Owens Corning Inc New (OC): Price and Financial Metrics

OC Price/Volume Stats

| Current price | $165.04 | 52-week high | $173.65 |

| Prev. close | $165.22 | 52-week low | $98.02 |

| Day low | $160.82 | Volume | 731,100 |

| Day high | $165.99 | Avg. volume | 674,508 |

| 50-day MA | $158.88 | Dividend yield | 1.46% |

| 200-day MA | $143.47 | Market Cap | 14.36B |

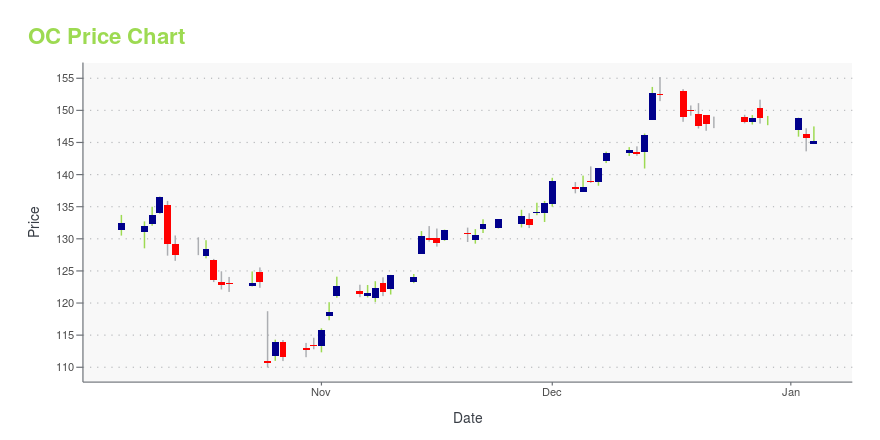

OC Stock Price Chart Interactive Chart >

Owens Corning Inc New (OC) Company Bio

Owens Corning develops, manufactures and markets insulation, roofing, and fiberglass composites. The company was founded in 1938 and is based in Toledo, Ohio.

Latest OC News From Around the Web

Below are the latest news stories about OWENS CORNING that investors may wish to consider to help them evaluate OC as an investment opportunity.

Wall Street Bulls Look Optimistic About Owens Corning (OC): Should You Buy?The average brokerage recommendation (ABR) for Owens Corning (OC) is equivalent to a Buy. The overly optimistic recommendations of Wall Street analysts make the effectiveness of this highly sought-after metric questionable. So, is it worth buying the stock? |

Should Value Investors Buy Owens Corning (OC) Stock?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

Is TopBuild (BLD) Outperforming Other Construction Stocks This Year?Here is how TopBuild (BLD) and Owens Corning (OC) have performed compared to their sector so far this year. |

5 Stocks to Watch on Their Recent Dividend HikeFive stocks that have recently raised dividends are: BMY, PWR, CARR, AVGO, OC. |

Insider Sell: President Marcio Sandri Sells 6,111 Shares of Owens-Corning IncIn a notable insider transaction, President of Composites, Marcio Sandri, sold 6,111 shares of Owens-Corning Inc (NYSE:OC) on December 15, 2023. |

OC Price Returns

| 1-mo | -1.30% |

| 3-mo | 10.32% |

| 6-mo | 49.19% |

| 1-year | 61.42% |

| 3-year | 78.42% |

| 5-year | 252.24% |

| YTD | 12.25% |

| 2023 | 77.17% |

| 2022 | -4.23% |

| 2021 | 20.93% |

| 2020 | 18.12% |

| 2019 | 50.63% |

OC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching OC

Want to do more research on Owens Corning's stock and its price? Try the links below:Owens Corning (OC) Stock Price | Nasdaq

Owens Corning (OC) Stock Quote, History and News - Yahoo Finance

Owens Corning (OC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...