The market continues to rip higher, with the “SPDR (SPY)” now up some 305 from the March low and just 10% from its all-time highs. In recent Option360 Monday Outlooks I’ve discussed the difficulty being bearish in general and especially during the current environment in which the rules, policies, and government institutions are geared towards rewarding shareholders.

First and foremost, you have 10 years of the Federal Reserve’s intervention which has not only run far and wide from the Feds supposed dual mandate but has a completely perverted monetary policy, the very nature of money and purpose of public markets in which risk/reward and responsibility are supposedly associated with participating in the buying and selling of financial assets.

It may sound simple, but it’s true; Don’t fight the Fed. And they’ve come out and said they will do everything and anything, including the direct purchase of corporate and municipal bonds and even high yield ETFs such as “SPDR Bloomberg High Yield Bond (JNK)”.

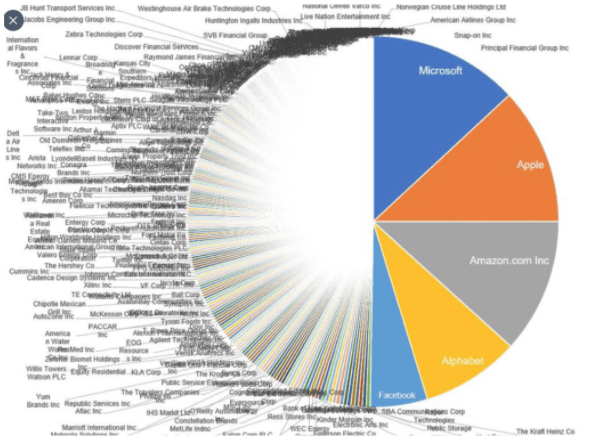

There are also structural dynamics in the construction of equity indices like SPY, in which failing companies get dumped and the more profitable, higher growth gets added. And with the nature of passive investing, winners keep winning which leads to the market cap-weighted SPY currently looks like this:

Being bearish was often referred to as ‘going to the dark side’ due to the underlying pessimism, skepticism and negativity required to build a short position. It held an intellectual allure, “we’re unearthing truth rather than blindly following the buy-side analysts’ narrative” coupled with ‘prices take the escalator up and down’ meaning if you capture a puncture in a perceived bubble you’re a genius and a legend.

Big winners of big shorts include not just macro calls like the housing bubble but also stock specific cases like Enron.

But, for every great call there are many that get caught on the wrong side of so-called ‘story stocks’ as they get bogged down in current valuation while ignoring large term trends and something known as the ‘animal spirits’ of investors which sweep a company’s stock well beyond what seems reasonable.

For year’s people, myself included, fought “Netflix (NFLX)” as it burned through cash. But the larger trend of streaming and opting for home viewing over going to theaters, which has now been accelerated and cemented by the stay-at-home Covid, sent the stock new all-time highs last week. Another example is “Tesla (TSLA)” in which there is a hardcore group short community, known as TSLAQ which for years, has staged a spirited bearish campaign citing everything from accounting fraud to posting pictures of TSLA cars being fire.

Early on they seemed to make a fair and somewhat informed case. But then stock rose from $180 to $900 over the past year, and something interesting happened: during the rise the TSLAQ guys became more vocal about the righteousness of their bearish case and then two months ago when TSLA became cash-flow positive they went silent.

This speaks to two things about taking on a high profile stock; don’t be stubborn and don’t do it in a public manner. Hedge fund titan Bill Ackman certainly learned this lesson in his all-out short war against “Herbalife (HLF)” in which he not only lost a lot of money but also quite a bit of his reputation.

Do I think HLF is something of a Ponzi scheme? Sure.

Would I ever short the stock? Never.

Shorting is a hard way to make many and becomes infinitely harder when you let your beliefs between what is right and wrong get in the way.

The only thing I believe with any certainty is nothing. I don’t care what is right, what is wrong, what is good, what is evil, which may seem like a relativistic slippery slope. But the market doesn’t care about your principles. For 10 years, principles have gotten you nowhere.

Do I have principles? For sure, I have principles. I have disagreed with buybacks for years, mostly because corporations destroy value when they can trade their own stock. There is a lot of wrong out there these days. The federal government is bailing out a lot of companies that could have done a lot more to prepare for this day but didn’t.

That is wrong.

The Fed is lending to state and local governments. That is wrong.

The Fed is buying high-yield ETFs. Super wrong.

All of this is wrong. But it also creates gigantic opportunities if you can do the opposite of what your heart is telling you to do.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

7 “Safe-Haven” Dividend Stocks for Turbulent Times

REVISED 2020 Stock Market Outlook– Discover why there is more downside ahead and the Top 10 picks for the bear market.

SPY shares were trading at $293.21 per share on Wednesday afternoon, up $7.48 (+2.62%). Year-to-date, SPY has declined -8.37%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating |