Though tensions are high due to the ongoing Russia-Ukraine crisis, not everyone is bearish. According to Brian Belski of BMO Capital Markets, the benchmark S&P 500 would rise to 5,300 by the end of the year. Additionally, Belski doesn’t think a recession is on the horizon.

In addition, the U.S. economy posted its strongest growth in almost four decades in 2021, on the backs of the government’s pumping of nearly $6 trillion for COVID-19 relief. The U.S. economy grew 5.7% in 2021. Pointing to the strength of the underlying economy, job growth in January exceeded expectations.

That’s why today we’re highlighting 3 stocks from our Top 10 momentum screen, which is just 1 of the 10 outperforming screens in our POWR Screens 10 service (more on that below). Obsidian Energy Ltd. (OBE - Get Rating), BCB Bancorp, Inc. (BCBP - Get Rating), and TransGlobe Energy Corporation (TGA - Get Rating) could be ideal investments right now, given their solid momentum.

Obsidian Energy Ltd. (OBE - Get Rating)

OBE explores, produces, and develops oil and natural gas properties in the Western Canada Sedimentary Basin. The company is headquartered in Calgary, Canada. The common shares of the company shifted trading to the NYSE American stock exchange on January 31, 2022,

On January 18, OBE announced the reconfirmation of its syndicated credit facility, with no changes made to its revolving period. The structure is expected to provide a stable capital source, operational liquidity, and a long-term maturity profile.

On November 24, OBE closed its acquisition of the remaining 45% interest in the Peace River Oil Partnership through a subsidiary. About this acquisition, Stephen Loukas, OBE’s Interim President and CEO, commented, “With full ownership and the current favorable commodity price outlook, we are executing a four-well development drilling program that is expected to be on production by the end of January 2022.”

For the fiscal third quarter ended September 30, OBE’s production revenues increased 65.1% year-over-year to CAD124.50 million ($97.58 million). Net income and comprehensive income came in at CAD46.60 million ($36.52 million), while net income per share stood at CAD0.60, both up substantially from their negative year-ago values.

Analysts expect OBE’s revenue to increase 17.5% year-over-year to $423.74 million for the fiscal year 2022.

The stock has gained 572.6% over the past year and 84.5% year-to-date to close Friday’s trading session at $7.60. It is currently trading above its 50-day and 200-day Moving Averages of $5.63 and $3.73, respectively.

BCB Bancorp, Inc. (BCBP - Get Rating)

BCBP operates as a bank holding company for BCB Community Bank that provides banking products and services to businesses and individuals in the country. The company offers deposit products, including savings and club accounts and interest and non-interest-bearing demand accounts, and provides loans, like commercial and multi-family real estate.

On January 14, BCBP declared a quarterly dividend of $0.16 per share, payable to common shareholders on February 15, 2022. This reflects upon the company’s financial performance and ability to return shareholders.

BCBP’s total interest and dividend income increased 0.1% year-over-year to $28.35 million in the fiscal fourth quarter ended December 31. Net income available to common stockholders and net income per common share rose 48.9% and 48.8% from the prior-year quarter to $10.44 million and $0.61.

The consensus EPS estimate of $0.50 for the fiscal quarter ending March 2022 indicates a 25% year-over-year increase. Likewise, the consensus revenue estimate for the same period of $26.32 million reflects an improvement of 8.4% from the prior-year period. Moreover, BCBP has an impressive surprise earnings history, as it has topped consensus EPS estimates in each of the trailing four quarters.

Over the past year, the stock has gained 42.4% and 20.4% year-to-date to close Friday’s trading session at $18.58. It is currently trading above its 50-day Moving Average of $16.43 and its 200-day Moving Average of $15.03.

It’s no surprise that BCBP has an overall A rating, which translates to Strong Buy in our POWR Ratings system. The POWR Ratings are calculated by considering 118 different factors, with each factor weighted to an optimal degree.

BCBP has a Stability and Sentiment grade of A and a Value and Momentum grade of B. In the 56-stock Northeast Regional Banks industry, it is ranked #1. The industry is rated B.

To see the additional POWR Ratings for Growth and Quality for BCBP, click here.

TransGlobe Energy Corporation (TGA - Get Rating)

TGA and its subsidiaries acquire, explore, produce and develop crude oil and natural gas in Egypt and Canada. It holds 100% working interests in four Production Sharing Concessions (PSCs) in West Gharib, North-West Gharib, West Bakr, and South Ghalazat in Egypt. It also owns working interest assets in Cardium and Ellerslie formation in the Harmattan area of Western Canada. The company is headquartered in Calgary, Canada.

On January 20, TGA announced the execution of its concession agreement, consolidating and amending its three existing Eastern Desert concession agreements (West Gharib, West Bakr, and North West Gharib). The Egyptian Parliament ratified the agreement in December 2021 and is expected to give the company added time to exploit its existing producing fields in the region to their utmost potential.

For the fiscal third quarter ended September 30, TGA’s revenue increased 243.3%% year-over-year to $57.87 million. Net earnings came in at $37.08 million, while net earnings per share stood at $0.51, both up substantially from their negative year-ago values.

The consensus EPS estimate of $0.70 for fiscal 2022 indicates a 363.2% year-over-year increase. Likewise, the consensus revenue estimate for the same year of $146.62 million reflects an improvement of 0.6% from the prior year.

TGA’s stock has gained 128.3% over the past year to close Friday’s trading session at $3.15. It has gained 93.3% over the past six months. The stock is currently trading higher than its 50-day and 200-day Moving Averages of $3.08 and $2.37, respectively.

This promising outlook is reflected in TGA’s POWR Ratings. The stock has an overall A rating, which equates to Strong Buy in our proprietary rating system.

TGA has an A grade for Momentum, Sentiment, and Quality and a B grade for Growth and Value. It is ranked #3 in the 46-stock Foreign Oil & Gas industry. The industry is rated A.

To see the additional POWR Ratings for Stability for TGA, click here.

Want more stocks like these?

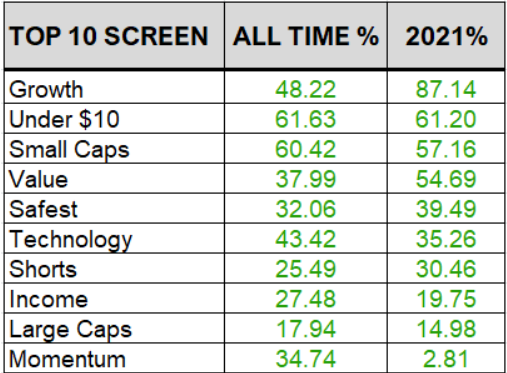

These three stocks are just a fraction of what you will find in our coveted Top 10 Momentum strategy. And the Momentum strategy is just a fraction of what you get with our popular service; POWR Screens 10.

POWR Screens provides 10 market beating strategies with exactly 10 stocks each. Truly something for every investor with verified performance.

To see all these market topping strategies and the best 10 stocks updated daily, then just click the link below.

Learn More About “POWR Screens 10” >>

OBE shares were trading at $7.61 per share on Tuesday morning, up $0.01 (+0.13%). Year-to-date, OBE has gained 84.69%, versus a -9.05% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| OBE | Get Rating | Get Rating | Get Rating |

| BCBP | Get Rating | Get Rating | Get Rating |

| TGA | Get Rating | Get Rating | Get Rating |