Shopify Inc. (SHOP - Get Rating) has exhibited impressive growth in recent years and is poised to continue its expansion as a leading global commerce company. Despite a significant dip in online retail spending due to a decrease in consumer expenditure amidst inflationary pressure, Shopify demonstrated a powerful resurgence in 2023.

This Canadian-based e-commerce leader reported third-quarter results that exceeded expectations. It is anticipated that Shopify’s 2023 revenue will show a mid-twenties percentage increase year-on-year, fueled by a high-teen percentage revenue growth in the fourth quarter.

Analysts predict a growth in SHOP’s revenue and earnings per share (EPS) of 19.6% and a striking 329.4%, respectively – projecting $2.07 billion and $0.30 for the quarter ended December 2023.

The company reported a net income of $718 million, or 55 cents per share, for the third quarter, reversing a loss of $158.4 million, or a deficit of 12 cents a share recorded in the same quarter the previous year.

With significant improvement in financials and optimistic guidance, the stock has surged, trading at a lofty valuation. In order for the premium to sustain this year, the company needs to execute a robust performance.

Investors should exercise caution when buying the stock due to its high asking price. An examination of some of its key performance indicators could prove enlightening. Diversifying investments with regard to other stocks may also be a prudent financial move.

Shopify Financial Trends: Analyzing Revenue Growth Amidst Fluctuating Net Income and Key Metrics (2021-2023)

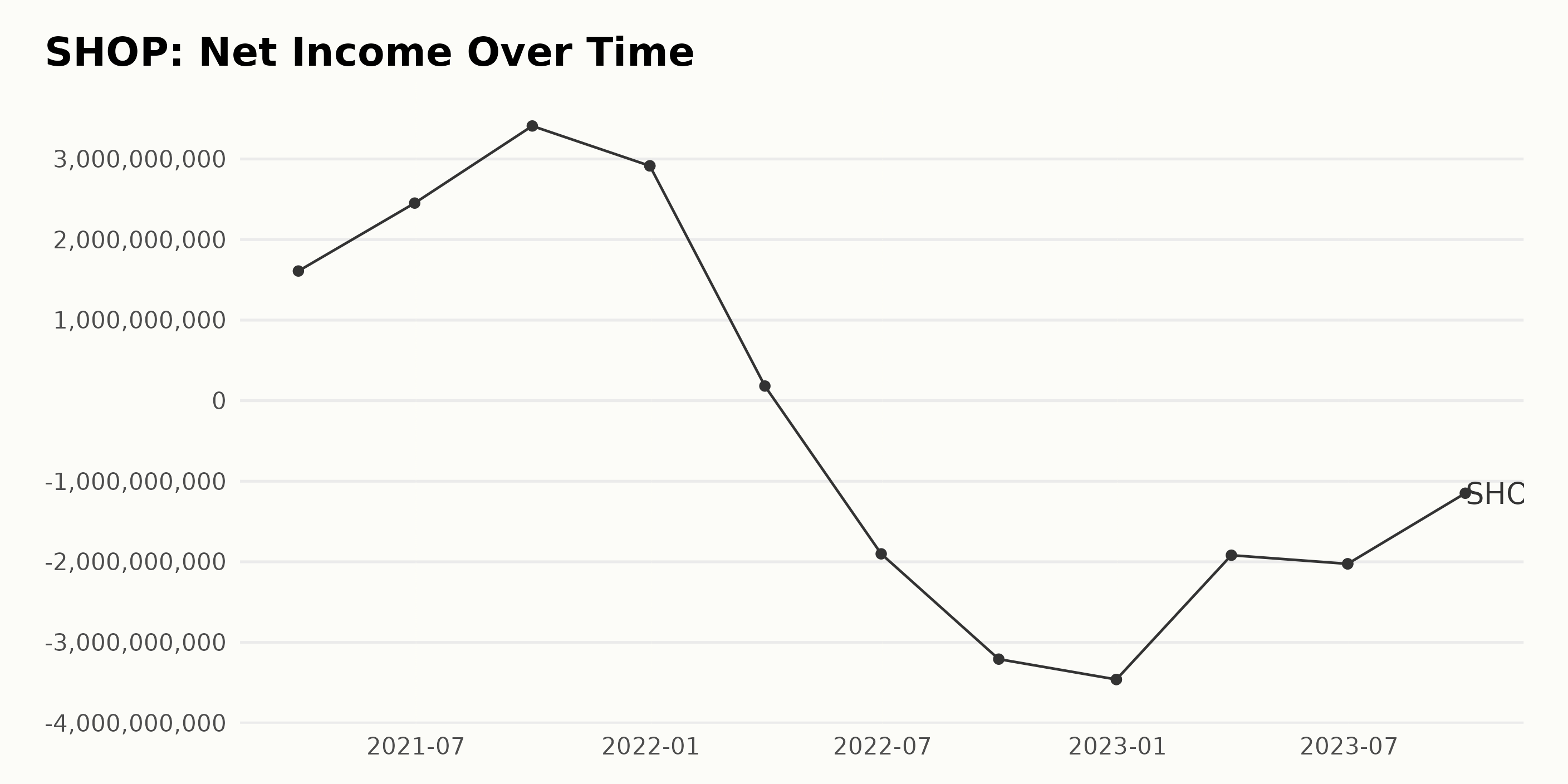

The trailing-12-month Net Income of Shopify Inc. (SHOP) demonstrates a significant fluctuation in the given data series. From March 2021 to December 2021, the company’s Net Income saw substantial growth, increasing from $1.61 billion to $2.91 billion by the end of 2021. However, this trend reversed starting from the first quarter of 2022. Notable highlights in this data series include:

- Starting on March 31, 2022, Net Income plummeted to $181.81 million.

- A sharp decrease was observed by June 30, 2022, where the Net Income volume slumped into the negative region at -$1.90 billion.

- Further decline continued till December 31, 2022, reaching the lowest point in the series at -$3.46 billion.

- Starting the first quarter of 2023, Net Income saw some recovery, still in negatives but significantly less at -$1.92 billion by March 31, 2023.

- By September 30, 2023, the size of the Net Losses had further decreased to -$1.15 billion.

Emphasizing more recent data and the last value in the series, the Net Income for SHOP stood at -$1.15 billion as of September 30, 2023. This implies a decrease of significant magnitude when we compare it to the initial figure of $1.61 billion logged on March 31, 2021. Overall, there has been an evident downward trend in the Net Income of Shopify Inc. from its peak in December 2021.

The Gross Margin of SHOP has experienced fluctuations with an overall decreasing trend throughout the observed period. Below are the key observations:

- On March 31, 2021, the Gross Margin of SHOP stood at 53.5%.

- It saw gradual increments and reached its highest point of 54.5% on September 30, 2021.

- From there, it started falling with intermittent slight upturns, culminating in a Gross Margin of 48.9% by September 30, 2023.

When we consider the growth rate from the first recorded value on March 31, 2021, to the last recorded value on September 30, 2023, there is a negative growth rate. The Gross Margin has fallen from 53.5% to 48.9%, indicating a decrease of approximately 4.6% over this period. It should be noted that the rate of decrease is not consistent, as there were minor increases during this downward trend.

The ROA of SHOP showed significant fluctuations throughout the reported period:

- On March 31, 2021, the ROA was 0.21.

- A noticeable upward trend continued until September 30, 2021, when it reached a peak of 0.31.

- Thereafter, a sharp downturn began, with the ROA dropping to 0.235 in the last quarter of 2021.

- The downward trend continued in 2022 with further slips to 0.014, -0.154, and -0.272 in the succeeding quarters.

- The company hit its lowest ROA of -0.311 on December 31, 2022.

- Some recovery was seen in the first half of 2023, but the ROA remained negative with -0.176 and -0.19 for the first and second quarters respectively.

- By September 30, 2023, the ROA had mildly improved to -0.11.

Overall, data suggest a downward trend for Shopify’s ROA from late 2021 through 2023, with some preliminary sign of improvement by September 2023. From the first value (0.21) to the latest value (-0.11), we see a substantial decrease of more than 100% in the ROA over this period.

Between March 2021 and September 2023, the Current Ratio of Shopify Inc. (SHOP) showed significant fluctuation. From a high of 17.13 in March 2021, there’s a noticeable downward trend in the Current Ratio over the subsequent periods, reaching its lowest of 6.64 by September 2022.

- By June 2021, the Current Ratio slightly decreased to 16.55.

- In September 2021, it continued to drop significantly to 13.97.

- By the end of 2021, the Current Ratio was at 12.15, repeating the same level.

- 2022 began with a further decrease to 11.84 in March, followed by a drop to 11.17 by June.

- There was a sharp decrease by September 2022, with the Current Ratio plunging to 6.64.

- It then recovered slightly to 7.07 by the end of 2022 and repeated the same value.

- In March 2023, it slightly decreased to 6.71, but remained relatively flat through June 2023 repeating at 6.71.

- The series ended with an increase to 7.23 in September 2023 as it displays signs of recovery.

In summary, the Current Ratio exhibited a clear downward trend from 17.13 to 7.23 over the period, a decrease of approx 58%. The most recent data indicates a slight recovery, although it is still significantly lower than the beginning of the series. This may suggest liquidity challenges for Shopify Inc. (SHOP) during this period.

Riding the Wave: Shopify Inc.’s Upward Trend amidst Short-term Fluctuations, August 2023- February 2024

The data for Shopify Inc. (SHOP) share prices shows a general upward trend from August 2023 to February 2024, though there are some fluctuations in the short term. Here’s a detailed description:

- On August 18, 2023, the share price was $53.82.

- The price increased gradually to reach a peak of $65.01 on September 8, 2023.

- This growth didn’t sustain long; there’s a decrease in the price over the next weeks, dropping as low as $49.24 by October 27, 2023.

- From November 3, 2023, we start seeing a strong and accelerating upward trend. By December 29, 2023, the price shot up to $78.16.

- There’s a slight dip at the start of the new year 2024 with a price of $73.45 on January 5th, this minor setback is quickly recovered.

- The price climbs consistently during January 2024, eventually reaching $81.12 by the end of the month.

- Continuing this positive trajectory, the share price further elevated to a new high of $85.04 on February 9, 2024.

In summary, despite some weekly fluctuations, the overall trend of SHOP shares for the period from August 2023 through February 2024 is upward, showing the signs of both growth and acceleration. Here is a chart of SHOP’s price over the past 180 days.

Examining Shopify’s Key Performance Ratings: Growth, Sentiment, and Momentum

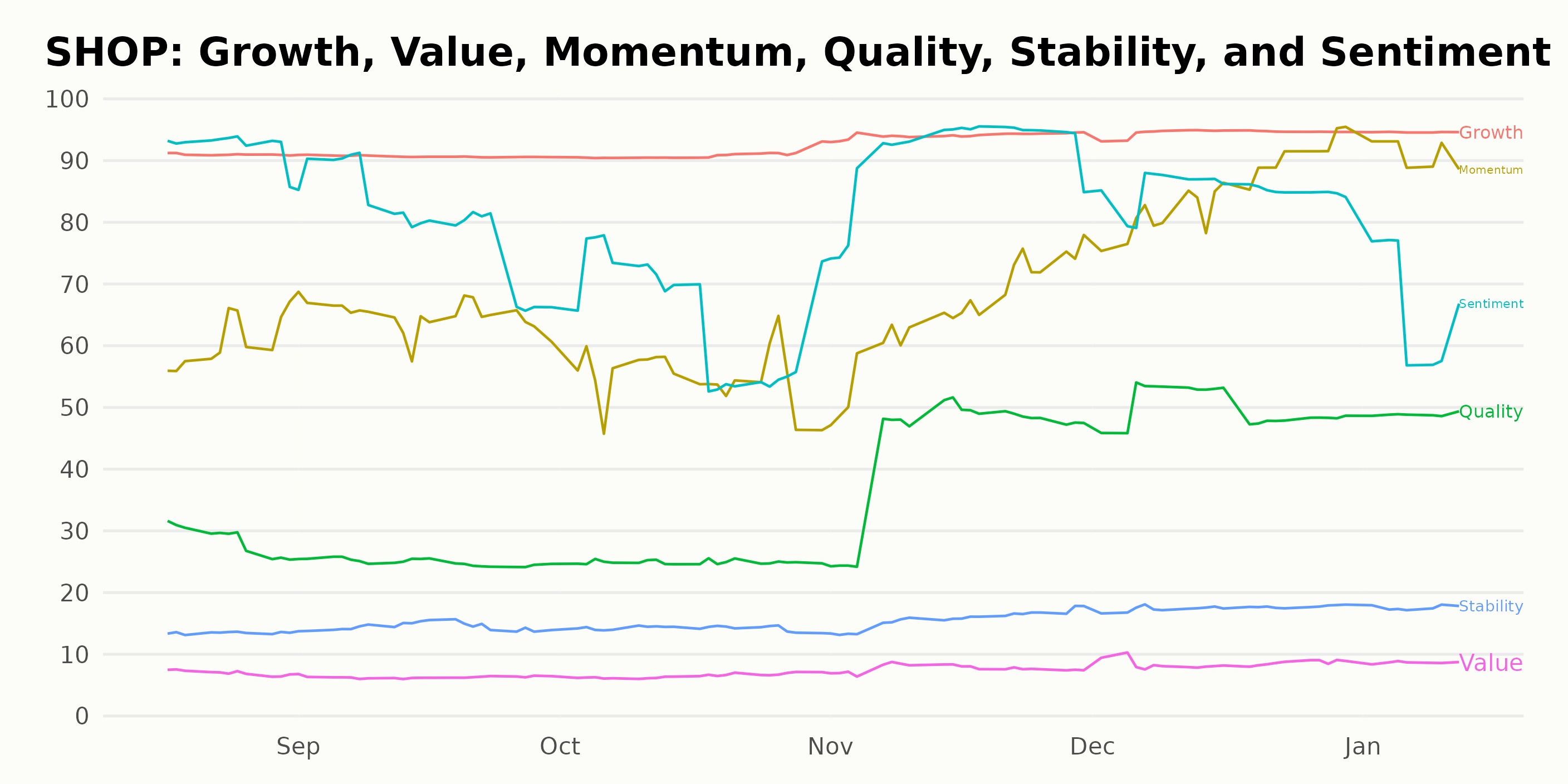

SHOP has an overall C rating, translating to a Neutral in our POWR Ratings system. It is ranked #17 out of the 28 stocks in the Internet – Services category.

The POWR Ratings for SHOP highlight three key dimensions in terms of the highest ratings. These are Growth, Momentum, and Sentiment.

Growth dimension: August 31, 2023: The growth rating stood relatively high at 91. January 12, 2024: By this date, there was a notable enhancement as the growth rating reached 95. This signifies a prominent upward trend in the growth parameter over time.

Sentiment dimension: August 31, 2023: The sentiment rating was remarkably high with a value of 93. October 31, 2023: However, there was a significant decrease by October where it lowered to 65. December 30, 2023: Yet, by the end of December, the sentiment rating had bounced back significantly to 85. January 12, 2024: It then dropped slightly to a still-respectable 67 early in the next year.

Momentum dimension: August 31, 2023: The momentum rating started at a mediocre 61. September 30, 2023: By September, there was a slight improvement, raising the rating to 65. October 31, 2023: A slight decrease was observed in October as it dropped to 55. December 30, 2023: Momentum picked up remarkably towards the end of the year, landing at 86 in December. January 12, 2024: The upward trend continued in January 2024, where the momentum rating peaked at 91, indicating positive traction for SHOP during this period.

This data reveals that Growth, Sentiment, and Momentum were strongly influential parameters for Shopify Inc. during the specified time frame.

How does Shopify Inc. (SHOP) Stack Up Against its Peers?

Other stocks in the Internet – Services sector that may be worth considering are Shutterstock, Inc. (SSTK - Get Rating), Upwork Inc. (UPWK - Get Rating) and Wix.com Ltd. (WIX - Get Rating) — they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

Want More Great Investing Ideas?

SHOP shares were trading at $89.93 per share on Monday afternoon, down $0.79 (-0.87%). Year-to-date, SHOP has gained 15.44%, versus a 5.62% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SHOP | Get Rating | Get Rating | Get Rating |

| SSTK | Get Rating | Get Rating | Get Rating |

| UPWK | Get Rating | Get Rating | Get Rating |

| WIX | Get Rating | Get Rating | Get Rating |