Real Estate Investment Trust (REIT) Realty Income Corporation (O - Get Rating) is known for its monthly dividends. The company has grown its topline significantly in the recent past. Its revenue grew at 30.8% and 23% CAGRs over the past three and five years, respectively.

On the other hand, it is trading at a premium compared to its peers. Its forward non-GAAP P/E of 44.71x is 49.5% higher than the industry average of 29.90x, while its trailing-12-month Price/Sales multiple of 10.87 is 147.5% higher than the 4.39 industry multiple.

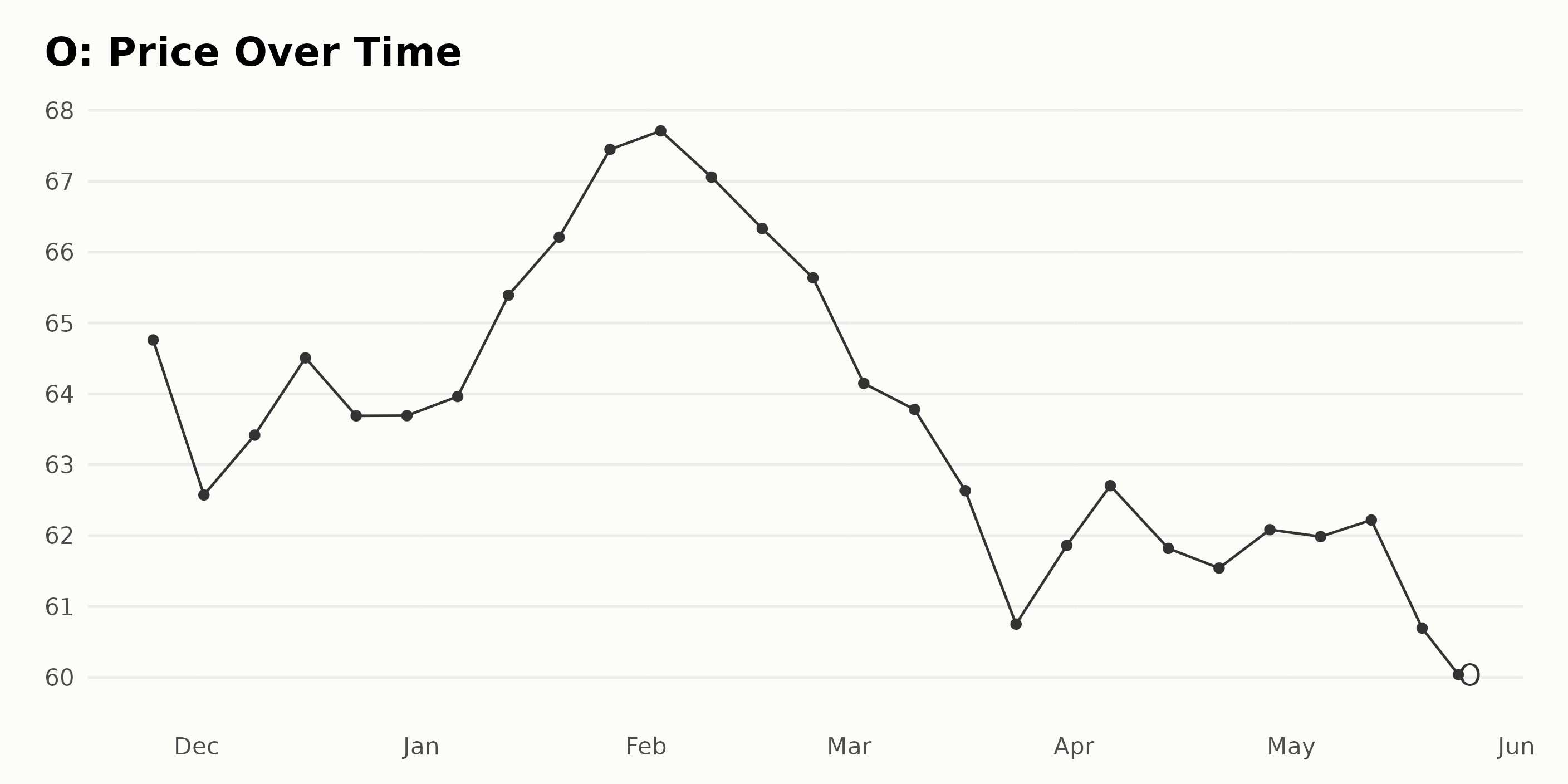

The stock closed its last trading session at $60.10, lower than its 50-day moving average of $61.72 and 200-day moving average of $63.97, indicating a downtrend.

Hence, would it be wise to invest in this Robinhood top 100 stock now? Let’s look at trends of some of its key financial metrics to answer that.

Tracking Realty Income Corporation’s (O) Revenue, Gross Margin & ROA

O’s revenue has steadily increased over the past couple of years. Starting from $1.60 billion in June 2020 to $3.45 billion in March 2023, its revenue grew by around 115% or at an 11.5% growth rate during this period.

This growth rate has been relatively consistent throughout the year, with the most significant jump being from March 2021 to June 2021, where the revenue increased from $1.68 billion to $1.73 billion, representing an increase of $51 million.

O’s gross margin has slightly decreased from 93.9% in June 2020 to 93.0% in March 2023. The gross margin remained mostly stable at around 93.7% until dropping slightly to 93.2% in December 2022 and 93.0% in March 2023. This presents a 0.9% decrease in gross margin between the first and the last value.

The ROA was 0.026 as of June 30, 2020, and has fluctuated since then. The most recent ROA reading was 0.019 as of March 31, 2023 – a 27% decrease from the initial reading. The ROA recorded on March 31, 2021, was 0.017. Hence there is a 12% increase in ROA between March 31, 2021, and March 31, 2023.

O’s price target has seen minimal fluctuation between January 2021 to May 2023. The price target generally stayed around $79 and $78.5, with the greatest variation observed in October 2022, when the price target dropped from $74.8 to $71.8. From the beginning of 2021 through May 2023, the analyst price target increased from $79 to $70.5, representing a growth rate of approximately 10.7%.

Realty Income Corporation Share Prices Show Decline

There is a slight downward trend for O’s share prices since November 25, 2022. The growth rate has decreased from the initial high of $64.76 on November 25, 2022, to the current $60.10 on May 23, 2023. Here is a chart of O’s price over the past 180 days.

Trends in Realty Income POWR Ratings

The most recent POWR Ratings grade of O is a D, which equates to Sell in our proprietary rating system, with a rank of #22 out of 29 stocks in the F-rated REITs – Retail industry.

The three most noteworthy dimensions of O in relation to the POWR Ratings are Growth, Momentum, and Quality. The highest rating for Growth was 91 at the end of November 2022, while the lowest was 30 at the end of March 2023. There is a clear downward trend in this dimension.

Momentum’s highest rating was 72 at the end of November 2022, and its lowest was 45 at the end of May 2023. This shows a decreasing trend. Lastly, Quality’s highest Rating was 55 at the end of May 2023, and its lowest was 36 at the end of December 2022. It shows an increasing trend.

How Does Realty Income Corporation (O) Stack Up Against its Peers?

Other stocks that may be worth considering are Arlington Asset Investment Corp. (AAIC - Get Rating), Saul Centers, Inc. (BFS - Get Rating), and Ladder Capital Corp (LADR - Get Rating) — they have better POWR Ratings.

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

Want More Great Investing Ideas?

O shares were trading at $59.22 per share on Wednesday afternoon, down $0.88 (-1.46%). Year-to-date, O has declined -5.15%, versus a 7.80% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| O | Get Rating | Get Rating | Get Rating |

| AAIC | Get Rating | Get Rating | Get Rating |

| BFS | Get Rating | Get Rating | Get Rating |

| LADR | Get Rating | Get Rating | Get Rating |