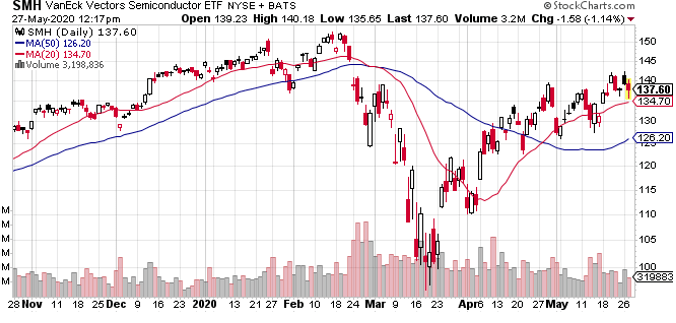

The Semiconductor Conductor Sector has fared fairly well during the past few months, enjoying one of the strongest bounce backs sine the broad market or “SPDR S&P 500 (SPY - Get Rating)” low in late March.

While SPY has rallied some 25% from the March low and is still 12$ from the February all-tome-high. The “Semiconductor ETF (SMH)” has rallied 44% and is a mere 8.8% from its all-time high.

Yesterday the group took a hit as part of the larger rotation trade, that is people dumping the stay/work from plays such as game makers like “Activision (ATVI)”—the day ended with “Nasdaq 100 (QQQ)” down while the “Russell 200 (IWM)” was up some 3.5%

Today the losses are extending after U.S Commerce Secretary Wilbur Ross said, the U.S. will block semiconductor shipments to Huawei for national security reasons.

Under the change, companies using U.S. chipmaking equipment must obtain a U.S. license before supplying to Huawei or its affiliates.

Shares of top stocks such as “Nvidia (NVDA)” and “Advanced Micro Devices (AMD)” are down over 5% at midday and lost nearly 10% in just the past two days.

I think this presents a buying opportunity.

In the past, people used to adhere to the ‘Dow Theory’ which saws the market says the market is in an upward trend if the main Dow, advances above a previous important high and is accompanied or followed by a similar, the Dow Jones Transportation Average (DJTA).

The thinking was the transports, which are comprised of truckers, cargo ships railroad, and delivery by air such as “FedEx (FDX)” provides the true pulse of the economy. Transports need to conform to the broad market and the rebounding economy, or it can be a forecasting tool for predicting a recession.

Trouble is that this COVID-19 virus has created a self-induced recession that has hit transports the hardest.

A good of commerce and work and entertainment can now, and continues to be, done online. My “New Dow Theory” uses the Semiconductor Index or SMH as the canary for confirmation.

So far, it’s telling me things remain on the comeback trail I’m using today’s dip to pick up some chips. My top pick is AMD. With shares around $50, I’m using call options to build a small bullish position.

While I don’t know if these reversions will persist for the next few days. I’m betting will soon resolve Semiconductors remain one of the secular leaders and are thus an area I want to continue to bet on from the long side.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

7 “Safe-Haven” Dividend Stocks for Turbulent Times

SPY shares were trading at $300.29 per share on Wednesday afternoon, up $1.21 (+0.40%). Year-to-date, SPY has declined -6.15%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |