The demand for oil and gas is rising, as is the prominence of unconventional sources and new drilling methods. As a result, the global oil and gas well drilling services market is poised to reach $173.52 billion by 2028, growing at a CAGR of 4.1%.

Superior Drilling Products, Inc. (SDPI - Get Rating), a promising energy drilling services provider with noteworthy financial prospects, is at the forefront of these trends.

For the current fiscal year (ending December 2023), the consensus EPS and revenue estimates of $0.14 and $25.11 million indicate 250% and 31.5% year-over-year increases, respectively. The stock also has a 12-month price target of $2.00, reflecting a potential upside of 110.3% from the last closing price of $0.95.

Let’s take a closer look at some of its key metrics.

Revenue Growth and Fluctuating Metrics

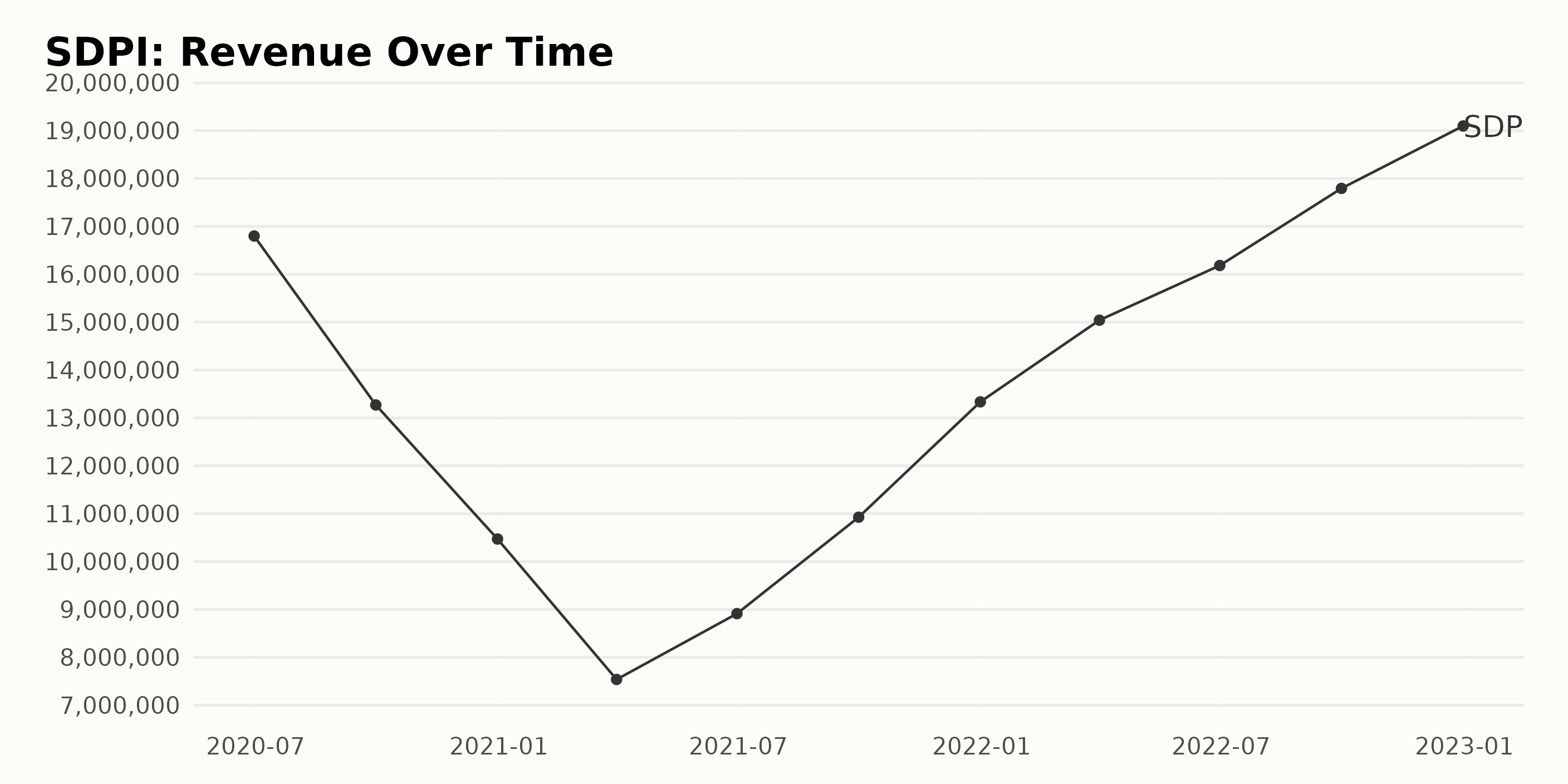

The revenue of SDPI has had a generally upward trend over the last two and a half years, with fluctuations along the way. Data from June 2020 shows a revenue of $16.8 million, which dropped to $13.3 million by September 2020.

There were small increases in December 2020 ($10.5 million), March 2021 ($7.5 million), and June 2021 ($8.9 million), before increasing substantially to over $10.9 million in September 2021.

There was a steady climb to $15 million in March 2022, and $16.2 million in June 2022, before reaching its peak of $19.1 million in December 2022. Overall, the growth rate from June 2020 to December 2022 is 12%, with revenue increasing from $16.8 million to $19.1 million.

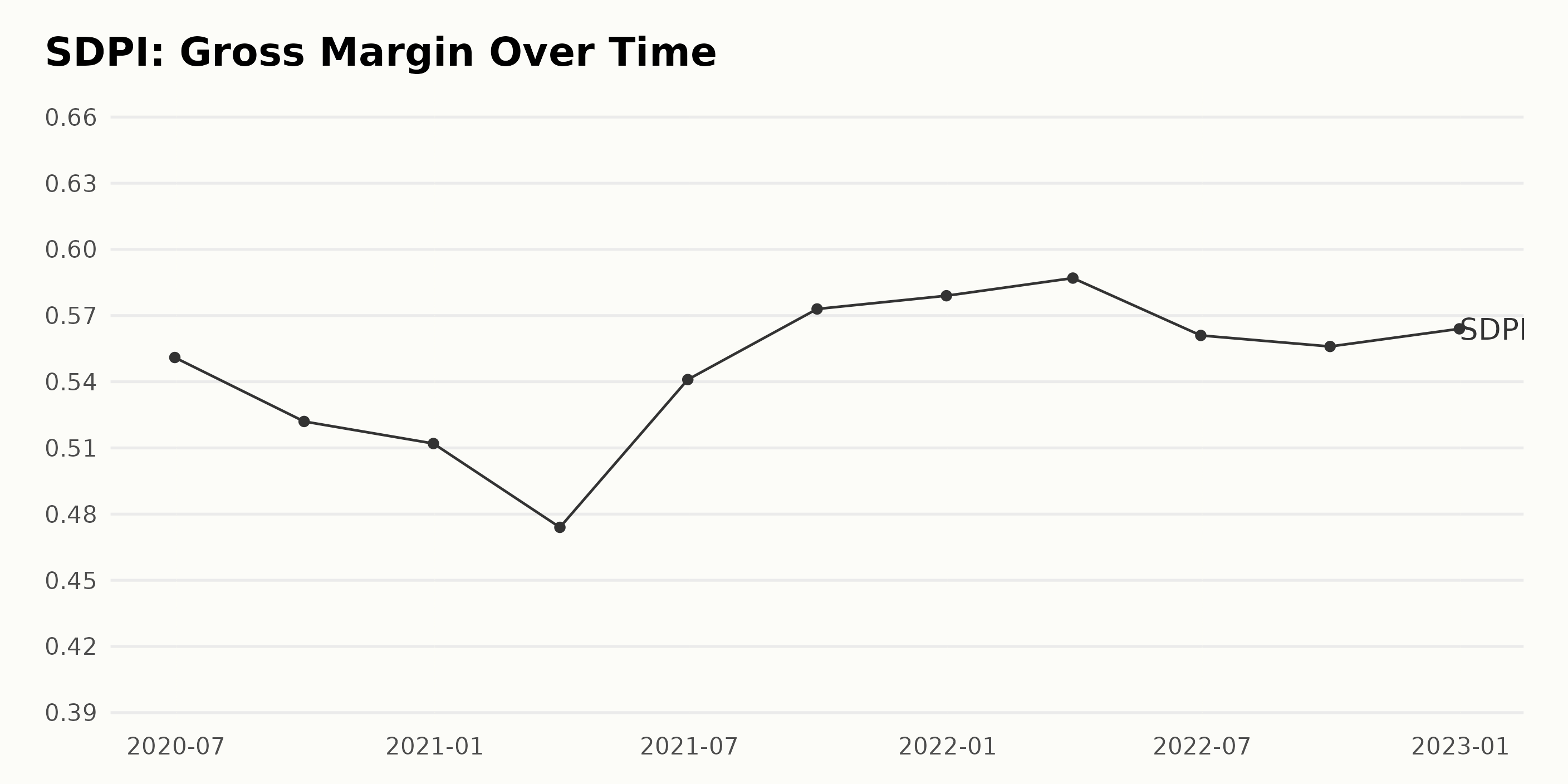

SDPI’s gross margin has fluctuated over the past two years, from June 2020 to December 2022, with a 52.1% decrease from June 2020 to September 2020 and a 19.8% increase from December 2021 to December 2022. The most recent reported gross margin for SDPI was 56.4% in December 2022.

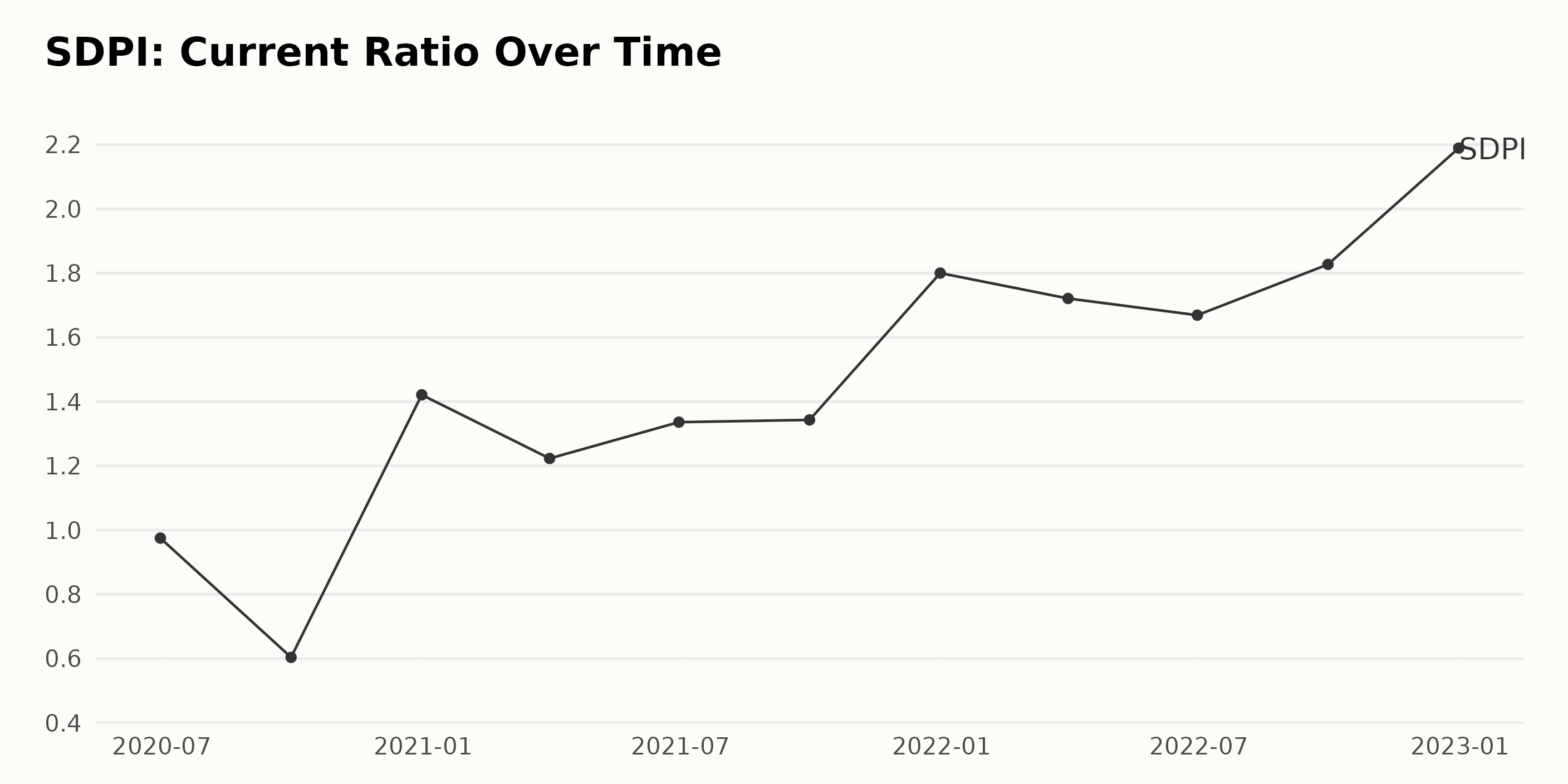

The current ratio of SDPI has generally been increasing in recent years. From December 2020 to December 2022, the current ratio increased from 1.42 to 2.19, a growth rate of 54%. The current ratio saw its most significant increase between September 30, 2021, and December 31, 2021, with an increase of 0.45.

There have also been some fluctuations; for example, the current ratio between June 2020 and September 2020 decreased by 36%.

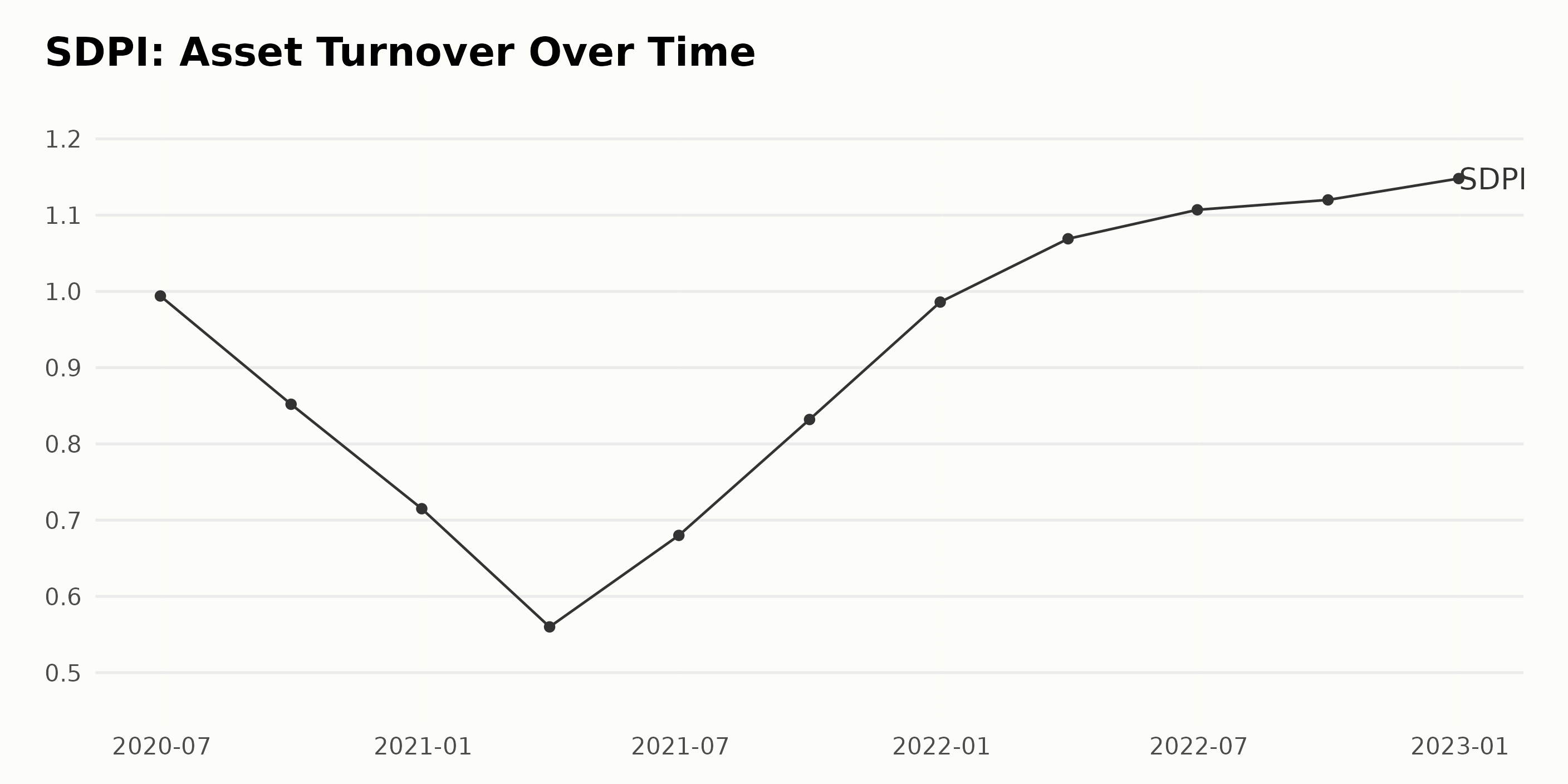

The asset turnover of SDPI has seen changes over the past two years, going from 0.994 on June 30, 2020, to 1.148 on December 31, 2022. This is a 15.7% increase between the first and last values.

In general, the asset turnover saw fluctuations in the first year of data, starting at 0.994, dropping to 0.852 by September 2020, then rising steadily to 0.986 by December 2021. It peaked at 1.107 on June 30, 2022, and has only increased since then.

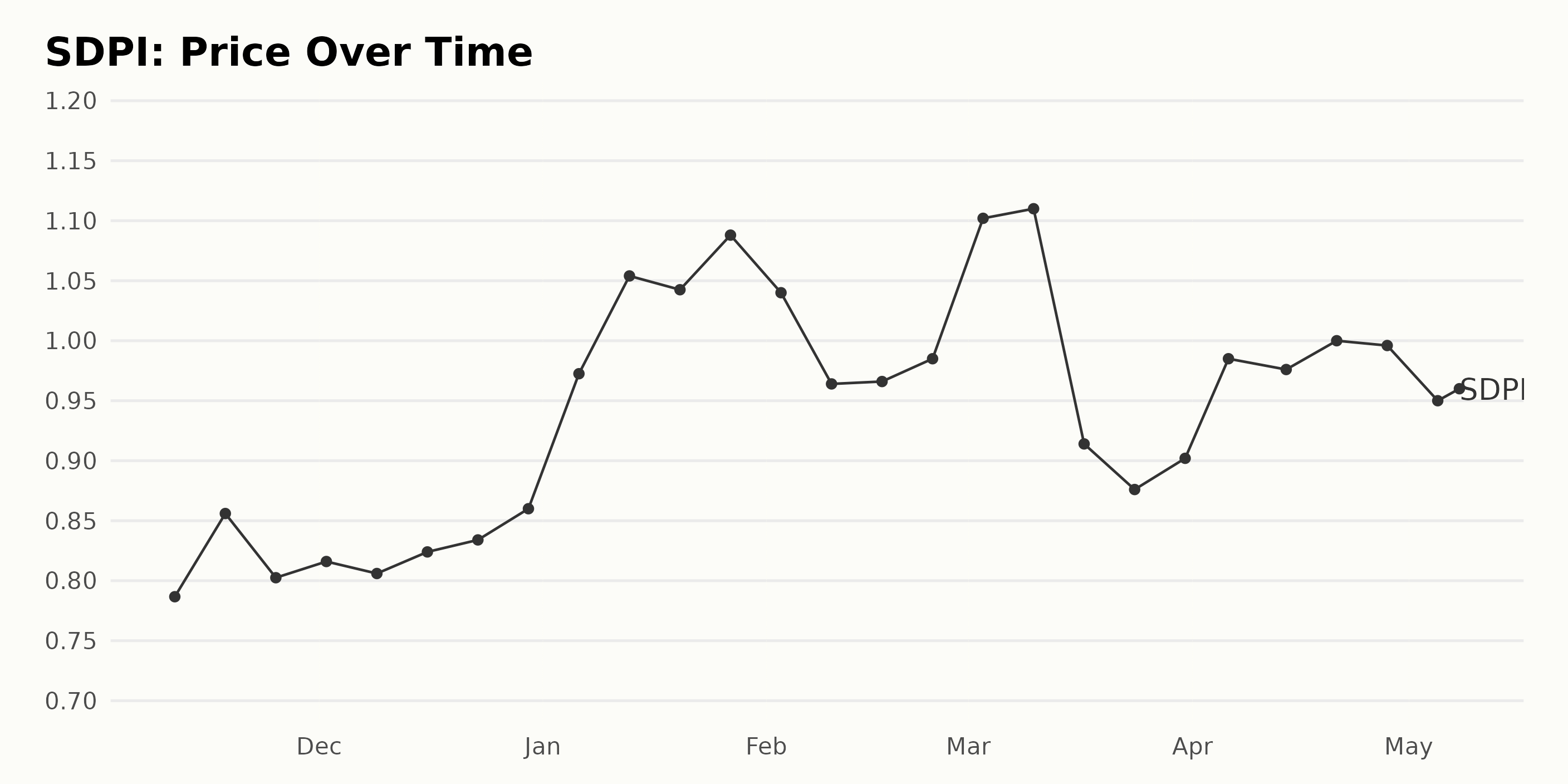

SDPI Stock Price: Increasing Trend and Acceleration

There appears to be an overall increasing trend in the share price of SDPI from $0.79 on November 11, 2022, to $1.00 on April 21, 2023. The growth rate appears to accelerate as the price rises drastically from $0.86 on December 30, 2022, to $1.05 on January 13, 2023. Here is a chart of SDPI’s price over the past 180 days.

POWR Ratings Reflect Promising Prospects

SDPI’s POWR Ratings reflect this solid outlook. The stock has an overall B rating, which translates to Buy in our proprietary rating system. The POWR Ratings assess stocks by 118 different factors, each with its own weighting.

The stock also has an A grade for Momentum and Sentiment. It also has a Quality grade of B. It is ranked first in the 15-stock Energy – Drilling industry. Click here to see the additional POWR Ratings for SDPI (Growth, Value, and Stability).

How does Superior Drilling Products, Inc. (SDPI) Stack Up Against its Peers?

Other stocks in the Energy – Drilling sector that may be worth considering are Precision Drilling Corporation (PDS - Get Rating), Patterson-UTI Energy, Inc. (PTEN - Get Rating), and Nabors Industries Ltd. (NBR - Get Rating) — they have better POWR Ratings.

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

Want More Great Investing Ideas?

SDPI shares were trading at $0.95 per share on Monday afternoon, down $0.00 (+0.01%). Year-to-date, SDPI has gained 3.36%, versus a 8.25% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SDPI | Get Rating | Get Rating | Get Rating |

| PDS | Get Rating | Get Rating | Get Rating |

| PTEN | Get Rating | Get Rating | Get Rating |

| NBR | Get Rating | Get Rating | Get Rating |