Last week, President Biden signed an executive order setting a target for zero-emissions vehicles to represent at least half of all cars sold in the United States by 2030. The executive order is aligned with the country’s goal of phasing out internal combustion vehicles by 2050.

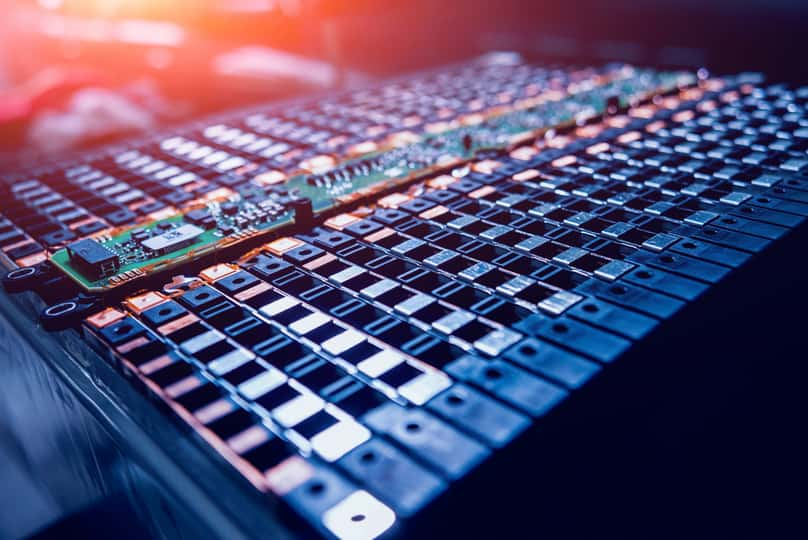

Rising concerns about climate change, government incentives, and the long-term cost-saving benefits of electric vehicles (EVs) should propel the industry’s growth. As a result, the EV battery market is expected to grow significantly. According to a Fortune Business Insights report, the global EV battery market is projected to grow at a 6.6% CAGR over the next six years to $82.20 billion by 2027. Given this backdrop, fundamentally sound EV battery stocks Panasonic Corporation (PCRFY - Get Rating) and EnerSys (ENS - Get Rating) should witness substantial growth.

However, production and supply bottlenecks have caused some companies in this space to suffer declining financials. For example, the growth prospects of QuantumScape Corporation (QS - Get Rating) and CBAK Energy Technology, Inc. (CBAT - Get Rating) look bleak. These companies are also dealing with several class-action lawsuits. So, we think their stocks are best avoided now.

Stocks to Buy:

Panasonic Corporation (PCRFY - Get Rating)

Headquartered in Kadoma, Japan, PCRFY manufactures and sells various electronic products through five segments: Appliances; Life Solutions; Connected Solutions; Automotive; and Industrial Solutions. Its main product offerings include automotive-use batteries, refrigerators, and industrial motors and sensors.

PCRFY’s sales increased 28.8% year-over-year to ¥1.79 trillion ($16.21 billion) in the fiscal first quarter, ended June 30. Its operating profit rose 2,647.4% from the same period last year to ¥104.40 billion ($950 million ). Net income grew 1,276.8% from the year-ago value to ¥81.20 billion ($720 million). Its EPS grew 878.9% year-over-year to ¥32.79 ($0.30).

On June 10, PCRFY’s North American subsidiary Panasonic Energy and Schlumberger New Energy (SLB) partnered to develop a new, improved battery-grade-lithium production process. As the demand for EVs rises worldwide, this partnership should allow PCRFY to become a major lithium supplier.

PCRFY sold its stake in Tesla, Inc. (TSLA) for approximately ¥400 billion ($3.60 billion). It plans to use the proceeds to invest in its growth. The Street expects PCRFY’s revenues to rise 2.8% year-over-year to $16.14 billion in the current quarter, ending September 2021. A $0.28 consensus EPS estimate for the current quarter indicates a 16.7% improvement year-over-year. In addition, PCRFY surpassed the Street’s EPS estimates in three of the trailing four quarters. PCRFY’s shares have gained 36.6% over the past year and 6.4% year-to-date.

PCRFY has an overall B rating, which equates to Buy in our proprietary POWR Ratings system. The POWR Ratings are calculated considering 118 distinct factors, with each factor weighted to an optimal degree.

The stock has an A grade for Value, and B for Stability. Of the 45 stocks in the B-rated Technology – Hardware industry, PCRFY is ranked #11.

Beyond what we’ve stated above, we have rated PCRFY for Growth, Momentum, Sentiment, and Quality. Get all PCRFY ratings here.

EnerSys (ENS - Get Rating)

ENS in Reading, Pa., provides stored energy solutions for industrial applications through three segments–Energy Systems; Motive Power; and Specialty. In addition to making products for uninterruptible power systems applications, it manufactures specialty batteries and energy solutions. It is a leading player in the stored energy solutions space.

In its fiscal first quarter, ended July 4, 2021, ENS’ net sales rose 15.6% year-over-year to $814.90 million, with its Energy Systems sales increasing 5%, its Motive Power segment sales growing 27.9%, and its Specialty segment sales rising 21.3%. from the prior-year quarter. Its net income grew 24.7% from its year-ago value to $43.90 million, while its EPS increased 23.2% year-over-year to $1.01.

On June 23, ENS launched cost-effective, high-performance Lithium-ION (LION) batteries, compliant with Automotive/Rigorous Functional Safety Standard ISO 26262. These premium power batteries should meet rigorous operational demands at a lower total cost of ownership.

Analysts expect ENS’ revenues to rise 11.1% year-over-year to $3.31 billion in the current year. A$5.41 consensus EPS estimate for the current ongoing year represents a 20.5% rise from the same period last year. In addition, the company has an impressive earnings surprise history; it beat the Street’s EPS estimates in each of the trailing four quarters. Shares of ENS have gained 26.6% over the past year and 13.3% year-to-date.

ENS has an overall A rating, which equates to a Strong Buy in our proprietary rating system. In addition, the stock has a B grade for Value, Momentum, Quality, and Stability. Furthermore, it is ranked #17 of 90 stocks in the B-rated Industrial – Equipment industry.

In addition to the grades mentioned above, one can view ENS ratings for Sentiment and Growth here.

Click here to check out our Industrial Sector Report for 2021

Stocks to Avoid:

QuantumScape Corporation (QS - Get Rating)

QS is a development stage company that develops and commercializes solid-state lithium-metal batteries for electric vehicles. The San Jose, Calif.-based company leverages its original equipment manufacturer validated battery technology to develop anode-less lithium batteries.

QS’ loss from operations increased 248.8% year-over-year to $49.62 million in its fiscal second quarter, ended June 30. However, the company’s net income came in at $80.99 million owing to a $130.61 million gain from a change in the fair value of assumed common stock warrant liabilities. Its loss per share doubled from the same period last year to $0.12.

Several class-action lawsuits have been filed against QS recently. Law firms have been investigating an alleged breach of fiduciary duties by senior officials. It was alleged that QS had made misleading statements and had overstated the claims related to its solid-state battery power, battery life, and energy density.

The Street expects QS’s EPS to remain negative until at least next year. Shares of QS have slumped 58.8% in price over the last six months and 73.3% year-to-date.

It’s no surprise that QS has an overall F rating, which equates to a Strong Sell in our POWR Ratings system. In addition, it has an F grade for Growth, Value, and Sentiment, and is ranked #66 of 67 stocks in the Auto Parts industry.

Click here to see additional QS ratings for Momentum, Quality, and Stability.

CBAK Energy Technology, Inc. (CBAT - Get Rating)

Based in Dalian, China, CBAT develops, manufactures, and sells lithium batteries internationally. Its products have applications in heavy electric vehicles, such as cars and buses, and light vehicles like electric bicycles and sight-seeing cars.

CBAT’s net revenues for the first quarter ended March 2021 represented a 36.4% year-over-year increase to $9.42 million. However, the company’s operating loss came in at $27,882. Its net income came in at $ 29.61 million, representing a 1357.7% improvement from the same period last year, while its EPS rose 975% from the prior-year quarter to $0.35. However, its bottom-line growth was facilitated by a $1.22 million gain in the fair value of warrants it holds.

In January, Pomerantz LLP began investigating whether CBAK’s senior management has engaged in securities fraud or other unlawful business practices, following a research report published by J Capital Research. The company’s goodwill is likely to have taken a hit following such allegations.

CBAT share price has declined 53.8% over the past six months to close yesterday’s trading session at $3.44. The stock has lost 32% year-to-date.

CBAT has a D grade in our proprietary POWR Ratings system, which translates to Sell. In addition, it has a grade of F for Stability, and a D for Quality. It is ranked #75 in the Industrial – Equipment industry.

Beyond what we’ve stated above, we have also rated CBAT for Momentum, Growth, Value, and Sentiment. Get all CBAT ratings here.

Click here to check out our Industrial Sector Report for 2021

Want More Great Investing Ideas?

PCRFY shares were trading at $12.39 per share on Friday afternoon, down $0.07 (-0.56%). Year-to-date, PCRFY has gained 6.42%, versus a 19.96% rise in the benchmark S&P 500 index during the same period.

About the Author: Aditi Ganguly

Aditi is an experienced content developer and financial writer who is passionate about helping investors understand the do’s and don'ts of investing. She has a keen interest in the stock market and has a fundamental approach when analyzing equities. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| PCRFY | Get Rating | Get Rating | Get Rating |

| ENS | Get Rating | Get Rating | Get Rating |

| QS | Get Rating | Get Rating | Get Rating |

| CBAT | Get Rating | Get Rating | Get Rating |