Insider buying activity for Processa Pharmaceuticals, Inc. (PCSA - Get Rating) indicates confidence in the company’s growth prospects. Insiders have been net buyers of 5.4% shares of the company over the past six months.

However, the stock is seeing signs of weakness, as it is currently trading below its 50-day and 200-day moving averages of $0.61 and $1.84, respectively. This article provides insight into the metrics that are reflective of the current challenges the company is facing.

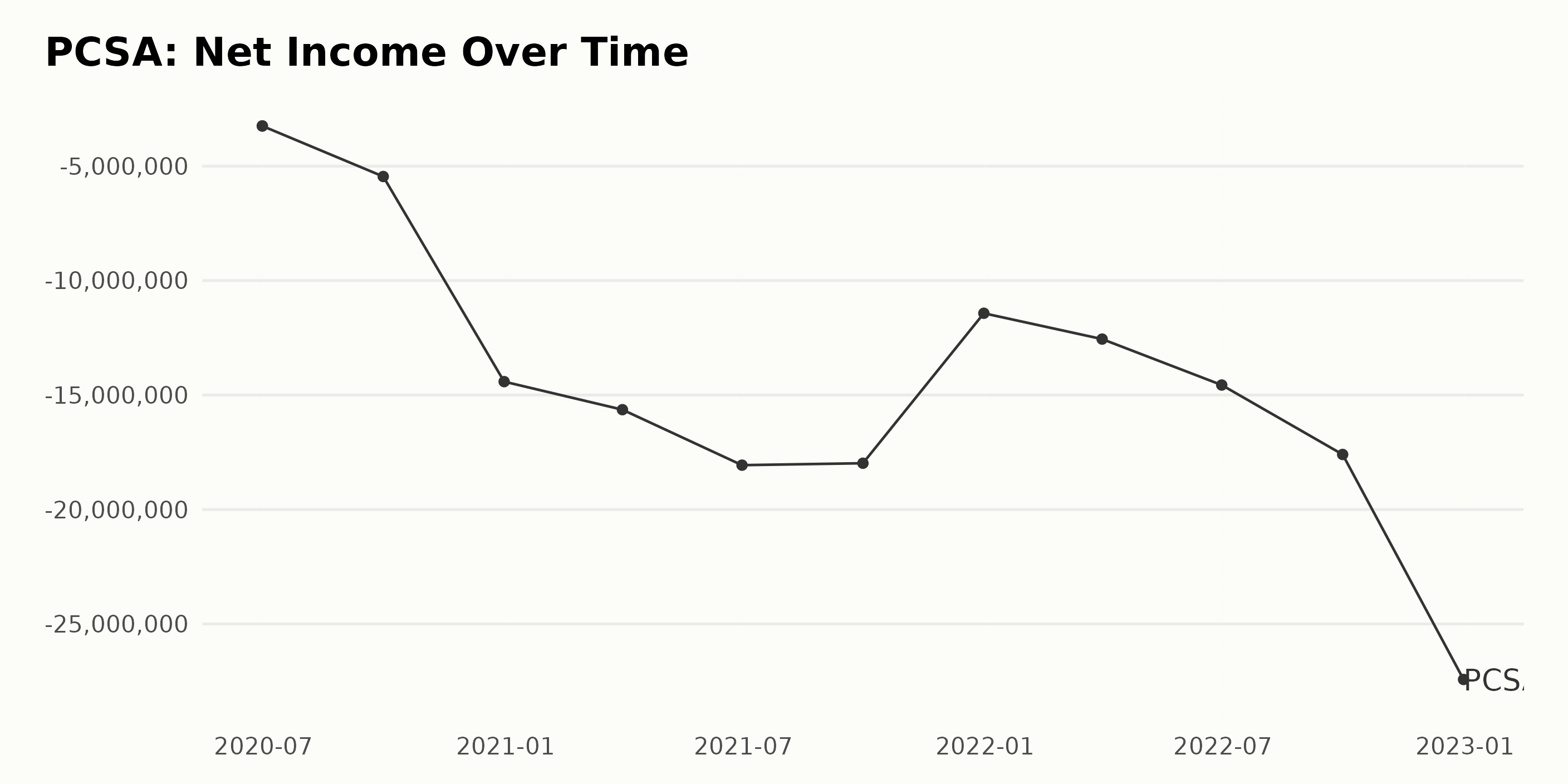

Processa Pharmaceuticals, Inc.’s (PCSA) Net Income: A Decrease of 742% Since June 2020

Since June 2020, PCSA’s net income has been on a downward, with fluctuations along the way. The net income has decreased from -$3.25 million in June 2020 to -$27.4 million in December 2022, an improvement of 742%. There have been several fluctuations along the way, reaching a high of -$17.6 million in September 2021 and a low of -11.2 million in December 2021.

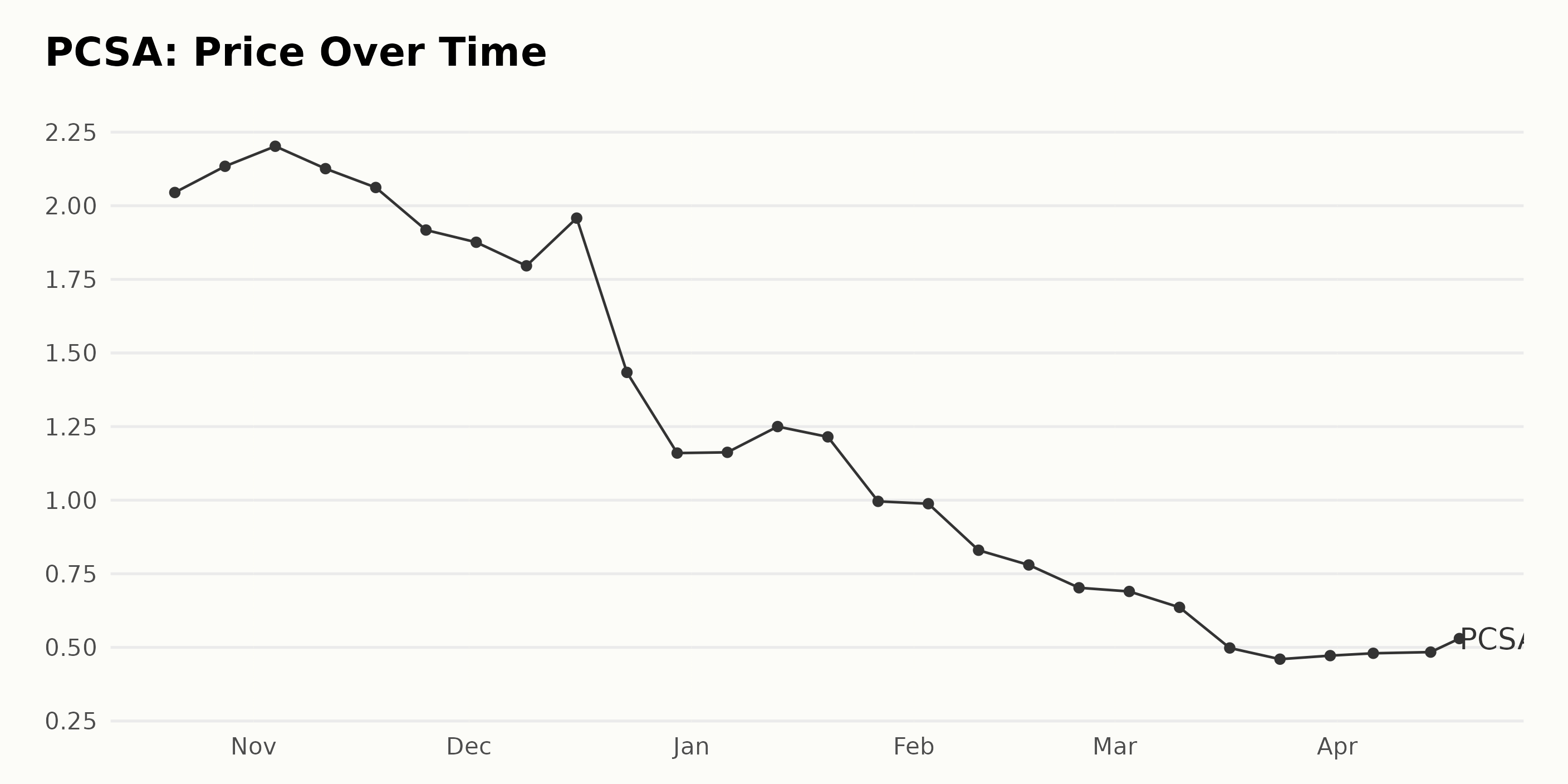

PCSA Share Price Declines -0.84%

The PCSA’s share price from October 21, 2022 to April 17, 2023 shows a downward. The growth rate is -0.84% for this period. The lowest share price of ($0.46) was recorded on March 24, 2023 and the highest ($2.045) on October 21, 2022. Here is a chart of PCSA’s price over the past 180 days.

Unfavorable POWR Ratings

PCSA has an overall rating of D, translating to a Sell in our proprietary POWR Ratings system. The POWR Ratings are calculated considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. The stock has a D grade for Momentum and Quality. PCSA is ranked #212 among 491 stocks in the Biotech industry.

Stocks to Consider Instead of Processa Pharmaceuticals, Inc. (PCSA)

Other stocks in the Biotech sector that may be worth considering are Gilead Sciences Inc. (GILD - Get Rating), Otsuka Holdings Co., Ltd. (OTSKY - Get Rating), and Alexion Pharmaceuticals Inc. (ALXN - Get Rating) — they have better POWR Ratings.

What To Do Next?

Get your hands on this special report:

What gives these stocks the right stuff to become big winners, even in this brutal stock market?

First, because they are all low priced companies with the most upside potential in today’s volatile markets.

But even more important, is that they are all top Buy rated stocks according to our coveted POWR Ratings system and they excel in key areas of growth, sentiment and momentum.

Click below now to see these 3 exciting stocks which could double or more in the year ahead.

Want More Great Investing Ideas?

PCSA shares were trading at $0.54 per share on Tuesday afternoon, down $0.00 (+0.58%). Year-to-date, PCSA has declined -50.91%, versus a 8.54% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| PCSA | Get Rating | Get Rating | Get Rating |

| GILD | Get Rating | Get Rating | Get Rating |

| OTSKY | Get Rating | Get Rating | Get Rating |

| ALXN | Get Rating | Get Rating | Get Rating |