The resurgence in global oil demand following China’s reopening and OPEC+’s oil production cuts has set a bullish trend for oil prices. Against this backdrop, PBF Energy Inc.’s (PBF - Get Rating) solid key financial metrics and meaningful partnerships could make this stock a solid portfolio addition.

Below, we take a look at some of PBF’s key financial metrics:

PBF Energy’s Fluctuating Revenues and Gross Margin Growth

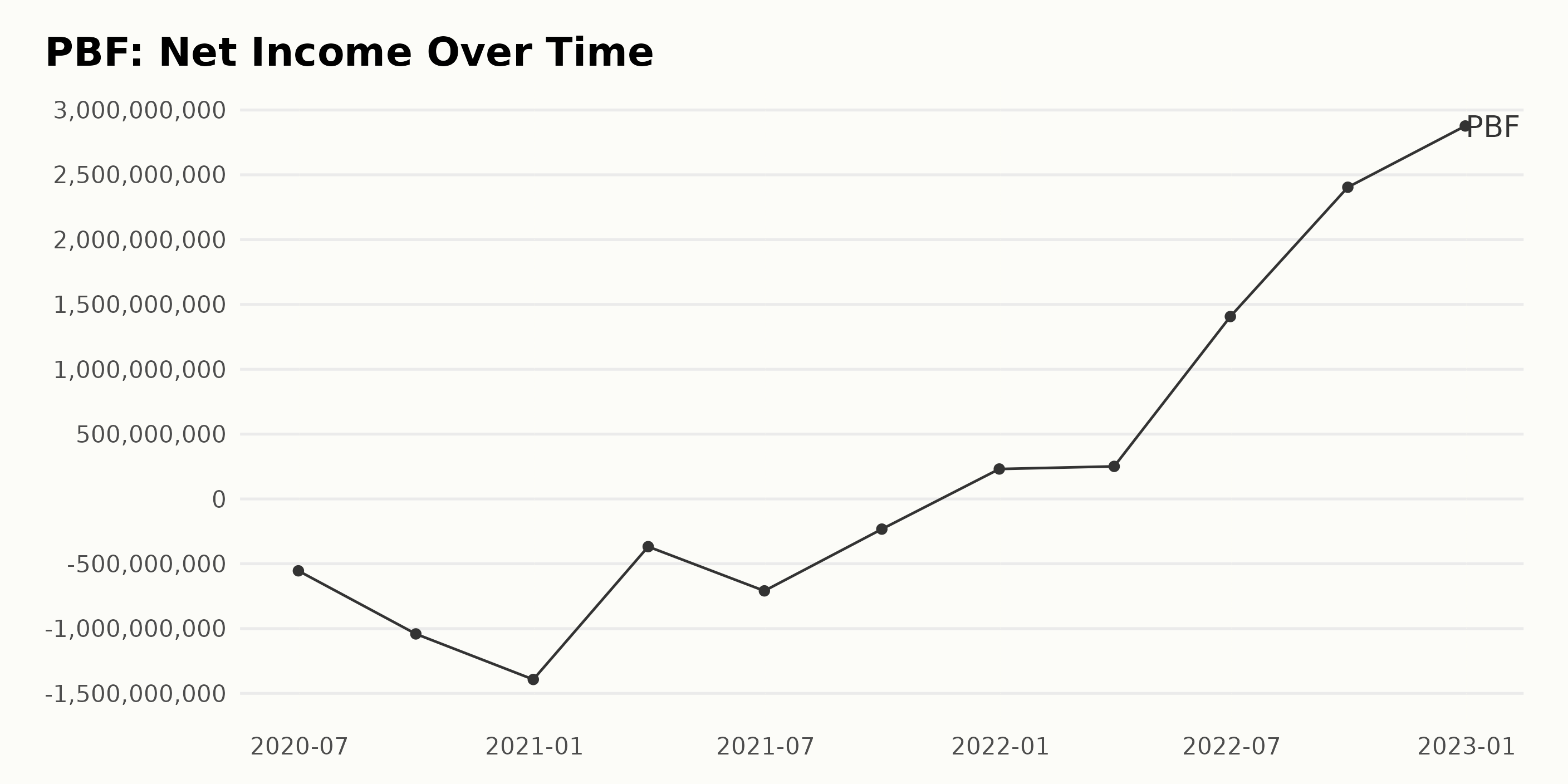

Overall, the net income of PBF has fluctuated over the last two years, with a growth rate of almost 620%. The net income started at -$554.3 million in June 2020, before dropping to a low of -$2.327 billion a year later in September 2021. The situation improved dramatically in the last six months, culminating in a net income of $28.768 billion in December 2022.

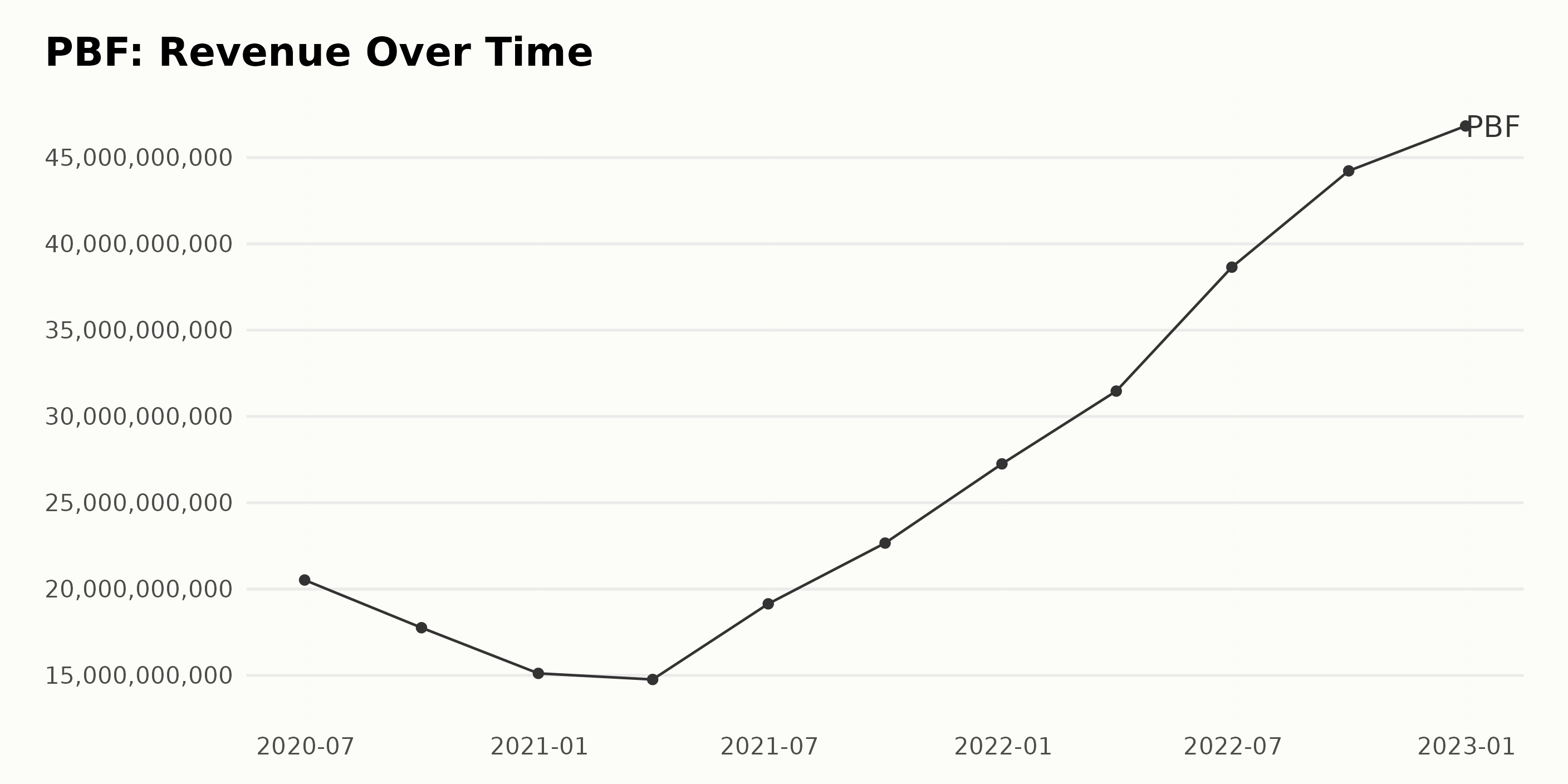

PBF’s revenue has generally been fluctuating. From June 2020 to December 2021, the company’s revenue decreased by 28.7% from $20.53 billion to $15.12 billion. However, after December 2021, the revenue increased significantly, reaching a peak of $46.83 billion in December 2022, which is an increase of 209.2% compared to June 2020.

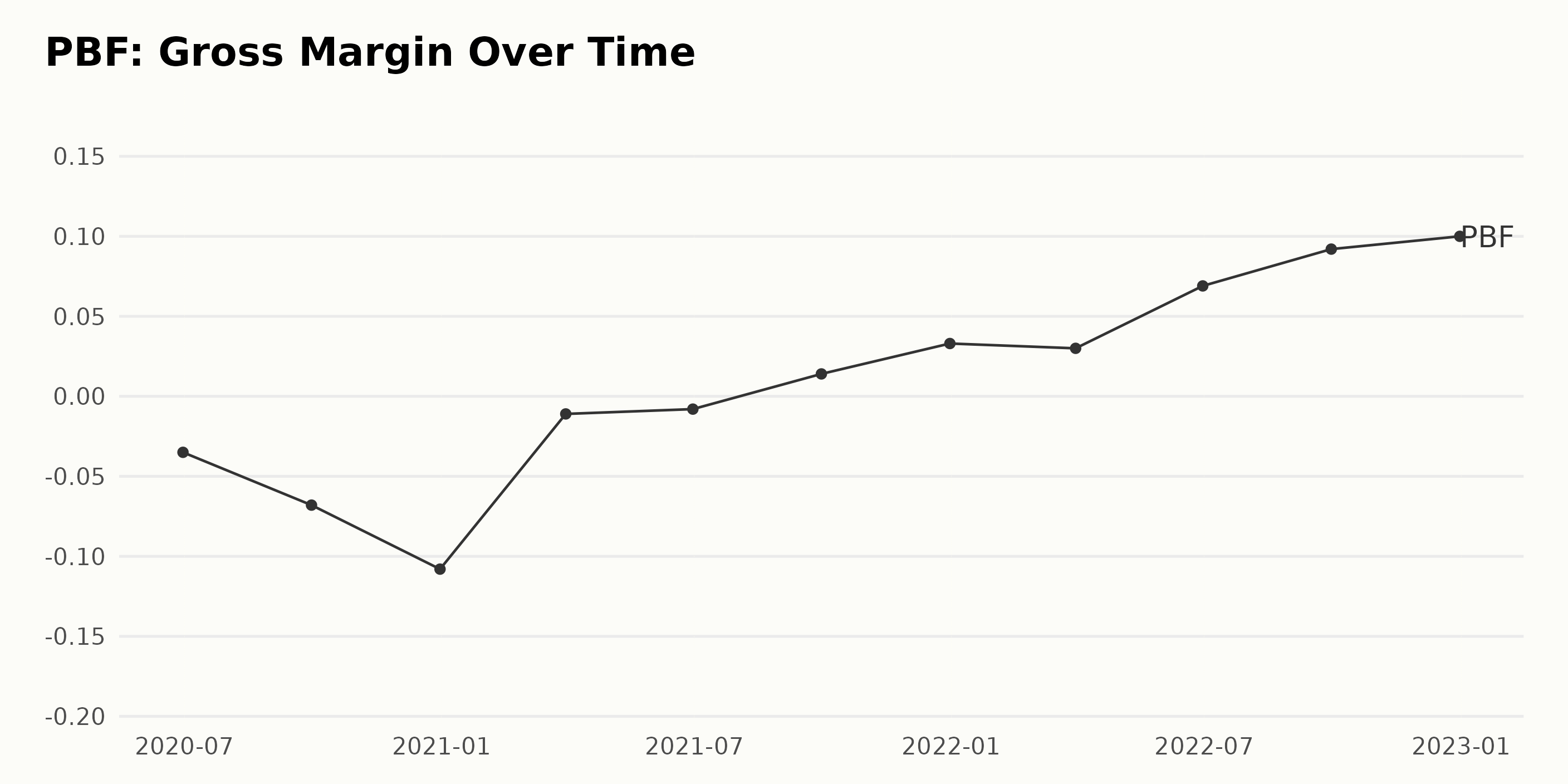

The gross margin of PBF has seen a steady overall increase over the last two years, with fluctuating trends in-between. From June 2020 to September 2022, the gross margin increased from negative 0.035% to 0.1%, indicating a growth rate of 186%. The most significant increase was seen between September 2021 and December 2021, when the gross margin rose from 0.014% to 0.033%, a 135% change.

Analysis of PBF Energy Stock Price Increase

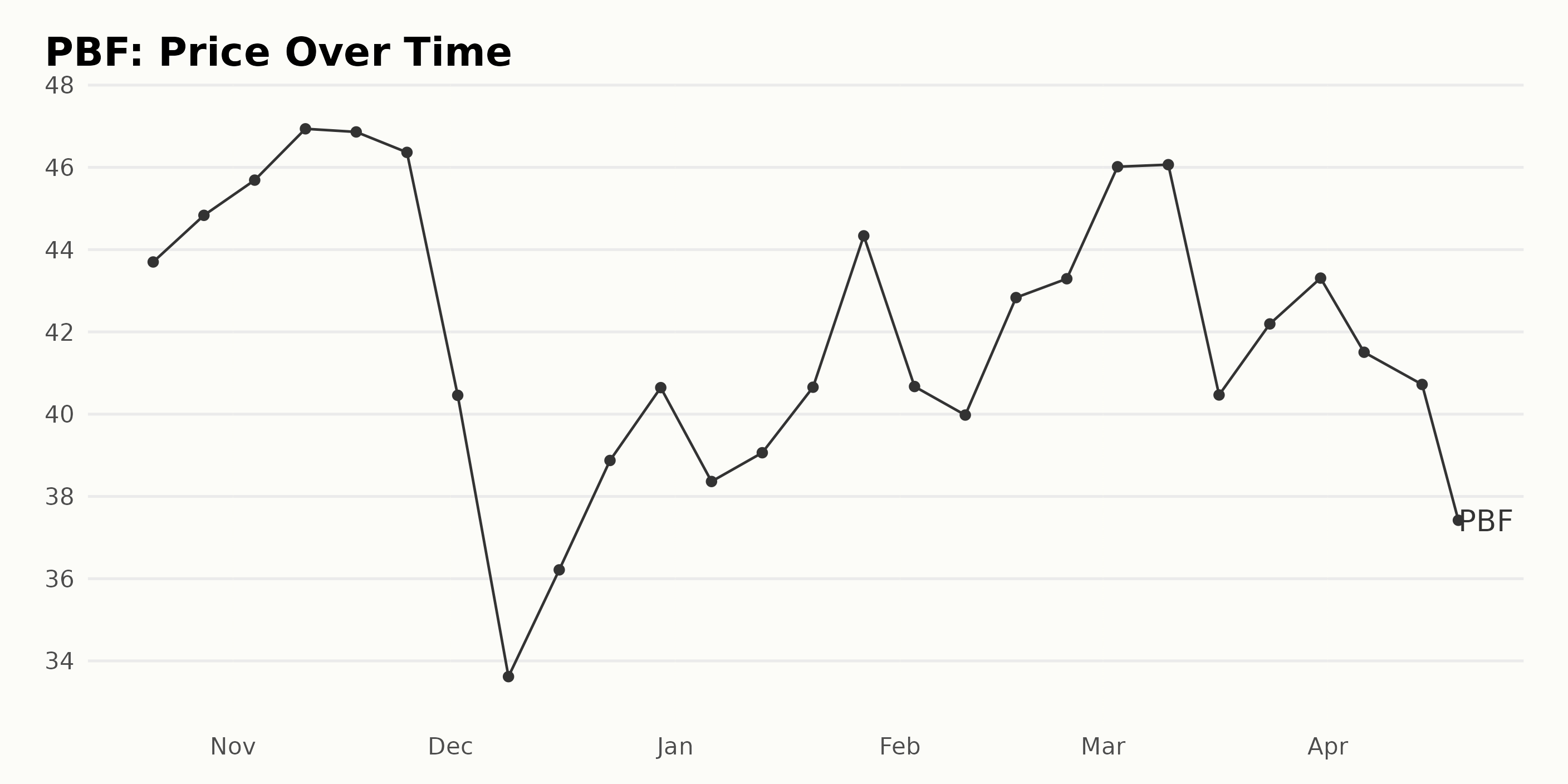

The share price of PBF has generally been increasing over this period of two months–from October 21, 2022, to April 19, 2023, the share price rose from $43.70 to $36.55. Initially, the trend was quite steep, with a growth rate of $1.13 per week, but the rate slowly began to decrease over time and had declined to $0.44 by mid-April. Here is a chart of PBF’s price over the past 180 days.

Powerful Performance: Analyzing PBF’s POWR Ratings

PBF has an overall POWR grade of B, which translates to a Buy in our POWR Ratings system. Compared to the 91 stocks in the Energy – Oil & Gas category, it currently ranks 4th and is improving steadily, making it an attractive investment. Its latest POWR grade is B.

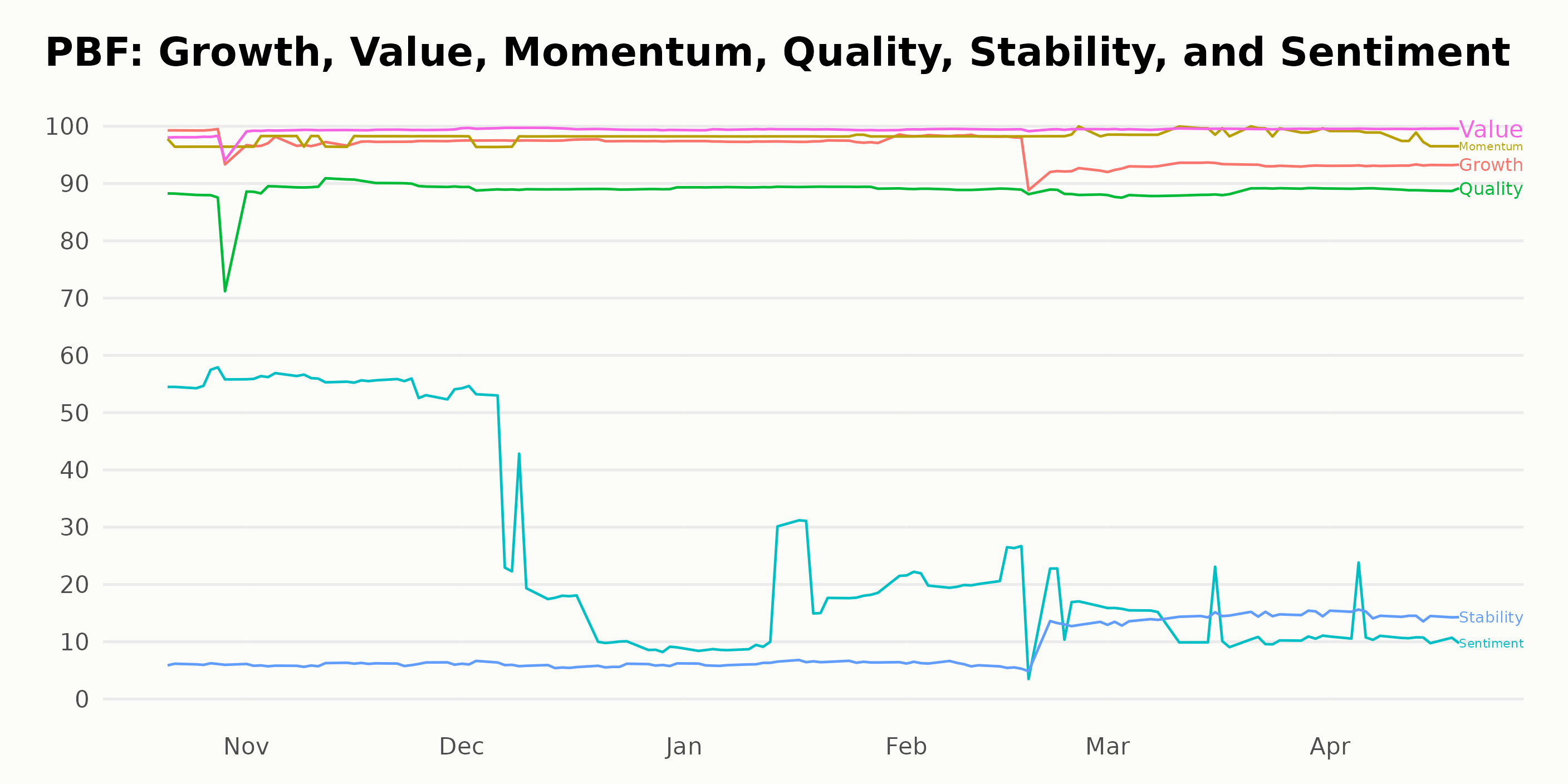

The three most noteworthy dimensions of the POWR Ratings for PBF are Momentum, Value, and Quality. Momentum has consistently received ratings of 97 through 100 from October 2022 to April 2023, showing a clear positive trend. Similarly, Value has been rated at 98 or higher, with a peak of 100 in March 2023. The same period has seen Quality ratings range from 86-90, indicating a solid consistency for this parameter.

How does PBF Energy Inc. (PBF) Stack Up Against its Peers?

Other stocks in the Energy – Oil & Gas sector that may be worth considering are Valero Energy Corporation (VLO - Get Rating), Marathon Petroleum Corporation (MPC - Get Rating), and Phillips 66 (PSX - Get Rating) — they have better POWR Ratings.

Consider This Before Placing Your Next Trade…

We are still in the midst of a bear market.

Yes, some special stocks may go up like the ones discussed in this article. But most will tumble as the bear market claws ever lower this year.

That is why you need to discover the “REVISED: 2023 Stock Market Outlook” that was just created by 40 year investment veteran Steve Reitmeister. There he explains:

- 5 Warnings Signs the Bear Returns Starting Now!

- Banking Crisis Concerns Another Nail in the Coffin

- How Low Will Stocks Go?

- 7 Timely Trades to Profit on the Way Down

- Plan to Bottom Fish For Next Bull Market

- 2 Trades with 100%+ Upside Potential as New Bull Emerges

- And Much More!

You owe it to yourself to watch this timely presentation before placing your next trade.

REVISED: 2023 Stock Market Outlook >

Want More Great Investing Ideas?

PBF shares were trading at $36.63 per share on Wednesday afternoon, down $1.12 (-2.97%). Year-to-date, PBF has declined -9.77%, versus a 8.72% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| PBF | Get Rating | Get Rating | Get Rating |

| VLO | Get Rating | Get Rating | Get Rating |

| MPC | Get Rating | Get Rating | Get Rating |

| PSX | Get Rating | Get Rating | Get Rating |