Biotech company Regeneron Pharmaceuticals, Inc. (REGN - Get Rating) could be a great addition to any portfolio before the release of its first-quarter results next week. The biotech powerhouse has seen immense financial success in recent years.

REGN’s revenue, EBIT, and net income have grown at 22.9%, 31.2%, and 27% CAGRs, respectively, over the past three years. Its EPS has increased at a CAGR of 27.5% over the same period.

Moreover, the biotech industry is booming thanks to an aging population and rising chronic diseases. The global biotech market is expected to be worth around $1.68 trillion by 2030, growing an 8.7% CAGR.

Given this backdrop, let us discuss the company’s key financial metrics.

REGN’s Revenue, Gross Margin, and Return on Assets Trends

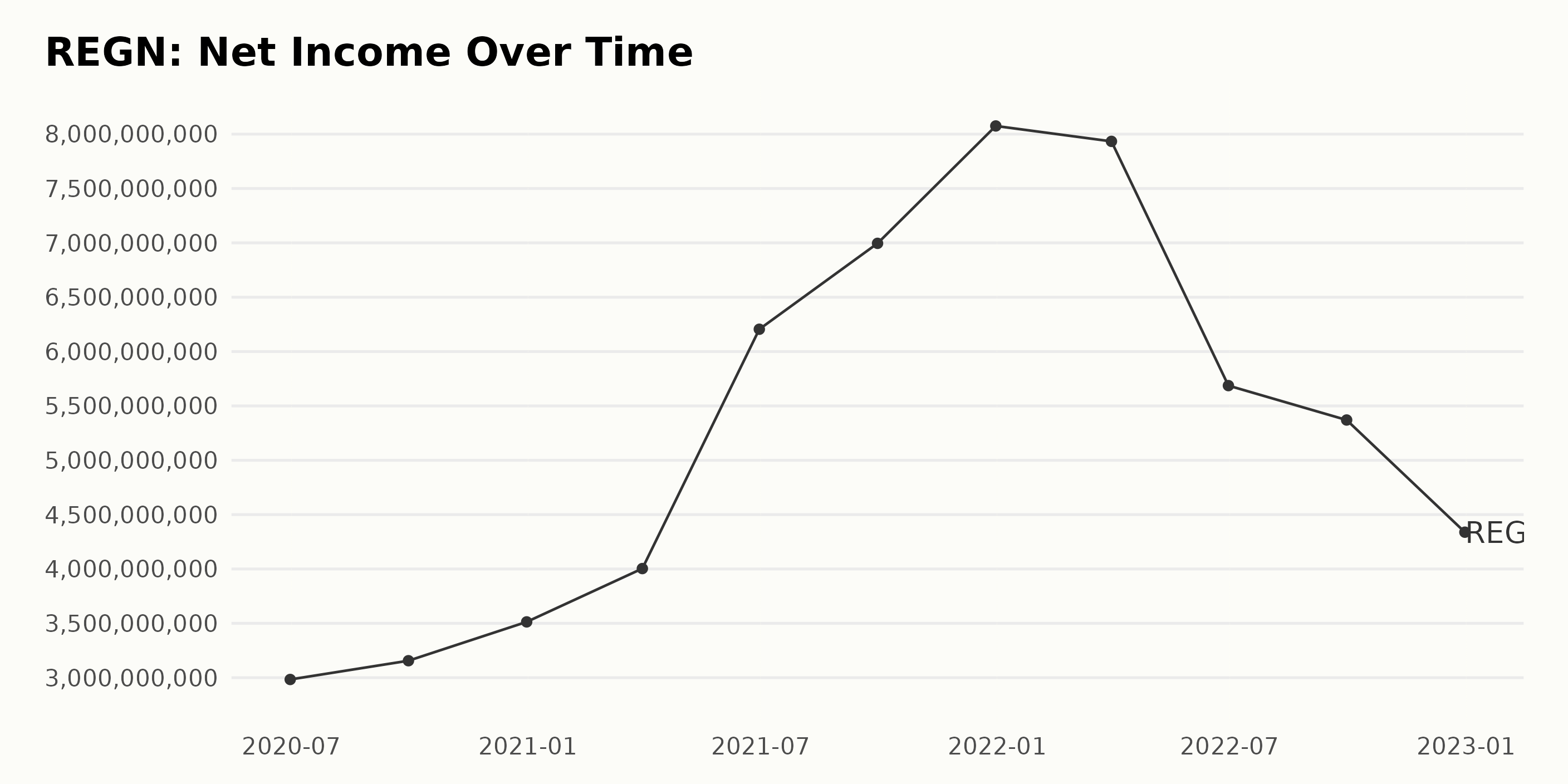

REGN’s net income exhibited substantial growth throughout the series, rising from $298.4 million on June 30, 2020, to $807.5 million on December 31, 2021, an increase of 170%. The net income peaked at $873.6 million on March 31, 2022, before dropping to $433.8 million by December 31 of the same year, a decrease of 50.3%.

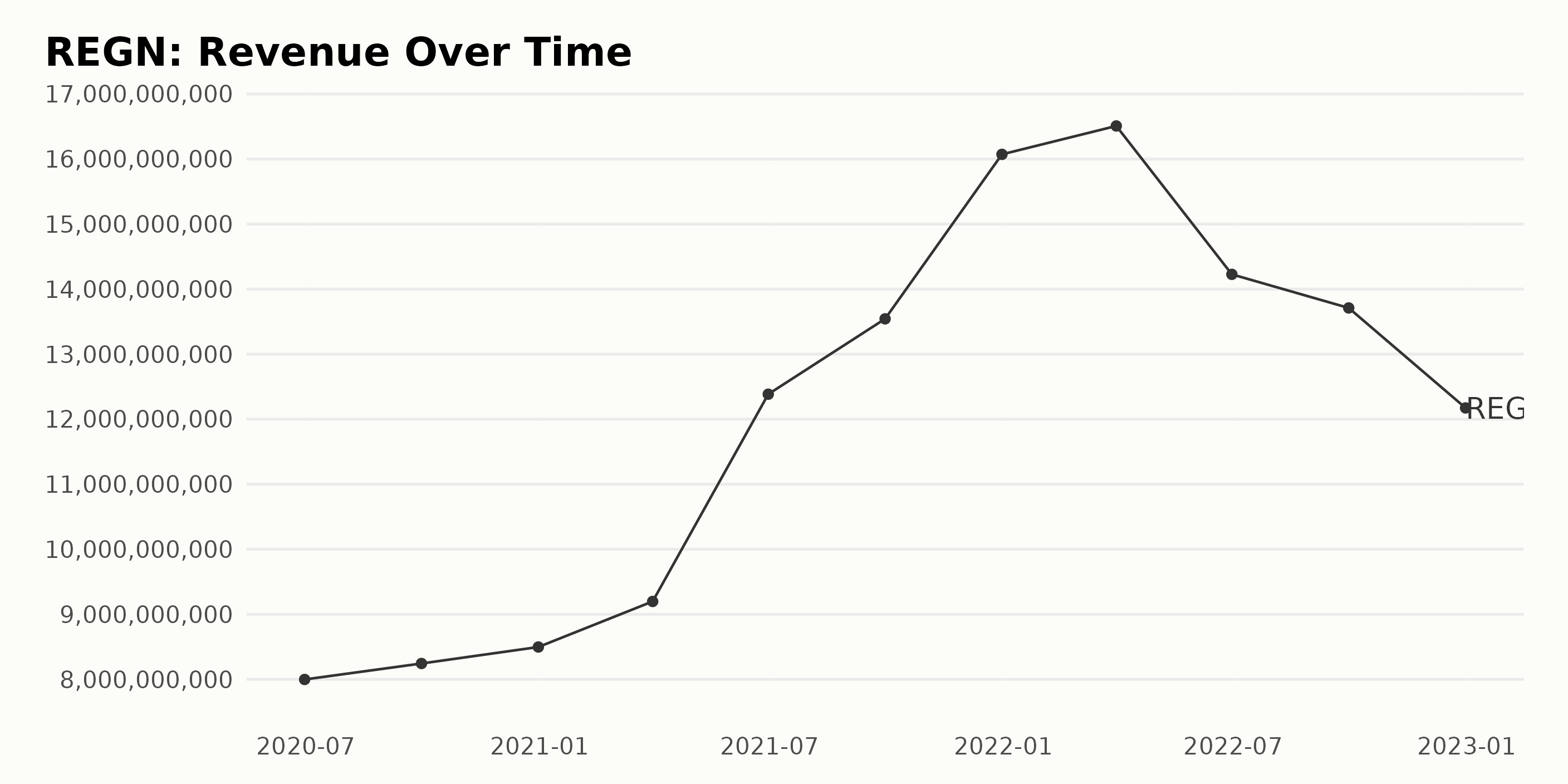

REGN experienced an overall upward trend in revenue since June 2020, with the most recent reported revenue of $1.22 billion in December 2022, representing a growth rate of about 53% from the first reported revenue of $7.99 billion in June 2020. Revenue increased significantly from June 2021 to September 2021, from $1.23 billion to $1.35 billion, then slightly decreased over the ensuing quarters until reaching its current level at the end of 2022.

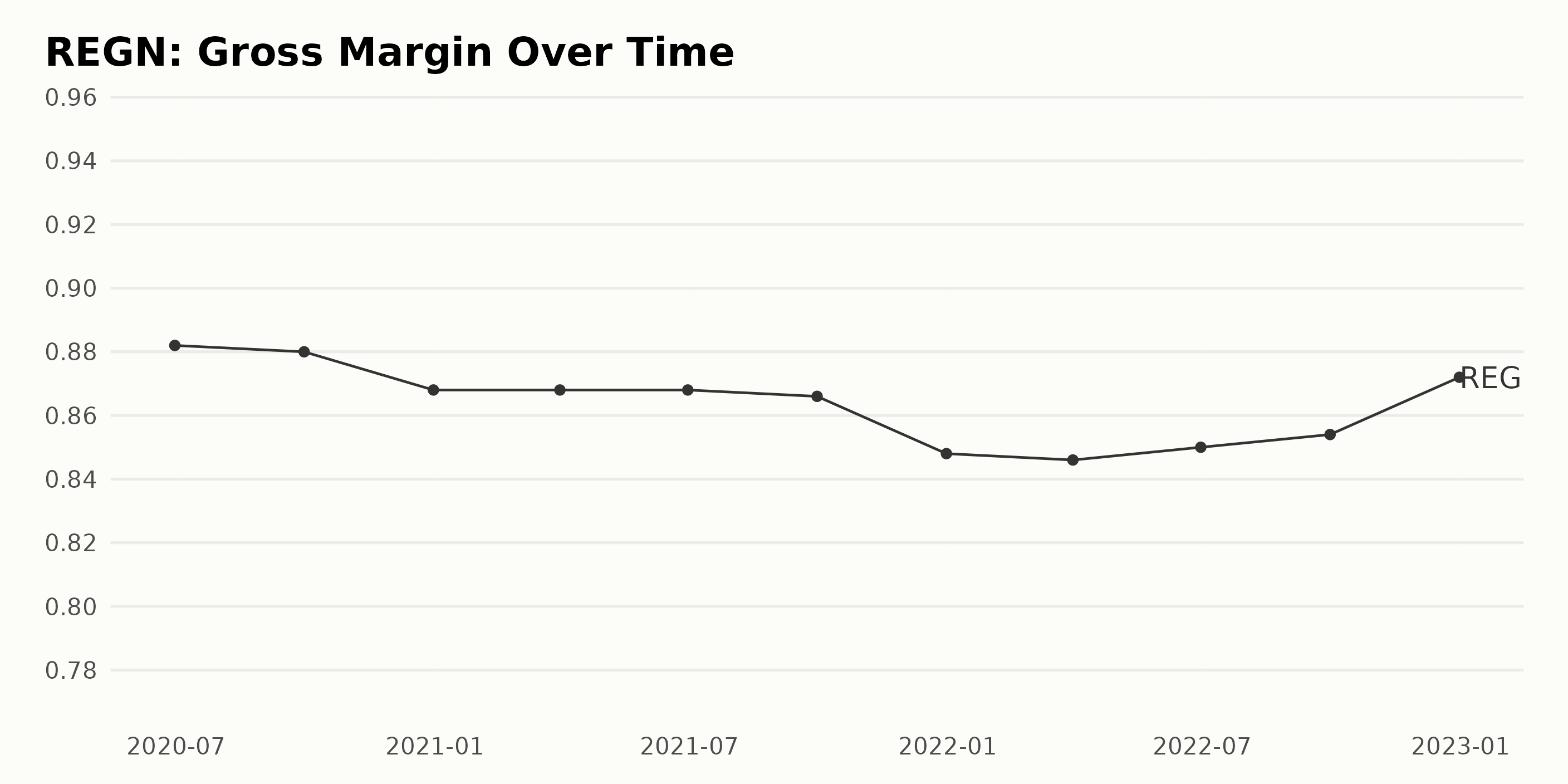

REGN’s gross margin steadily declined from 88.2% on June 30, 2020, to 84.8% on December 31, 2021, followed by a relatively steady growth trend, up to 87.2% on December 31, 2022.

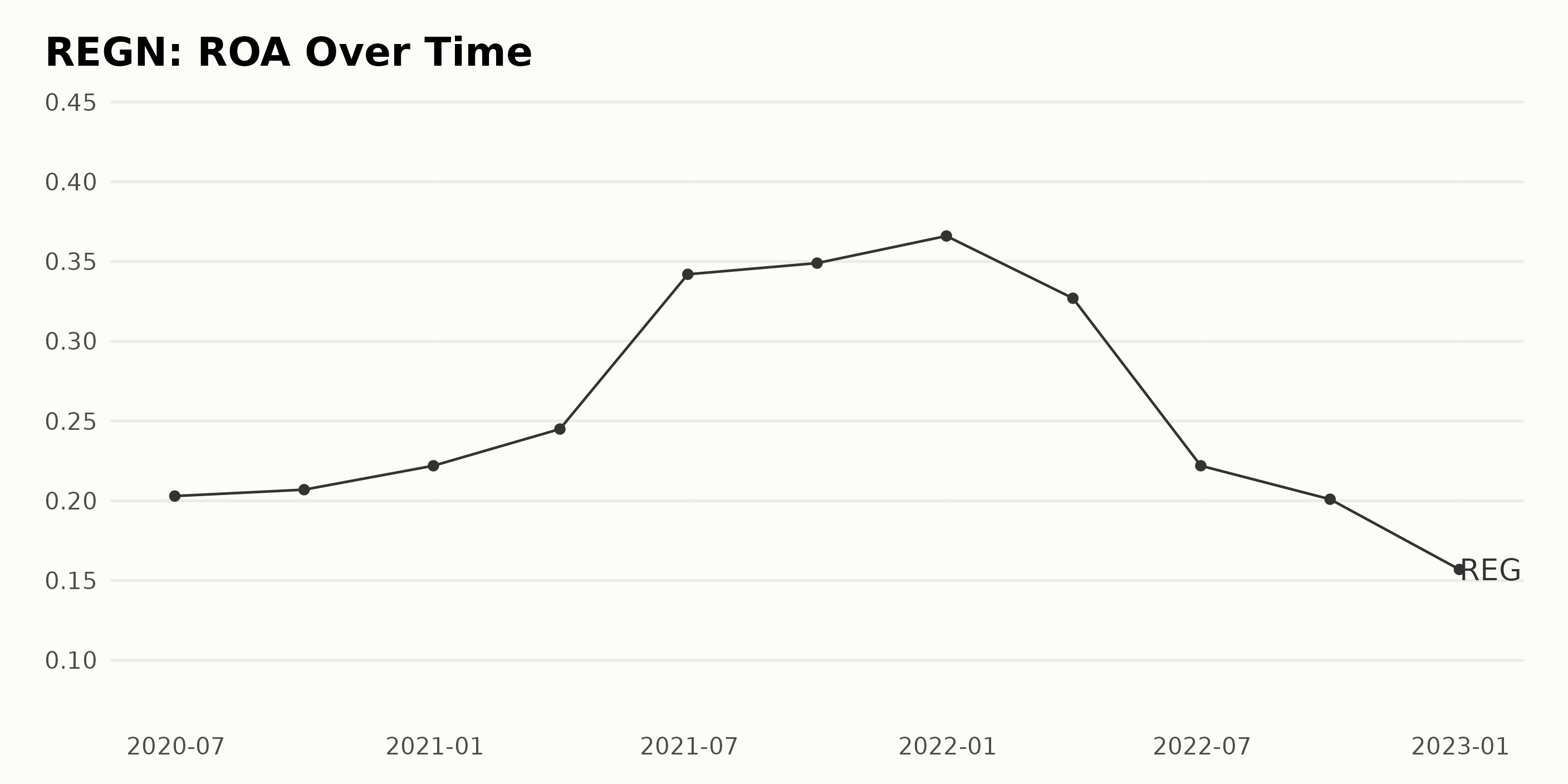

Between June 2020 and December 2022, REGN’s ROA shows an overall upward trend. The ROA increased from 0.203 in June 2020 to 0.366 in December 2021, representing a growth of 80% over this period. In the most recent quarter, between December 2021 and March 2022, ROA slightly decreased from 0.366 to 0.327. The current ROA is 0.157.

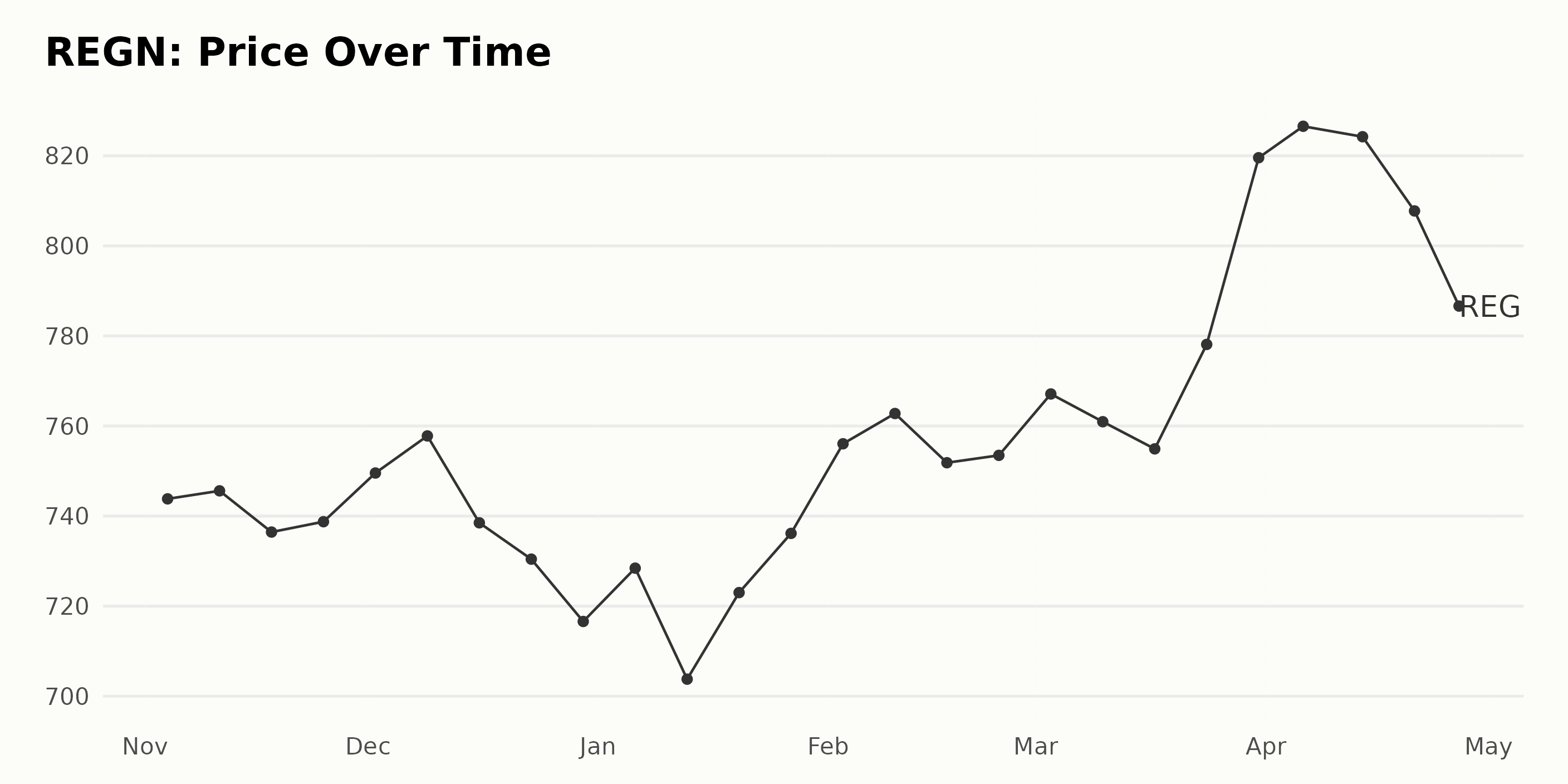

REGN’s Accelerating Share Price Increase

REGN’s share price has been on an overall uptrend, with the value increasing from $716.60 on December 30, 2022, to $826.56 on April 6, 2023. The growth rate appears to be accelerating as the share price increased more rapidly for March 10 – April 27, 2023 than for November 4, 2022 – February 24, 2023. Here is a chart of REGN’s price over the past 180 days.

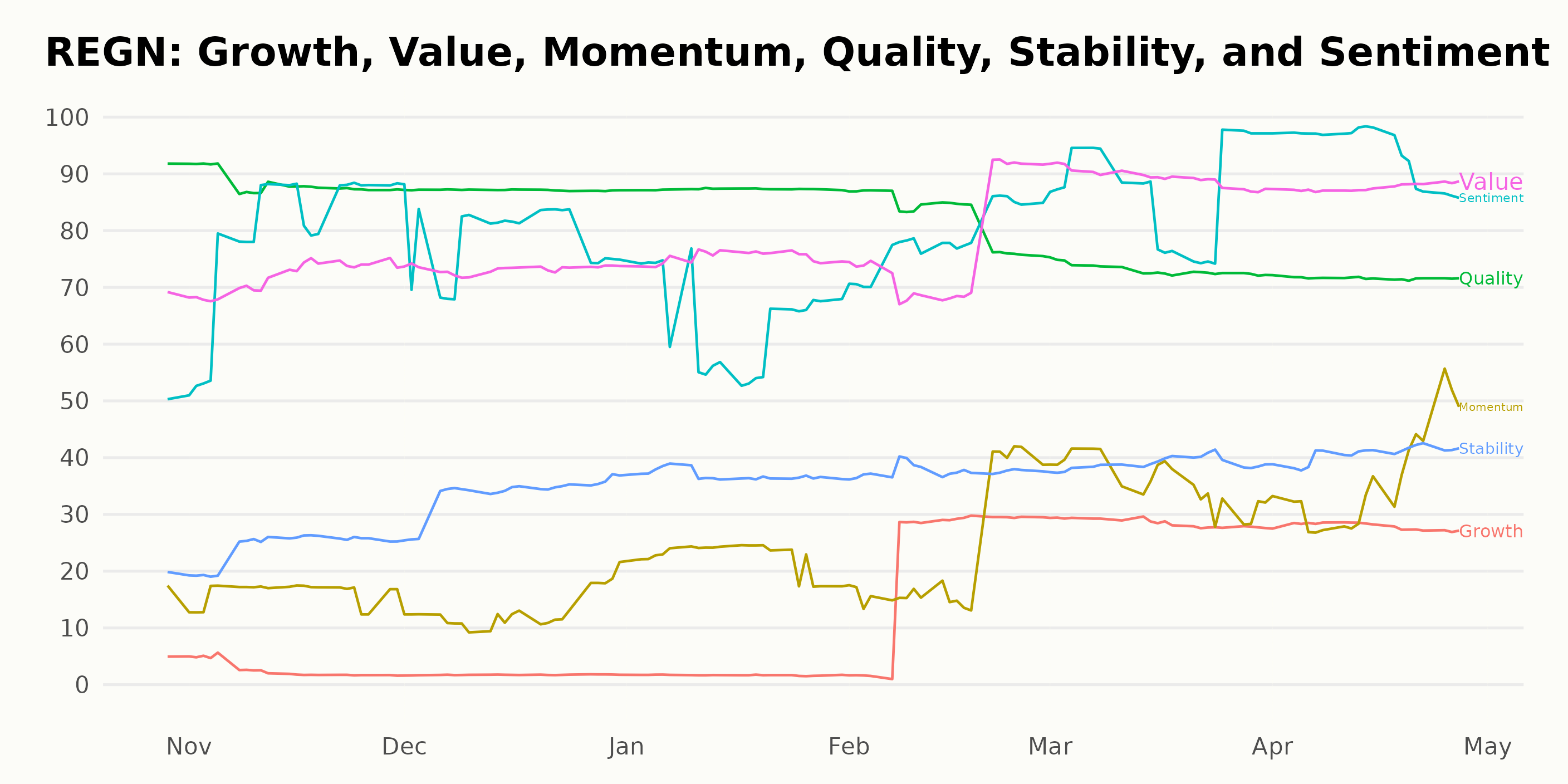

Quality, Momentum, and Stability: POWR Ratings for REGN

REGN has an overall B rating, which translates to Buy in our in our proprietary POWR Ratings system. At the time of writing, REGN has a rank in the Biotech category of #19 out of 383 stocks, which is relatively good as lower values denote superior rank.

The POWR Ratings for REGN indicate that Quality has the highest rating, with an average score of 86 across October 2022 to April 2023. Momentum also has consistently high ratings, ranging between 13 and 35 throughout the six-month period.

Stability was rated with the lowest scores, with an average score of only 35 out of 100 points. There is a general decreasing trend in Stability, with a low score of 20 in October 2022 and 41 in April 2023.

How does Regeneron Pharmaceuticals Inc. (REGN) Stack Up Against its Peers?

Other stocks in the Biotech sector that may be worth considering are Biogen Inc. (BIIB - Get Rating), Gilead Sciences Inc. (GILD - Get Rating), and Vanda Pharmaceuticals Inc. (VNDA - Get Rating) — they have better POWR Ratings.

The Bear Market is NOT Over…

That is why you need to discover this timely presentation with a trading plan and top picks from 40 year investment veteran Steve Reitmeister:

REVISED: 2023 Stock Market Outlook >

Want More Great Investing Ideas?

REGN shares were trading at $781.97 per share on Thursday morning, up $3.97 (+0.51%). Year-to-date, REGN has gained 8.38%, versus a 7.25% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| REGN | Get Rating | Get Rating | Get Rating |

| BIIB | Get Rating | Get Rating | Get Rating |

| GILD | Get Rating | Get Rating | Get Rating |

| VNDA | Get Rating | Get Rating | Get Rating |