Energizer Holdings, Inc. (ENR): Price and Financial Metrics

ENR Price/Volume Stats

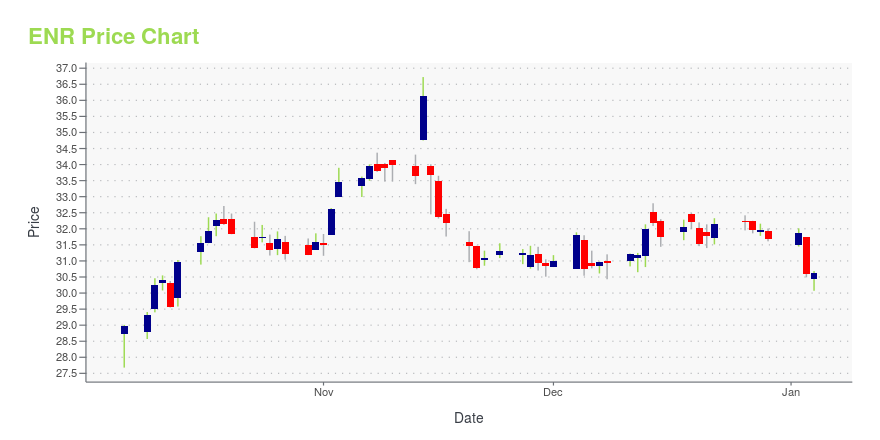

| Current price | $31.07 | 52-week high | $37.32 |

| Prev. close | $30.77 | 52-week low | $26.92 |

| Day low | $30.95 | Volume | 347,384 |

| Day high | $31.29 | Avg. volume | 513,144 |

| 50-day MA | $29.45 | Dividend yield | 3.94% |

| 200-day MA | $30.25 | Market Cap | 2.23B |

ENR Stock Price Chart Interactive Chart >

Energizer Holdings, Inc. (ENR) Company Bio

Energizer Holdings, Inc. manufactures, markets, and distributes household batteries, specialty batteries, and lighting products worldwide. The company was founded in 1896 and is based in St. Louis, Missouri.

Latest ENR News From Around the Web

Below are the latest news stories about ENERGIZER HOLDINGS INC that investors may wish to consider to help them evaluate ENR as an investment opportunity.

New Strong Sell Stocks for December 19thARI, ENR and MRTN have been added to the Zacks Rank #5 (Strong Sell) List on December 19, 2023. |

Is Now The Time To Look At Buying Energizer Holdings, Inc. (NYSE:ENR)?Energizer Holdings, Inc. ( NYSE:ENR ), might not be a large cap stock, but it saw a decent share price growth in the... |

Why Is Energizer (ENR) Down 5% Since Last Earnings Report?Energizer (ENR) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

Should Income Investors Look At Energizer Holdings, Inc. (NYSE:ENR) Before Its Ex-Dividend?Energizer Holdings, Inc. ( NYSE:ENR ) stock is about to trade ex-dividend in 3 days. Typically, the ex-dividend date is... |

Dow Set To Turn In 4th Consecutive WinStocks are looking to extend yesterday's strong rally, with more upbeat inflation data fueling investors' optimism. |

ENR Price Returns

| 1-mo | 4.72% |

| 3-mo | 10.06% |

| 6-mo | -3.41% |

| 1-year | -8.17% |

| 3-year | -17.16% |

| 5-year | -9.74% |

| YTD | 0.04% |

| 2023 | -2.18% |

| 2022 | -13.19% |

| 2021 | -2.21% |

| 2020 | -13.75% |

| 2019 | 14.30% |

ENR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ENR

Want to do more research on Energizer Holdings Inc's stock and its price? Try the links below:Energizer Holdings Inc (ENR) Stock Price | Nasdaq

Energizer Holdings Inc (ENR) Stock Quote, History and News - Yahoo Finance

Energizer Holdings Inc (ENR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...