Pacific Biosciences of California, Inc. (PACB - Get Rating) in Menlo Park, Calif., provides life scientists with extremely precise sequencing technologies. The company’s unique equipment is based on single molecule, real-time Sequencing technology, which provides a complete picture of genomes, transcriptomes, and epigenomes, allowing access to the whole spectrum of genetic diversity in any organism.

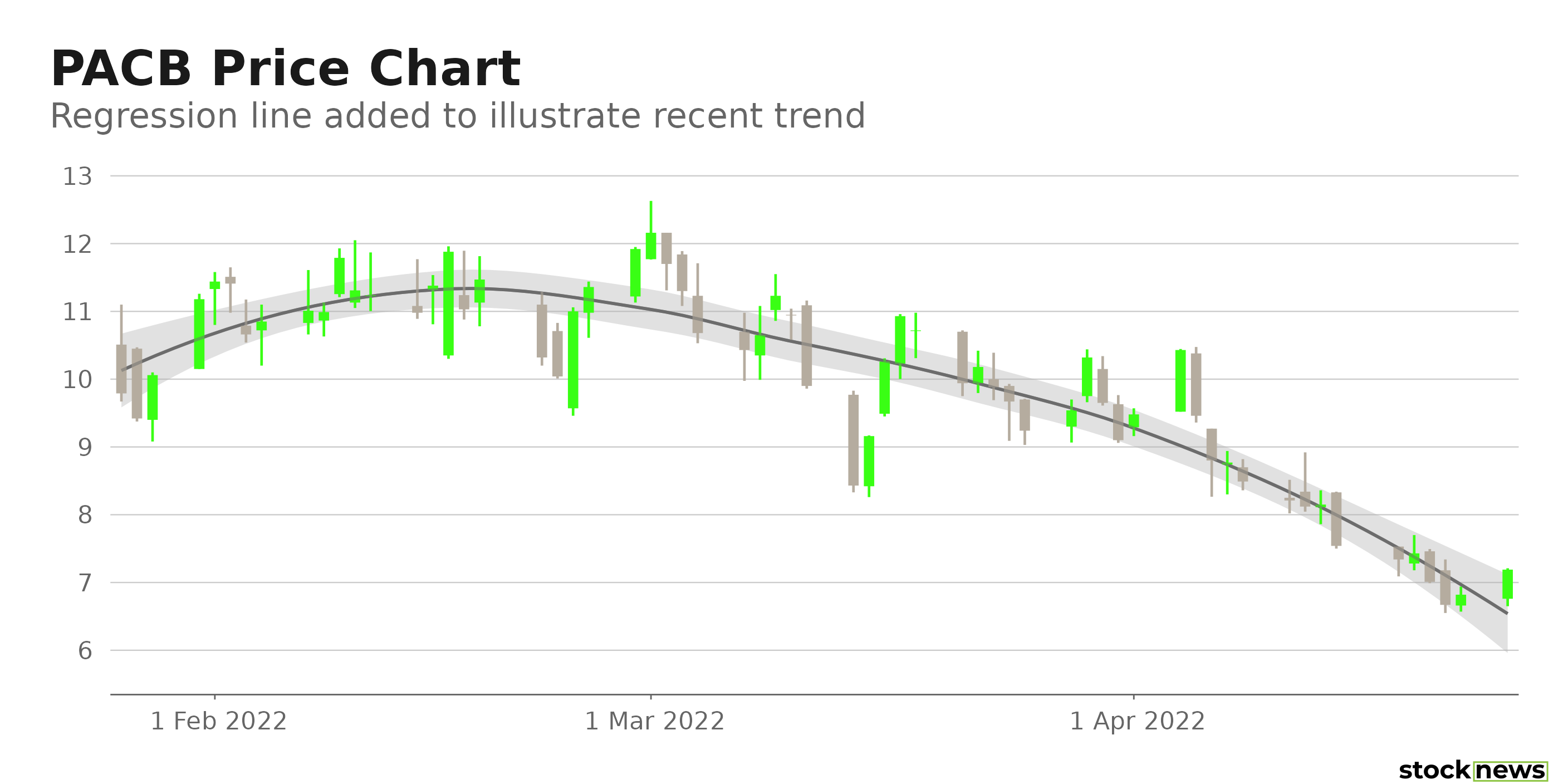

The company’s shares are down 64.9% in price year-to-date and 22.2% over the past month to close yesterday’s trading session at $7.19. In addition, PACB failed to meet consensus sales estimates in its last reported quarter, which further weighed on its stock’s price performance.

PACB saw lower utilization in January, due mainly to pandemic-related effects and accompanying quarantines, which slowed lab production and, in some cases, prevented lab access. Along with the pandemic, the current economic environment has resulted in capital purchase delays in the first quarter, notably in EMEA.

Here is what could shape PACB’s performance in the near term:

Poor Bottom line Performance

PACB’s total revenue increased 32.7% year-over-year to $36.02 million for the three months ended Dec. 31, 2021. However, its operating expenses increased 130.2% from its year-ago value to $81.44 million. Its operating loss grew 169.7% year-over-year to $64.68 million. The company reported a $69.33 million net loss, compared to a net profit of $74.94 million in the prior-year period. Its loss per share came in at $0.31 over this period.

Poor Profitability

PACB’s 45.4% trailing-12-months gross profit margin is 17.9% lower than the 55.2% industry average. Its trailing-12-months asset turnover ratio of 0.11% is 68.8% lower than the 0.35% industry average. Also, its trailing-12-months ROA, net income margin and ROC are negative 9.03%, 138.9%, and 10.5%, respectively.

POWR Ratings Reflect Uncertainty

PACB has an overall D rating, which equates to Sell in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. PACB has a D grade for Stability and Quality. The stock’s 1.26 beta is consistent with its Stability grade. In addition, its poor profitability is in sync with the Quality grade.

Among 49 stocks in the D-rated Medical – Diagnostics/Research industry, PACB is ranked #42.

Beyond what I have stated above, you can view PACB ratings for Value, Momentum, Growth, and Sentiment here.

Click here to checkout our Healthcare Sector Report for 2022

Bottom Line

While the company reported solid revenue growth in its last quarter, it failed to meet analysts’ estimates. In addition, analysts expect its EPS to decline 47.7% in the current year. Furthermore, the stock is currently trading below its 50-day and 200-day moving average of $9.77 and $20.44, respectively, indicating a downtrend. So, we believe the stock is best avoided now.

How Does Pacific Biosciences of California Inc. (PACB) Stack Up Against its Peers?

While PACB has an overall D rating, one might want to consider its industry peers, Global Cord Blood Corporation (CO - Get Rating), Qiagen N.V. (QGEN - Get Rating), and Agilent Technologies Inc. (A - Get Rating), which have an overall A (Strong Buy) rating.

Want More Great Investing Ideas?

PACB shares fell $7.19 (-100.00%) in premarket trading Tuesday. Year-to-date, PACB has declined -64.86%, versus a -9.50% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| PACB | Get Rating | Get Rating | Get Rating |

| CO | Get Rating | Get Rating | Get Rating |

| QGEN | Get Rating | Get Rating | Get Rating |

| A | Get Rating | Get Rating | Get Rating |