With a $4.68 billion market cap, SoFi Technologies, Inc. (SOFI - Get Rating) provides digital financial services. The company operates through three segments: Lending; Technology Platform; and Financial Services. It offers student loans, personal loans, and home loans.

In addition, SOFI operates Galileo, a technology platform that offers services to financial and non-financial institutions; Apex, a technology-enabled platform that provides investment custody and clearing brokerage services; and Technisys, a cloud-based digital multi-product core banking platform.

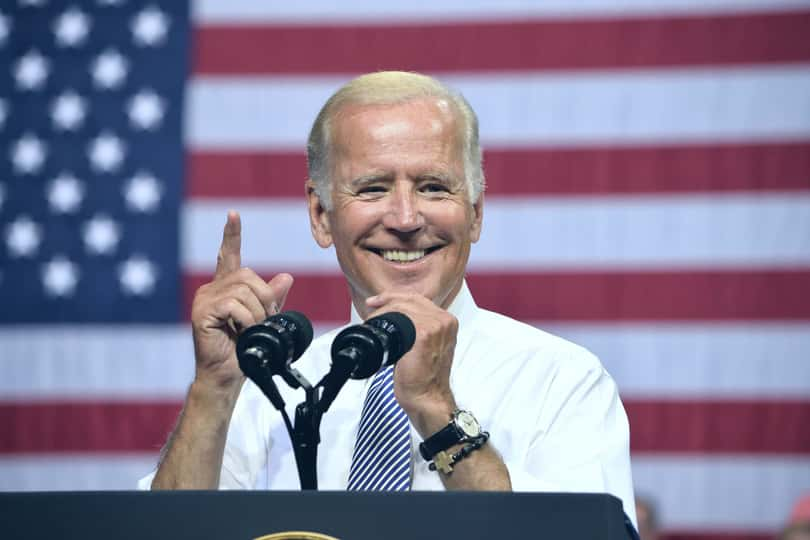

On August 24, Joe Biden announced a three-part plan to provide student loan relief to address the financial harms of the pandemic, fulfilling the President’s promise in his campaign. The Department of Education will provide up to $20,000 in debt cancellation to Pell Grant recipients and up to $10,000 in debt cancellation to non-Pell recipients.

Along with the loan forgiveness plan, Biden is expected to end the student loan repayment pause that has been in effect for more than two years. The recent announcement is expected to be a catalyst for SOFI as the company could see a significant surge in borrowers looking to refinance their remaining balances.

However, investors have been bearish about SOFI due to its disappointing financials and declining growth. For the second quarter of fiscal 2022, the company’s net loss and loss per share came in at $95.84 million and $0.12, respectively. Also, as of June 30, 2022, its total liabilities stood at $7.16 billion, compared to $4.48 billion as of December 31, 2021.

Furthermore, SOFI has been beaten down in the recent market turbulence. The stock has plunged 47.8% in price over the past six months and 62.7% year-to-date to close the last trading session at $5.85. It is currently trading 76.3% below its 52-week high of $24.65, which it hit on November 11, 2021.

Here is what I think could influence SOFI’s performance in the upcoming months:

Poor Financials

For the fiscal 2022 second quarter ended June 30, 2022, SOFI’s non-interest expense increased 15.5% year-over-year to $458.24 million. Its loss before income taxes amounted to $95.72 million. Also, the company’s net loss and loss per share came in at $95.84 million and $0.12, respectively.

As of June 30, 2022, SOFI’s total liabilities stood at $7.16 billion versus $4.48 billion as of December 31, 2021. In addition, cash outflows from operating and investing activities came in at $1.96 billion and $4.92 million, respectively, for the six months that ended June 30.

Bleak Growth Prospects

Analysts expect the company’s revenues to increase 41.7% year-over-year to $391.05 million in the fiscal 2022 third quarter (ending September 2022). However, the consensus loss per share estimate for the ongoing quarter is expected to come at $0.07. Also, the company has missed the consensus EPS estimates in three of the trailing four quarters, which is disappointing.

Furthermore, analysts expect the company’s loss per share for the fiscal 2022 and 2023 to come in at $0.32 and $0.11, respectively.

Low Profitability

In terms of trailing-12-month net income margin, SOFI’s negative 28.46% compares to the 27.96% industry average. And its trailing-12-month ROCE and ROTA of negative 8.25% and 2.74% compare to 11.53% and 1.21% industry averages, respectively. Likewise, the stock’s trailing-12-month asset turnover ratio of 0.12% is 38.8% lower than the industry average of 0.20%.

POWR Ratings Reflect Bleak Prospects

SOFI’s overall F rating translates to a Strong Sell in our proprietary POWR Ratings system. The POWR Ratings are calculated considering 118 distinct factors, with each factor weighted to an optimal degree.

SOFI has a grade of F for Stability. The stock’s beta of 1.12 justifies the Stability grade. In addition, it has an F grade for Quality, consistent with its lower-than-industry profitability multiples.

SOFI has ranked #107 out of 108 stocks in the F-rated Financial Services (Enterprise) industry.

Beyond what I have stated above, we have also given SOFI grades for Sentiment, Growth, Value, and Momentum. Get all SOFI ratings here.

Bottom Line

Fintech disruptor SOFI delivered poor financial results in the second quarter of fiscal 2022. And analysts expect the company to report significant losses in the fiscal 2022 and 2023. Furthermore, the stock is currently trading below its 50-day and 200-day moving averages of 6.50 and 9.76, respectively, indicating a downtrend.

Although Biden’s recent announcement on student debt would act as a catalyst for SOFI, the company is still expected to witness decelerating growth in the near term. Given SOFI’s disappointing financials, weak growth prospects, lower-than-industry profitability, and high volatility, we think it could be wise to avoid the stock now.

How Does SoFi Technologies, Inc. (SOFI) Stack Up Against its Peers?

SOFI has an overall POWR Rating of F. One could also check out these other stocks within the Medical-Devices & Equipment industry: Forrester Research, Inc. (FORR - Get Rating) and Everi Holdings Inc. (EVRI - Get Rating) with an A (Strong Buy) rating and WNS (Holdings) Ltd. ADR (WNS - Get Rating) with a B (Buy) rating.

Want More Great Investing Ideas?

SOFI shares fell $5.85 (-100.00%) in premarket trading Friday. Year-to-date, SOFI has declined -63.00%, versus a -15.92% rise in the benchmark S&P 500 index during the same period.

About the Author: Mangeet Kaur Bouns

Mangeet’s keen interest in the stock market led her to become an investment researcher and financial journalist. Using her fundamental approach to analyzing stocks, Mangeet’s looks to help retail investors understand the underlying factors before making investment decisions. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SOFI | Get Rating | Get Rating | Get Rating |

| FORR | Get Rating | Get Rating | Get Rating |

| EVRI | Get Rating | Get Rating | Get Rating |

| WNS | Get Rating | Get Rating | Get Rating |