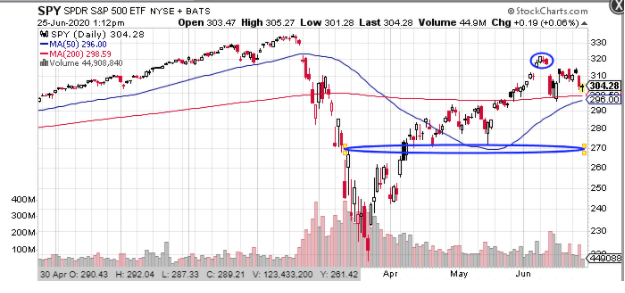

With the recent rebound in the stock market, the “SPDR Trust (SPY - Get Rating)” is now just 4% away from its February all-time highs. But, with the COVID-19 virus still spreading, there is a rethinking of the pace and scope of the reopening, causing concern among investors that the rally may have been fueled by an overly optimistic outlook. Over the past few days, the retrenchment came fast and furious as companies such as “Apple (AAPL)” closed stores across the south from Arizona to Texas and Florida — and “Disney (DIS)” is being forced to delay the opening of parks and film releases.

Regional governments such as New York are now delaying the reopening and enforcing quarantine rules for out-of-state travelers. This led to the major indices suffering a 3% decline on Wednesday, breaking a nine-day winning streak for the “Nasdaq 100 (QQQ - Get Rating)” and their worst day in over a month.

While mega-cap and high-growth tech names such as “Zoom (ZM)” and “Redfin (RDFN)” continue powering higher, helping the headline index readings such as the QQQ and SPY remain near highs, there has been renewed damage below the surface as travel and leisure-related sectors get hammered.

Once again, begging the question: Just how long and far can the generals lead without the soldiers following?

From a technical standpoint, the SPY has now left a bearish island and looks at risk of heading back down to the $270 level or about a 10% correction from current levels.

So how does one go about structuring portfolio protection without being shaken out during a potentially turbulent summer heading into the November election?

How Much Protection & for How Long?

Buying put options offers the most complete and probably efficient way to hedge a position. But, it comes at a cost. As with all insurance policies, it will be a function of the amount of protection and its duration. The main items to consider when choosing put protection, be it an individual stock or broad equity portfolio — are:

1. What magnitude of a decline is expected?

2. At what level of the decline do you want the position to be fully hedged or protected?

3. For what length of time do you want the protection in place?

Answering these questions will help you determine the appropriate number of puts to buy at a given strike with a certain expiration date. By using the basic applications of the delta, in which an at-the-money option is expected to move 0.50 for every $1 unit price move in the underlying security, one can begin to assess how much and at what levels and cost protection can be purchased.

Combination Approach

Let’s have a $100,000 portfolio that is benchmarked to the S&P 500 Index or a position equivalent to owning 480 shares of the SPY. You want to establish protection to carry you through next quarter’s earnings report; most companies were given a pass last quarter for large year-over declines and not providing any guidance. But now the rubber will really meet the road in terms of the impact of the shut-down.

For example, three-step approach, using SPY options to create portfolio protection:

1. Use a spread of closer-to-the-money strikes – such as buying the October 300 puts and selling the October 270 puts. Such a spread could be bought for around $8 net debit. For a $100,000 portfolio, purchasing about 20 of these might provide reasonable protection. But because we’re protecting it in 2 other ways (read on), buying 10 spreads should suffice.

2. The next step is to sell a call spread for a credit to help finance the cost of the put spread. Basically, you are creating a collar.

But, I would put a small twist and sell a call spread with a nearer dated expiration. This accomplishes two things; 1) it gets time decay in your favor 2) It provides more flexibility to adjust by either rolling out (up or down) to collect an additional premium or simply remove and open up the upside profit potential if the market starts trending to a new leg higher.

My suggestion would be to sell the August $350 calls and buy the August 370 calls. This call spread can garner about a $1.50 net credit. Remember: As a spread, this won’t limit your upside as once SPY climbs above the 360 level you become outright long again. You could probably sell up to about 20 of these spreads. Be aware there’s a “dead zone”; if SPY is between 350 and 370, then you’ll lose $3.50 on this position. But I assume you’d be making money if the SPY rallied another 15% from the current $305 levels.

- The last step is to use the proceeds of the call spreads to buy some near term out-of-the-money puts to provide low-cost disaster protection. For example, the $1,000 proceeds or net credit from the collar could finance the purchase of about 10 of the July 280 puts. Those OTM puts give you outright disaster protection, should another wave of selling hits the market over the next month.

This is just a loose construct — and you can play around with the numbers — but I think the best hedges will ultimately involve more than simply picking one strike or one expiration date.

The upshot is; be forward-thinking and use the flexibility of options to customize your portfolio’s risk profile so it aligns with both your outlook and temperament.

To learn more about Steve Smith’s approach to trading and access to his Option360 click here.

SPY shares were trading at $303.57 per share on Thursday afternoon, down $0.52 (-0.17%). Year-to-date, SPY has declined -4.71%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |