Earlier this month, PepsiCo, Inc. (PEP - Get Rating) earned a B (Buy) rating in our POWR Ratings system. The upgrade reflects the beverage giant’s expanded market reach and established global presence, resulting in steady revenue and earnings growth, gushing cash flow, and healthy sales. This impressive performance is expected to continue driving growth for the company.

Moreover, PEP boasts an impressive dividend payment record, making the stock even more attractive to investors. In this article, we’ll explore some metrics showcasing the company’s solid growth prospects.

Examining the Performance of PepsiCo Inc. (PEP - Get Rating)

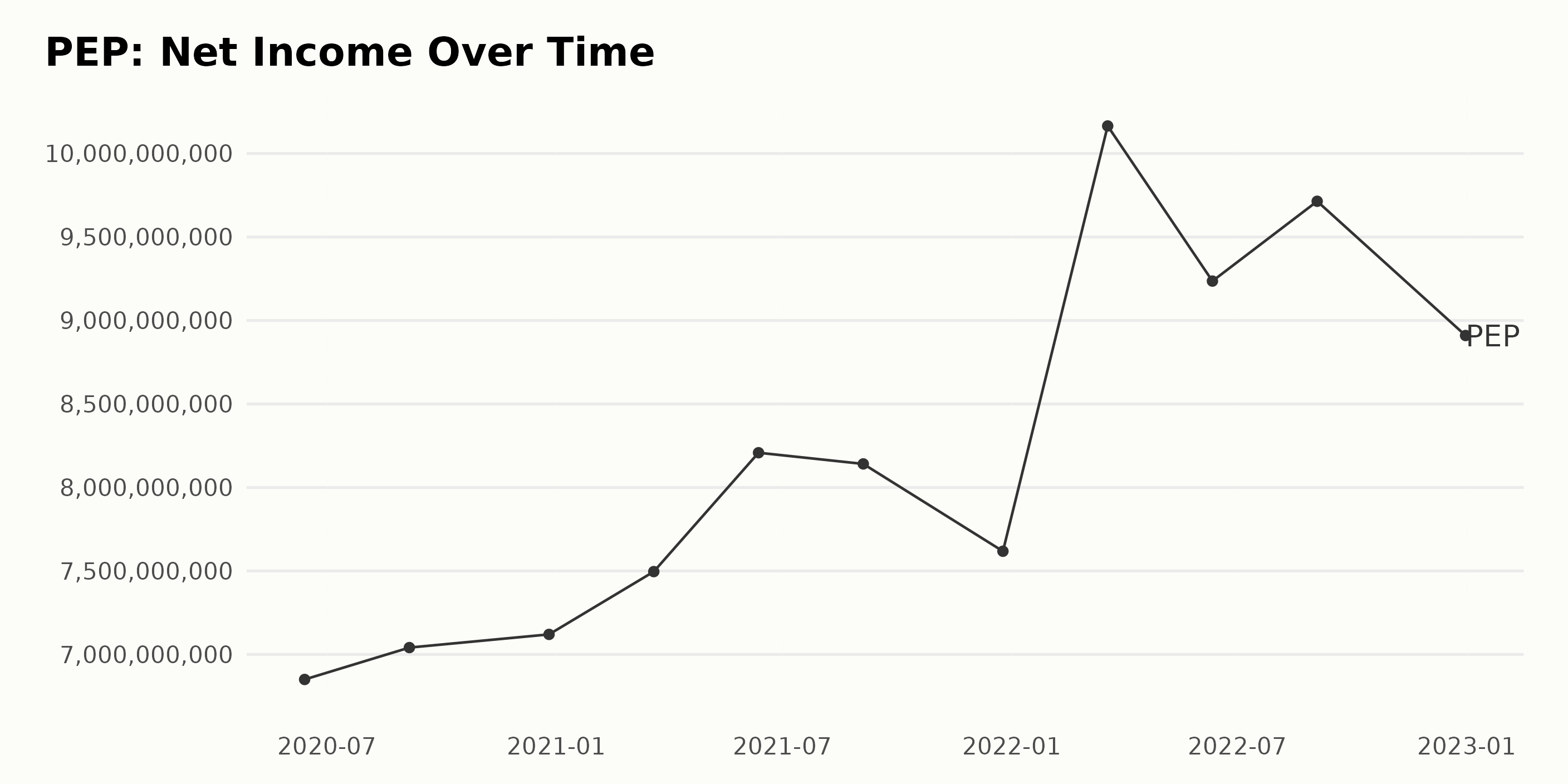

The net income of PEP has fluctuated over the past three years, but the trend is generally increasing. From June 13th, 2020, to December 31st, 2022, the net income increased by 30%, from $685 million to $891 million. The most notable increase was at the beginning of 2023 when net income reached $1,016 million.

PEP has shown an upward trend in its reported revenue over the past two years, with increases of 8.2% from June 2020 to September 2022. The revenue has consistently increased quarter-over-quarter since June 2020, with fluctuations of -3.3% in June 2021, 6.3% in December 2021, and 4.1% in September 2022. The latest reported revenue for September 2022 is $86.4 billion, marking an 8.2% increase from June 2020 and a 5.2% increase from September 2021.

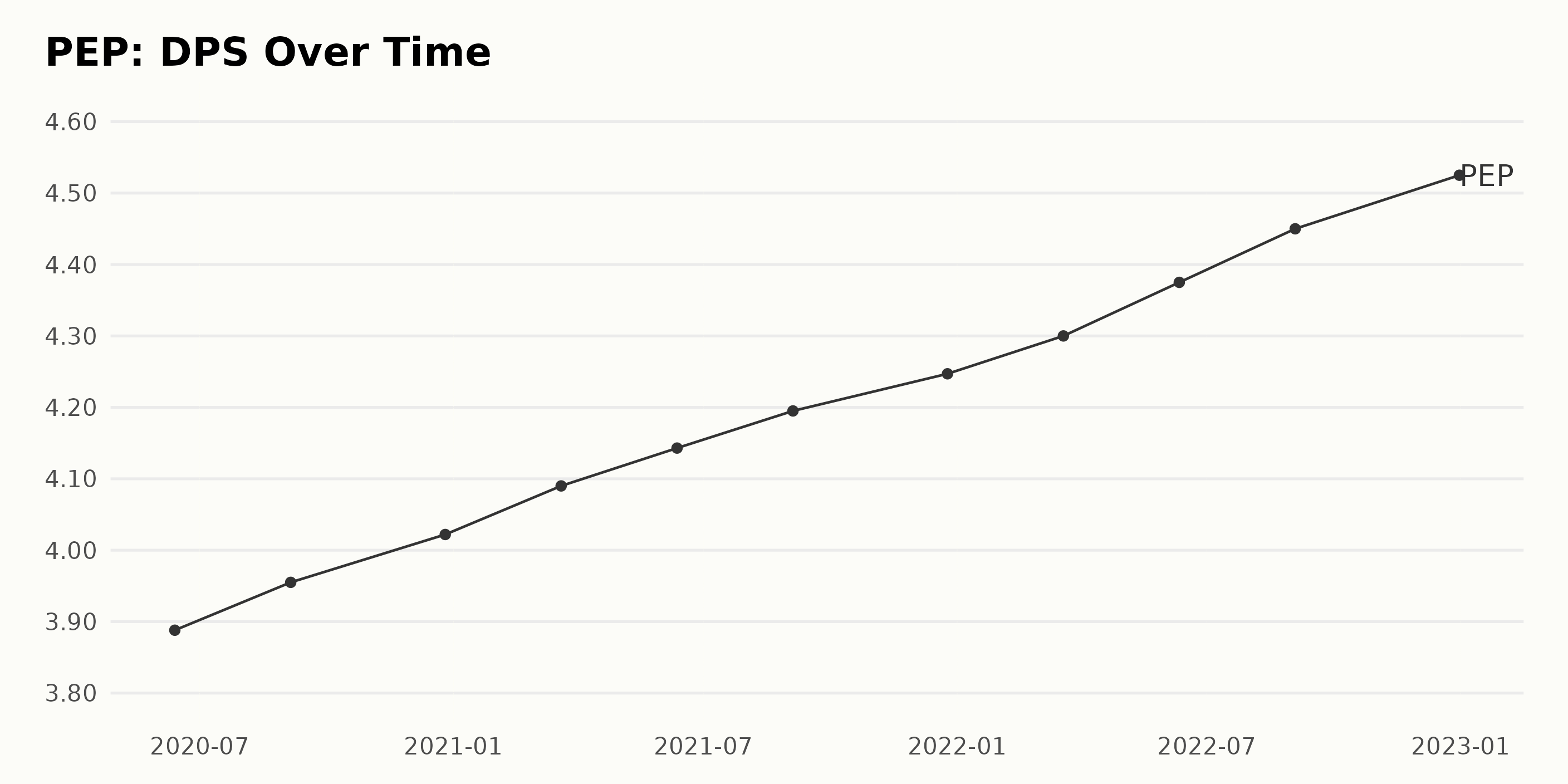

PEP has had a generally positive dividend per share (DPS) trend over the past two years. Starting from June 2020, DPS has steadily increased from $3.89 to a value of $4.53 in December 2022, which indicates a 16.8% increase. The DPS has fluctuated between individual periods but has been climbing at a favorable rate overall.

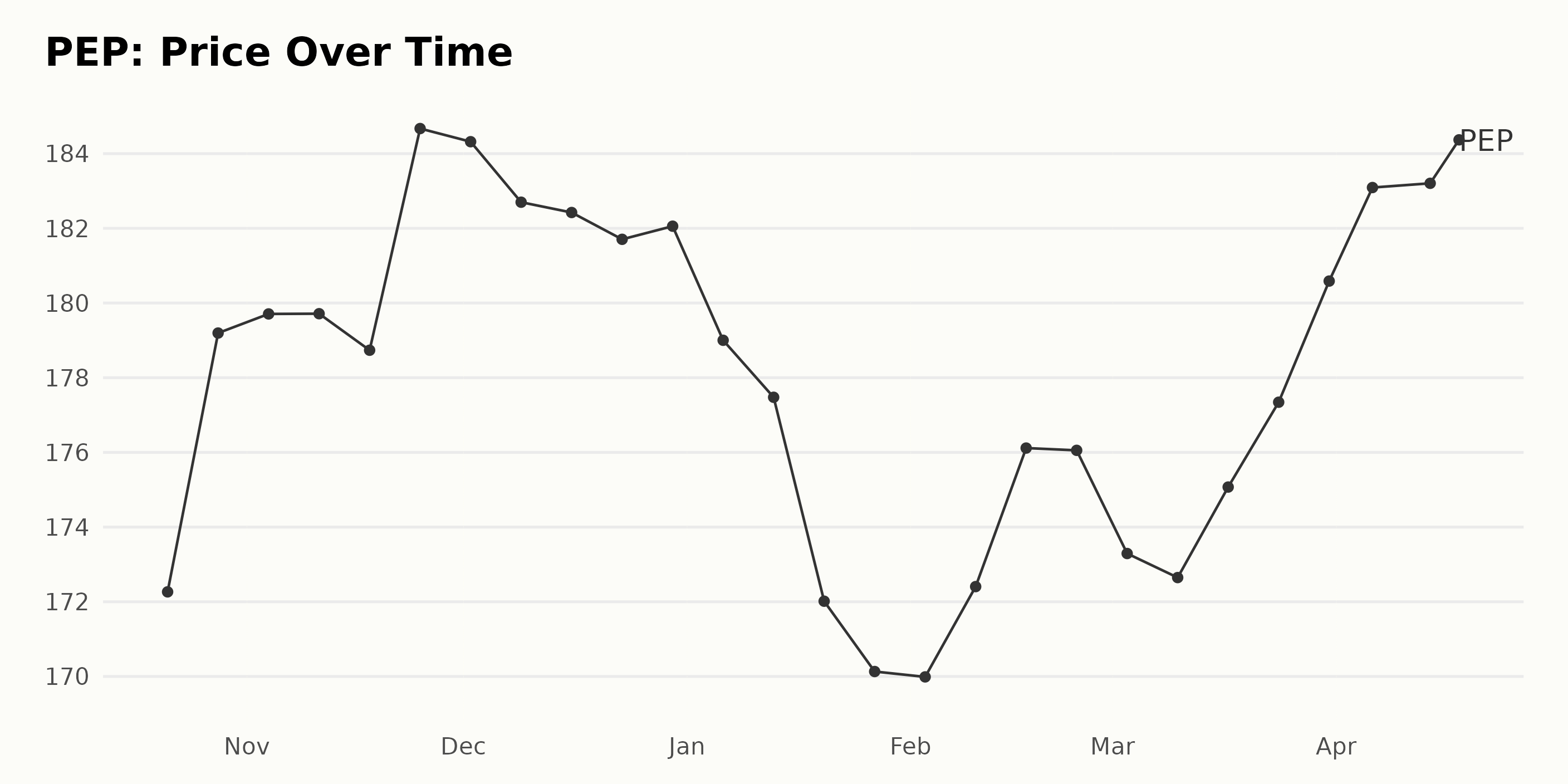

PepsiCo Inc. (PEP) Price Increase of 0.5% Per Week

There appears to be a slight increase in the price of PEP shares, with the stock increasing from $172.27 on October 21, 2022 to $183.21 on April 18, 2023. The growth rate is roughly 0.5% per week. Here is a chart of PEP’s price over the past six months.

PepsiCo Inc. Quality, Sentiment and Stability Ratings

On April 4, 2023, PEP’s overall rating was upgraded to B, translating to a Buy in our POWR Ratings system. Its rank in the Beverages category is 17 out of 37 stocks, which is below average.

According to the POWR Ratings for PEP, the three most noteworthy dimensions are Quality, Sentiment, and Stability. In October 2022, the Quality score was 96, Sentiment scored 89 and Stability scored 80. Meanwhile, in November 2022, Sentiment decreased to 81 while Quality and Stability remained the same.

By December 2022, three of the highest-scoring dimensions were still Quality (97), Sentiment (78), and Stability (78). From December 2022 to April 2023, all of these dimensions saw some movement. Quality only dropped slightly to 95 in March 2023, but Sentiment fell to 65 and Stability dropped to 76. April 2023 then saw a slight increase in Sentiment to 76, while Quality and Stability remained consistent.

Other stocks in the Beverages sector that may be worth considering are Coca-Cola Femsa S.A.B. de C.V. (KOF - Get Rating), Embotelladora Andina S.A. (AKO.B - Get Rating), and Suntory Beverage & Food Limited (STBFY - Get Rating) — they have better POWR Ratings.

What To Do Next?

Get your hands on this special report:

What gives these stocks the right stuff to become big winners, even in this brutal stock market?

First, because they are all low priced companies with the most upside potential in today’s volatile markets.

But even more important, is that they are all top Buy rated stocks according to our coveted POWR Ratings system and they excel in key areas of growth, sentiment and momentum.

Click below now to see these 3 exciting stocks which could double or more in the year ahead.

Want More Great Investing Ideas?

PEP shares were trading at $184.83 per share on Tuesday afternoon, up $0.38 (+0.21%). Year-to-date, PEP has gained 3.00%, versus a 8.71% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| PEP | Get Rating | Get Rating | Get Rating |

| KOF | Get Rating | Get Rating | Get Rating |

| AKO.B | Get Rating | Get Rating | Get Rating |

| STBFY | Get Rating | Get Rating | Get Rating |