- A speedbump for the company

- Square is up next, and Shopify has them in its crosshairs

- Shopify looks frothy, but the stock is a freight train

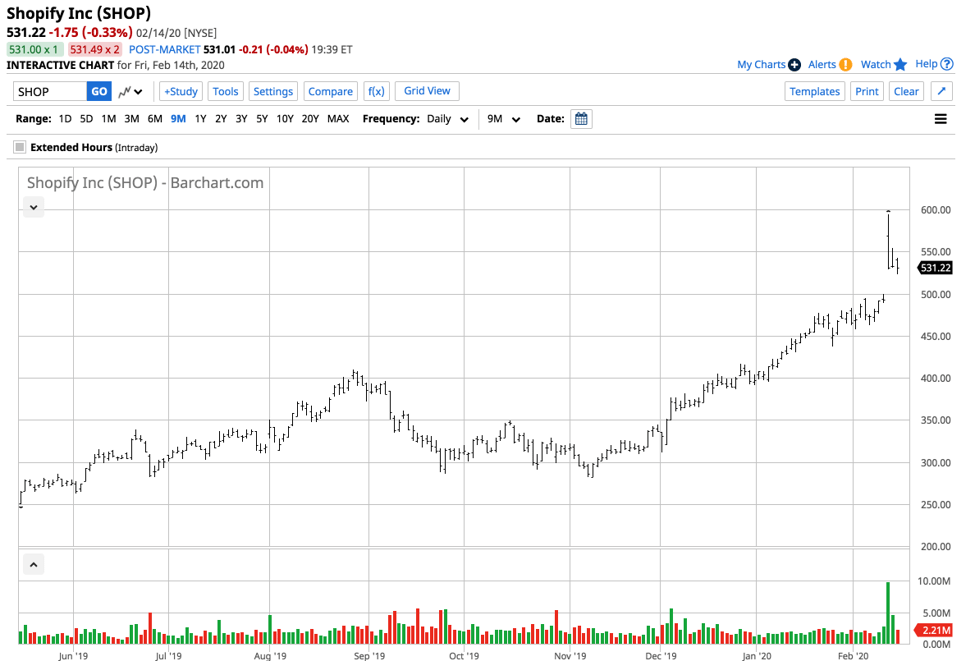

Shopify Inc. (SHOP - Get Rating) is a cloud-based multi-channel commerce platform for small and medium-sized businesses in the United States and around the world. The company has benefited from the trend away from retail shops to online commerce. Shopify (SHOP) went public on May 21, 2015, at $28 per share, which was 60% higher than its $17 offering price. The shares had exploded to a high of $499.88 on February 11, even after the company missed consensus earnings estimates for the third quarter of 2019. The market had expected the company to earn 11 cents per share in Q3, but a loss of 29 cents did little to slow down the ascent of the shares. On February 12, SHOP reported its fourth-quarter 2019 earnings after beating estimates in three of the past four periods. The market expected the company to earn 24 cents per share with the stock in the stratosphere.

A speedbump for the company

The Q3 earnings turned out to be nothing more than a short-term speedbump for Shopify (SHOP). The market turned out to be correct. After the third-quarter miss, the shares exploded after the company blew away estimates when it reported adjusted EPS of 43 cents per share.

(Source: Barchart)

The chart shows that Q4 earnings lit a fuse under Shopify’s (SHOP) shares sending them to a high of $593.89 on February 12 and closing over the $530 level on Friday, February 14. The current consensus for Q1 2020 earnings is around an 11 cents per share loss. The company increased its guidance for 2020 during the conference call that followed the Q4 earnings announcement.

Square is up next, and Shopify has them in its crosshairs

Last week, Shopify’s (SHOP) COO Harley Finkelstein told CNBC’s Jim Cramer the company was building out its e-commerce platform’s fulfillment centers to compete with Amazon Amazon (AMZN - Get Rating) and eBay (EBAY - Get Rating). Moreover, the corporate strategy appeared to be a challenge to Square, Inc. (SQ - Get Rating), a company that has been highly successful in providing payment and point-of-sale solutions in the US and internationally.

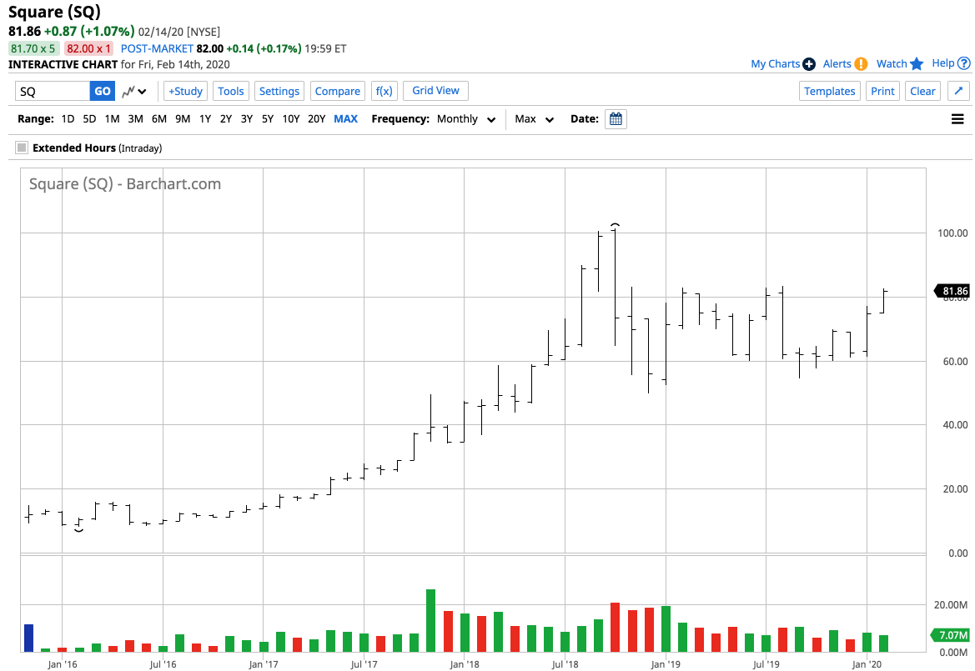

(Source: Barchart)

As the chart shows, Square (SQ) has moved from $9 per share in 2015 to a high of $101.15 in October 2018. At $81.86 per share last Friday, the company continues to deliver for shareholders.

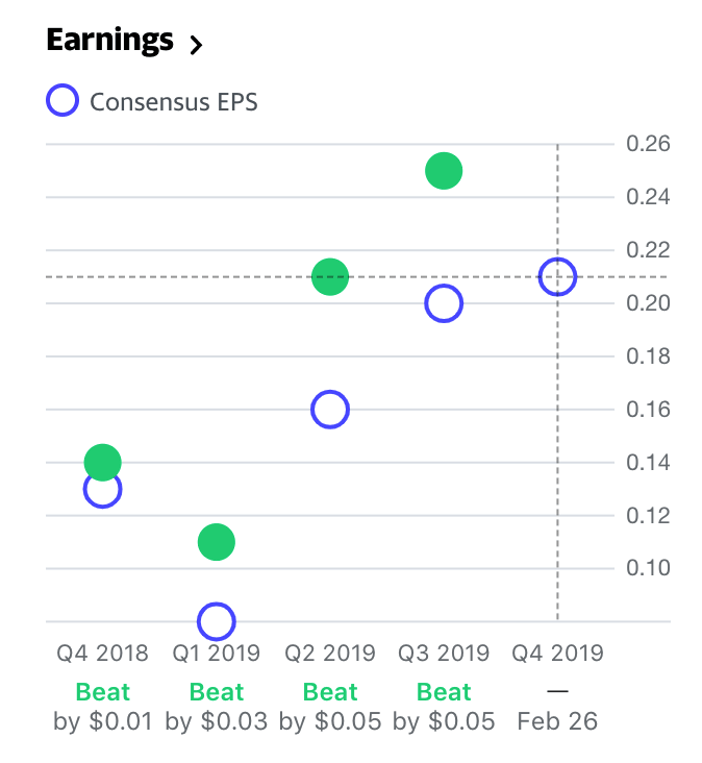

(Source: Yahoo Finance)

Square (SQ) has beaten the consensus estimates over the past four consecutive quarters. The company will report Q4 earnings on February 26, and the forecast is for a 21 cents per share profit. Based on last week’s interview on CNBC, Shopify (SHOP) is looking to take market share away from Square (SQ).

Shopify looks frothy, but the stock is a freight train

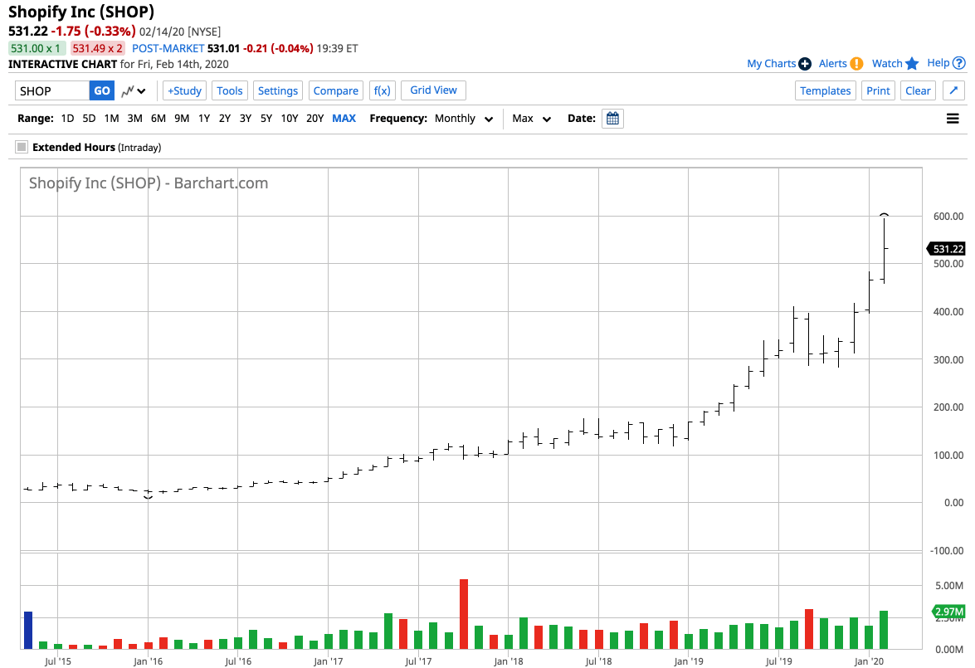

While Square (SQ) shares have been almost a ten-bagger since 2015, Shopify’s performance has left it in the dust.

(Source: Barchart)

The long-term chart in Shopify (SHOP) shows the rise from $24.11 in May 2015 to just under $594 per share last week. At the highs, the stock appreciated by almost twenty-five times. While Shopify shares may look frothy at the most recent high, and the stock came back down to around the $530 level at the end of the week, the company continues to experience exponential growth and deliver results to shareholders. Shopify (SHOP) had a market cap of around $61.8 billion at the end of last week. The company that is looking to take on Amazon (AMZN) with a market cap of $1.063 trillion could have a lot more upside over the coming months and years. Shopify (SHOP) is a freight train, and I would not stand in front of those shares as the odds and track record favor higher highs.

SHOP shares were unchanged in after-hours trading Monday. Year-to-date, SHOP has gained 33.61%, versus a 4.89% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SHOP | Get Rating | Get Rating | Get Rating |

| AMZN | Get Rating | Get Rating | Get Rating |

| EBAY | Get Rating | Get Rating | Get Rating |

| SQ | Get Rating | Get Rating | Get Rating |