Marathon Oil Corporation (MRO): Price and Financial Metrics

MRO Price/Volume Stats

| Current price | $27.77 | 52-week high | $30.06 |

| Prev. close | $27.74 | 52-week low | $21.63 |

| Day low | $27.51 | Volume | 5,859,626 |

| Day high | $27.94 | Avg. volume | 9,687,663 |

| 50-day MA | $26.62 | Dividend yield | 1.58% |

| 200-day MA | $25.65 | Market Cap | 15.87B |

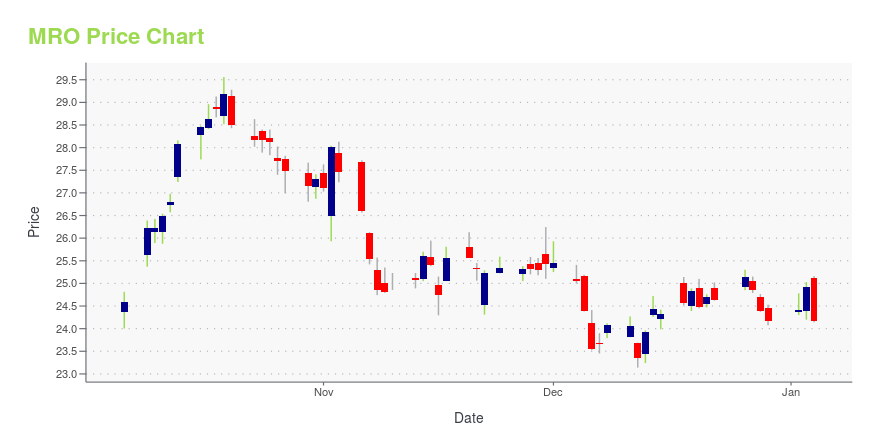

MRO Stock Price Chart Interactive Chart >

Marathon Oil Corporation (MRO) Company Bio

Marathon Oil Corp is an exploration and production company. It focuses on producing crude oil and condensate, natural gas liquids and natural gas as well as bitumen from oil sands deposits. In 2011, Marathon Oil spun off from Marathon Petroleum Corporation becoming an independent exploration and production company. The company has operations in four of the oil rich basins in the United States – the Eagle Ford Basin, the Bakken Basin, the STACK/SCOOP basin, and the Permian Basin. Marathon Oil employs just under 1,700 individuals and is headquartered in Houston, Texas. Lee Tillman serves as President and Chief Executive Officer.

Latest MRO News From Around the Web

Below are the latest news stories about MARATHON OIL CORP that investors may wish to consider to help them evaluate MRO as an investment opportunity.

In 2024 The US Will Sell CITGO Petroleum And Pay Out Two Canadian JuniorsVenezuela owns Citgo Petroleum. This is a big company – the 7th largest refiner in North America. By July, a US court may make Venezuela liquidate to pay its debts, and some miners may get unexpected windfalls. |

Marathon Oil (NYSE:MRO) Shareholders Will Want The ROCE Trajectory To ContinueTo find a multi-bagger stock, what are the underlying trends we should look for in a business? One common approach is... |

12 Best Energy Dividend Stocks To Buy NowIn this article, we discuss 12 best energy dividend stocks to buy now. You can skip our detailed analysis of the energy sector and the performance of dividend stocks over the years, and go directly to read 5 Best Energy Dividend Stocks To Buy Now. As 2023 draws to a close, experts are evaluating how […] |

Marathon Oil (MRO) Down 9.2% Since Last Earnings Report: Can It Rebound?Marathon Oil (MRO) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

Do Options Traders Know Something About Marathon Oil (MRO) Stock We Don't?Investors need to pay close attention to Marathon Oil (MRO) stock based on the movements in the options market lately. |

MRO Price Returns

| 1-mo | 0.22% |

| 3-mo | 20.21% |

| 6-mo | 1.98% |

| 1-year | 20.34% |

| 3-year | 162.99% |

| 5-year | 71.29% |

| YTD | 15.49% |

| 2023 | -9.29% |

| 2022 | 66.91% |

| 2021 | 149.77% |

| 2020 | -50.38% |

| 2019 | -3.93% |

MRO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MRO

Want to do more research on Marathon Oil Corp's stock and its price? Try the links below:Marathon Oil Corp (MRO) Stock Price | Nasdaq

Marathon Oil Corp (MRO) Stock Quote, History and News - Yahoo Finance

Marathon Oil Corp (MRO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...