New York City’s Warby Parker Inc. (WRBY - Get Rating), a co-founder-led lifestyle brand, pioneers ideas, designs products, and develops technologies and designer-quality prescription glasses and contacts, and offers eye exams and vision tests online in more than 160 retail stores across the United States and Canada.

WRBY’s stock declined 2.4% in price after missing analyst forecasts in its first-quarter earnings report last month. According to the company, the COVID-19 Omicron variant impacted its first-quarter revenue to the tune of some $15 million in projected missed sales, with the disruption accentuated in the latter weeks of December and in the first quarter. Furthermore, last month Goldman Sachs Group Inc. (GS) downgraded the stock to a “neutral” rating from a “buy” rating, citing fading confidence in the company’s revenue outlook.

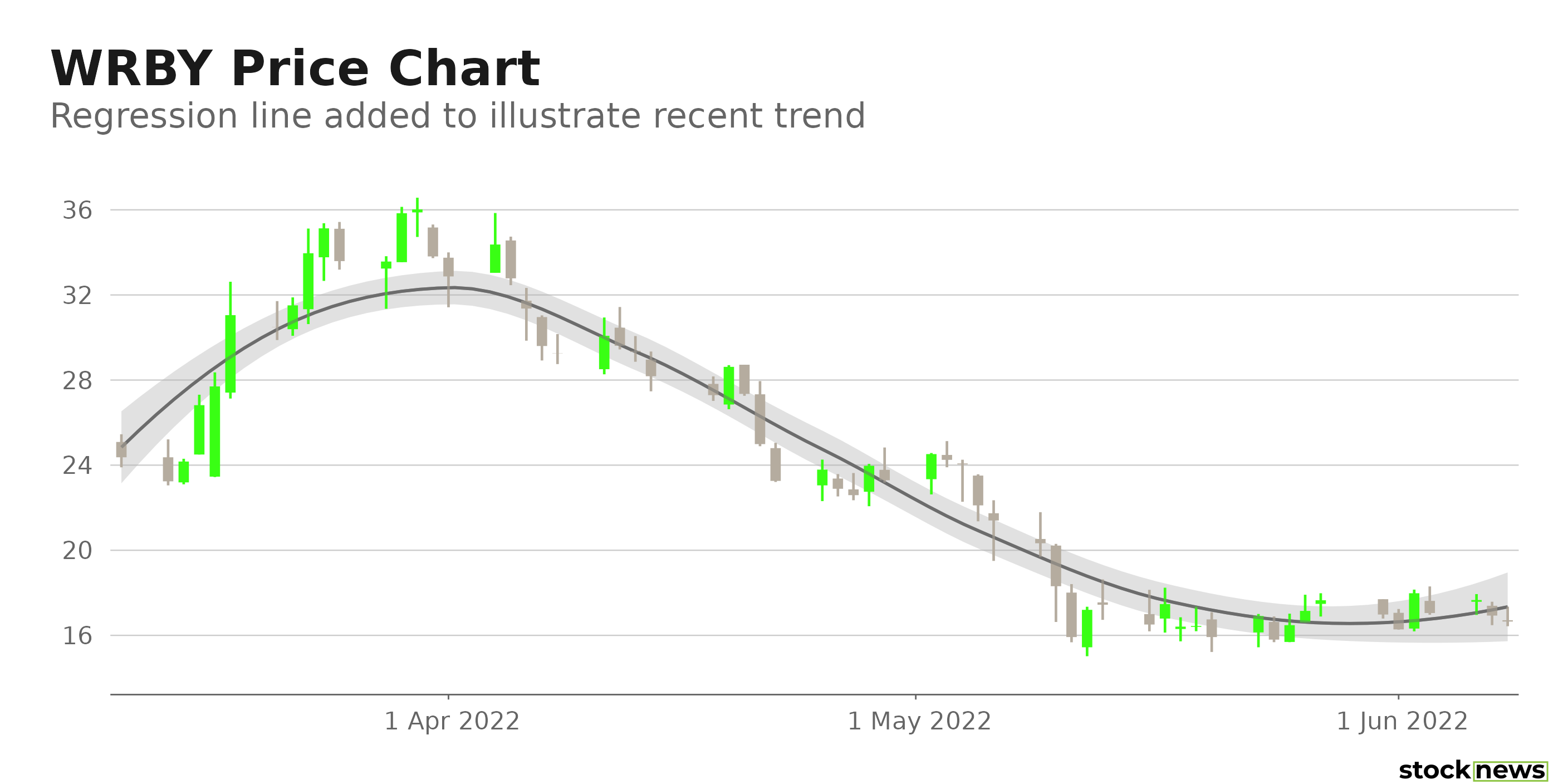

WRBY’s shares have plunged 64.2% in price year-to-date and 22.2% over the past month to close yesterday’s trading session at $16.65.

Here is what could shape WRBY’s performance in the near term:

Top-line Growth could not translate into Bottom-line Improvement

WRBY’s net revenue increased 10.3% year-over-year to $153.22 million for the first quarter, ended March 31, 2022. Its operating loss came in at $33.74 million, compared to $3.02 million in operating income in the prior-year quarter. The company’s net loss surged significantly from the prior-year quarter to $34.13 million. Its loss per share amounted to $0.30. In addition, its net cash used in operating activities grew 214.2% to $10.29 million for the three months ended March 31, 2022.

Poor Profitability

WRBY’s 0.65% trailing-12-month levered FCF margin is 81.9% lower than the 3.6% industry average. Also, its trailing-12-month ROA, ROC, and net income margin are negative 33.3%, 24.4%, and 32.7%, respectively.

Premium Valuation

In terms of forward Price/Book, the stock is currently trading at 6.94x, which is 175.3% higher than the 2.52x industry average. And its 2.89x forward EV/Sales is 157.8% higher than the 1.12x industry average. Furthermore, WRBY’s 3.01x forward Price/Sales is 224.7% higher than the 0.93x industry average.

POWR Ratings Reflect Bleak Outlook

WRBY has an overall D rating, which equates to Sell in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. WRBY has a D for Value and Quality. In addition, the company’s poor profitability is consistent with the Quality grade.

Among the 149 stocks in the D-rated Medical – Devices & Equipment industry, WRBY is ranked #140.

Beyond what I have stated above, one can view WRBY ratings for Growth, Stability, Momentum, and Sentiment here.

Click here to checkout our Healthcare Sector Report for 2022

Bottom Line

WRBY’s failed to meet analysts’ estimates, which caused its stock to plunge significantly in price. Moreover, the stock is currently trading below its 50-day and 200-day moving averages of $23.06 and $32.45, respectively, indicating bearish sentiment. So, we think this, along with its lofty valuation, makes the stock best avoided now.

How Does Warby Parker Inc. (WRBY) Stack Up Against its Peers?

While WRBY has an overall D rating, one might want to consider its industry peers, Fonar Corporation (FONR - Get Rating), Olympus Corp. (OCPNY - Get Rating), and Electromed Inc. (ELMD - Get Rating) which have an overall A (Strong Buy) rating.

Want More Great Investing Ideas?

WRBY shares rose $0.25 (+1.50%) in premarket trading Thursday. Year-to-date, WRBY has declined -63.70%, versus a -13.42% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| WRBY | Get Rating | Get Rating | Get Rating |

| FONR | Get Rating | Get Rating | Get Rating |

| OCPNY | Get Rating | Get Rating | Get Rating |

| ELMD | Get Rating | Get Rating | Get Rating |