New York City-based UiPath Inc. (PATH - Get Rating) offers an end-to-end automation platform with a range of robotic process automation (RPA) solutions in the United States, Romania, and Japan. The company provides a suite of interconnected technologies to help organizations design, manage, run, engage, measure, and regulate automation.

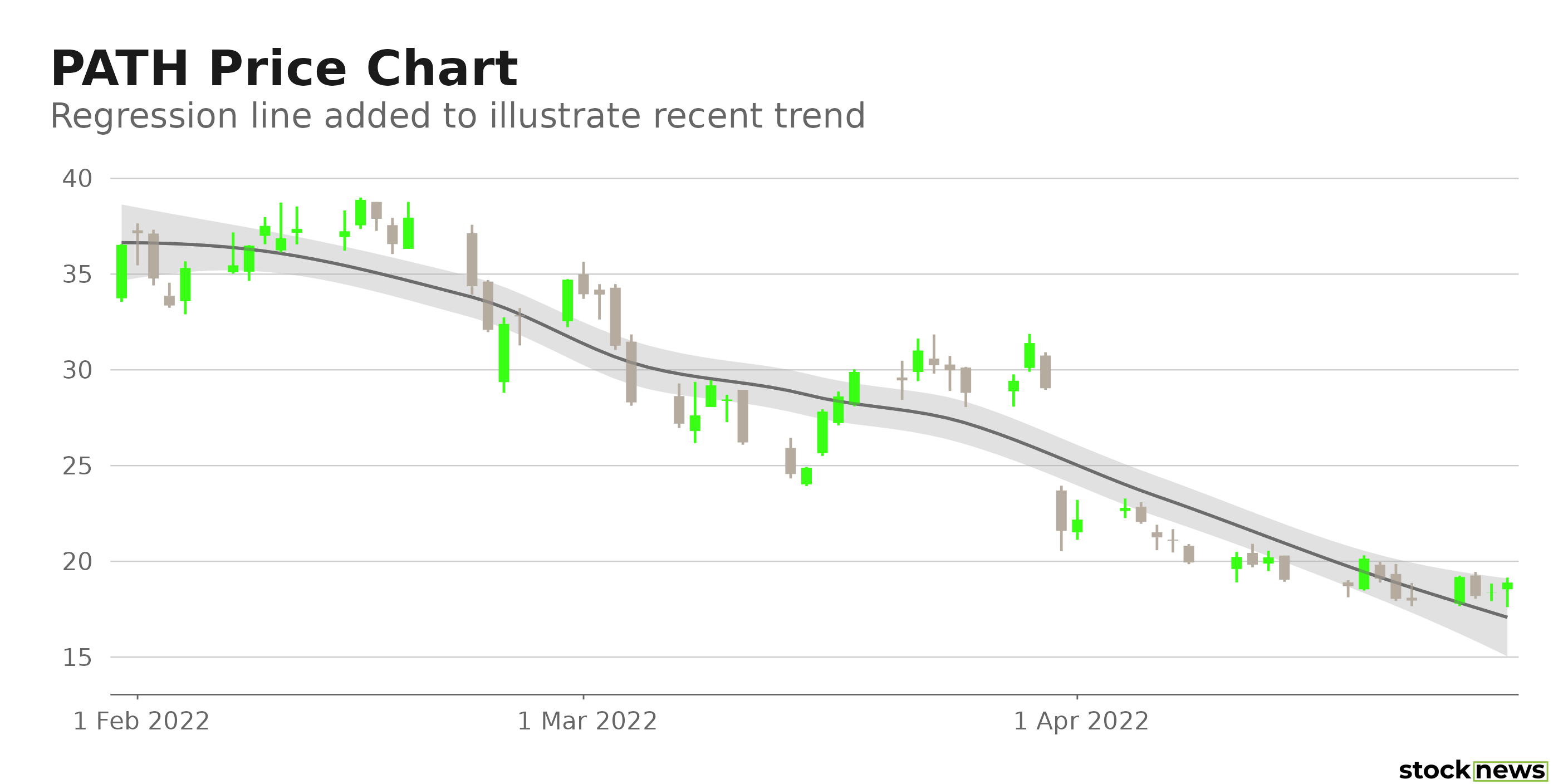

The stock is down 75% in price over the past year and 56.2% year-to-date to close yesterday’s trading session at $18.89. In addition, it is currently trading 79% below its 52-week high of $90, which it hit on May 28, 2021.

Although the company’s ground-breaking Academic Alliance program could help it benefit from the growing need for automation, increased competition from major industry players may threaten its market-share growth.

Here is what could shape PATH’s performance in the near term:

Increasing Competition

The worldwide automation services sector has grown highly competitive as more firms opt for Robotic Process Automation (RPA) technology services to automate repetitive operations and streamline business processes. Because digital behemoths like Microsoft Corporation (MSFT) and International Business Machines Corporation (IBM) are increasingly partnering with prominent niche firms to capitalize on their market development potential and obtain a vast client base, PATH’s growth may be stymied.

Poor Bottom line Performance

PATH’s total revenue increased 39.4% year-over-year to $289.69 million for the three months ended Jan. 31, 2021. However, its operating expenses increased 72.9% from its year-ago value to $299.41 million. Its operating loss came in at $50.88 million, compared to a $50.88 million operating profit. The company reported a $63.11 million net loss, compared to a $26.26 million net profit in the prior-year period. Its loss per share came in at $0.12 over this period.

Stretched Valuation

In terms of forward Price/Book, the stock is currently trading at 5.52x, which is 25.9% higher than the 4.38x industry average. Also, its 7.45x trailing-12-months EV/Sales is 153.9% higher than the 2.93x industry average. Furthermore, PATH’s 9.40x trailing-12-months Price/Sales is 201.5% higher than the 3.12x industry average.

Poor Profitability

PATH’s 0.52% trailing-12-months asset turnover ratio is 17.3% lower than the 0.63% industry average. Its trailing-12-months cash from operations stood at negative $54.96 million, versus the $90.61 million industry average. Also, its trailing-12-months ROA, net income, and ROC are negative 20.4%, 58.9%, and 25.9%, respectively.

POWR Ratings Reflect Bleak Outlook

PATH has an overall D rating, which equates to Sell in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. PATH has a D grade for Value. The company’s higher than industry valuation is consistent with the Value grade.

Among the 25 stocks in the F-rated Software – SAAS industry, PATH is ranked #23.

Beyond what I have stated above, you can view PATH ratings for Growth, Momentum, Stability, Quality, and Sentiment here.

Click here to check out our Software Industry Report for 2022

Bottom Line

The rising demand for robotic process automation for automating repetitive processes has boosted the growth of major automation companies like PATH. However, the stock’s lofty valuation and increased competition from established companies have raised concerns about its prospects. Therefore, we believe the stock is best avoided now.

How Does UiPath Inc. (PATH) Stack Up Against its Peers?

While PATH has an overall D rating, one might want to consider its industry peers, MiX Telematics ADR (MIXT - Get Rating), The Sage Group Plc (SGPPY), and Descartes Systems Group Inc. (DSGX - Get Rating), which have an overall B (Buy) rating.

Want More Great Investing Ideas?

PATH shares fell $0.28 (-1.48%) in premarket trading Friday. Year-to-date, PATH has declined -56.20%, versus a -9.65% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| PATH | Get Rating | Get Rating | Get Rating |

| MIXT | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating | |

| DSGX | Get Rating | Get Rating | Get Rating |