CapStar Financial Holdings, Inc. (CSTR): Price and Financial Metrics

CSTR Price/Volume Stats

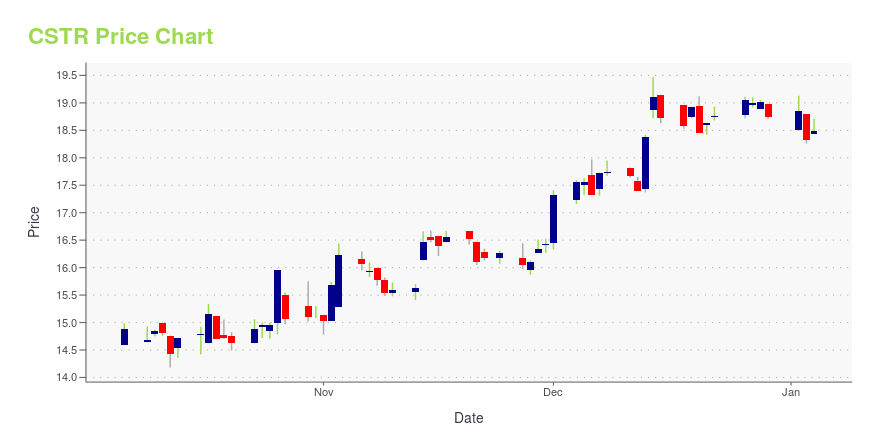

| Current price | $20.00 | 52-week high | $20.20 |

| Prev. close | $20.10 | 52-week low | $11.22 |

| Day low | $20.00 | Volume | 100 |

| Day high | $20.00 | Avg. volume | 100,585 |

| 50-day MA | $18.69 | Dividend yield | 2.19% |

| 200-day MA | $16.03 | Market Cap | 416.28M |

CSTR Stock Price Chart Interactive Chart >

CapStar Financial Holdings, Inc. (CSTR) Company Bio

Capstar Financial Holdings, Inc. operates as a holding company for CapStar Bank which offers commercial banking products and services in Tennessee. The company was founded in 2015 and is based in Nashville, Tennessee.

Latest CSTR News From Around the Web

Below are the latest news stories about CAPSTAR FINANCIAL HOLDINGS INC that investors may wish to consider to help them evaluate CSTR as an investment opportunity.

Seacoast Banking (SBCF) Moves 5.1% Higher: Will This Strength Last?Seacoast Banking (SBCF) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might help the stock continue moving higher in the near term. |

Strength Seen in Capstar Financial (CSTR): Can Its 5.4% Jump Turn into More Strength?Capstar Financial (CSTR) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions may not translate into further price increase in the near term. |

Old National to buy CapStar in $344M dealThe deal would boost the Evansville, Indiana-based lender’s assets by $3.3 billion and help it expand in Nashville, Tennessee, and three other high-growth metro areas, the companies said. |

Capstar Financial (CSTR) Q3 Earnings: How Key Metrics Compare to Wall Street EstimatesWhile the top- and bottom-line numbers for Capstar Financial (CSTR) give a sense of how the business performed in the quarter ended September 2023, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values. |

Capstar Financial (CSTR) Q3 Earnings Surpass EstimatesCapstar Financial (CSTR) delivered earnings and revenue surprises of 19.44% and 8.34%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

CSTR Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | 6.21% |

| 1-year | 37.85% |

| 3-year | 0.93% |

| 5-year | 37.99% |

| YTD | 7.40% |

| 2023 | 9.22% |

| 2022 | -14.48% |

| 2021 | 44.27% |

| 2020 | -9.86% |

| 2019 | 14.40% |

CSTR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CSTR

Want to do more research on CapStar Financial Holdings Inc's stock and its price? Try the links below:CapStar Financial Holdings Inc (CSTR) Stock Price | Nasdaq

CapStar Financial Holdings Inc (CSTR) Stock Quote, History and News - Yahoo Finance

CapStar Financial Holdings Inc (CSTR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...