I think we can all agree that December was a harrowing month for stocks. On December 24th the S&P 500 (SPY) not only closed 19.8% below its all-time high but was experiencing its 11th worst month in market history. And while US stocks didn’t officially enter a bear market, 66% of the S&P 500 companies did, including Apple (AAPL) which recently suffered a 40% meltdown thanks in part to a surprise guidance cut (its first in 15 years).

But as gutwrenching as that volatility was, it was mostly based on market fears about the trade war and the Fed’s interest rate policy. Now we’re about to enter earnings season when stock volatility naturally spikes and investor discipline is tested to its limits. So here’s what you need to know about one of the most critical earnings seasons in years, what it might mean for your portfolio, and most importantly how you can profit from short-term market chaos.

What to Expect From the 2019 Earnings Season

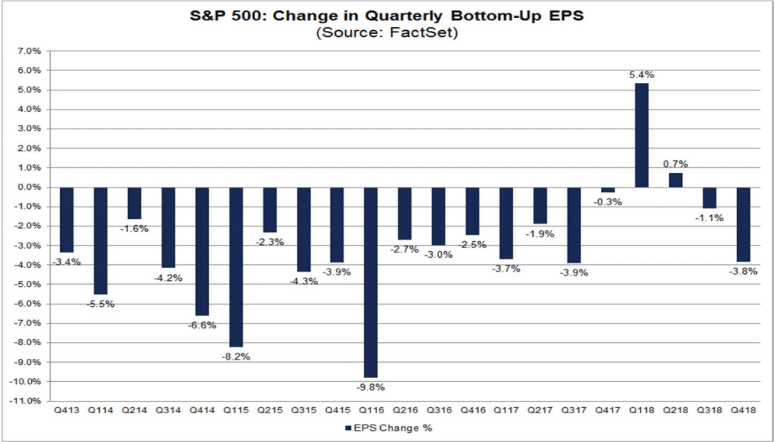

The good news is that Q4’s earnings will be the last one in which tax reform is going to boost earnings. Currently, analysts are expecting 11.4% EPS growth from the S&P 500 for this quarter, which is down 3.8% from the start of Q4. But while a 25% earnings projection decline might sound shocking it’s actually quite normal.

In fact, over the past five years, analysts have averaged 4.8% EPS growth forecast cuts over the course of each quarter. This is a time-honored Wall Street tradition. Analysts steadily lower expectations so that the companies they cover can then beat those expectations.

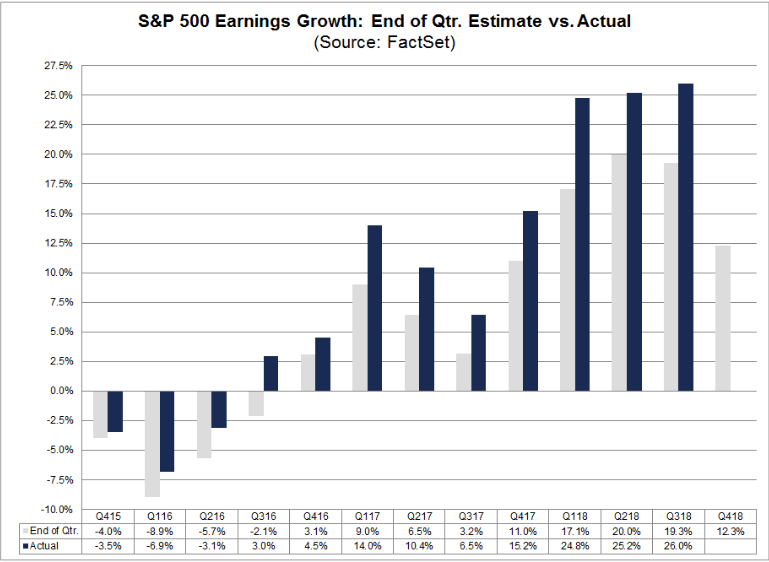

For example, over the past five years on average 71% of companies beat earnings expectations. That means that if historical trends hold we might see 15% or even 16% EPS growth this quarter, which could further fuel the recent sharp, V-shaped recovery off Dec 24th’s lows.

In fact, thus far earnings have been good. While just 4% of companies have reported thus far (20 companies), 67% have beaten on revenue and 89% on earnings. This shows that the bar has now been lowered so far that stocks might be in for a surprisingly good next few months. That’s especially true given that the S&P 500’s forward PE is 14.2, far below its 20-year average of 16.0.

On the other hand, any company that misses these much smaller EPS growth forecasts could be hammered. And of course, the results will matter far less to forward-looking Wall Street than the guidance for 2019 that companies put out. So let’s take a look at what the market is likely to care about most this earnings season.

What Wall Street Will Be Watching And What It Means for Your Portfolio

Apple’s bombshell guidance cut shocked not just Wall Street, but even many economists. That’s because it was seen by many as the clearest sign that the US/China trade war is having not just negative effects on China’s economic growth, but potentially is causing that country’s growth to slow at an alarming rate.

Based on Tim Cook’s letter to investors, it now appears as if Apple’s China sales (20% of total revenue) might be set to decline by about 50%. While it’s impossible to say how much of that is purely macroeconomic (China’s GDP growth is the second slowest in 25 years and its manufacturing sector is contracting) and how much due to a nationalistic backlash against US smartphones (Huawei’s CFO was arrested in December per US request), it certainly doesn’t look good for corporate America’s overseas revenues and earnings.

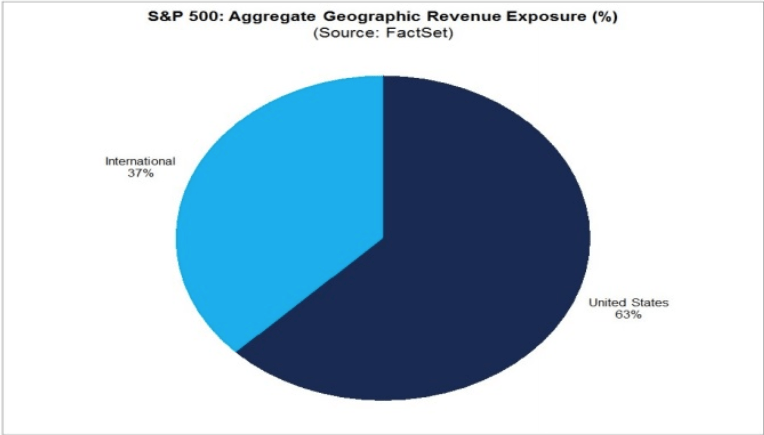

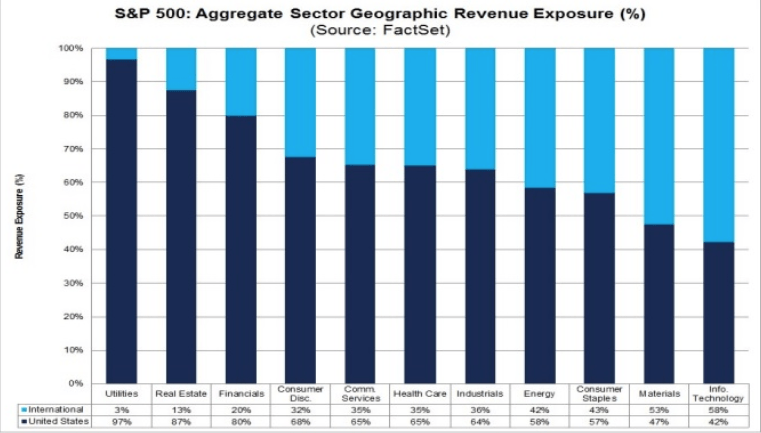

Since 47% of all S&P 500 sales are from overseas, this means that weaker China growth could spill over into emerging market economies like Brazil and India. Many emerging market economies are heavily dependent on exports of commodities of which China has historically been the biggest buyer. And given that tech, basic materials, energy, and consumer staples are the most exposed to foreign sales (and thus the trade war) these sectors, in particular, might be vulnerable to negative guidance cuts in the coming months.

My recommendation is to have your watchlists ready so you know what quality stocks to buy should the market overreact to bad news (or guidance that’s perceived as catastrophic when its really not). In fact, my new Deep Value Dividend Growth Portfolio, which so far is beating the market by 8.3%, is composed entirely of low-risk dividend growth stocks that are trading at such bargain levels they are likely to deliver at least 13% long-term returns.

Rest assured that I stand ready to pounce on any short-term freakouts with opportunistic buying should the market’s infinite short-term stupidity give me a great entry point. But it’s not just trade and tariffs that Wall Street will be focusing on like a laser.

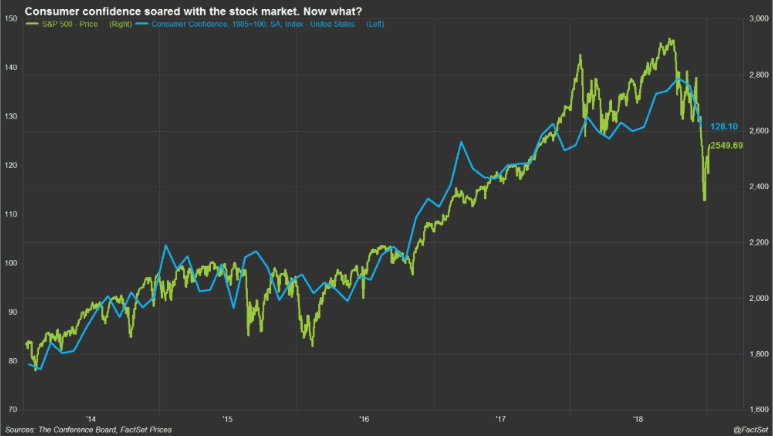

The US economy as well is showing signs of weakening at a rate that some find alarming. That’s partially because consumer confidence, which is a soft leading indicator of future consumer spending (drives 65% of our economy) has been falling for several months now. Note that this is off the highest levels in 20 years and remains very strong.

Now part of that decline might have been due to the most severe correction in a decade, but probably not all of it. That’s because 46% of Americans have zero exposure to stocks, even in retirement accounts. Rather it’s likely that all the fear the media has been hyping about the Fed, trade war, and possibly the government shutdown itself (now in its 17th day) might be causing fear that the red hot job market might cool.

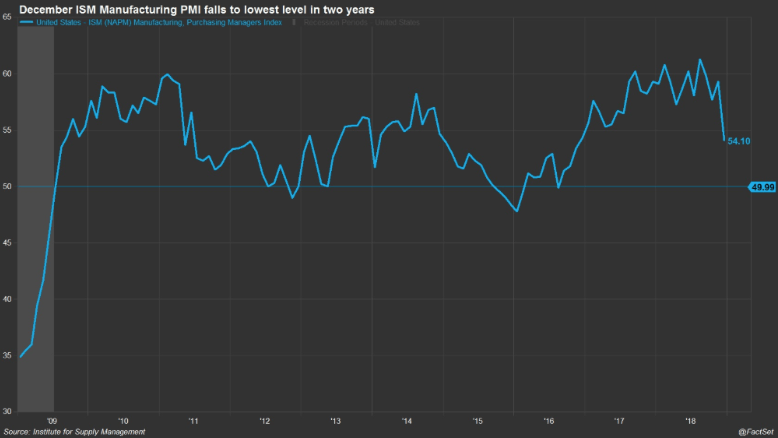

We’ve already seen some evidence of that, including the latest ISM manufacturing report which showed the fastest one month decline since October 2008. Now mind you a reading of 54 is still indicative of about 3.4% economic growth (50 is neutral so anything above points to growth). However, the survey’s new order indicator came in at just 51, barely above recessionary levels. The reason cited by managers for the fall in new orders was trade uncertainty messing up supply chains as well as lower demand from overseas.

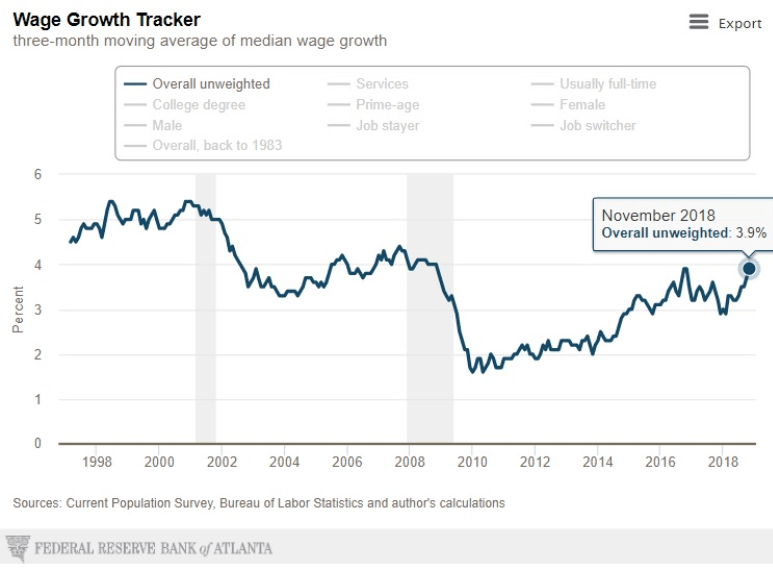

Now the good news is that so far the US job market appears unaffected by the economic slowdown. The latest jobs report showed 312,000 net jobs created in December, revised up the previous two months by 58,000, and average wage growth of 3.2% YOY for all workers and 3.3% for non-supervisors (80% of the labor force). That’s the fastest wage growth in 10 years. What’s more is that average figure is being dragged down by 10,000 baby boomers (who are at peak earnings) retiring and being replaced by younger workers who make less.

When you look at median wages (which are unaffected by retiring boomers) the wage growth picture looks even better. According to the Atlanta Federal Reserve from June to November rolling 3-month median wage growth rose from 3.2% to 3.9%.

With 3.3% average wage growth for non-supervisors (which is mostly what median wage growth ultimately tracks) we’re likely to see this figure rise by 0.1% to 0.2% in December to 4% or 4.1%. That would also be the highest level in a decade. And since inflation is currently running around 2% and falling (thanks to oil prices crashing 45% in two months recently) US workers are currently experiencing a golden age of real purchasing power growth. Or at the very least, the best real wage growth in a decade.

This is likely why Mastercard just reported that US holiday retail sales rose 5.1% YOY, the strongest growth rate in six years. If the trade war ends soon then it’s likely that continued strong job creation and rising wages (which Fed Chair Jerome Powell just said he’s NOT worried about) might continue to drive strong consumer spending. This is what’s needed in order to avoid a recession starting in mid-2020 and a bear market likely commencing in early 2020.

Bottom Line: Stocks Might Become Even More Volatile During This Earnings Season So Get Ready

While earnings season is naturally a volatile time, this one, in particular, is going to be extra important. Not just are analysts expecting much slower earnings growth than we’ve seen in the first three quarters of the year, but thanks to Apple ripping off the bandaid about the trade war’s effects in China, we might get a lot more warnings from corporate America about slower bottom line growth in 2019. On the other hand with earnings expectations now so low, it’s possible that enough companies will beat earnings to keep the recent rally going and possibly end the most severe correction in a decade within the next few months.

But any company that dares miss much lower expectations could be hammered hard and see its shares plunge. This means that volatility for some trade sensitive stocks (energy, tech, basic materials, consumer staples) might be especially high, so investors need to be ready for it. Not just to remain calm in the face of potentially shocking one-day declines (10% or more are possible) but more importantly to profit from short-term stock market turmoil. Because at the end of the day anyone quarter’s earnings don’t actually matter much to long-term investors, and harnessing volatility is one of the three easiest ways to get rich on Wall Street.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!