ContextLogic Inc. (WISH - Get Rating) is a mobile e-commerce company that operates the Wish platform, which connects users to merchants. Although the stock has a 12-month consensus price target of $8.56, indicating a 20.1% potential upside, only one out of five Wall Street analysts have given it a Buy rating.

Moreover, analysts expect its EPS to remain negative for the current fiscal year (ending December 2023), while its revenue is expected to decline 27.3% year-over-year to $415.12 million in the same period.

Therefore, it could be wise to avoid the stock now. Let’s look at the trends of some of its key financial metrics to gain a better understanding.

Tracking WISH’s Revenue, Gross Margin, ROA, and Asset Turnover

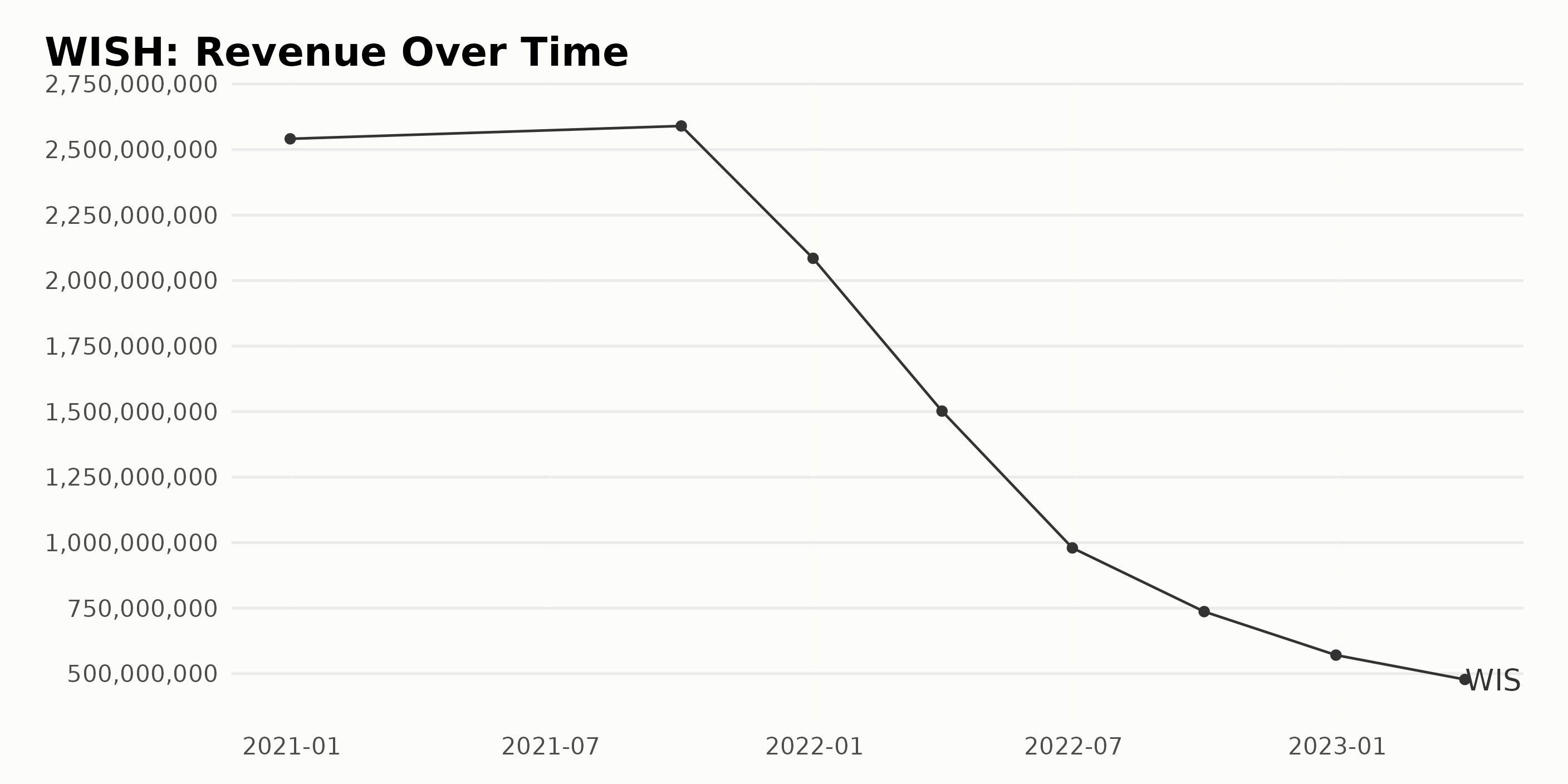

WISH’s revenue has fluctuated over the past few years. Revenue was at a high of $2.54 billion on December 31, 2020, and has since declined to $478 million on March 31, 2023, representing an 81% decrease in revenue. However, the growth rate has been positive, with revenue increasing from $571 million on December 31, 2022, to $478M million on March 31, 2023, a 16% increase.

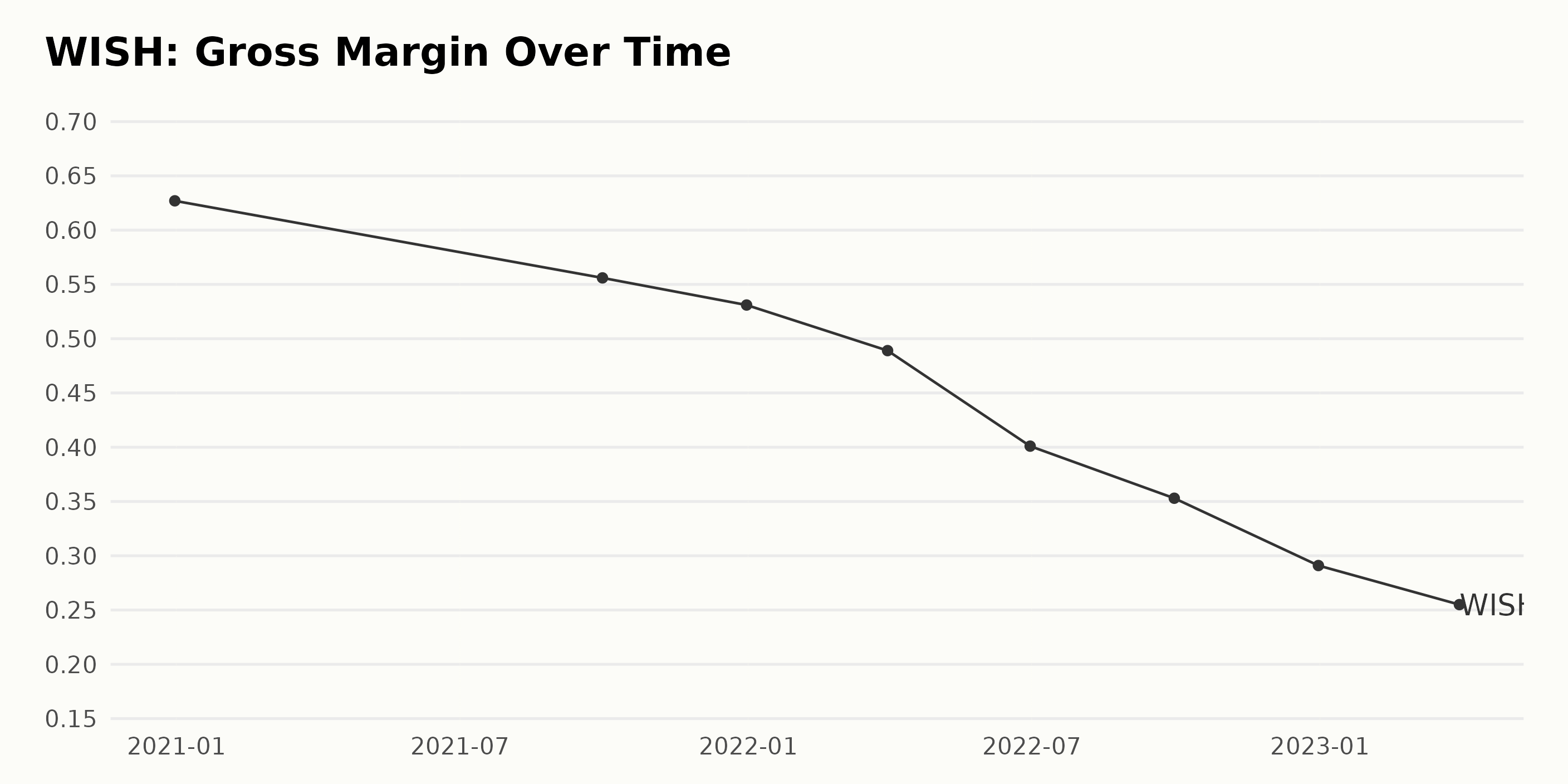

WISH’s gross margin has fluctuated over the last few years, with an overall downward trend. It dropped from 62.7% at the end of 2020 to 25.5% at the end of 2023, representing a drop of 59.2%. The largest decrease was from June 2022 to September 2022, when it fell from 40.1% to 35.3%, a decrease of 11.2%.

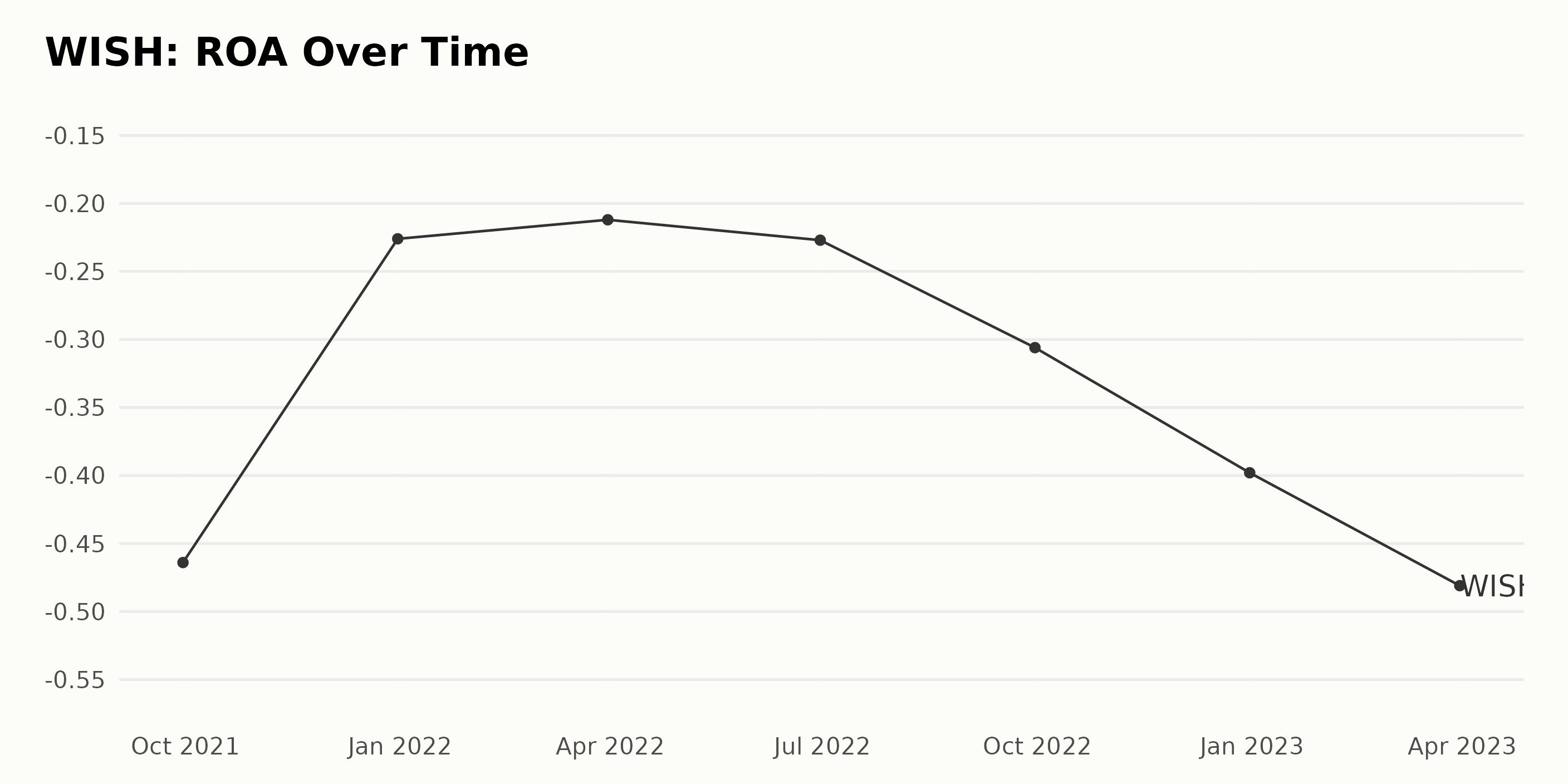

WISH experienced a general decline in ROA from September 2021 to March 2023 and an overall drop of 15.7%, from -0.46 to -0.481. The largest decrease was seen in the Dec 2022 quarter, with a value of -0.398, representing a drop of 14%.

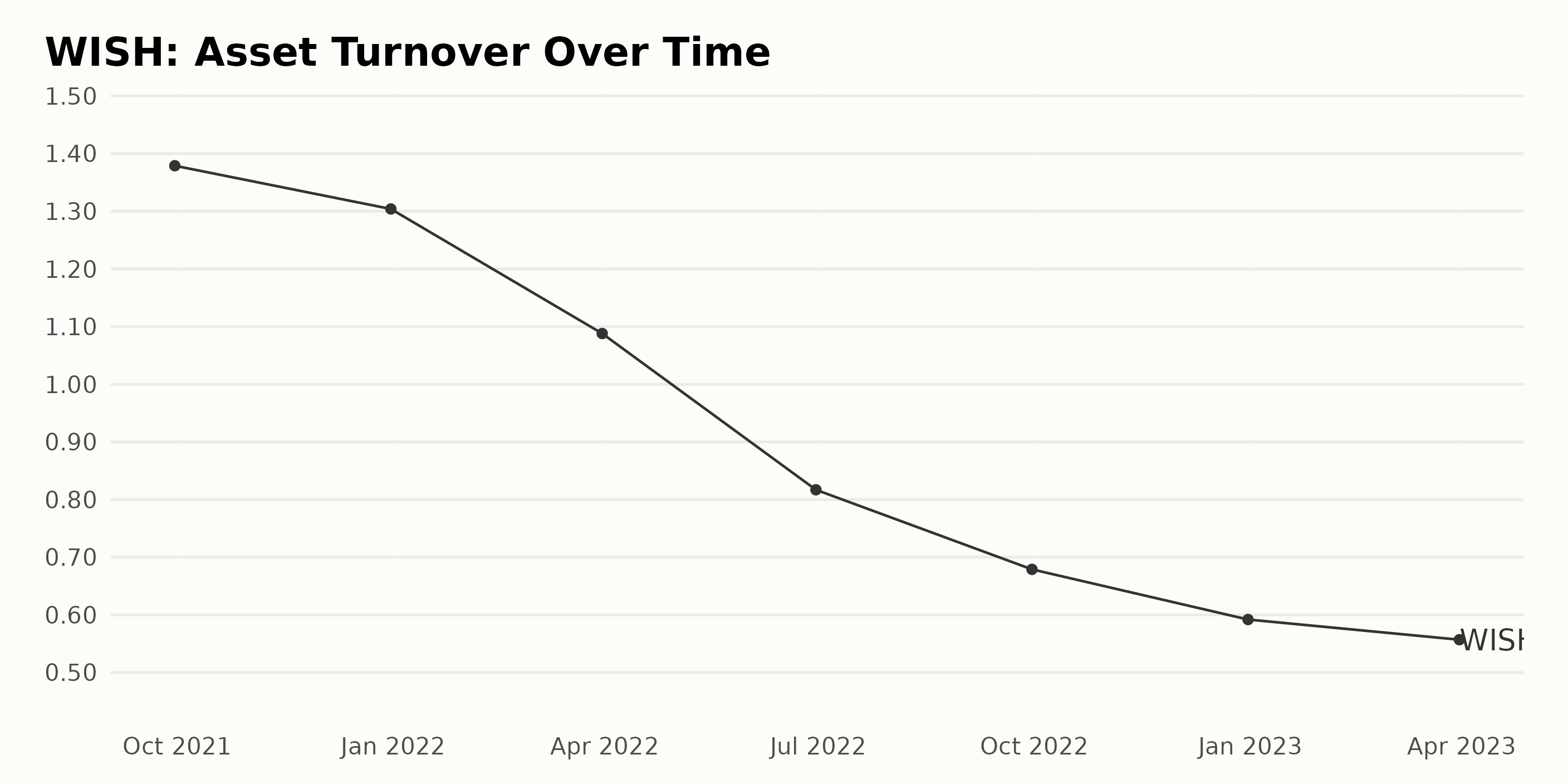

WISH’s asset turnover has slowed with fluctuations over the past two years. Starting at 1.38 in September 2021, the turnover has decreased by an overall rate of 46.6%, down to its most recent value of 0.557 in March 2023.

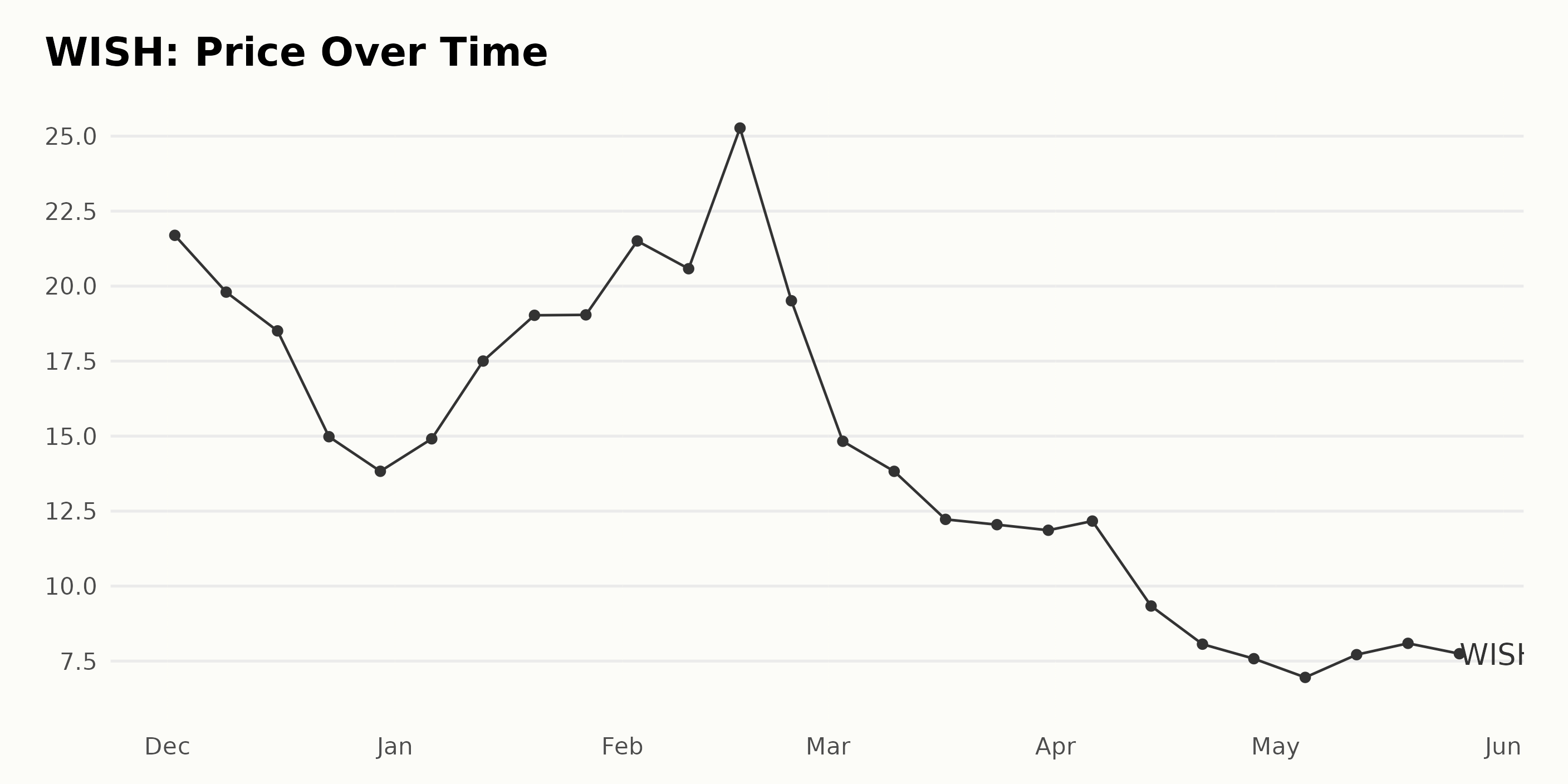

Price Drop of WISH Over 180 Days

The share price of WISH has been decreasing over the observed period, with a noticeable acceleration from December 2022 to May 2023. Prices began at $21.69 and sank to $7.75 by late May 2023, representing a decrease of 64.1%. Here is a chart of WISH’s price over the past 180 days.

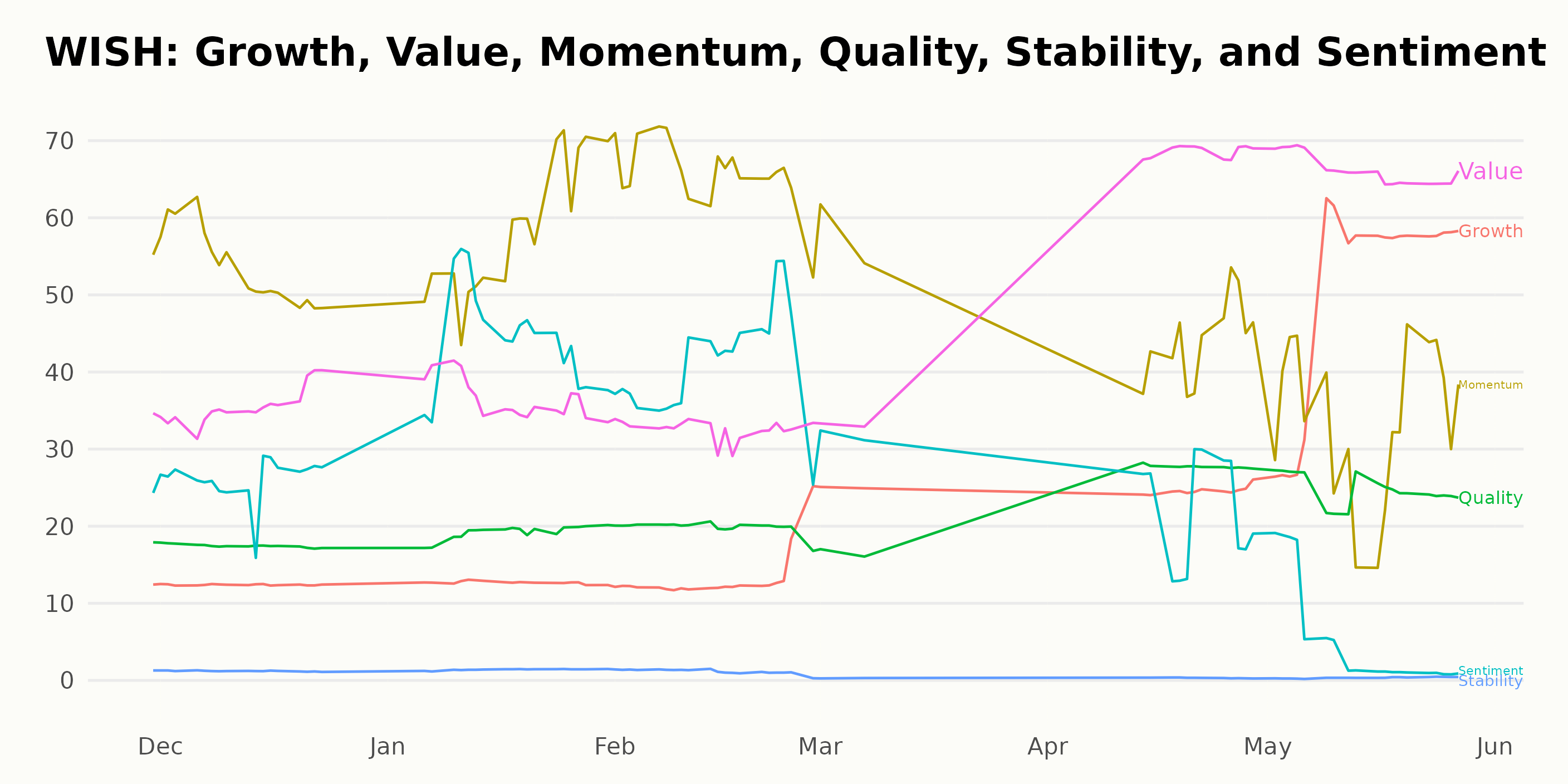

Rising POWR Ratings for WISH Reflect Value, Momentum, and Growth

The overall POWR Ratings grade for WISH has generally been hovering around the D, which translates to Sell in our proprietary rating system. It has a rank in the Internet industry of #54 out of 58 stocks.

The POWR Ratings for WISH indicate that the highest-rated dimensions are Value, Momentum, and Growth. In particular, there is a clear trend that each of these three dimensions has been increasing over time, with Value having the highest rating at 69.

The Ratings for Growth have steadily increased from 12 in November 2022 to 50 in May 2023, Momentum has increased from 55 in November 2022 to 66 in February 2023, and Value has also increased from 35 in November 2022 to 69 in April 2023. Meanwhile, the three lowest-rated dimensions are Sentiment, Stability, and Quality.

How does ContextLogic Inc. (WISH) Stack Up Against its Peers?

Other stocks in the Internet sector that may be worth considering are trivago N.V. (TRVG - Get Rating), Travelzoo (TZOO - Get Rating), and Opera Limited (OPRA - Get Rating) — they have better POWR Ratings.

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

Want More Great Investing Ideas?

WISH shares were trading at $7.13 per share on Monday afternoon, down $0.07 (-0.97%). Year-to-date, WISH has declined -51.27%, versus a 10.25% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| WISH | Get Rating | Get Rating | Get Rating |

| TRVG | Get Rating | Get Rating | Get Rating |

| TZOO | Get Rating | Get Rating | Get Rating |

| OPRA | Get Rating | Get Rating | Get Rating |