Traders are currently anticipating the May job report. Although job growth is expected to have slowed in the past month, the labor market remains strong. On Thursday, the major averages rose for the first time in three days after a choppy start. The Dow rose 1.3%. The S&P 500 surged 1.8%, and the tech-heavy Nasdaq Composite gained 2.7%.

However, fear of a possible recession hitting the economy is becoming more and more apparent. Dawn Fitzpatrick, the custodian of billionaire George Soros’s wealth, stated that the sky-high inflation and rate hikes make recession “inevitable.”

In this volatile market scenario where the CBOE Volatility Index (^VIX) is up about 47% this year, income stocks, which are securities that pay regular dividends, might be solid choices. That’s why today we’re highlighting 3 exciting stocks from our Top 10 Income screen, which is just 1 of the 10 screens in our POWR Screens 10 service (more on that below). Natural Resource Partners L.P. (NRP - Get Rating), PT United Tractors Tbk (PUTKY - Get Rating), and Genie Energy Ltd. (GNE - Get Rating) are sound investments to navigate the volatile market.

Natural Resource Partners L.P. (NRP - Get Rating)

NRP owns and operates a diversified portfolio of mineral properties in the United States. The company primarily holds interest in coal, trona, other natural gas resources, and soda ash operations.

On February 7, NRP announced it had executed a CO2 Sequestration Agreement for the evaluation and potential development of a permanent CO2 sequestration site located on Alabama’s Gulf Coast with Denbury Carbon Solutions, LLC, a subsidiary of Denbury Inc. (DEN). Craig Nunez, NRP’s President and Chief Operating Officer, stated, “We are very pleased to partner with Denbury on this world-class carbon sequestration project, which has the potential to provide important benefits to the environment and add significant value to NRP.”

On May 5, NRP declared an increase in its common unit distribution from $0.45 to $0.75 per common unit, which was payable on May 24. Its annual dividend of $3.00 yields 6.35% on its prevailing share price. The company’s dividend payouts have increased at a CAGR of 5.3% and 3.1% over the past three years and the past five years. It has had two years of consecutive dividend growth.

For the fiscal first quarter ended March 31, NRP’s total revenues and other income increased 141.5% year-over-year to $89.72 million. Net income rose 662.4% from the prior-year quarter to $63.90 million. Net income per common unit improved 6,120% from the same period the prior year to $3.11.

The consensus revenue estimate of $208.10 million for the fiscal year 2022 indicates a 7.1% year-over-year increase.

The stock has gained 135.5% over the past year and 40.9% year-to-date to close yesterday’s trading session at $47.09.

NRP’s strong fundamentals are reflected in its POWR Ratings. The stock has an overall rating of A, which equates to a Strong Buy in our proprietary rating system. The POWR Ratings are calculated by considering 118 different factors, with each factor weighted to an optimal degree.

NRP has a Growth, Sentiment, and Quality grade of B. In the 12-stock MLPs – Other industry, it is ranked #1. The industry is rated A.

Click here to see the additional POWR Ratings for NRP (Value, Momentum, and Stability).

PT United Tractors Tbk (PUTKY - Get Rating)

Based in Jakarta Timur, Indonesia, PUTKY engages in the selling and renting of heavy equipment. The company operates through the five broad segments of Construction Machinery; Mining Contracting; Coal Mining; Gold Mining; and Construction Industry.

PUTKY’s annual dividend of $1.71 yields 3.91% on the current share price. Its payout ratio is 23.88%.

PUTKY’s total revenue increased 56.3% year-over-year to IDR27.98 trillion ($1.96 billion) in the fiscal first quarter ended March 31. Net income and EPS improved 131.4% and 131.6% from the prior-year period to IDR4.32 trillion ($302.47 million) and IDR1,158.

Analysts expect PUTKY’s revenue to increase 19.5% year-over-year to $6.63 billion for the fiscal period ending December 2022.

Over the past year, the stock has gained 34.9% and 48.2% year-to-date to close yesterday’s trading session at $44.53.

It’s no surprise that PUTKY has an overall A rating, which translates to Strong Buy in our POWR Rating system.

PUTKY has an A grade for Quality and a B grade for Growth and Stability. It is ranked #3 out of the 88 stocks in the Industrial – Services industry. The industry is rated B.

To see the additional POWR Ratings for Value, Momentum, and Sentiment for PUTKY, click here.

Genie Energy Ltd. (GNE - Get Rating)

GNE operates as an electricity and natural gas supplier for residential and small business customers globally. The company functions through the Genie Retail Energy (GRE); GRE International; and Genie Renewables segments.

On May 25, GNE announced that CPP Genie Community Solar, LLC., the company’s joint venture with community solar customer acquisition firm Community Power Partners, LLC., would provide customer aggregation and management services for certain community solar projects in New York State. CPP Genie is expected to offer subscriptions to a local community solar project to customers without having to install solar panels. This venture might benefit the company.

On May 9, GNE declared a quarterly dividend on its Class A and Class B common stock of $0.075 per share, which was payable to shareholders on or about May 31. Its annual dividend of $0.30 yields 3.68% on current prices.

For the fiscal first quarter ended March 31, GNE’s gross profit increased 259.9% year-over-year to $45.54 million. Net income attributable to GNE common stockholders and EPS came in at $17.52 million and $0.67, up substantially from their negative year-ago values.

GNE’s shares have gained 31.4% over the past year and 46.5% year-to-date to close yesterday’s trading session at $8.16.

GNE has a Value grade of B. In the 92-stock Energy – Oil & Gas industry, it is ranked #32.

In addition to the POWR Rating grades we’ve stated above, one can see GNE ratings for Growth, Momentum, Stability, Sentiment, and Quality here.

Want more stocks like these?

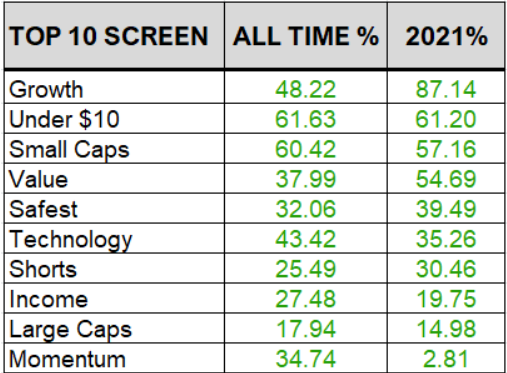

These three stocks are just a fraction of what you will find in our coveted Top 10 Income strategy. And the income strategy is just a fraction of what you get with our popular service; POWR Screens 10.

POWR Screens provides 10 market beating strategies with exactly 10 stocks each. Truly something for every investor with verified performance.

Learn More About POWR Screens 10 >>

Want More Great Investing Ideas?

NRP shares were trading at $46.97 per share on Friday morning, down $0.12 (-0.25%). Year-to-date, NRP has gained 44.45%, versus a -12.76% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| NRP | Get Rating | Get Rating | Get Rating |

| PUTKY | Get Rating | Get Rating | Get Rating |

| GNE | Get Rating | Get Rating | Get Rating |