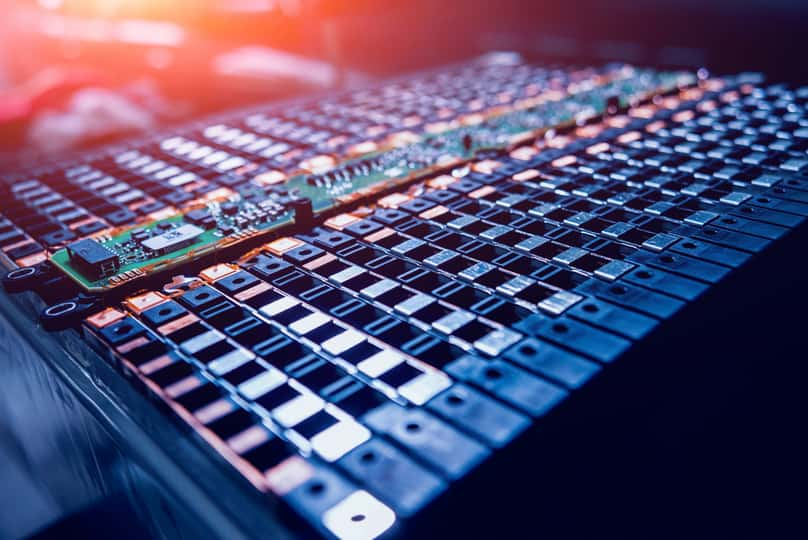

Development stage company QuantumScape Corporation (QS - Get Rating) in San Jose, Calif., is creating next-generation solid-state lithium-metal batteries for use in electric vehicles (EVs). The company has been making significant progress in its pre-pilot manufacturing line QS-0. Also, its recent advance in testing 10-layer cells to develop a solid-state battery has garnered considerable investor attention.

However, QS shares have declined 11.5% in price over the past month and 76% over the past year. In addition, the stock is trading 84.8% below its 52-week high of $132.73, indicating short-term bearishness.

Although QS has made decent progress in developing its battery technology, it is still in the research phase and does not have any products for commercial sale. In addition, strong competition in the solid-state lithium battery technology industry and uncertainty surrounding its production horizon could make investors nervous.

Click here to checkout our Electric Vehicle Industry Report for 2021

So, here is what we think could influence QS’ performance in the near term:

Lawsuits and Investigations

In June, Johnson Fistel, LLP started investigating potential claims against certain officers and directors of QS on behalf of the company’s shareholders. Also, in May, Robbins LLP began investigating QS to determine whether certain officers and directors of the company breached fiduciary duties and violated the Securities Exchange Act of 1934. Furthermore, earlier this year, Levi & Korsinsky, LLP, the Schall Law Firm, the Klein Law Firm, and several other law firms filed a class-action lawsuit against the company for allegedly making potentially misleading statements and overstating the purported success of its solid-state batteries.

Challenges in Business

QS continues to make significant progress in building its solid-state lithium-metal battery to improve battery performance in EVs. While its manufacturing innovations and goal of showing results from 10-layer cells by the end of this year reflects its rapid rate of progress, there could be major hurdles ahead for the company. The race to capture the next-generation battery market is now intensely competitive. With established players such as Toyota Motor Corporation (TM), Ford Motor Company (F), and General Motors Co. (GM) making significant investments in solid-state batteries, QS could face a serious threat to its business. Moreover, the company does not expect to deliver its prototype samples before 2022 and enter commercial production before 2024 – 2025. Given that it is still a long way from commercial sales, the stock’s prospects look risky.

Lackluster Financials

QS’ total operating expenses for the second quarter, ended June 30, 2021, were $49.62 million. This compares to $14.23 million for the second quarter of 2020. Also, its non-GAAP operating loss came in at $38.02 million, representing a 215.7% increase year-over-year. And QS’ adjusted EBITDA amounted to a negative $35.21 million for this quarter. Its loss per share totaled $0.12, while other comprehensive losses on marketable securities came in at $837,000. QS has not yet generated any revenues because its commercial production is not expected to begin before 2024.

Its trailing-12-month ROE, ROA, and ROTC are negative 268.9%, 94.5%, and 10.6%, respectively. And its trailing-12-month cash from operations stood at a negative $93.70 million.

Dismal Growth Potential

Analysts expect QS’ EPS to decline 4.7% in its fiscal year 2022. Its EPS is expected to remain negative in the fiscal year ending December 2021 and December 2022. The company also failed to surpass Street’s EPS estimates in three of the trailing four quarters.

Unfavorable POWR Ratings

QS has an overall F rating, which translates to a Strong Sell in our POWR Ratings system. The POWR Ratings are calculated by considering 118 different factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight different categories. QS has a D grade for Quality. The stock’s negative profit margin is reflected in this grade.

Also, it has an F grade for Growth, which is consistent with the stock’s bleak growth prospects.

In terms of Stability Grade, QS has a D. This indicates that the stock is more volatile than its peers.

Beyond the grades I’ve highlighted, one can check out additional QS ratings for Sentiment, Value, and Momentum here.

Of the 67 stocks in the A-rated Auto Parts industry, QS is ranked #64.

Bottom Line

Even though QS’ advancements in testing its first 10-layer cells and building a pre-pilot manufacturing facility have captured investors’ interest, it might take the company a long time to start its production. Meanwhile, the ongoing legal investigations and growing competition in the solid-state technology space could pose a risk to the stock. So, we believe it’s wise to avoid the stock now.

How Does QuantumScape (QS) Stack Up Against its Peers?

While QS has an overall POWR Rating of F, one might want to consider taking a look at its industry peers, DENSO Corporation (DNZOY - Get Rating), Bridgestone Corporation (BRDCY - Get Rating), and LKQ Corporation (LKQ - Get Rating), which have A (Strong Buy) ratings.

Click here to checkout our Electric Vehicle Industry Report for 2021

Want More Great Investing Ideas?

QS shares were trading at $20.02 per share on Wednesday morning, down $0.21 (-1.04%). Year-to-date, QS has declined -76.29%, versus a 19.54% rise in the benchmark S&P 500 index during the same period.

About the Author: Imon Ghosh

Imon is an investment analyst and journalist with an enthusiasm for financial research and writing. She began her career at Kantar IMRB, a leading market research and consumer consulting organization. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| QS | Get Rating | Get Rating | Get Rating |

| DNZOY | Get Rating | Get Rating | Get Rating |

| BRDCY | Get Rating | Get Rating | Get Rating |

| LKQ | Get Rating | Get Rating | Get Rating |