As the saying goes, the generals can lead the charge, but if none of soldiers follow, they will soon beat a hasty retreat.

This seems not only to be true of the overall U.S. market vis-a-vis the rest of world. But also within the U.S. market itself.

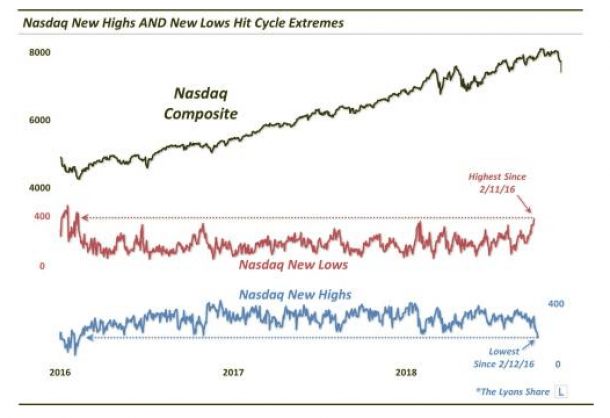

It had been large cap technology leading the indices higher. But, they had been going higher on narrow leadership. In fact, the bulk of stocks had already moved into down trends, and the number of issues hitting new 52 lows was the highest in nearly two years.

Source: jlfmi.tumblr.com/

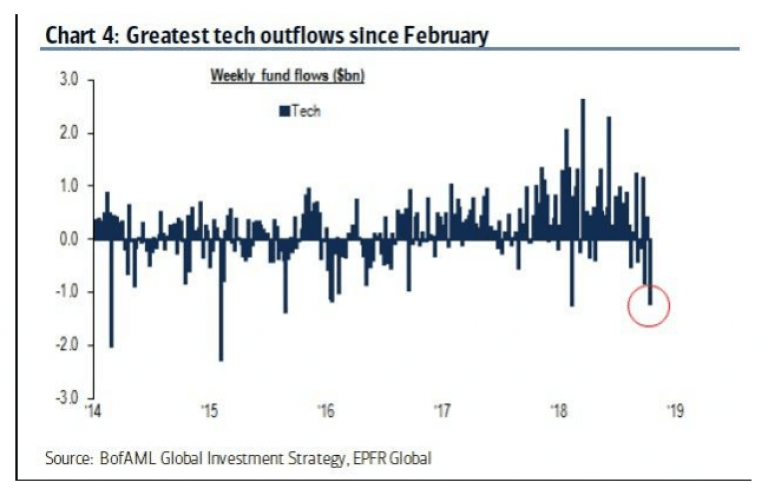

This loss of leadership has led to investor outflows with tech funds seeing their largest withdrawals of the year last week.

Source: BofAML Global Investment Strategy, EPFR Global

How Higher Rates Hurt

The near zero rate environment of the past 6 years had created the TINA (There Is No Alternate) helping fuel the bull market as investors were forced in stocks to seek yield.

But with 2-Year notes now yielding 2.5%, many wealth managers can now move client money into fixed income without feeling foolish — meaning they are selling stocks to make this reallocation happen.

A more detrimental aspect of rising rates is that companies with weaker balance sheets that were able to borrow (and basically stay in business) are starting to default on loans.

Last week, Bank OZK (formerly Bank of the Ozarks), blew up after reporting earnings that contained two shockingly large write-offs that were tied to commercial loans for construction projects – the kind of projects you see underway in cities and states all over America, such as skylines filled with cranes revitalizing downtowns, business districts, and millennial-friendly urban spaces everywhere.

George Gleason, the Chairman & CEO of Bank OZK, predicted that there will be more to come, and the stock immediately lost 25% of its market cap. This brings us to housing. You can see the U.S. Home Construction Index (ITB) — which had been underperforming for most of the year — went into an absolute free-fall late September. This happens to be when 10-year interest rates crossed above the psychological 3% level, and quickly rose to 3.25%.

Source: stockcharts.com

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!