New Mountain Finance Corporation (NMFC): Price and Financial Metrics

NMFC Price/Volume Stats

| Current price | $12.45 | 52-week high | $13.23 |

| Prev. close | $12.40 | 52-week low | $12.12 |

| Day low | $12.38 | Volume | 290,643 |

| Day high | $12.45 | Avg. volume | 411,420 |

| 50-day MA | $12.42 | Dividend yield | 10.33% |

| 200-day MA | $12.64 | Market Cap | 1.34B |

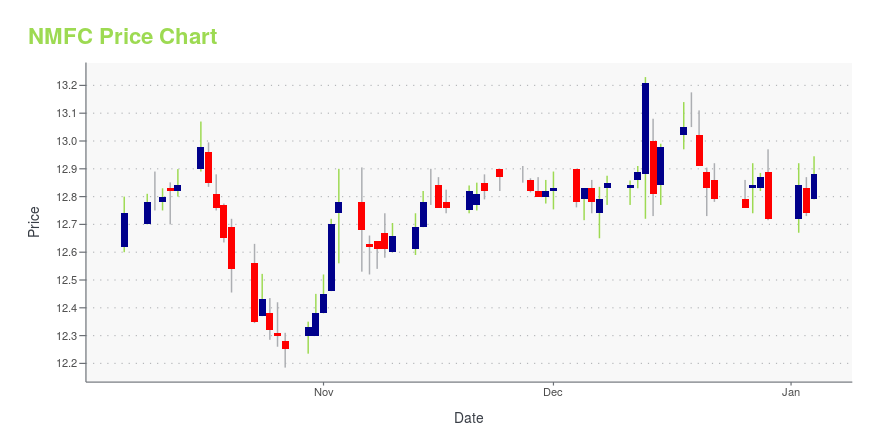

NMFC Stock Price Chart Interactive Chart >

New Mountain Finance Corporation (NMFC) Company Bio

New Mountain Finance Corporation is a is a closed-end, non-diversified management investment firm. The Company's investment objective is to generate current income and capital appreciation through investments in debt securities. The company was founded in 2008 is based in New York, New York.

Latest NMFC News From Around the Web

Below are the latest news stories about NEW MOUNTAIN FINANCE CORP that investors may wish to consider to help them evaluate NMFC as an investment opportunity.

New Mountain Finance Corporation Declares a Special Distribution and Announces the Extension of its Stock Repurchase ProgramNEW YORK, December 13, 2023--New Mountain Finance Corporation (NASDAQ: NMFC) ("NMFC" or "the Company") today announced that on December 8, 2023, its board of directors declared a special distribution of the Company’s excess undistributed taxable income. The special distribution will be in the amount of $0.10 per share payable on December 29, 2023 to shareholders of record as of December 22, 2023. The special distribution is driven primarily from the gain realized on our investment in Haven Midst |

New Mountain Finance Corporation Appoints Kris Corbett as Chief Financial OfficerNEW YORK, November 22, 2023--New Mountain Finance Corporation (NASDAQ: NMFC) ("New Mountain"), the publicly traded credit BDC arm of New Mountain Capital, today announced the appointment of Kris Corbett as Chief Financial Officer, effective November 27, 2023. |

New Mountain Finance Corporation Prices Public Offering of $115.0 Million 8.250% Notes Due 2028NEW YORK, November 06, 2023--New Mountain Finance Corporation (the "Company," "we," "us" or "our") (Nasdaq: NMFC) today announced that it has priced an underwritten public offering of $115.0 million in aggregate principal amount of 8.250% unsecured notes due 2028 (the "Notes"). |

New Mountain Finance Corporation (NASDAQ:NMFC) Q3 2023 Earnings Call TranscriptNew Mountain Finance Corporation (NASDAQ:NMFC) Q3 2023 Earnings Call Transcript November 3, 2023 Operator: Good morning, everyone, and welcome to the New Mountain Finance Corporation’s Third Quarter 2023 Earnings Conference Call. All participants will be in listen-only mode. [Operator Instructions] After today’s presentation, there will be an opportunity to ask questions. Please note this event […] |

Q3 2023 New Mountain Finance Corp Earnings CallQ3 2023 New Mountain Finance Corp Earnings Call |

NMFC Price Returns

| 1-mo | 2.55% |

| 3-mo | 0.60% |

| 6-mo | 0.88% |

| 1-year | 9.54% |

| 3-year | 27.00% |

| 5-year | 52.37% |

| YTD | 3.50% |

| 2023 | 15.83% |

| 2022 | -0.55% |

| 2021 | 31.94% |

| 2020 | -7.13% |

| 2019 | 20.64% |

NMFC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NMFC

Want to see what other sources are saying about New Mountain Finance Corp's financials and stock price? Try the links below:New Mountain Finance Corp (NMFC) Stock Price | Nasdaq

New Mountain Finance Corp (NMFC) Stock Quote, History and News - Yahoo Finance

New Mountain Finance Corp (NMFC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...