- PENN was a grand slam in 2020

- The second leading online gaming company

- Expect lots of volatility in PENN shares

- COVID changed behaviors- Online gaming with continue to grow

If we learned anything in 2020, businesses with a technology angle outperformed other companies in the same sector. Perhaps the starkest example was in the automobile manufacturers. Tesla’s (TSLA) shares exploded higher, moving from $83.67 on December 31, 2019, to the $685 as of December 30.

Amazon (AMZN) benefited from the pandemic as shoppers remained at home, purchased products online, and the company’s trucks delivered necessities. AMZN shares rose from $1847.84 at the end of 2019 to $3,305 with one day left in 2020. There are countless examples of companies with a technology angle that experienced incredible share appreciation in 2020.

As we move forward into 2021, the technology will continue to support businesses and propel some company’s stocks to the upside. As more states legalize online gambling, Penn National Gaming (PENN - Get Rating) could continue to experience growth. PENN is another stock with a technology angle that experienced an explosive rally in 2020.

PENN was a grand slam in 2020

PENN shares closed 2019 at $25.56 per share. The highly speculative stock fell to a low of $3.75 in March as risk-off selling gripped the stock market and markets across all asset classes. Since then, the price action has been explosive.

Source: Barchart

Source: Barchart

An investment in PENN in March paid off like a four-team parlay with all underdogs as the stock rose to a high of $99.24 on December 23. PENN was trading at around $87 per share on December 30, a rise of over 240% in 2020, with one day to go before the end of the year. From the low, the stock moved over twenty-three times higher.

The second leading online gaming company

PENN, together with its subsidiaries, owns and manages gaming and racing properties and operates video gaming terminals focusing on slot machine entertainment. The company is organized geographically with segments in the US Northeast, South, West, and Midwest.

PENN also offers sport betting at its properties in Indiana, Iowa, Mississippi, Nevada, Pennsylvania, and West Virginia. As of mid-March 2020, the company owned, managed, or had ownership interests in 41 gaming and racing properties in 19 jurisdictions. PENN has been in business since 1972, with its headquarters in Wyomissing, Pennsylvania.

At the $87 per share level on December 30, PENN had a market cap of just over $13.5 billion. The shares trade an average of over 5.1 million shares per day.

Source: Yahoo Finance

Source: Yahoo Finance

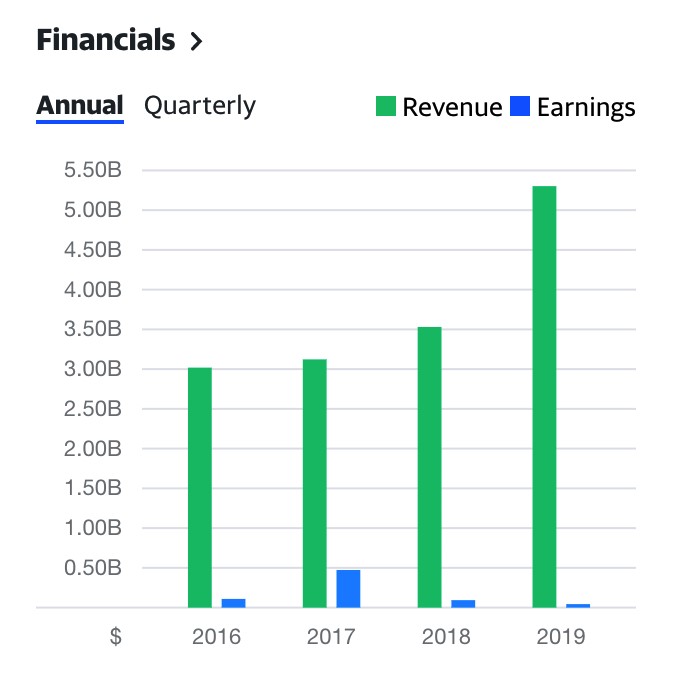

As the chart shows, the revenue trend has been positive from 2016 through 2019.

Source: Yahoo Finance

Source: Yahoo Finance

PENN posted positive EPS over the past two of four quarters. In Q1, a significant loss came as the global pandemic caused the shares to drop to $3.75, but the company earned 93 cents in Q3, beating consensus estimates by 40 cents. The current forecast for Q4 is for PENN to earn 35 cents per share.

The $13.5 billion market cap is second to DraftKings (DKNG), the online sports entertainment and gaming company with over a $19 market cap as of December 30. DKNG has a franchise in fantasy sports betting.

Expect lots of volatility in PENN shares

PENN has been a bullish beast in 2020 after the shares dropped below $4, the lowest level since 2001. However, the explosive move took PENN to a record high, surpassing the previous 2007 peak of $63.38 in September 2020.

PENN is not a stock for the faint of heart, as its volatility over 2020 shows. However, as more US states legalize online gaming, PENN’s addressable market grows. The states are looking for new revenue sources as the price tag for COVID-19 has been prohibitive. It may not be long before all fifty US states allow online gaming to bolster tax revenues. A survey of sixteen analysts on Yahoo Finance has an average price target of only $78.63 for PENN shares, with forecasts ranging from $31 to $115.

Source: Yahoo Finance

Source: Yahoo Finance

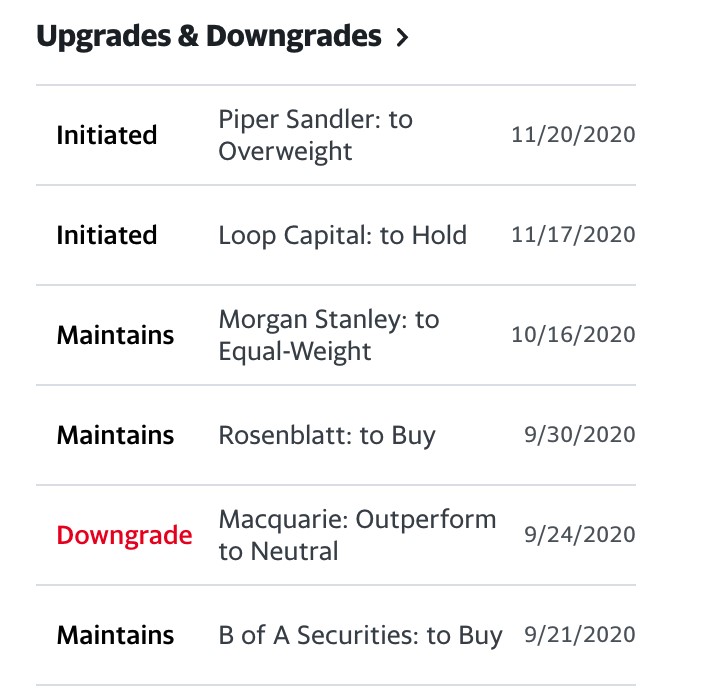

The chart shows that the Wall Street companies rate PENN anything from neutral to a buy at the end of December 2020, even though the stock is at the $87 level.

COVID changed behaviors- Online gaming with continue to grow

Americans love sports. While attending most sporting events has been impossible in 2020, watching while sitting on the couch is still a favorite pastime. Many Americans have also stayed away from casinos, given the threat of the coronavirus.

Gambling on sporting events or playing games of chance on the internet offers action from the comfort of people’s homes. PENN is a leading company offering an online solution for those looking for action. As more states legalize gaming and betting, the trend in PENN’s revenues is likely to continue to rise.

Online betting is a growing business in the US, and PENN is a company that is likely to increase its business in a growing addressable market. PENN is a growth stock for 2021, but the ride could be bumpy given the stock’s penchant for extreme price volatility.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

The #1 CRITICAL Investment Lesson from 2020

7 Best ETFs for the NEXT Bull Market

PENN shares . Year-to-date, PENN has gained 240.73%, versus a 17.73% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| PENN | Get Rating | Get Rating | Get Rating |