As December’s market crash, about a 20% decline in the S&P 500, Dow Jones Industrial Average and Nasdaq in just three weeks, illustrates, the stock market can be a scary and volatile place.

And with the risks of a recession in 2020 now significantly higher, it’s tempting to just sell everything after the best first-quarter rally in 10 years, and sit in cash or some other risk-free asset (like bonds).

That’s precisely what my father inquired about when I helped him to rebalance his dangerous portfolio two weeks ago. He has a rather unique situation that caused him to be 100% in stocks, including some high-risk ones that might get decimated during a recession and bear market.

So I helped him to shift is asset allocation into a more defensive one that’s a better fit for his risk-profile and retirement time horizon (14 years from now), which included significant holdings in the Vanguard Long-Term Treasury ETF (VGLT). After I walked him through a basic explanation of good risk management and asset allocation for his particular situation he asked me why my own retirement portfolio (where I keep 100% of my life savings and net worth) was still 92% stocks.

He knew that I had spent the last few months recession-proofing my life savings and asked me “why not just sell it all and go 100% into long bonds since those are going to rise so much in a recession.” So here’s what I told my father, which is applicable to almost all investors, about why selling all your stocks before a recession is generally a terrible idea.

Avoid the Sirens Song of Market Timing…

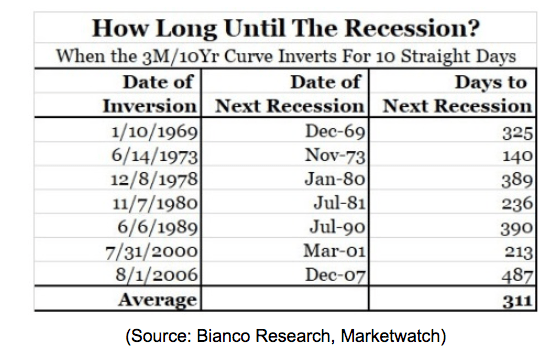

The reason my father thought it might be a good idea for me to go 100% into bonds was this table.

Now this table takes some explaining because if you don’t know how statistics or probabilities work then it can send you into a panic (as the media often likes to do). The 10y-3m yield curve (10-year Treasury yield minus 3-month treasury yield) is the most accurate recession predictor in history according to studies by both the San Francisco and Cleveland Federal reserves.

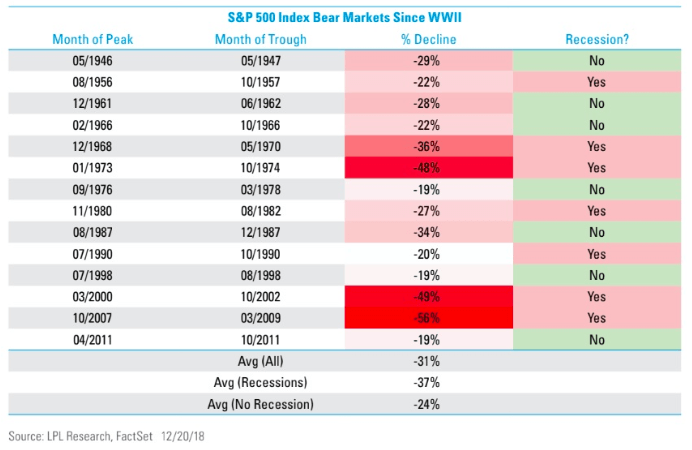

And since 1946 there has never been a recession without a bear market also occurring (on average 37% decline in S&P 500 from the all-time high). However, just because 10 straight days of an inverted yield curve (it went positive on day six most recently, resetting the confirmation clock) has always been followed by a bear market within 16 months doesn’t mean that the yield curve is a crystal ball.

Seven data points aren’t statistically significant so the most we can say about an inverted yield curve for 10 consecutive days (hasn’t happened yet) is that it represents a higher risk environment. One in which it’s appropriate for reassessing your portfolio’s asset allocation and stock positions to make sure you aren’t taking more risks than you’re comfortable with should stocks start falling hard and fast.

In the case of my father, he was in a very high-risk strategy that could have been disastrous for his long-term retirement goals if stocks started sliding now. That’s why I recommended he get more defensive.

I had previously made the mistake of using margin on higher risk positions as well, which I eliminated as soon as the curve inverted on March 22nd. I’d rather be too early than too late when it comes to recession-proofing my retirement portfolio and ensuring that 100% of my stock portfolio was in blue-chip dividend stocks whose dividend will likely be safe in a recession.

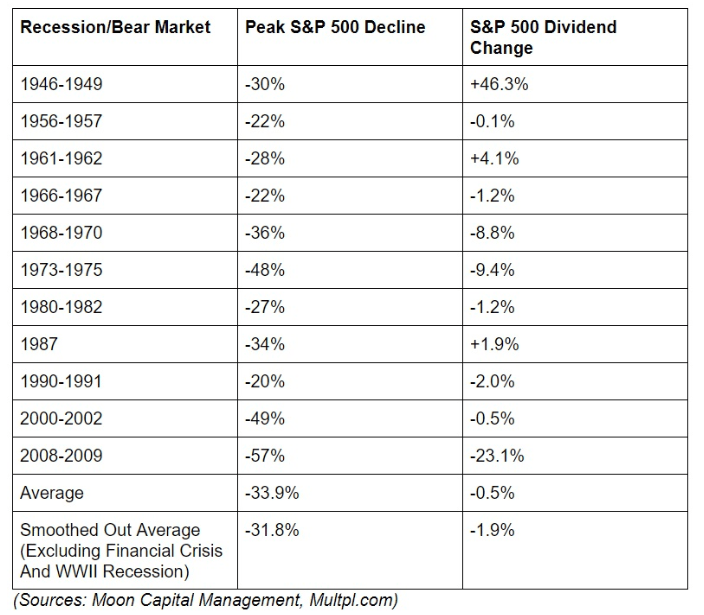

Why only blue-chips? Well, for one thing, blue-chip dividends (an 8 or higher on my proprietary 11 point quality score) tend not to cut dividends even during recessions.

And my portfolio is also chock full of dividend aristocrats and kings, stocks with 25+ and 50+ consecutive years of annual dividend growth which shows the resilience of their payouts even in a severe economic downturn.

My portfolios goal is entirely focused on maximizing safe income over time, which is why my portfolio now has a yield on cost of 5% and 12% 5-year average dividend growth.

While I certainly hope to beat the market over time, I’m not counting on red hot growth stocks to do it, but rather using opportunistic buying (“greedy when others are fearful” on “fat pitches” as Buffett would say) to maximize yield on cost until eventually dividends alone will earn me market-beating returns.

Capital gains are a natural offshoot of buying quality companies at historical discounts to fair value. How do I know my approach works?

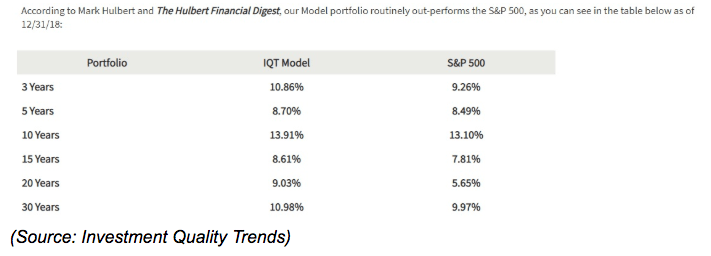

Because since 1966 blue-chip dividend stocks have been the only thing that asset manager/newsletter publisher investment quality trends has been using to beat the market and with 10% less volatility to boot. In fact, according to Hulbert Financial Digest, over the past 30 years, IQT has had the best risk-adjusted total returns of any investing newsletter in America.

All from only buying blue-chip dividend stocks (based on six quality criteria) when their yields are significantly above their historical norms (historically undervalued).

But IQT’s impressive results (which beat 95% of all mutual funds) are not the only reason 100% of my life savings is now in this low-risk strategy.

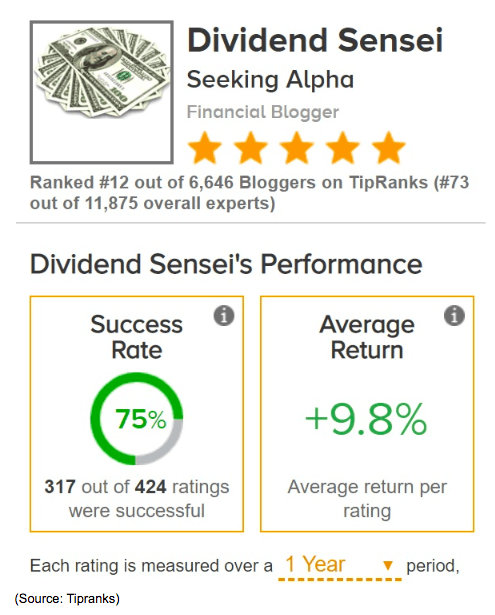

Since I’ve been focusing my article recommendations on low-risk blue-chips (all historically undervalued) my success rate (as tracked by Tipranks) has sky-rocketed to 75%. The greatest investors in history are right 60% to 80% of the time and thanks to my low-risk/high probability strategy I’ve now climbed into the top 1% of all analysts tracked by tipranks, 5,500 of which are professionals on Wall Street.

My own portfolio’s returns have also improved, and the individual trades I’ve made using this approach (tracked in a portfolio within my portfolio) have consistently been beating the market, even during the hottest quarter since 2009. And that’s using low-risk blue-chips like Walgreens (WBA), CVS (CVS), Tanger Factory Outlet Centers (SKT), and AbbVie (ABBV). In other words, out of favor companies that I managed to buy so inexpensively that even before these coiled springs took off I was still getting better returns than had I invested the money in the red hot S&P 500 (now historically fair value).

But that explains why I personally don’t try to time the market (other than in buying quality companies at ridiculously low prices). Here’s why it’s likely a mistake for you to do it.

…Because It’s Almost Impossible to Do Well

“I never buy at the bottom and I always sell too soon.” ~ Baron Nathan Rothschild

Nathan Rothschild, one of the greatest bankers in history’s famous quote is a good reminder that great investing returns are not about picking the exact top or bottom in any market, but in being generally correct (more often than not) and using good risk management combined with strategies that are proven successful over time (high probability investing).

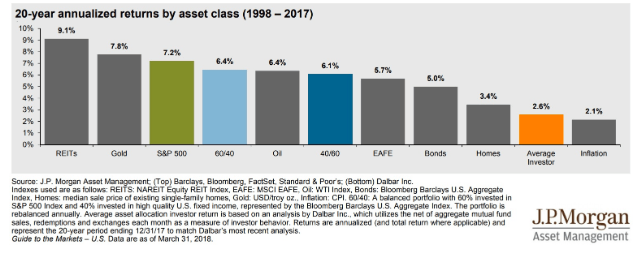

In contrast here’s how the typical invest has done over the past 20 years. Terrible market timing has caused the average retail investor to underperform every asset class. In fact, buying and holding a 100% bond portfolio would have been a better choice than the way most people market time the stock market.

But the allure of timing is strong because almost everyone thinks that they can become above average if they just find the right strategy.

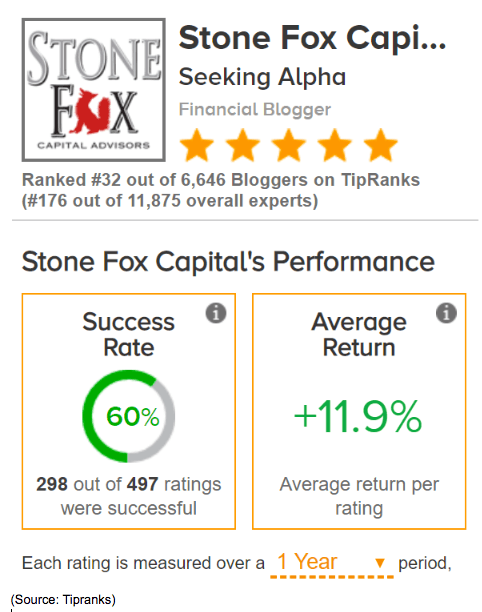

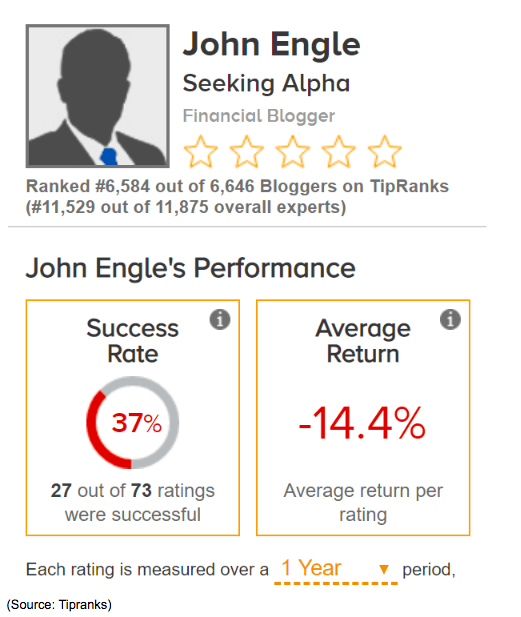

Here’s the track record of the second most popular long trader on Seeking Alpha. 60% is a decent success rating, and certainly better than Seeking Alpha’s top short seller author.

That’s because the stock market goes up 74% of the time and short selling requires you to not just be right on timing, but magnitude and direction as well.

But the point is that each of us has dedicated our lives to professional market analysis and spent thousands of hours honing our craft. I’ve been standing on the shoulders of giants like Buffett, Lynch, Graham, and Dodd.

These other analysts have been attempting to use various technical analysis approaches they are confident can help them jump in and out of stocks at a profit. It’s not easy to do, even for those who can dedicate their entire professional lives to it.

Why is that? Because of the very market volatility that investors hate so much.

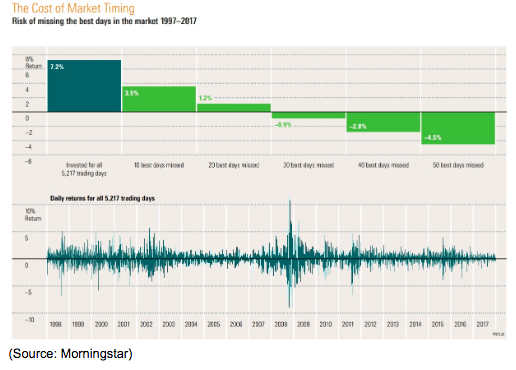

The majority of the market’s gains (actually pretty much all of them) come from just a handful of the best single-day gains (like the March 26th 5% rally, the biggest post-Christmas day gain in history). Those almost always occur within two weeks of the worst days, when volatility (and fear) are at its peak and valuations are their lowest.

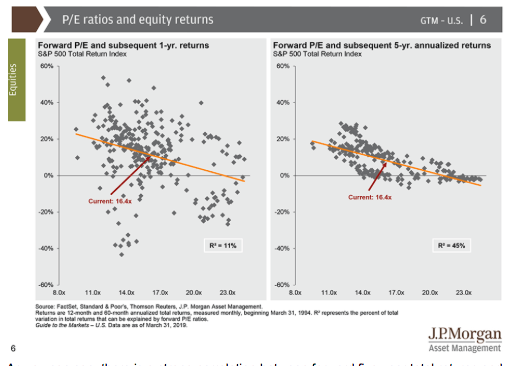

It’s no coincidence that Q1 2019 was the best first quarter in 10 years, because the December correction was the worst in 10 years, with the market bottoming on December 24th at a forward PE of 13.7. That’s below the 14.1 the market bottomed in 2002 after the 50% tech crash.

As you can see, there is a strong correlation between forward five year total returns and what valuation stocks are trading at now (on a forward PE basis).

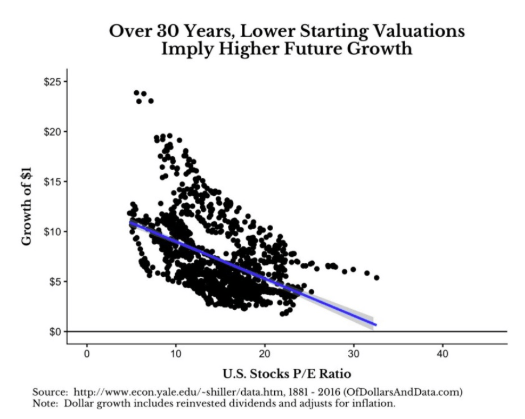

And according to a Yale study that analyzed almost 150 years of market data that link between returns and starting valuation extends out to 30 years.

Here’s the thing though. While everyone may say they want a bargain, stocks are a peculiar thing. When the market is actually on sale is exactly when investor fear is at its peak and few want to buy even quality companies (thus the reason stocks become historically undervalued).

The reason value investing works is because contrarians like myself have learned the discipline to trust in high probability investing which says that worst case scenarios are rare and that valuations will (barring a total economic collapse) eventually revert towards their historical means.

In other words as long as “this time isn’t different” and we make many diversified bets using good risk management (a diversified portfolio) then we’ll be right enough that any losers will be more than offset by winners. And since loser can only fall 100% (assuming you don’t sell when it’s obvious the thesis is broken) but winners can climb thousands of percent over time, great returns become easy for the patient and disciplined investor to achieve.

As Buffett famously said:

“We don’t have to be smarter than the rest, just more disciplined…the stock market is designed to transfer money from the active to the patient.”

Now I’m not an index investor but a stock picker. That’s because no matter how high the market climbs something great is always on sale. For example, right now healthcare blue-chips (like the ones I pointed out earlier) are in the toilet and trading at multi-year lows.

Just as REITs were left for dead in mid-2016 to mid-2018 but red hot now (I made 15% 35% annualized returns on my REIT investments from back then) it’s a high probability event that in a few years healthcare blue-chips will revert towards their historical valuations when the worst case scenarios currently baked into their prices don’t occur.

Do I know when that will be? No, I have no idea. All I know is market history and how to analyze companies and their valuations based on fundamentals like earnings, cash flow, and safe dividends.

But that’s enough to make a killing in the market by taking advantage of whatever blue-chip the market hates most at any given time (within a well-constructed risk management system tailored to my own needs).

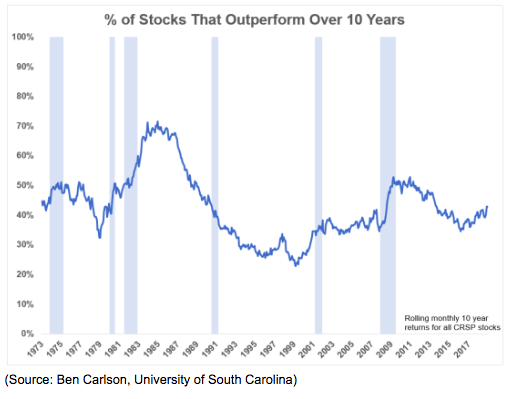

Why blue-chips only? Because according to JPMorgan Asset Management, since 1980 ⅔ of stocks have underperformed the market, and 40% have suffered permanent declines of 70% or more.

And since 1973 the median % of stocks that outperformed over a decade was 41%. In other words, stock picking is hard, even for the pros.

Blue-chips, while not certain to succeed, increase your odds of generating great returns if you own them in a diversified portfolio, and buy them opportunistically.

Bottom Line: Trust in the Most Time Tested Investing Strategies to Reach Your Financial Goals, Not the Alchemy of Market Timing

It can be VERY tempting to try to time the market and sell all your stocks in favor of some other asset that’s likely to appreciate in value during a bear market. And with so many purported great market timing schemes out there, which can seem plausible in theory, far too many investors make the costly mistake of market timing, to the detriment of their long-term returns.

The simple fact is that market timing, in order to pull off well, requires you to be a winner in a zero-sum game in which your profits come at the expense of others. Or to put another way, you have to outsmart other investors, including Wall Street pros who are paid millions and have dedicated their lives (and are backed by armies of quants and AI-driven algos) to not being the “sucker” in any trade.

Since gaining a short-term edge is all but impossible, the best investors can do is use long-term, high-probability strategies in concert with the right asset allocation strategy that works for your risk profile. That boring method may not be sexy, but decades of market studies and the personal experience of the greatest investors in history shows this is the best chance you have of achieving your financial goals.

I’m personally still deeply investing in stocks and have no plans to change that, no matter how high recession and bear market risk starts flashing. That’s because I try to live my life as much as possible driven by data and facts and both are very clear on this, time in the market is far more important (and effective) than timing the market.

That doesn’t necessarily mean blindly piling money into the entire market via an index fund, valuation be darned. My personal strategy is focused on 100% dividend growth blue-chips bought at incredible discounts to fair value. While such a portfolio of low-risk stocks will likely outperform the market during a crash, it’s not going to avoid short-term paper losses.

But remember that running your portfolio is like running a business. That means focusing not on the daily cacophony of wildly swinging share prices, but on the actual businesses, you own.

- Strong, recession resistant cash flow

- Good balance sheets

- Quality management teams you can trust with your hard earned money

- Safe and growing dividends, even during a recession and bear market

- Maximizing portfolio income (so you can eventually retire on dividends alone)

The beauty of the stock market is that it can be infinitely stupid in the short-term, with even top quality blue-chips plunging in value as the market grossly overreacts to one risk or another.

Those times can offer what Buffett likes to call “fat pitches” or very high probability opportunities to earn high-risk style returns with low-risk companies.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!