When the Federal Reserve initially stepped into the breach on March 26th to stop the sickening stock slide, Chairman Jerome Powell stated he’ll, “never run out of ammunition” sparking a near 30% rally in the stock market. And more importantly, it stabilized the bond market.

Sure enough in the ensuing weeks the Fed, and congress, followed additional funding in various forms that have now crossed a $10 trillion mark.

The jaw-dropping record amount of money being pumped into the system wasn’t even the most eye-popping element of the intervention.

What really caused people to gasp, and lace on their bull buying shoes was when Fed said it would not only directly buy bonds across the spectrum, from corporate to municipal but it would also buy a basket of Exchange Traded Funds such as “SPDR High Yield Bond (JNK)” and “iShares Boxx High Yield (HYG)” which are essentially filled with junk bonds or those rated below investment grade.

Since then both stocks and bonds have rallied nearly in lockstep, which at first blush makes no sense towards near-zero rates suggests a flight to safety which typically occurs during a recession. The rally in stocks is predicated the economy will “see its way to the other side” with prolonged damage.

The way equity and government-bond prices incorporate this consensus on zero rates make it appear to many as if the equity and fixed-income markets are offering divergent messages on the economic outlook. Yet there is less of a disconnect than might be obvious.

But it’s not all that hard to reconcile the implied world views of equity and bond investors.

Both markets are responding, each in its own way, to the same accommodative Fed, the same scarcity of reliable cash flows, and the same investor risk-aversion.

The stock market has registered the poor economic outlook where it has the greatest relevance, in the more cyclical areas, which hold less sway in SPDR 500 Index (SPY - Get Rating)”.

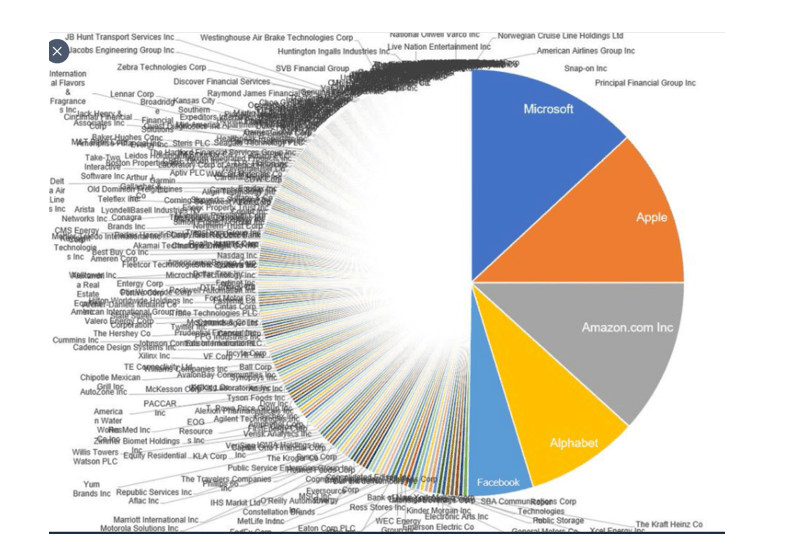

Remember when you buy the SPY this is what you get; just five stocks, including “Microsoft (MSFT)” “Apple (AAPL)” and “Amazon (AMZN)” account for some 25% of the index weighting.

The bond market is reflecting the Covid-19 shock and bulge in unemployment, which will keep the economy operating way below potential for a while, sapping inflationary pressures.

Equity owners, who stand behind bondholders in terms of rights, understand with the Fed backstopping bonds against potential defaults or bankruptcies, it is less likely stock owners will get wiped out.

That provides a huge sigh of relief and explains the comfort level in bidding up stock price or the SPY which has gained some 30% in the past six weeks.

But during today’s press conference J. Powell made it clear he has done everything he can or at least feels what will be effective, in terms of monetary policy.

Despite Trump’s constant pleading Powell says he will not push towards negative interest rates. He says at this point rates are not the issue; demand is, and that can only be addressed by policy, such as infrastructure spending. Or of course the safe re-opening of the economy.

Basically, Powell said, any additional liquidity or rate reduction will have little effect on the economy.

Translation: The Fed has run out of ammunition.

To learn more about Steve Smith’s approach to trading and access to his Options360 service click here

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

7 “Safe-Haven” Dividend Stocks for Turbulent Times

REVISED 2020 Stock Market Outlook– Discover why there is more downside ahead and the Top 10 picks for the bear market.

SPY shares were trading at $281.18 per share on Wednesday afternoon, down $5.49 (-1.92%). Year-to-date, SPY has declined -12.13%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |