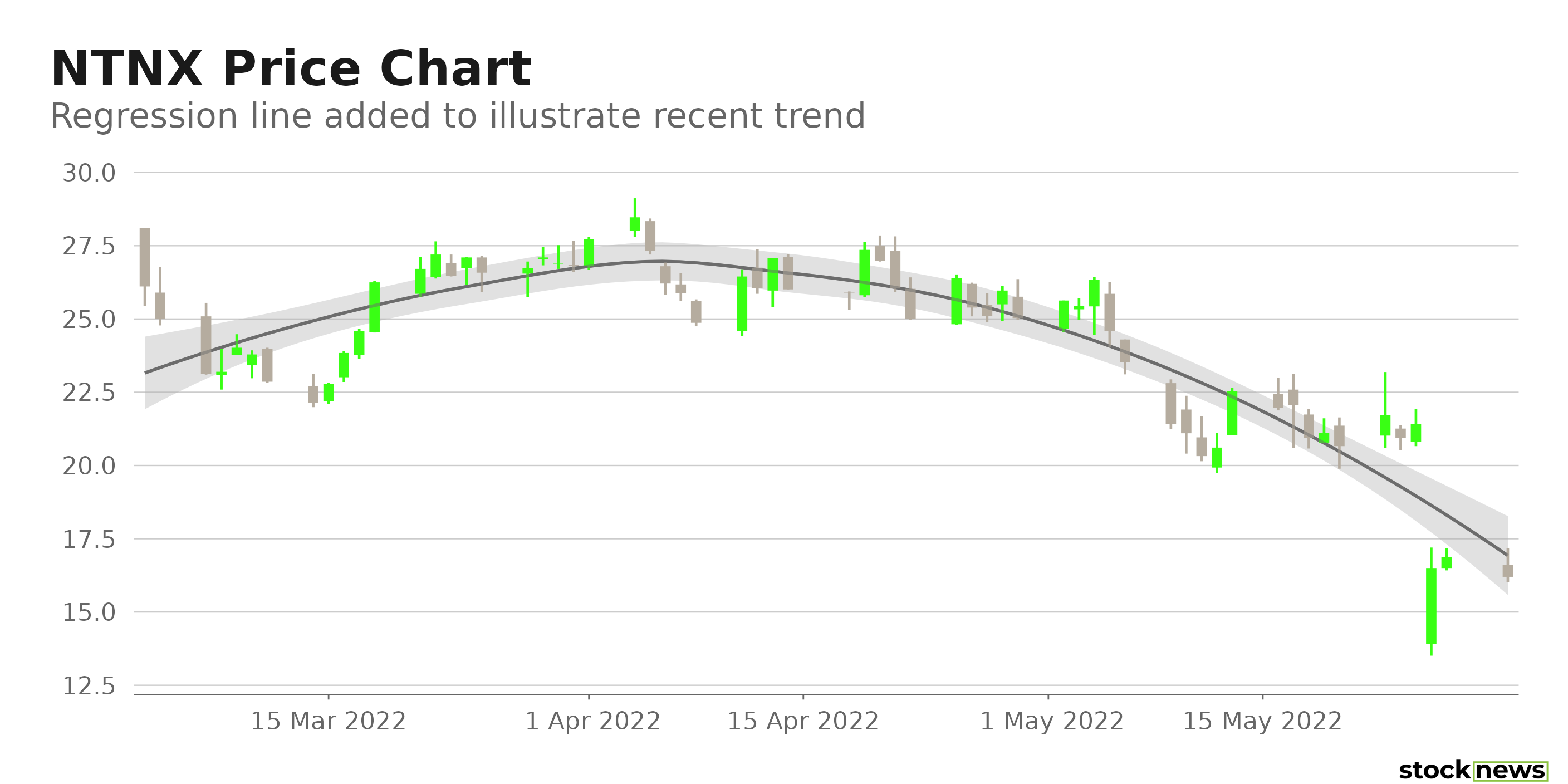

Nutanix Inc. (NTNX - Get Rating) in San Jose, Calif., is a global leader in cloud software and a pioneer in hyper-converged infrastructure solutions, making clouds invisible and allowing clients to focus on their business goals. The company’s shares are down 48.6% in price over the past year and 35.3% over the past month. In addition, closing yesterday’s trading session at $16.20, the stock is currently trading 63.6% below its 52-week high of $44.50, which it hit on Sept. 07, 2021.

The hybrid cloud provider reported solid growth in its fiscal third quarter, but the results fell far short of analyst estimates. NTNX announced quarterly results for the three months ended April 30. Its revenue increased by 17% year-over-year to $404 million, with annual recurring revenue (ARR) increasing by 46% to $1.1 billion.

However, investors were disappointed with the company’s quarterly revenues and instead focused on its loss and prognosis for the rest of the year. NTNX’s $0.50 diluted loss per share in the quarter was an improvement over the $0.60 loss in the year-ago quarter, but it was significantly worse than the $0.22 loss anticipated by Wall Street.

Here is what could shape NTNX’s performance in the near term:

Mixed Profitability

NTNX’s 79.8% trailing-12-months gross profit margin is 58.7% higher than the 50.3% industry average. Its 3.3% trailing-12-months CAPEX/Sales multiple is 38.5% higher than the 2.4% industry average. However, its trailing-12-months net income margin, ROA and ROC are negative 63.4%, 42.7%, and 53.4%, respectively. Also, its $4.91 million trailing-12-months cash from operations is 94.3% lower than the $85.32 million industry average.

Mixed Growth Prospects

The Street expects NTNX’s revenues and EPS to rise 11.6% and 52.7%, respectively, in fiscal 2022. However, NTNX’s EPS is expected to decline at a 38.5% CAGR over the next five years. Furthermore, analysts expect its EPS to decline 53.8% in the current quarter (ending June 30, 2022) and 18.2% next quarter (ending Sept. 30, 2022).

Consensus Rating and Price Target Indicate Potential Upside

Among the 12 Wall Street analysts that rated NTNX, six rated it Buy, and six rated it Hold. The 12-month median price target of $26.50 indicates a 63.6% potential upside. The price targets range from a low of $18.00 to a high of $35.00.

POWR Ratings Reflect Uncertainty

NTNX has an overall C rating, which equates to a Neutral in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. NTNX has a C grade for Stability and Quality. Its 1.49 stock beta is in sync with its Stability grade. In addition, the company’s mixed profitability is consistent with the Quality grade.

Among the 156 stocks in the F-rated Software – Application industry, NTNX is ranked #53.

Beyond what I’ve stated above, you can view NTNX ratings for Growth, Value, Momentum, and Sentiment here.

Click here to check out our Software Industry Report for 2022

Bottom Line

NTNX stock declined nearly 40% in price last week after the cloud computing firm issued poor revenue projections for the fourth quarter and full year, owing to heightened supply-chain disruptions and higher-than-expected sales attrition. In addition, the stock is currently trading below its 50-day and 200-day moving averages of $24.24 and $30.58, respectively, indicating bearish sentiment. So, we think investors should wait before scooping up its shares.

Click here to check out our Cloud Computing Industry Report for 2022

How Does Nutanix Inc. (NTNX) Stack Up Against its Peers?

While NTNX has an overall C rating, one might want to consider its industry peer, Commvault System Inc. (CVLT - Get Rating), Rimini Street Inc. (RMNI - Get Rating), and Progress Software Corporation (PRGS - Get Rating), which has an overall A (Strong Buy) rating.

Want More Great Investing Ideas?

NTNX shares were unchanged in premarket trading Wednesday. Year-to-date, NTNX has declined -49.15%, versus a -12.79% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| NTNX | Get Rating | Get Rating | Get Rating |

| CVLT | Get Rating | Get Rating | Get Rating |

| RMNI | Get Rating | Get Rating | Get Rating |

| PRGS | Get Rating | Get Rating | Get Rating |