- Any dip has been a buy since the late 1980s

- A pullback since late 2020

- A rising dividend

- Steady earnings and revenue growth

- Keep buying those dips

Attention Walmart shoppers, you have made the shares of the company founded by Sam Walton in Arkansas soar.

At $129.92 per share on February 26, Walmart Inc (WMT - Get Rating) had a $367.581 billion market cap. The company is an eight-hundred-pound gorilla in retail and wholesale markets. WMT operates in three segments, Walmart US, Walmart International, and Sam’s Club, its exclusive membership warehouse club that was likely a model for Costco (COST). On April 7, 1983, Sam’s Club, the namesake for Walmart’s founder, burst on the scene in Midwest City, Oklahoma. On September 15, 1983, Costco opened its first location in Seattle, Washington.

WMT operates approximately 11,500 stores and various e-commerce websites under 56 banners in 27 countries. Just over 51% of WMT shares are held by insiders, Sam Walton’s heirs.

Walmart could be one of the ultimate growth stocks as the trend has been higher for decades.

Any dip has been a buy since the late 1980s

From 1987 through 1999, WMT shares experienced substantial growth. The stock moved sideways over the next dozen years from 2000 through 2012 when it broke out to a new high.

Source: Barchart

Source: Barchart

The chart shows that WMT broke above the 1999 high of $70.25 in 2012 and moved steadily higher through 2020. The stock reached its latest all-time high of $153.66 in December 2020.

MWT has been a growth stock for decades. Any price weakness has been a buying opportunity since the late 1980s.

A pullback since late 2020

Even the most aggressive bull markets or growth stocks rarely move in a straight line. Corrections make investors nervous, but they can present excellent buying opportunities.

Source: Barchart

Source: Barchart

As the chart illustrates, WMT shares corrected from the December 1 all-time high of $153.66 to below the $130 level at the end of last week.

The shares remain well-above the March 2020 $102 low when risk-off conditions sent the stock market to a significant bottom during the start of the global pandemic.

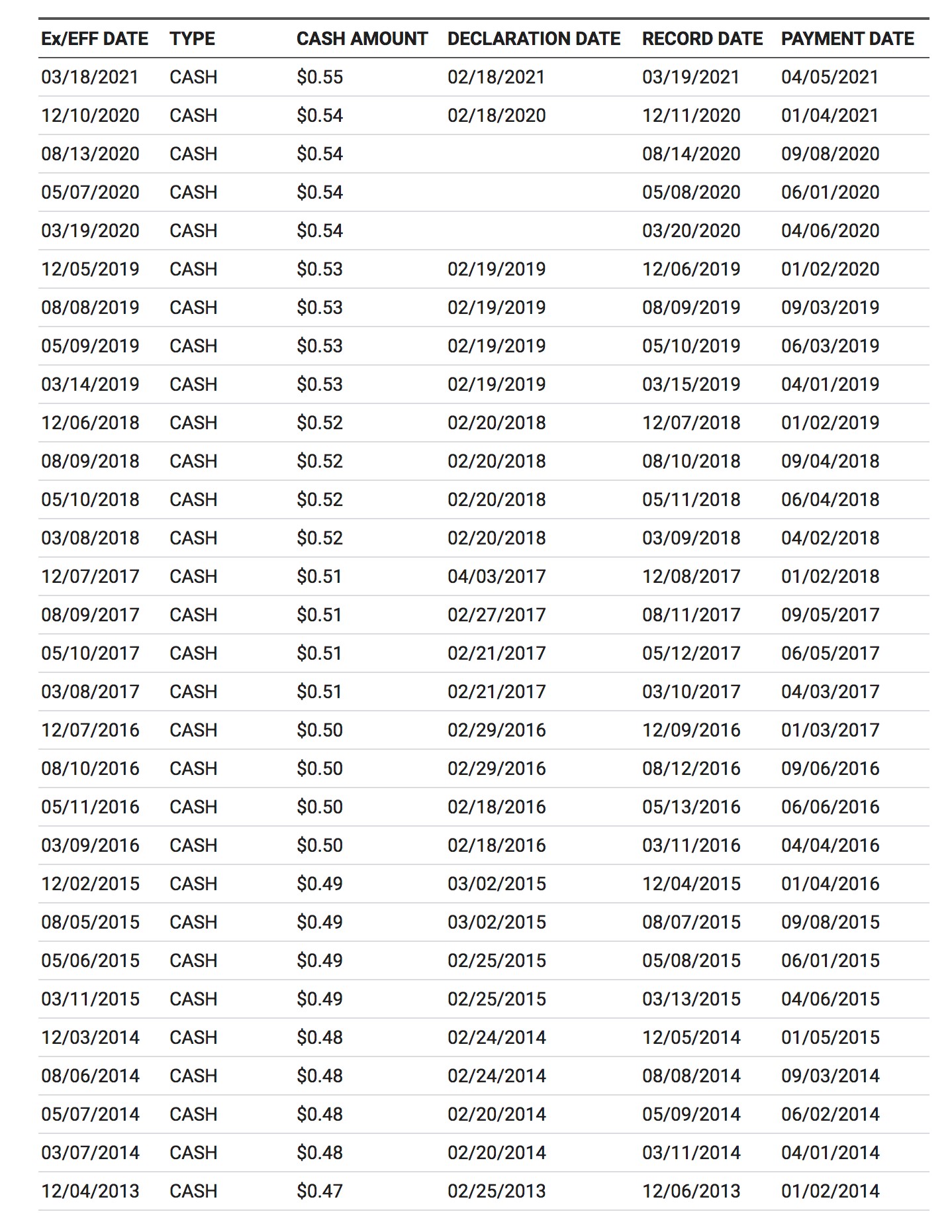

A rising dividend

WMT currently pays shareholders a $2.20 dividend. At $137 per share, the yield is 1.69%. The dividend trend has been positive over the past years.

Source: https://www.nasdaq.com/market-activity/stocks/wmt/dividend-history

Source: https://www.nasdaq.com/market-activity/stocks/wmt/dividend-history

The chart shows the annualized dividend has gradually risen from $1.88 to $2.20 since 2013.

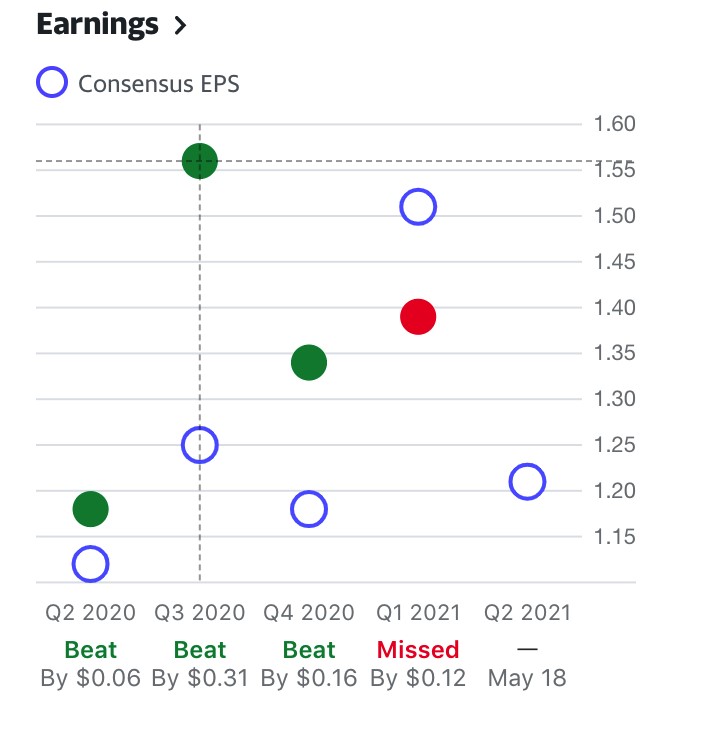

Steady earnings and revenue growth

Walmart consistently earns profits. However, rare earnings miss in Q1 2021 likely weighed on the stock price.

Source: Yahoo Finance

Source: Yahoo Finance

As the chart shows, WMT delivered EPS above consensus forecasts over three of the past four quarters. In the first financial quarter of 2021, the company missed estimates by twelve cents, reporting EPS of $1.39.

Source: Yahoo Finance

Source: Yahoo Finance

The revenue trend has been positive for the retailer. A survey of thirty-two analysts on Yahoo Finance has an average price target of $159.84 for WMT shares, with forecasts ranging from $120 to $180.

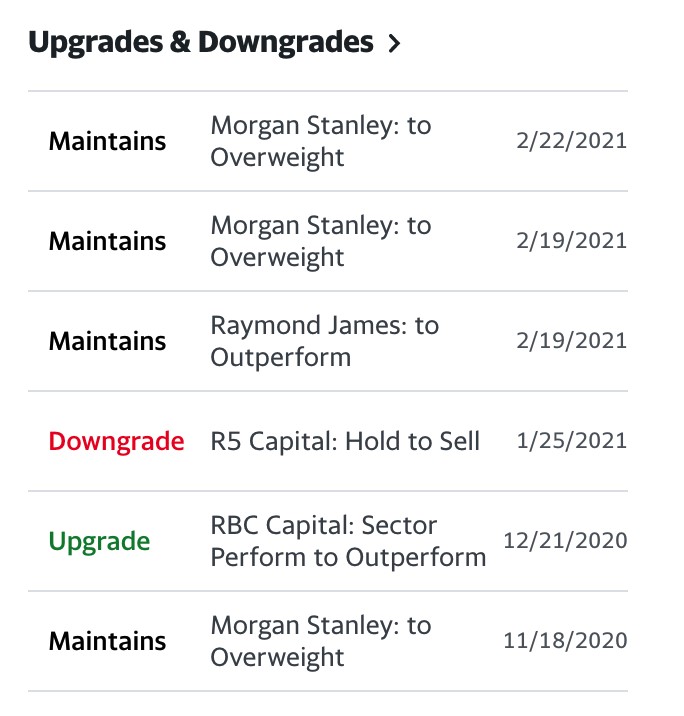

Meanwhile, Wall Street continues to favor the stock.

Source: Yahoo Finance

Source: Yahoo Finance

Five of six analysts rate WMT overweight or outperform, while only one has a sell rating in the stock.

Keep buying those dips

Walmart’s retail and wholesale franchises worldwide make WMT a growth stock. The company recently announced plans to invest $14 billion in enhancements, including automation, supply chain, and other areas, to boost long-term sales. Last year, the company invested a lower $10.3 billion.

Walmart is concentrating on its e-commerce business as it challenges Amazon.com (AMZN). CEO Doug McMillon recently said, “We weren’t the first place you go to buy products online. We’re trying to change that, obviously.”

The pandemic caused Walmart’s e-commerce sales to increase by 79% in fiscal 2021 after growing 37% in fiscal 2020. The lion’s share of growth came from grocery pickup and delivery service as WMT is the US’s leading grocer. Strategic partnerships with Shopify (SHOP) and The Trade Desk, a leading digital advertiser, could raise WMT’s profile on social media sites along with company profits.

The correction from December 2020’s record high in WMT shares is likely to be another buying opportunity for investors. WMT’s franchise and plans to expand its online presence bode well for its future and make it a growth stock for the coming years.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Ride the 2021 Stock Market Bubble

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

WMT shares rose $1.75 (+1.35%) in premarket trading Monday. Year-to-date, WMT has declined -8.68%, versus a 2.89% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| WMT | Get Rating | Get Rating | Get Rating |