Despite macroeconomic challenges, Owens Corning (OC) achieved higher-than-expected revenue and EPS in the first quarter ended March 2023. The company is confident of delivering similar financial performance in the upcoming quarters and is investing strategically to expand its growth potential and strengthen its earnings over the long term.

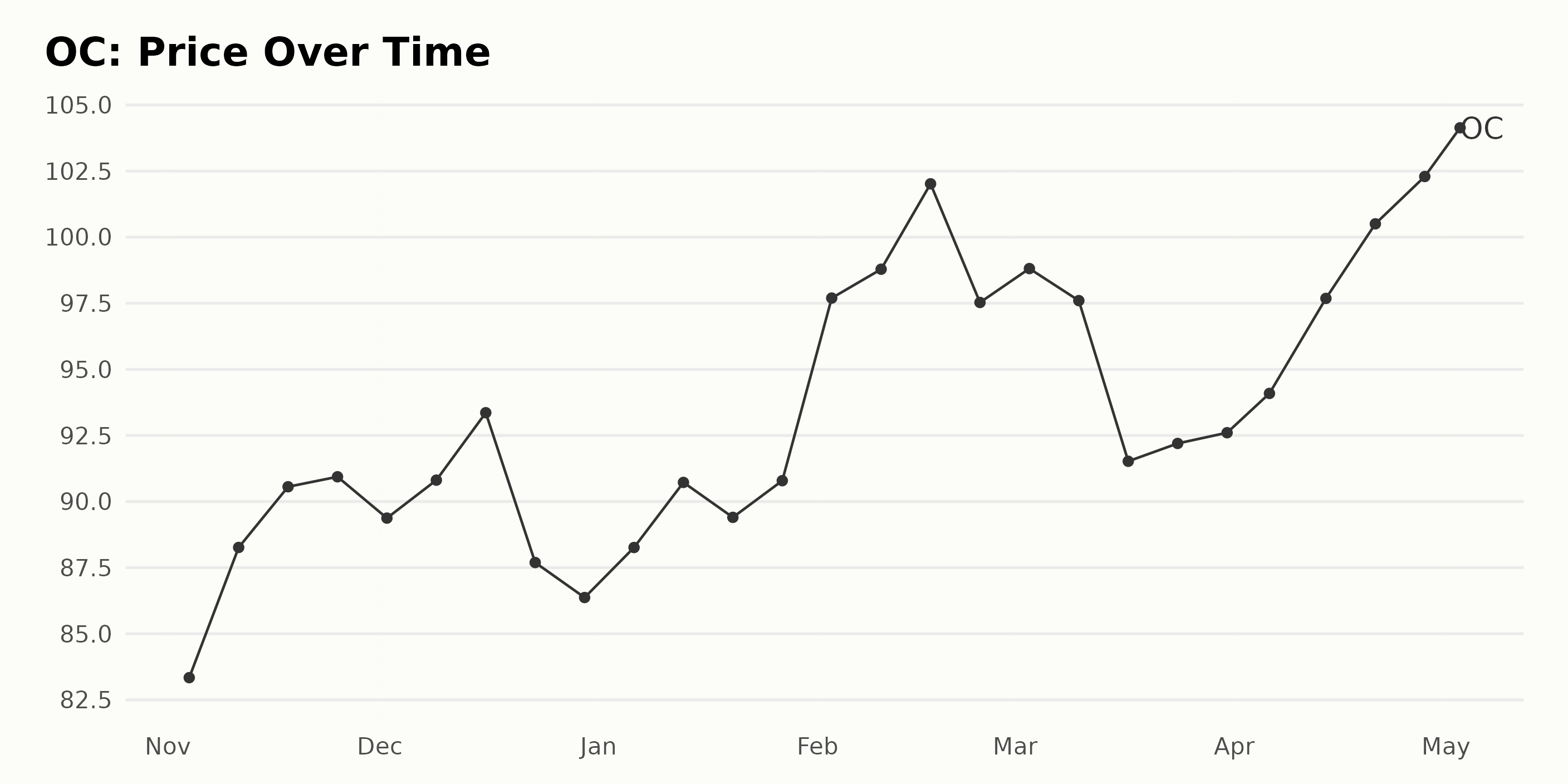

Investors’ optimism is apparent in the stock’s strong price performance. OC is trading above its 50-day and 200-day moving averages of $96.89 and $90.33, respectively. Let’s explore the financials and price momentum of OC to understand its prospects.

Owens Corning (OC) Experiences Net Income, Revenue, and DPS Growth

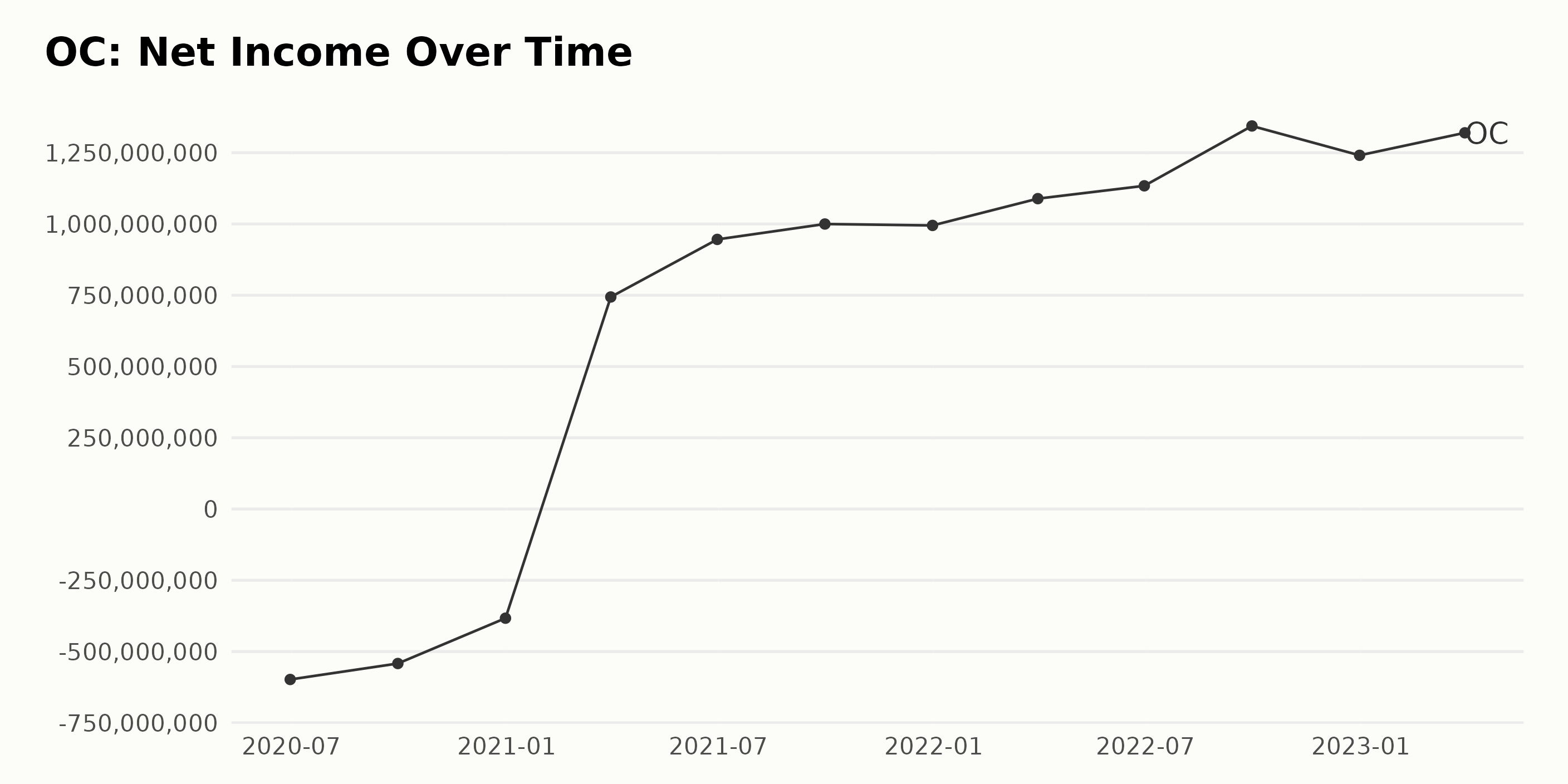

Overall, OC has seen a significant increase in net income over the past two years, rising from a low of negative $598 million on June 30, 2020, to a high of $1.32 billion on March 31, 2023. This represents a growth rate of 122%. The series fluctuated during the second half of 2021, with net income dipping from $1 billion to $995 million before continuing its uptrend.

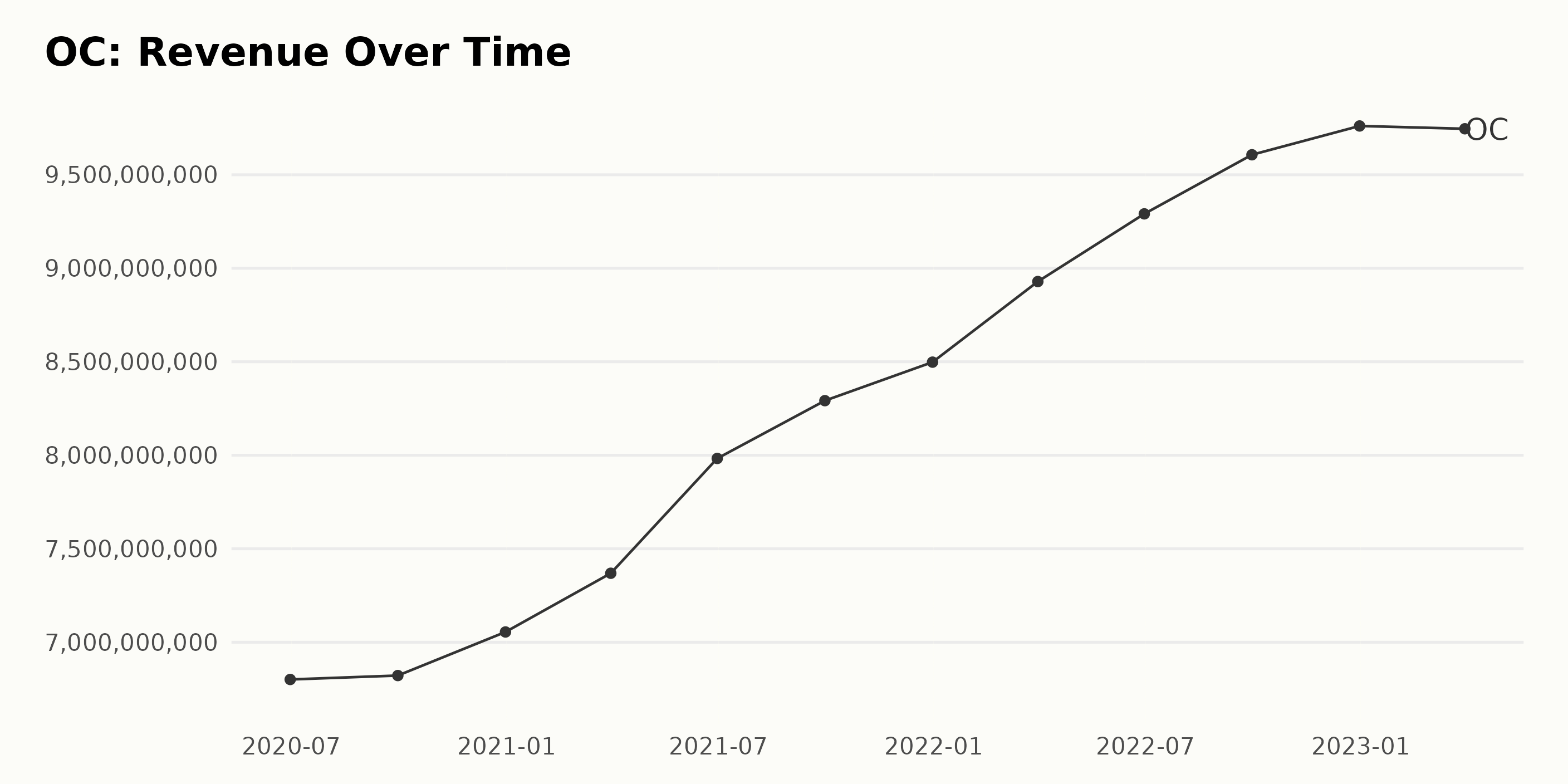

OC’s revenue has been steadily increasing since June 2020. Starting with a revenue of $6.80 billion, it rose to $9.76 billion in March 2023, representing a growth rate of 42%.

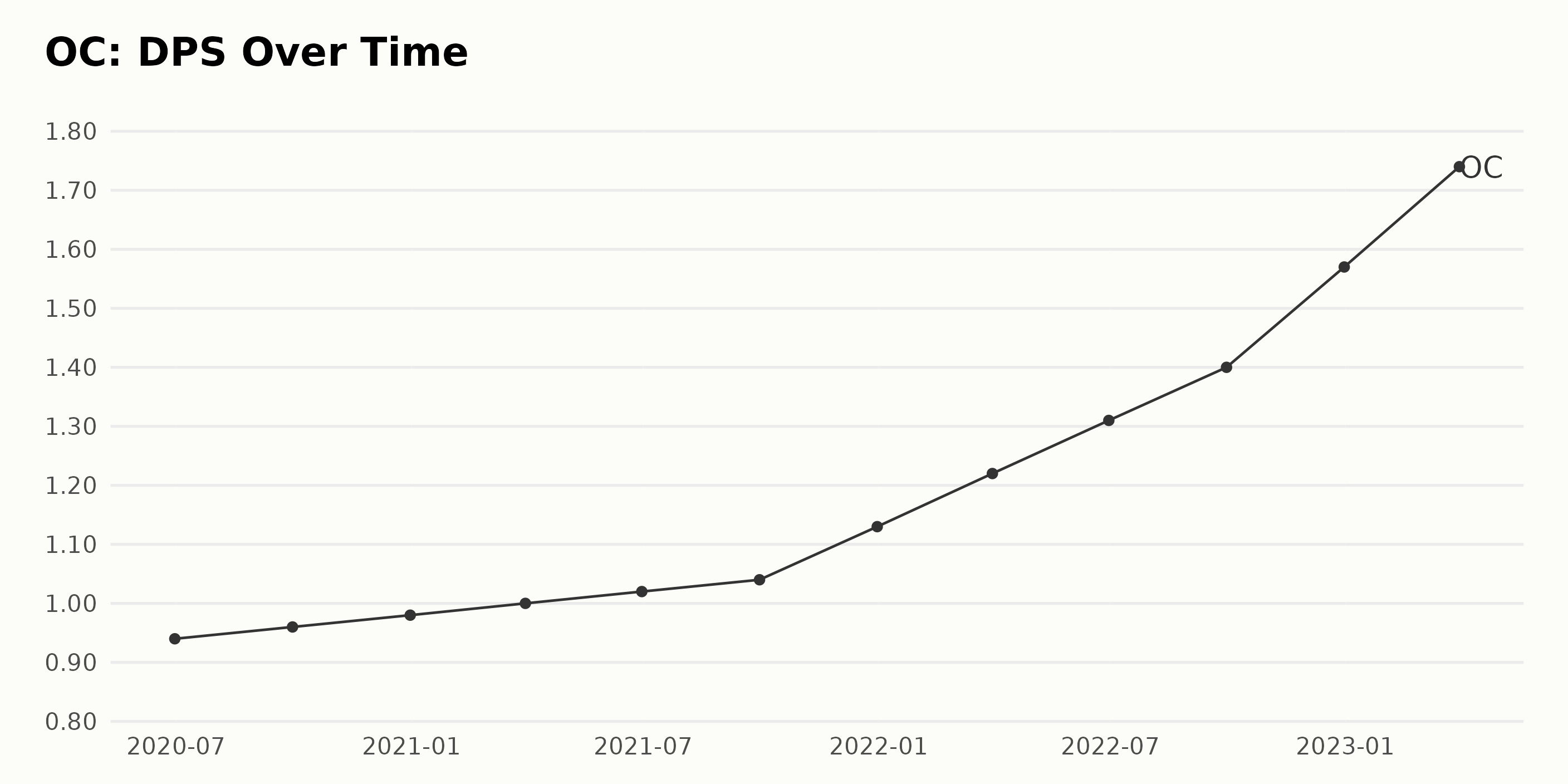

OC has experienced an upward trend in dividend per share (DPS), with the latest reported DPS at $1.74 as of March 31, 2023. This is an increase of 84% from the first reported DPS of $0.94 as of June 30, 2020. There have been fluctuations with DPS, but it has seen an overall increase from June 2020 to the latest reporting period.

OC Shows Strong Price Trends

The share price of OC has been steadily rising from $83.34 on November 4, 2022, to $105.84 on May 2, 2023, with some fluctuations. The overall trend appears to be increasing at an accelerating rate. Here is a chart of OC’s price over the past 180 days.

OC Emerges as Powerful Investment: Quality, Momentum, and Value Up

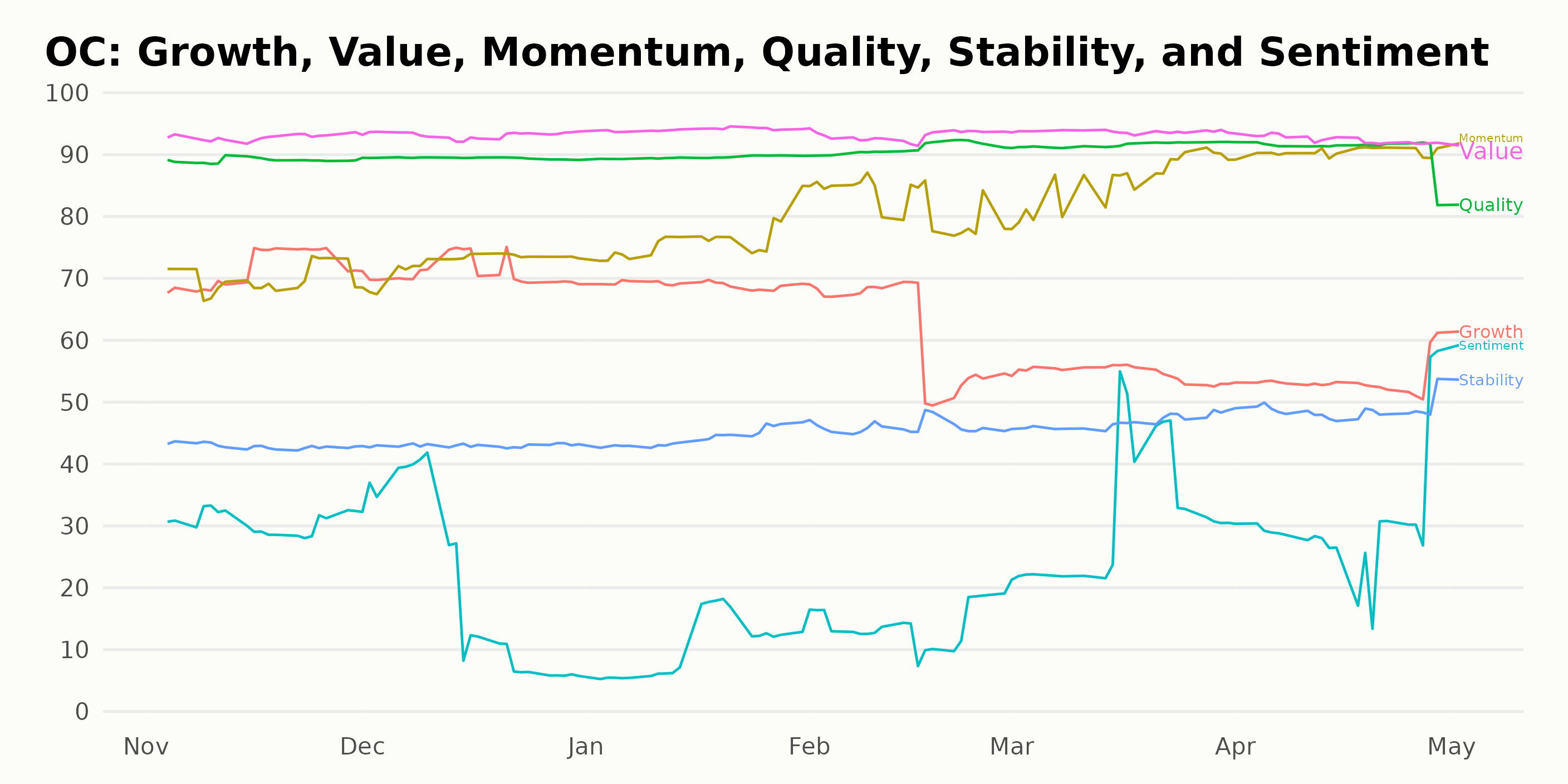

OC has an overall rating of A, equating to a Strong Buy in our POWR Ratings system. Since April 29, 2023, OC consistently received an A rating. As of May 2, 2023, OC was ranked #6 in the Industrial – Building Materials category, which consists of 46 stocks.

The POWR Ratings for OC portray the three most noteworthy dimensions, Quality, Momentum and Value. The highest ratings for these dimensions were Quality, with a score of 92, Momentum, with a score of 92, and Value, with a score of 94. All of these dimensions had a clear trend of improvement over the given timespan, with Quality increasing from 89 to 92, Momentum increasing from 70 to 92, and Value increasing from 93 to 94.

How does Owens Corning (OC) Stack Up Against its Peers?

Other stocks in the Industrial – Building Materials sector that may be worth considering are CRH PLC (CRH), Holcim Ltd. (HCMLY), and Apogee Enterprises Inc. (APOG). These stocks are also overall A-rated.

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

Want More Great Investing Ideas?

OC shares were unchanged in premarket trading Wednesday. Year-to-date, OC has gained 25.02%, versus a 7.99% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| OC | Get Rating | Get Rating | Get Rating |

| CRH | Get Rating | Get Rating | Get Rating |

| HCMLY | Get Rating | Get Rating | Get Rating |

| APOG | Get Rating | Get Rating | Get Rating |