The stock market has entered a higher volatility environment; what does that really mean, and how can you profit and protect your portfolio?

What sometimes gets lost in the broad discussion of VIX, and general market volatility levels, is the specifics of how implied volatility gets factored into individual option prices and impacts position profitability.

Implied volatility is one of the most important concepts when trading options. In this article, we’ll try to understand a little bit more why it is important and how to use it when trading to increase our profits. With volatility on the rise, this a good time to review some basic concepts surrounding it, both real and implied.

IV is the Answer

What do former NBA star Allen Iverson and implied volatility have in common?

They have both been labeled “The Answer.” While Iverson has been more of a question lately (on how he spent his $100 million+?)

Implied volatility remains the key to answering the number one question on an options trader’s mind:

Is this option “cheap,” or “expensive”?

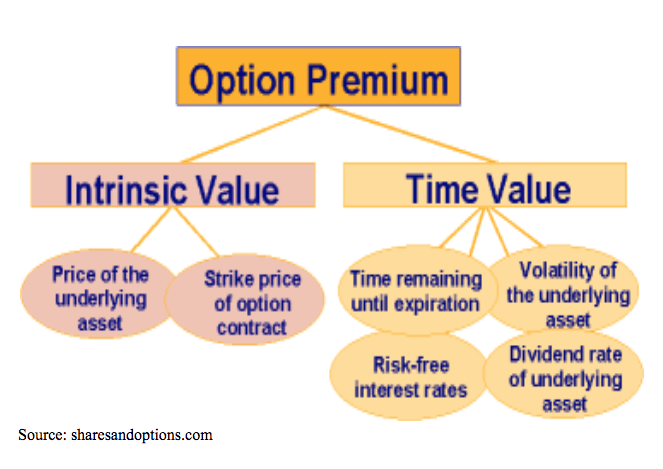

Implied volatility is a “plug number” (a placeholder number used to make a calculation estimate correct) — used to make the result from the commonly-used apparatus for valuing options, the Black-Scholes model. It considers 5 factors in calculating a particular option’s theoretical fair value:

1. The price of the underlying security

2. The strike price

3. The time, or expiration date of the option

4. Interest rates * this is becoming increasingly important in the rising rate environment and with upcoming FOMC meetings.

5. Implied volatility

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!