Headquartered in Airport City, Israel, My Size, Inc. (MYSZ - Get Rating) is an omnichannel platform that develops and commercializes device measurement solutions for e-commerce companies. It also provides AI/driven measurement solutions and operates a separate online retail platform Orgad.

MYSZ’s revenue came in at a record $404,000 in its fiscal first quarter, ended March 31, 2022, up 1400% year-over-year. This can be attributed to a 63% year-over-year improvement in MySizeID revenues. Its gross profit rose 467% from the same period last year to $153,000.

However, MYSZ’s gross margin declined 62.1 percentage points to 37.9%. In addition, the company’s operating loss worsened by 39% from the prior-year quarter to $2.11 million. Its net loss widened 50% from the year-ago value to $2.19 million. Its cash and cash equivalents balance stood at $7.80 million as of March 31, 2022, representing a 27.1% decline from the balance reported on Dec. 31, 2021.

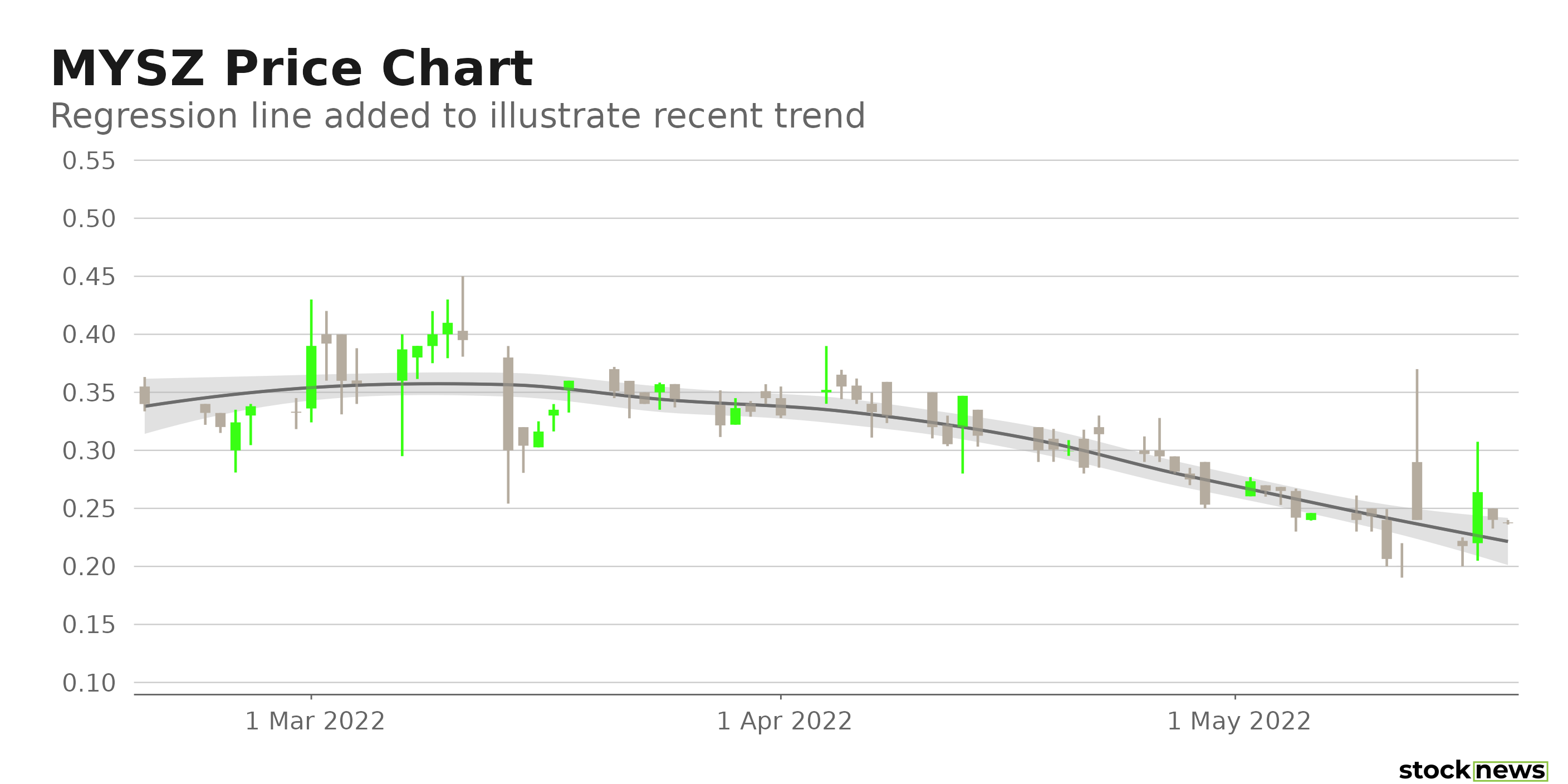

Following the release of the impressive first-quarter results on May 13, MYSZ stock soared 51% in price during premarket trading. The stock has gained 9.1% over the past five days.

Here is what could shape MYSZ’s performance in the near term:

Management Concerns

On October 22, 2021, a sizable MYSZ stockholder, Custodian Ventures LLC, released a statement regarding a lawsuit filed by the company to prevent Custodian Ventures from nominating director candidates. This lawsuit is allegedly a blatant disregard for shareholder rights and undermines corporate democracy.

The statement mentions that approximately 20% of the company’s outstanding shares were diluted in May 2021 for no reason except to “buy the vote” and control the company’s board of directors. MYSZ allegedly put shares in the hands of Shoshana Zigdon. Her husband, Yitzhak Zigdon, was reportedly closely involved in the business also and who at one point had an Interpol listing saying the United States wants him on charges of conspiracy to commit securities fraud, wire fraud, and mail fraud. Furthermore, MYSZ allegedly refused to produce any documents substantiating the legitimacy of the Zigdon transaction.

These allegations raise grave concerns regarding the management and governance of MYSZ, which might adversely impact the company’s growth potential in the future.

POWR Ratings Reflect Bleak Prospects

MYSZ has an overall D rating, which translates to Sell in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

MYSZ has an F grade for Stability and a D for Value. The stock’s relatively high 1.84 beta justifies the Stability grade. In addition, the stock’s negative EV/Revenue multiple is in sync with the Value grade.

Among the 169 stocks in the F-rated Software – Application industry, MYSZ is ranked #131.

Beyond what I’ve stated above, view MYSZ ratings for Momentum, Sentiment, Growth, and Quality here.

Click here to check out our Software Industry Report for 2022

Bottom Line

While MYSZ’s impressive top-line growth has fostered bullish investor sentiment, the substantial management and governance risk is a cause for concern. Allegations made about MYSZ by sizable shareholders are raising concerns regarding the company’s management stability. Thus, we think the stock is best avoided now.

How Does My Size (MYSZ) Stack Up Against its Peers?

While MYSZ has a D rating in our proprietary rating system, one might want to consider looking at its industry peers, Commvault Systems, Inc. (CVLT - Get Rating), Rimini Street Inc. (RMNI - Get Rating), and Enghouse Systems Limited (EGHSF - Get Rating), which have an A (Strong Buy) rating.

What To Do Next?

If you would like to see more top stocks under $10, then you should check out our free special report:

What gives these stocks the right stuff to become big winners?

First, because they are all low-priced companies with explosive growth potential, that excel in key areas of growth, sentiment and momentum.

But even more important is that they are all top Buy rated stocks according to our coveted POWR Ratings system, Yes, that same system where top-rated stocks have averaged a +31.10% annual return.

Click below now to see these 3 exciting stocks which could double (or more!) in the year ahead:

Want More Great Investing Ideas?

MYSZ shares were trading at $0.24 per share on Thursday morning, down $0.00 (-1.21%). Year-to-date, MYSZ has declined -52.48%, versus a -17.77% rise in the benchmark S&P 500 index during the same period.

About the Author: Aditi Ganguly

Aditi is an experienced content developer and financial writer who is passionate about helping investors understand the do’s and don'ts of investing. She has a keen interest in the stock market and has a fundamental approach when analyzing equities. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| MYSZ | Get Rating | Get Rating | Get Rating |

| CVLT | Get Rating | Get Rating | Get Rating |

| RMNI | Get Rating | Get Rating | Get Rating |

| EGHSF | Get Rating | Get Rating | Get Rating |