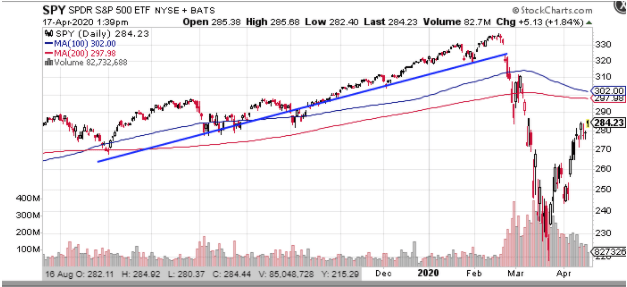

Last week, stocks posted their best week in 46 years, and assuming Friday’s rally holds are on pace to gain over 15% for the two-week spa, this would leave the “SPDR Trust (SPY)” a full 25% off the March low and just 16% below the all-time low.

Technically, this might move the market out of the 20% decline that defines a bear market. But can one really say that a recession was both priced in and then recovered from, in less than a two-month span?

First, many will point to the various ways a ‘bear’ market and its cessation can be defined. I’m of the camp that a new bull market doesn’t begin until a new high is made to begin a fresh starting point for measuring the size and duration of a bull phase. But, some of this “bull” or “bear” is just semantics and I think we should all agree the basic long term uptrend has been broken and despite the recent big bounce both the 100 and 200-day moving averages are still bending downward.

Many people are looking to the options market, which is essentially predicated on the probabilities of what the future may hold, for clues as to whether we are truly out of the bear phase. For the big picture view of what options volatility is saying, we can turn to the CBOE Volatility Index (VIX) which measures the implied volatility of the S&P 500 and by default the SPY.

The higher implied volatility or VIX is the wider range of price movement the market is bracing for. Or put another way, the greater the uncertainty. And given that we know the market hates uncertainty, it’s understandable how the VIX became known as the ‘fear gauge’ and is associated with falling or bear markets.

While the VIX has declined by half from the peak of 85 it hit in late March, the current reading of 40% is still very elevated and indicative of concern. In fact, it’s still above the peak of December 2018 when SPY also tumbled by 20% during the taper tantrum.

I’d expect that even if stocks head back down we won’t see another 80% plus reading. That’s because the second phase of a bear market, which is marked more by the resumption of a downward trend rather than the initial waterfall or crash, and the VIX is a statistical measure with a strong tendency to revert to the mean.

What I think will be more important in the coming weeks will be to see how stocks react to earnings reports. So far, it’s not promising. With many of the big banks such as “JPM Morgan (JPM) and “Bank America (BAC)” reporting better than expected numbers and trying to provide optimistic if cautious guidance the reaction has still been negative. And this is an “SPDR Financial (XLF)” sector that is still some 30% below the February high.

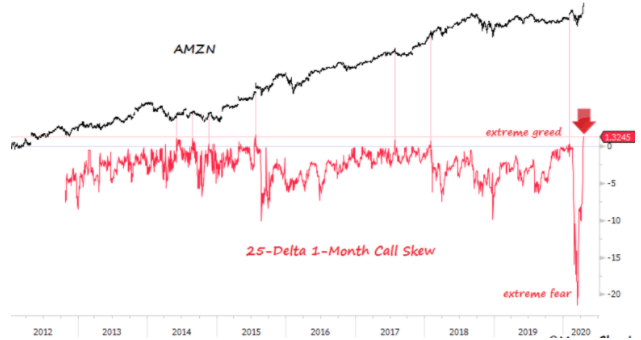

The real test will start coming next week when companies such as “Netflix (NFLX)” and “Amazon (AMZN)”, which have soared to new all-time highs over the past week, report earnings. If the options skew in AMZN, which measures how much more people are willing to pay for upside call exposure, is any indication people maybe be getting a bit too optimistic or greedy.

If the tech mega-cap leaders are met with a ‘sell the news’ reaction to earnings, we should see a resumption of the downtrend which would confirm we are still in a bear market.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

7 “Safe-Haven” Dividend Stocks for Turbulent Times

Investors Beware: It’s Still Really Bad Out There!

SPY shares were trading at $283.64 per share on Friday afternoon, up $4.54 (+1.63%). Year-to-date, SPY has declined -11.36%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating | |

| Get Rating | Get Rating | Get Rating |