Publicly owned investment manager T. Rowe Price Group, Inc. (TROW - Get Rating) in Baltimore, Md., launches and manages equity and fixed income mutual funds. The firm provides services to individuals, institutional investors, retirement plans, and financial intermediaries. Recently, the company announced plans to add strategies to its nascent bond ETF suite, including one that aims to defend portfolios from rising interest rates. It intends to launch its floating rate ETF and U.S. high yield bond ETF on or around August 1.

However, TROW has been under pressure, with CEO Rob Sharps describing the first quarter as “challenging”. The company saw clients pull $18.10 billion in assets from its equity funds during the quarter amid declining investor confidence due to fears related to sky-high inflation and the Russia-Ukraine war. This took a significant toll on the company’s revenues and profits, which missed Wall Street estimates. Furthermore, the company does not expect the situation to ease anytime soon. “There are a lot of challenges that we’ll have to navigate going forward,” Sharps said. “They are complex, and they’re not the sort of things that resolve themselves quickly.” The company has cut its guidance for the full year.

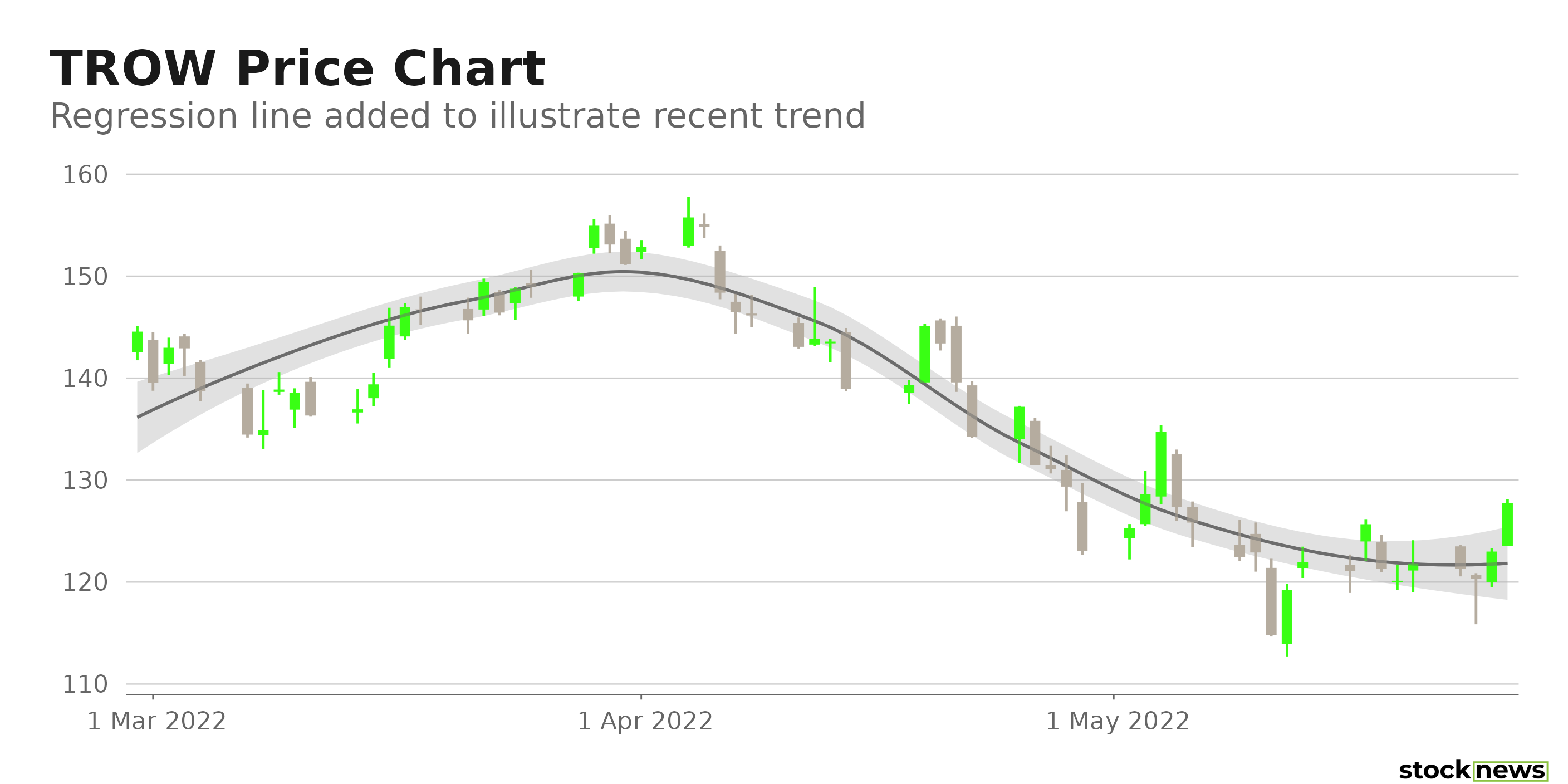

TROW shares have slumped 35% in price year-to-date to close the last trading session at $127.73. It has plummeted 31.9% over the past year.

Here is what could shape TROW’s performance in the near term:

Declining Financials

For its fiscal first quarter, ended March 31, 2022, TROW’s net revenues increased 2% year-over-year to $1.86 billion. Its adjusted net operating income declined 8.8% from its year-ago value to $838 million. The company’s adjusted net income came in at $616.90 million, down 13.4% from the prior-year quarter. And its EPS declined 13% year-over-year to $2.62. In addition, TROW reported preliminary assets under management (“AUM”) of $1.42 trillion as of April 30, 2022, reflecting an 8.5% decrease from $1.55 trillion in the prior month. The company’s AUM as of Dec.31, 2021, stood at $1.69 trillion.

Impressive Profitability

TROW’s EBITDA and net income margins of 51.19% and 37.64%, respectively, are 114.3% and 28.1% higher than the 23.88% and 29.38% industry averages. Also, its 34.72% levered FCF margin is 83.1% higher than the 18.97% industry average.

TROW’s 33.15%, 23.50%, and 23.47% respective ROE, ROA, and ROTC compare with the 12.70%, 1.26%, and 6.18% industry averages.

Bleak Analysts Expectations

Analysts expect the company’s revenues to come in at $1.78 billion in its fiscal second quarter, ending June 30, 2022, indicating a 7.7% decline year-over-year. Also, its revenue is expected to decrease 8.5% in the next quarter, ending Sept. 30, 2022, and 5.1% in the current year. The $10.41 consensus EPS estimate for the fiscal year indicates an 18.3% year-over-year decline. Moreover, the Street expects TROW’s EPS to decrease 22.8% in the current quarter and 20.6% in the following quarter.

Mixed Valuation

In terms of forward P/E, TROW is currently trading at 11.57x, which is 10.3% higher than the 10.49x industry average. Also, its 3.67 forward EV/Sales ratio is 31.5% higher than the 2.79 industry average.

However, TROW’s forward EV/EBITDA is 22.9% lower than the 10.29x industry average, and its forward Price/Cash Flow is 7.2% lower than the 10.31x industry average.

POWR Ratings Reflect Uncertain Prospects

TROW has an overall C rating, which translates to Neutral in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

The stock has a grade of C for Value, which is consistent with its mixed valuation.

TROW has an F grade for Sentiment. Bearish analyst sentiment about the stock justifies this grade.

Among the 61 stocks in the C-rated Asset Management industry, TROW is ranked #27.

Beyond what I have stated above, one can also view TROW’s grades for Quality, Growth, Momentum, and Stability here.

View the top-rated stocks in the Asset Management industry here.

Bottom Line

This year has been quite challenging for asset managers as they face the Fed’s interest rate hikes and its tightening monetary policies. Over the first quarter, TROW’s performance has been unsatisfactory, while analysts are bearish on its near-term prospects. Despite the company’s strong profitability and sound footing in the industry, I think it could be wise to wait for its prospects to stabilize before investing in the stock.

How Does T. Rowe Price Group, Inc. (TROW) Stack Up Against its Peers?

While TROW has an overall POWR Rating of C, one might want to consider taking a look at its industry peers, Silvercrest Asset Management Group Inc. (SAMG - Get Rating) and Gamco Investors, Inc. (GBL - Get Rating), which have an A (Strong Buy) rating.

Want More Great Investing Ideas?

TROW shares were unchanged in premarket trading Friday. Year-to-date, TROW has declined -34.47%, versus a -14.40% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| TROW | Get Rating | Get Rating | Get Rating |

| SAMG | Get Rating | Get Rating | Get Rating |

| GBL | Get Rating | Get Rating | Get Rating |