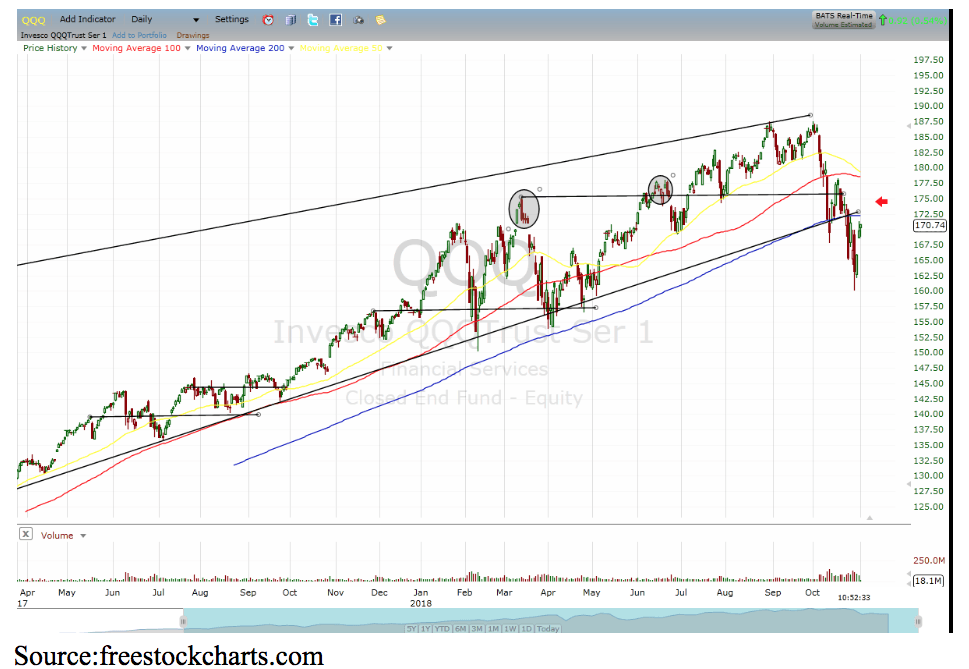

Things look even worse as we zoom out of the monthly chart, which now has a bearish candle breaking a multi-year trendline.

So, don’t let the recent action fool you into thinking the worst is over. Remember, the biggest stock market rallies come in bear markets. You don’t get 7% snap back rallies during up-trending bull markets.

It takes high volatility to spark something like that, and it only happens when risk is extremely elevated. The current rally is not characteristic of the type of environment where stocks are going up

Note, the top 10 largest up days over the past 30 years took place in 1987, 2002, 2008 & 2009. Those were all in the teeth of major bear markets.

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!