-year monthly beta of 1.62.

In the 157-stock Software – Application industry, it is ranked #142. The industry is rated F.

Click here to see the additional POWR Ratings for MSTR (Growth, Value, and Momentum).

View all the top stocks in the Software – Application industry here.

Click here to check out our Software Industry Report for 2022

Bottom Line

Bitcoin has slid over the past few days, setting the cryptocurrency up to extend a seven-week losing streak. MSTR’s exposure to bitcoin could trigger volatility in the stock. Moreover, Wall Street analysts expect its EPS to decline in the coming quarter. Also, the stock looks overvalued at its current price. Hence, I think the stock might be best avoided now.

How Does MicroStrategy Incorporated (MSTR) Stack Up Against its Peers?

While MSTR has an overall POWR Rating of D, one might consider looking at its industry peers, Commvault Systems, Inc. (CVLT - Get Rating) and Rimini Street, Inc. (RMNI - Get Rating), which have an overall A (Strong Buy) rating, and, Karooooo Ltd. (KARO - Get Rating) and Constellation Software Inc. (CNSWF - Get Rating), which have an overall B (Buy) rating.

Want More Great Investing Ideas?

MSTR shares were trading at $208.21 per share on Wednesday afternoon, down $16.66 (-7.41%). Year-to-date, MSTR has declined -61.76%, versus a -16.40% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| MSTR | Get Rating | Get Rating | Get Rating |

| CVLT | Get Rating | Get Rating | Get Rating |

| RMNI | Get Rating | Get Rating | Get Rating |

| KARO | Get Rating | Get Rating | Get Rating |

| CNSWF | Get Rating | Get Rating | Get Rating |