- Good riddance to 2020

- Higher asset prices could be a mirage

- Optimism over the end of the pandemic

- Pessimism over its’ cost

- Assets that should keep pace with rising inflation

On December 31, 2020, we will say farewell to this year, which was a challenge. The global pandemic left a trail of illness and death throughout most of 2020. Even as highly effective vaccines are now starting to be available; the virus continues to claim victims. Cities have reinstituted lockdowns, and people are on edge as they wait to receive a shot or two in the arm, they hope will protect them from COVID-19.

Meanwhile, the highly contentious November 3 election left half the US happy and the other half miserable. While Joe Biden will take the oath of the Presidency on January 20, the majority in the Senate is still up for grabs at the end of the year with a pair of runoff elections in Georgia. The runoffs will determine if the incoming administration has clear sailing for its agenda in 2021, which could make for substantial changes on many policy fronts.

The pandemic and political uncertainty have not stopped the stock market from reaching new record highs. Many asset prices have moved to lofty levels over the past months. As we head into 2021, optimism and pessimism are pulling the economy and people’s lives in opposite directions. Identifying assets that will survive and thrive in 2021 is more than a challenge as we head into the new year.

Good riddance to 2020

We often look back at years during our lives with fond memories. For the vast majority, 2020 will be a year to forget. We have been through the worst period of sickness and death in over a century since the 1918 Spanish flu causing fear and uncertainty, social distancing, and a significant change in daily behaviors.

The pandemic took a severe mental and physical toll on the health of many humans. Loneliness, throughout the most vulnerable, has caused problems. The fear of contracting the virus caused people to neglect health concerns and issues without necessary treatments. Long after the virus is a memory, these issues will be a legacy of the pandemic.

Aside from the human toll, many have lost jobs and businesses, making the financial aftermath of COVID-19 a factor that will continue to impact markets for the coming years.

Higher asset prices could be a mirage

Recently, I received a call from an economist who expressed the opinion that there is now another technology bubble similar to the one that occurred at the turn of this century. He pointed to the recent IPOs of DoorDash (DASH) and Airbnb (ABNB), which exploded higher on the first day of trading to levels that were over double the IPO prices.

The economist was calling a top in the market, which could be a tragic mistake. Markets tend to move far higher than logic dictates during bullish periods and lower than rational levels during bear markets. I suggested that the reason for the high prices could be the erosion of currency values and the inflationary pressures caused by a tidal wave of central bank liquidity and low interest rates and a tsunami of government stimulus programs.

Before 2020, the record for borrowing by the US Treasury was from June through September 2008 at $530 billion. In May 2020, the Treasury borrowed $3 trillion. Therefore, the rise in many asset prices could be a mirage, reflecting the decline in the value of the US dollar and all fiat currencies as deficits rise and governments continue to expand the money supply.

Optimism over the end of the pandemic

The flood of liquidity and stimulus stabilized the global economy in 2020, but optimism over the highly effective Pfizer (PFE) and Moderna (MRNA) vaccines have turbocharged markets. The combination of fiscal and monetary policy and optimism has been a powerful bullish force in the stock market and many other asset classes.

The potential for global herd immunity in 2021 caused markets to charge higher across most asset classes as markets look to the future rather than dwelling on the past or reflecting on the present. The optimism over the end of the pandemic, even as it continues to rage at the end of 2020, is one reason the bulls continue to charge in stocks, commodities, digital currencies, and other assets.

Pessimism over its’ cost

Albert Einstein said that the definition of insanity is doing the same thing repeatedly and expecting a different result. While the 2008 global financial crisis and the 2020 pandemic were very different events, central banks and governments used the same tools to combat the economic impacts. From 2008 through 2012, commodity prices moved to multi-year or all-time highs, and the stock market moved higher.

In 2008, US public debt was around the $10 trillion level. By 2012, it reached over $16 trillion, an increase of over 60% in four years. In 2019, the level was $22.7 trillion, and it will be well over $27 trillion at the end of 2020. Liquidity and stimulus levels were far higher during the pandemic than the financial crisis a dozen years ago. If the debt rises by the same percentage, it will reach over $36 trillion by 2024.

Like a person who goes on a wild shopping spree this year and charges up a storm on credit cards, the costs will follow them for years and even decades. The US and many countries worldwide will face the same dilemma. Rising inflationary pressures, is a legacy of liquidity and stimulus, will eventually cause bond prices to fall as the central bank pivots from accommodative to a more hawkish approach to monetary policy to control inflation.

As interest rates rise, it will make the cost of financing the debt soar. The real bull market is in the debt created by monetary and fiscal stimulus. The value of money that comes from the full faith and credit of countries that issue the legal tender is on a downward spiral.

Therefore, the prices of stocks like DOOR, ANBN, as well as commodities, and even Bitcoin, may only reflect the decline in traditional money’s value. The bull markets could be a smokescreen covering the fall in currency values.

Assets that should keep pace with rising inflation

Commodities are a global asset class. While stocks, currencies, bonds, and many other assets are often specific to countries, raw materials demand is worldwide. As the value of money declines, commodity prices tend to rise as all of the over 7.7 billion people in the world continue to require food, infrastructure, shelter, clothing. Commodities are the critical ingredients in the products that people need.

The world’s leading commodity-producing companies could be the leaders over the coming years. Inflationary pressures may increase the production costs, but the – commodity markets’ volatility during bull market periods is likely to outpace the rising costs.

Metals, minerals, and ores are the building blocks of infrastructure. Addressing unemployment in the US will require a massive works project over the coming years. In the 1930s, FDR rolled out the “New Deal,” which provided jobs and put Americans back to work after the Great Depression.

The incoming Biden administration has bipartisan support for an infrastructure program to rebuild the crumbling bridges, tunnels, airports, government buildings and schools, and other parts of US infrastructure. The project will require massive amounts of industrial commodities at a time when China continues to experience growing demand.

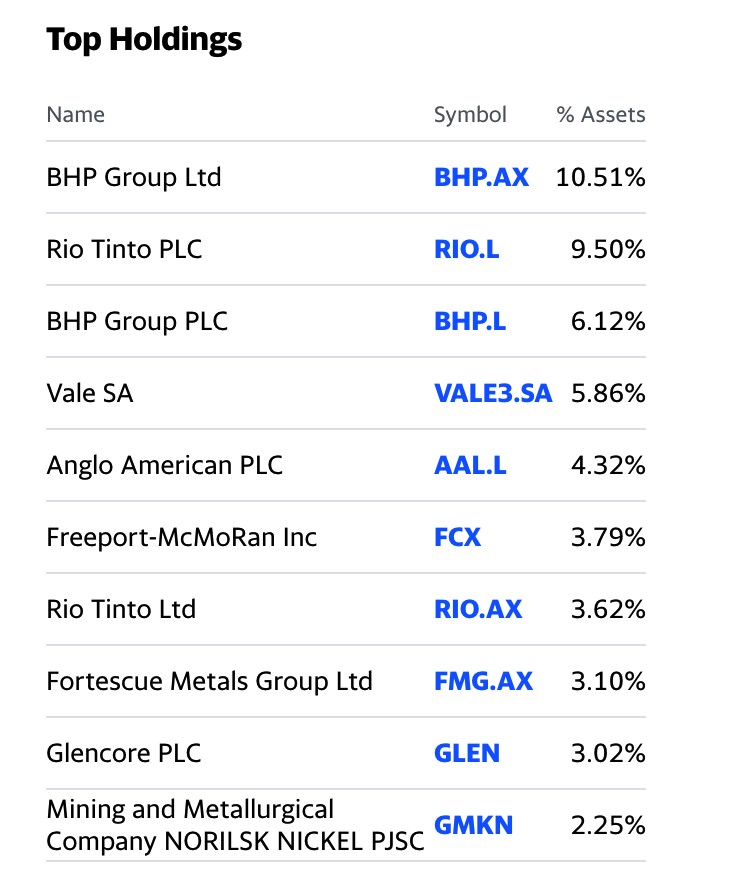

The top holdings of the iShares MSCI Global Metals & Mining Producers ETF product (PICK - Get Rating) include:

Source: Yahoo Finance

Source: Yahoo Finance

PICK holds a portfolio of the leading metals and mining companies worldwide. The ETF has net assets of over $281 million, trades an average of 175,951 shares each day, and charges a 0.39% expense ratio. Most recently, the ETF offered shareholders a blended dividend yield of 4.20%.

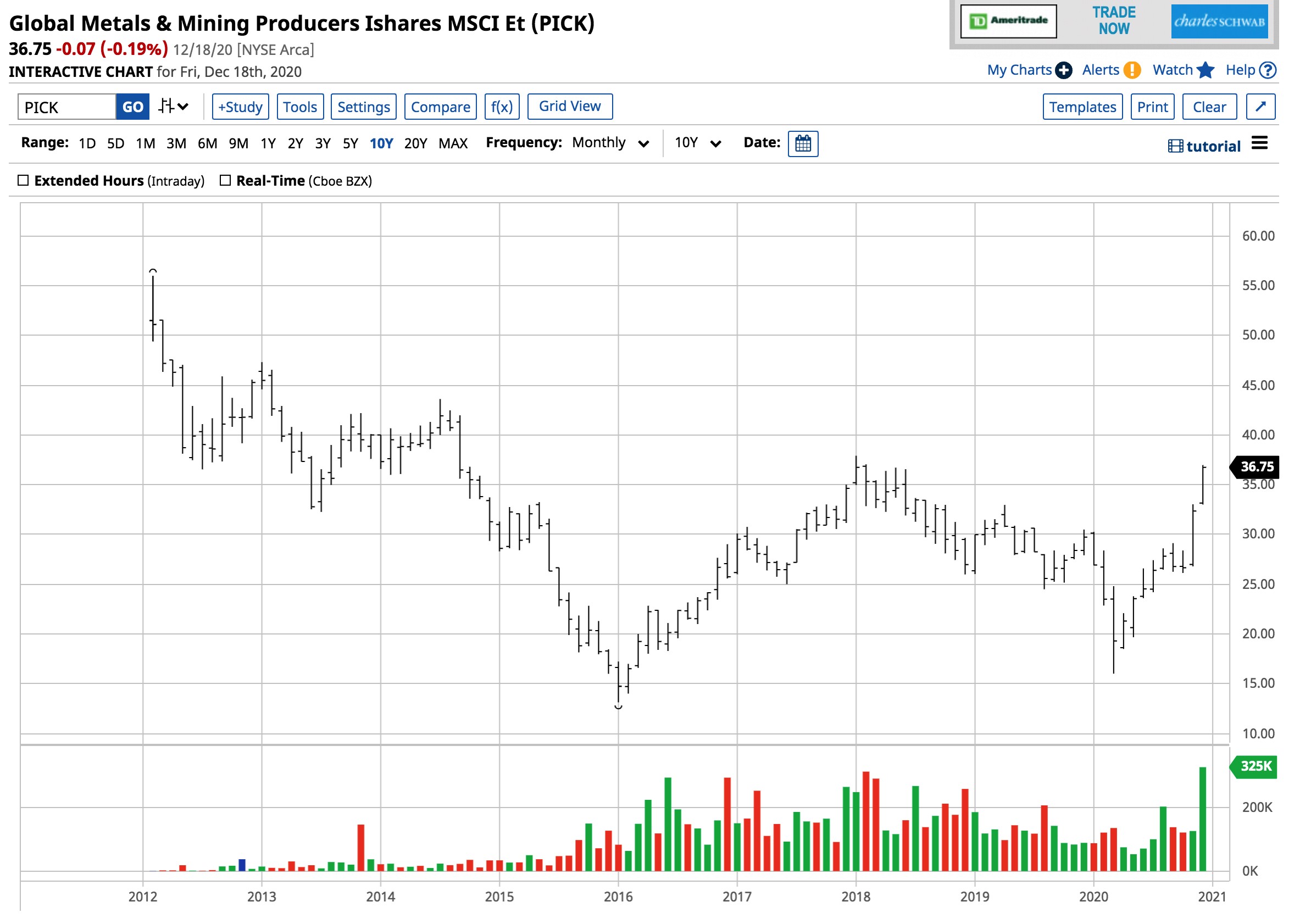

Source: Barchart

Source: Barchart

The chart shows the PICK ETF rose from a low of $16.01 in March to $36.97 late last week as it more than doubled since the 2020 lows. However, it could be just the beginning of a move to much higher levels if rising inflationary pressures continue to grip the global economy over the coming years. Commodities have the potential to be the next sector to soar after the technology bull market in 2020.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

Where is the Santa Claus Stock Rally?

5 WINNING Stocks Chart Patterns

PICK shares were trading at $35.80 per share on Monday morning, down $0.95 (-2.59%). Year-to-date, PICK has gained 23.83%, versus a 15.06% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| PICK | Get Rating | Get Rating | Get Rating |