As I write this on February 22nd, the S&P 500 is down for a 5th straight day.

Tesla fell 4% last week and is down 5% today alone. Apple, and many other popular tech stocks, are suddenly deeply out of favor, as sentiment turns from greed to fear.

But guess what, it’s simply not true that investors need to fear rising rates. Only speculators do.

Fact 3: Prudent Long-Term Investors Need Never Worry About Inflation And Interest Rates

The reason it’s so dangerous to talk about stocks as “bond alternatives” is that bonds, other than producing income, are nothing like stocks.

- bond values are 100% a function of interest rates

- set by the bond market based on long-term inflation expectations

- a thriving economy can indeed be bad for bonds

In contrast, a roaring economy is seldom bad for stocks.

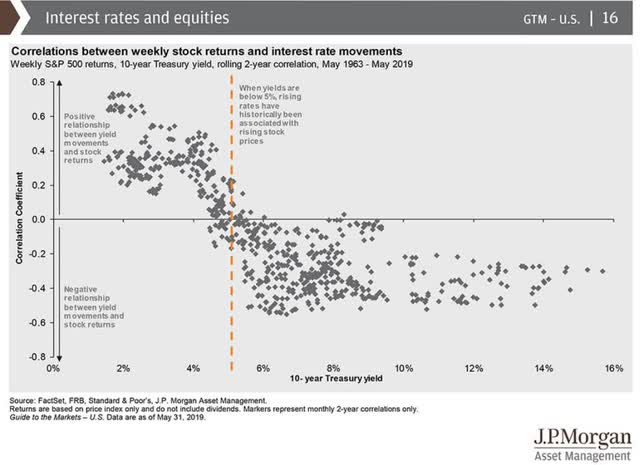

As long as 10-year yields are under 5%, historically rising interest rates are GOOD for stocks, not bad.

As long as interest rates don’t rise too quickly (Goldman estimates 37 bp per month) rising rates are good for stocks.

Similarly, REITs, the most “bond-like alternative” actually do slightly better with rising rates, though basically is no significant long-term correlation between REIT total returns and 10-year yields.

- insanely valued hyper-growth stocks can indeed be gutted

- while undervalued slower-growing value stocks are expected to do particularly well

- DK has been preparing for this since we began the Phoenix strategy

- the rise in long-term interest rates is what analysts said was most likely to bring about the end of the value bear market

Some tech stocks will crash (hello Tesla).

The names we’ve been accumulating are not likely to go off a cliff.

- hyper-growth at a reasonable price

In fact, during the modern era of the last 25 years, rising interest rates are actually good for all stocks. Big, small, growth, value, it doesn’t matter. Positive fundamentals, such as a thriving economy generating stronger inflation are good for stocks.

Rising Rates Are Bad For Overvalued Hyper-Growth

| Growth Rate | Fair Value Multiple (3.1% discount rate) | Fair Value Multiple (4% discount rate) | Fair Value Multiple (8% discount rate) | Fair Value Multiple (12% discount rate) | Fair Value Multiple (22% discount rate) |

| 5% | 1,133.75 | 113.2 | 22.5 | 12.4 | 5.82 |

| 15% | 1,785.44 | 177.1 | 34.3 | 18.5 | 8.24 |

| 25% | 2,707.57 | 267.3 | 50.7 | 26.9 | 11.5 |

| 50% | 6,731.94 | 660 | 121.4 | 62.4 | 24.93 |

| 100% | 28,348.60 | 2761.8 | 493.8 | 246.8 | 91.98 |

| Ratio Of 100/5 Growth Multiples | 25.00427784 | 24.3975265 | 21.94666667 | 19.90322581 | 15.80412371 |

(Source: Moneychimp)

- 22% discount rate = similar to what market offered when 10-year yield was 18% in 1981

- 3.1% discount rate is hypothetical if 10-year yields were -0.7%

Of course, if you pay absurd valuations for your companies, then even very fast-growth can result in catastrophic losses.

The more extreme low rates get, the larger the impact becomes, but especially for fast-growing companies.

- the value of future cash flow can approach infinity if the discount rate approaches zero.

- justifying literally any price

- as long as interest rates never go up…at all…ever

(Source: Ben Carlson)

Historically value tends to do better than growth over time. But especially during periods of higher inflation.

Why?

- higher inflation = higher interest rates

- higher discount rates

- current growth = more valuable relative to growth many years into the future

- because higher inflation makes the cash flow and profits of the future worthless today

However, all of these concepts are hiding the most important fact of all.

Fact 4: Stocks Are NEVER A Bond Alternative

Even some of the most respected analysts sometimes make the mistake of telling people to replace bonds with “bond alternatives”.

While it can be prudent to lower one’s allocation to bonds in a low rate environment in order to achieve your specific goals, I am very much opposed to ever calling any stock a “bond alternative”.

Other than generating income, dividend stocks and bonds are nothing alike.

- completely different asset classes

- owned for different reasons

- treasury bond prices are 100% a function of interest rates

- corporate bond prices are a function of both interest rates and company fundamentals (such as credit ratings)

- 91% of stock returns over time are a function of fundamentals

Remember how stocks actually do better as rates rise?

- A strong economy = rising interest rates

- a strong economy = strong earnings/cash flow and dividend growth

- the things that create intrinsic value

- that stock prices always eventually return to

A thriving economy, with 4%, 5%, even 6% GDP growth is bad for Treasury bonds. It can only generate inflation, which drives up interest rates and makes existing Treasuries less valuable.

On the other hand, do you know what the best inflation hedge in history is?

- not gold, but dividend stocks

- since 1926 dividends have grown faster than inflation by 2% annually

- 6.3X your buying power from dividends

- plus the strongest long-term capital gains

- + dividend reinvestment = larger ownership stake (more shares)

It’s compounding on top of compounding. What’s the secret to dividend stock’s success in a higher inflation environment? It’s very simple.

Stocks are ownership in real companies. That creates value for customers and passes on rising prices to customers to preserve profitability.

- pass on price hikes and a little extra overtime

- 2% extra per year, since 1926

Gold doesn’t produce income, crypto doesn’t produce income, companies produce income.

And dividend stocks, pass on a cut of that income to you as an owner in the company.

I don’t only own dividend stocks. I have about 23% of my portfolio in our growth stocks. That includes about 15% in Amazon (AMZN - Get Rating).

Amazon Free Cash Flow & Potential Dividend Consensus Forecast

| Year | FCF/Share Consensus | Dividend Per Share (50% Payout Ratio) | Yield On Today’s Cost | Consensus Yield Potential | 2026 Consensus Price |

| 2020 | $60.82 | $30.41 | 0.93% | NA | NA |

| 2021 | $83.80 | $41.90 | 1.28% | 1.16% | $3,609.00 |

| 2022 | $108.53 | $54.27 | 1.66% | 1.23% | $4,425.00 |

| 2023 | $146.08 | $73.04 | 2.24% | 1.35% | $5,411.00 |

| 2024 | $188.63 | $94.32 | 2.89% | 1.29% | $7,306.00 |

| 2025 | $234.78 | $117.39 | 3.60% | 1.38% | $8,490.00 |

| 2026 | $285.20 | $142.60 | 4.37% | 1.44% | $9,936.00 |

(Source: FactSet Research Terminal)

Amazon is generating such incredible free cash flow, that’s growing so rapidly that by 2026 analysts expect it will have $600 billion in cash on the balance sheet.

Guess what a company with the largest cash pile in history, and close to $200 billion in annual free cash flow will have to do? Buyback a lot of stock and most likely pay a very safe, and rapidly growing dividend.

My “Bezos retirement plan” is to buy Amazon today, so I can retire off the dividends tomorrow.

Amazon Long-Term Potential Dividend Forecast

| Year | AMZN Dividend Per Share (10% CAGR Growth) | AMZN Dividend Per Share (12.5% CAGR Growth) | AMZN Dividend Per Share (15% CAGR Growth) | AMZN Dividend Per Share (17.5% CAGR Growth) | AMZN Dividend Per Share (20% CAGR Growth) |

| 2026 | $142.60 | $142.60 | $142.60 | $142.60 | $142.60 |

| 2031 | $229.66 | $256.97 | $286.82 | $319.38 | $354.83 |

| 2036 | $369.87 | $463.07 | $576.90 | $715.32 | $882.94 |

| 2041 | $595.68 | $834.46 | $1,160.34 | $1,602.09 | $2,197.04 |

| 2046 | $959.34 | $1,503.73 | $2,333.87 | $3,588.20 | $5,466.94 |

| 2051 | $1,545.03 | $2,709.77 | $4,694.24 | $8,036.49 | $13,603.50 |

| 2056 | $2,488.28 | $4,883.10 | $9,441.80 | $17,999.30 | $33,849.86 |

| 2061 | $4,007.41 | $8,799.50 | $18,990.83 | $40,312.98 | $84,229.29 |

| 2066 | $6,453.97 | $15,856.98 | $38,197.34 | $90,288.86 | $209,589.43 |

| 2071 | $10,394.18 | $28,574.79 | $76,828.50 | $202,219.73 | $521,525.56 |

| 2076 | $16,739.94 | $51,492.70 | $154,529.55 | $452,910.99 | $1,297,722.48 |

Whether Amazon begins paying a dividend tomorrow or in 50 years, I’m a patient and disciplined income investor.

So let the tech darling correct, so I can buy more of the greatest future dividend growth blue-chips today, at a reasonable or even fantastic price.

When the market hated the highest quality value, that’s what I was buying.

When did the market start hating tech? The value was flying, so undervalued blue-chip tech is what I’m buying.

Hyper-growth at a reasonable or attractive price is the other half of the secret to retiring rich.

Maximum safe income to fund today’s expenses, and hyper-growth at a reasonable price to ensure rich retirement dream fulfilling long-term returns.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Ride the 2021 Stock Market Bubble

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

SPY shares were trading at $384.00 per share on Friday morning, up $1.67 (+0.44%). Year-to-date, SPY has gained 2.71%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| AMZN | Get Rating | Get Rating | Get Rating |