- Seasonality and more in the gasoline refining spread

- An update on VLO and MPC

- Demand may have just begun to emerge

- Product inventory data has been mega bullish

- From laggard to leader- What a difference a year can make

Refining crude oil into oil products is a far different business than extracting the energy commodity from the earth’s crust. While producers profit from higher petroleum prices and suffer when the oil price declines, refiners are exposed to the differential between oil and oil product prices.

A crack spread reflects the economics of processing a barrel of petroleum into products. Gasoline is the most ubiquitous oil product. Distillates include heating oil, diesel, and jet fuels. The heating oil futures contract that trades on the CME’s NYMEX division is a proxy for other distillate products.

The gasoline and distillate crack spreads are barometers for the demand for oil products, translating to the demand for crude oil, the main input in the products. The crack spreads also serve as real-time indicators of profit margins for companies that refine crude oil into the fossil fuels that power the world.

Valero Energy Corporation (VLO - Get Rating) and Marathon Petroleum Corporation (MPC - Get Rating) are two leading US oil refiners. Rising crack spreads over the past months have pushed VLO and MPC shares significantly higher.

Seasonality and more in the gasoline refining spread

What a difference a year has made in the gasoline processing spread. In March 2020, the refining margin for processing a barrel of crude oil into a barrel of gasoline fell to a low of negative $3.85 per barrel. As energy demand evaporated, refining companies bought crude oil and sold products at a loss, even before the substantial processing costs.

Refineries require massive capital for operations. In March 2020, they were loss-making businesses that threatened their survival. Meanwhile, the gasoline refining business has gone from famine to feast over the past year.

Source: CQG

Source: CQG

As the weekly chart shows, the gasoline refining spreads were at negative $3.65 per barrel during the week of March 23, 2020. At the end of last week, it stood at $19.85 per barrel, after trading to $24.86, the highest level in March since 2015.

Optimism over herd immunity to COVID-19 and the approaching 2021 driving season lifted the gasoline refining margin, which has been good news for companies that process petroleum into the fuel.

An update on VLO and MPC

At the $73.70 per share level at the end of last week, VLO’s market cap stood at over $30billion. The highly active and liquid stock trades an average of nearly four million shares each day and pays shareholders a $3.92 or 5.3% dividend. The stock exploded from a low of $31 on March 18, 2020.

Source: Barchart

Source: Barchart

As the chart shows, VLO shares rose to the latest high of $84.39 on March 11, 2021 and pullback to the $73.70 level on March 19. The rise in the gasoline crack spread fueled the rise in VLO.

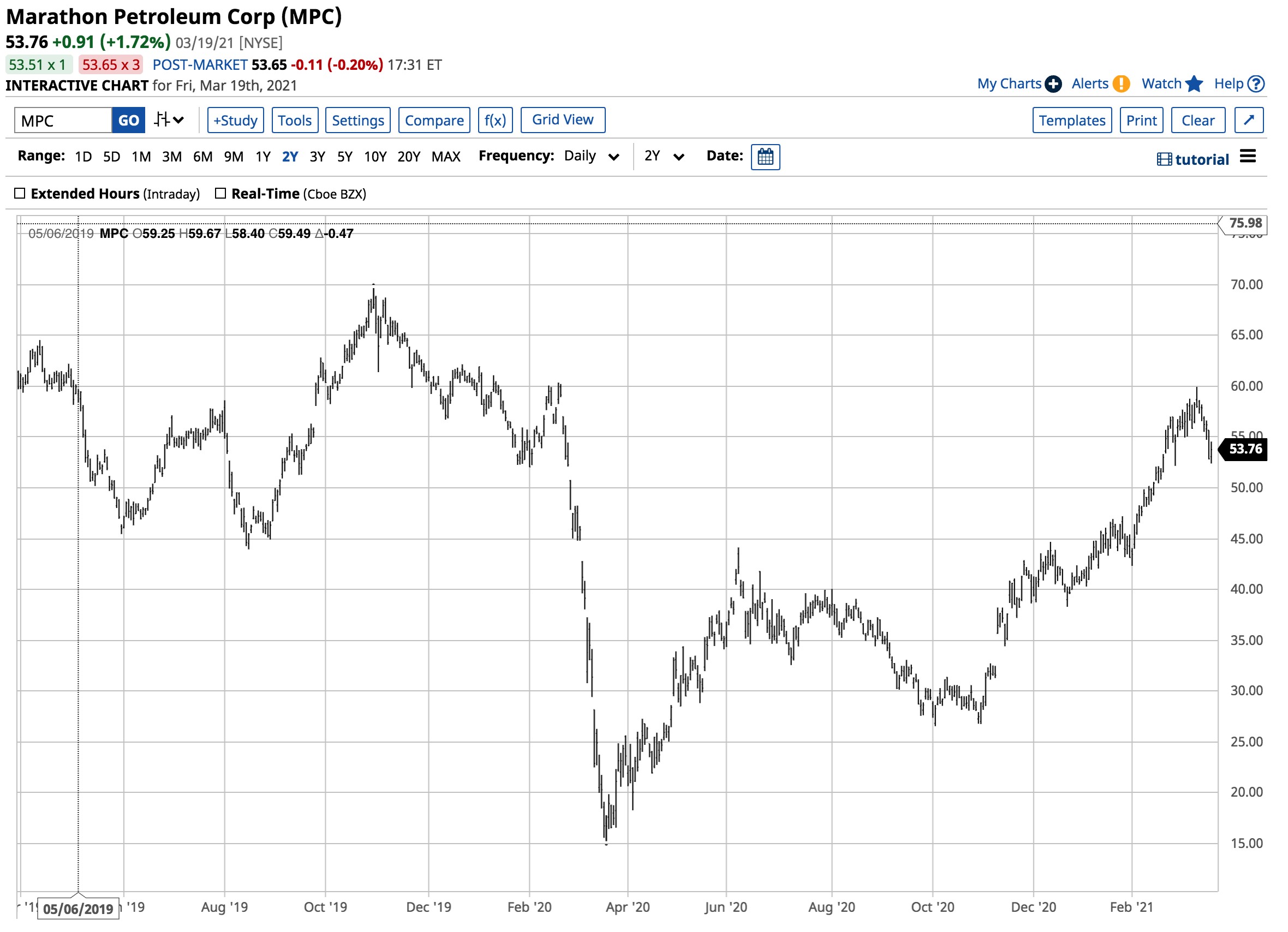

MPC is also a leading refiner of gasoline and oil products. At the $53.76 level on March 19, MPC’s market cap was over $35 billion. The $2.32 dividend translated to a 4.3% yield. MPC is also a liquid and actively traded stock with an average of over 6.1 million shares changing hands each day. On March 19, 2020, MPC shares reached a low of $15.26.

Source: Barchart

Source: Barchart

The chart shows that MPC shares nearly quadrupled over the past year when it hit the most recent high of $59.93 on March 11. At $53.76 at the end of last week, the stock corrected with crude oil, gasoline, and crack spreads. As with VLO, rising gasoline processing spreads lift profit margins for MPC.

Demand may have just begun to emerge

As we head into the 2021 driving season in the US, gasoline and gasoline processing spreads typically rise in the spring and remain strong through the summer months. Drivers put more mileage on their cars during the spring, summer, and early fall as driving conditions are favorable. Moreover, the summer vacation season is the time when people often venture out on long trips, consuming lots of fuel.

The 2020 driving season was anything but ordinary. Social distancing guidelines, job losses, business slowdowns, and working and studying from home led to the lowest gasoline demand in many years. As vaccines create herd immunity to the coronavirus, 2021 will see a return to more fuel consumption. Moreover, after being cooped up at home for more than a year, we could see a surge in travel by car and other transportation modes, making the 2021 driving season the most robust in years.

Simultaneously, the Biden administration is following a far greener path for US energy policy. On his first day in office, the President canceled the Keystone XL pipeline project. More regulations are on the horizon for the companies that extract fossil fuels from the earth’s crust in the US. Lower US production is likely to tighten supplies, leading to higher prices. Refining capital costs could rise because of regulatory expenses, but that could lead to higher crack spread levels.

Meanwhile, optimism at the start of the 2021 driving season could just be the start of bullish price action on gasoline and gasoline refining spreads. Inventory data is pointing to robust demand for oil products.

Product inventory data has been mega bullish

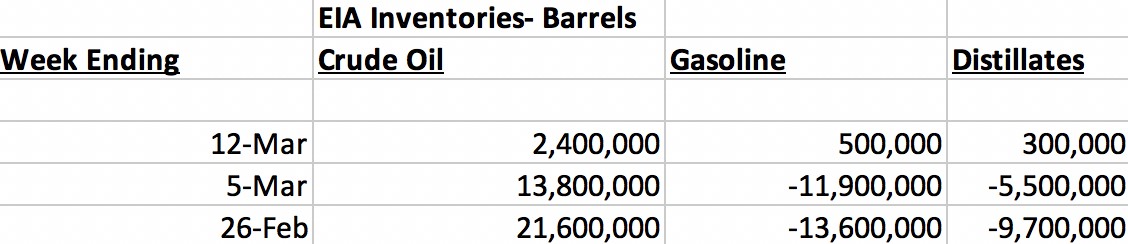

Over the past three weeks, gasoline and distillate stocks have experienced substantial declines.

Source: API

Source: API

The American Petroleum Institute reported a 19.358 million barrel decline in gasoline stocks and a 12.945 million barrel drop in distillate inventories over the past three weeks. The over 32.3 million barrel decline in products was far higher than the under 19.148 increase in crude oil supplies.

Source: EIA

Source: EIA

The Energy Information Administration reported a 25.0 million barrel decline in gasoline stocks and a 14.90 million barrel drop in distillate inventories over the past three weeks. The 39.90 million barrel decline in products was higher than the under 37.8 increase in crude oil supplies.

The decline in crude oil product stockpiles is a promising sign for demand over the coming weeks and months.

From laggard to leader- What a difference a year can make

Very often, the worst market sector over one period becomes the best during a subsequent timeframe. Crude oil and oil product demand have led to higher oil and product prices. Products have outperformed the raw energy commodity, pushing crack spreads higher, leading to gains in refining stocks. Moreover, sector rotation in the stock market lifted energy-related shares since late last year when the crude oil price made its last significant low on November 2 at $33.64 per barrel.

This week, crude oil, and product prices took the elevator to the downside as nearby NYMEX futures fell to $58.20 on March 18. However, the energy commodity recovered and settled at the $61.42 level on March 19.

Last March, the crude oil and product markets were reeling, leading to a decline in nearby NYMEX futures that took the price below zero on April 20. This year, optimism over the end of the pandemic, sector rotation in stocks, and a shift in US energy policy could make the coming weeks as bullish as last year was bearish despite the recent correction.

Want More Great Investing Ideas?

How to Ride the NEW Stock Bubble?

9 “MUST OWN” Growth Stocks for 2021

5 WINNING Stocks Chart Patterns

VLO shares fell $1.40 (-1.94%) in premarket trading Tuesday. Year-to-date, VLO has gained 27.21%, versus a 4.72% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| VLO | Get Rating | Get Rating | Get Rating |

| MPC | Get Rating | Get Rating | Get Rating |