B&G Foods, Inc. B&G Foods, Inc. (BGS): Price and Financial Metrics

BGS Price/Volume Stats

| Current price | $8.53 | 52-week high | $15.15 |

| Prev. close | $8.35 | 52-week low | $7.20 |

| Day low | $8.32 | Volume | 820,100 |

| Day high | $8.55 | Avg. volume | 1,081,499 |

| 50-day MA | $8.67 | Dividend yield | 9.29% |

| 200-day MA | $9.73 | Market Cap | 674.31M |

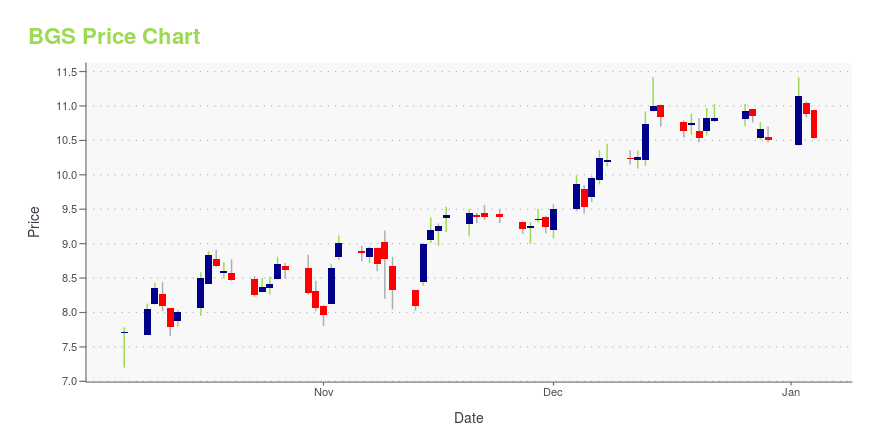

BGS Stock Price Chart Interactive Chart >

B&G Foods, Inc. B&G Foods, Inc. (BGS) Company Bio

B&G Foods manufactures, sells, and distributes shelf-stable food and household products in the United States, Canada, and Puerto Rico. The company was founded in 1996 and is based in Parsippany, New Jersey.

Latest BGS News From Around the Web

Below are the latest news stories about B&G FOODS INC that investors may wish to consider to help them evaluate BGS as an investment opportunity.

7 Dividend Stocks I Wouldn’t Touch With a 10-Foot PoleAvoid these seven dividend stocks to sell at all costs, as their payouts may not be a sustainable as they seem. |

B&G Foods (NYSE:BGS) Will Pay A Dividend Of $0.19B&G Foods, Inc. ( NYSE:BGS ) will pay a dividend of $0.19 on the 30th of January. This means the annual payment is 7.4... |

Effective Pricing Actions Aid B&G Foods (BGS) Amid High CostsB&G Foods (BGS) is reaping benefits from continued margin recovery on the back of pricing actions undertaken to counter inflationary costs through pricing and productivity efforts. |

Why Is B&G Foods (BGS) Up 16.9% Since Last Earnings Report?B&G Foods (BGS) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

Here's What To Make Of B&G Foods' (NYSE:BGS) Decelerating Rates Of ReturnWhat trends should we look for it we want to identify stocks that can multiply in value over the long term? One common... |

BGS Price Returns

| 1-mo | 6.49% |

| 3-mo | -21.05% |

| 6-mo | -14.84% |

| 1-year | -28.65% |

| 3-year | -64.28% |

| 5-year | -32.59% |

| YTD | -15.41% |

| 2023 | 0.33% |

| 2022 | -60.70% |

| 2021 | 17.69% |

| 2020 | 67.73% |

| 2019 | -31.93% |

BGS Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BGS

Want to do more research on B&G Foods Inc's stock and its price? Try the links below:B&G Foods Inc (BGS) Stock Price | Nasdaq

B&G Foods Inc (BGS) Stock Quote, History and News - Yahoo Finance

B&G Foods Inc (BGS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...