And while it’s true that four or five more rate hikes would almost certainly invert the yield curve and start the recession clock ticking, there are also very good reasons that investors shouldn’t expect the Fed to hike nearly that much.

…And Why They Shouldn’t Be

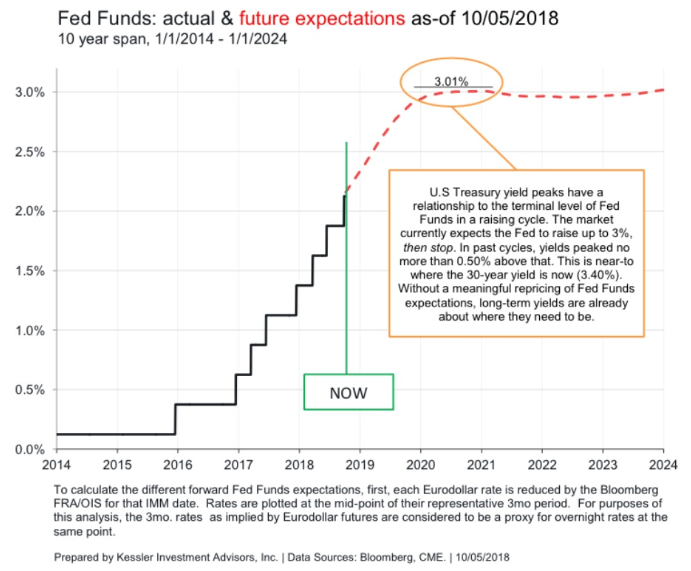

The bond futures market is currently pricing in just three more rate hikes and then expects the Fed to end its current rate hike cycle.

That’s because a Fed Funds Rate of 3.0% is the Fed’s best estimate of the “neutral rate,” or the rate at which point it is neither slowing or accelerating economic growth. An FFR of 3% coincides with three more rate hikes, not the five or six the dot plot is currently signaling.

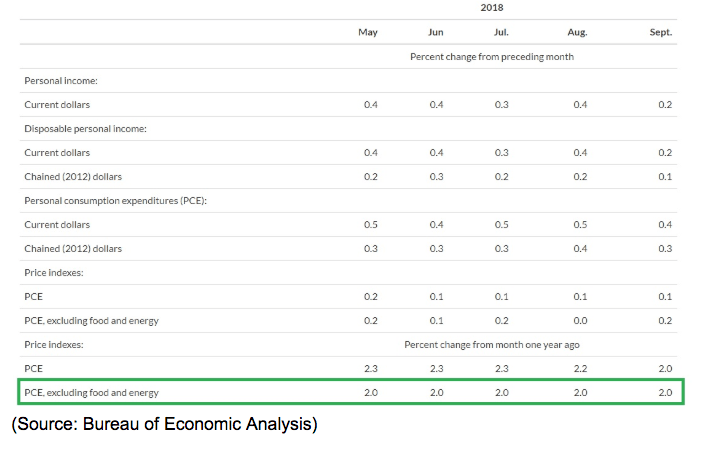

Why is the bond market expecting the Fed to end its rate hikes early? Well for three reasons. First, the Fed’s goal with rate hikes is purely to avoid allowing core inflation (which it officially measures by core PCE), to rise above its long-term target of 2.0%.

Core inflation has been stable at the Fed’s long-term target all year. The October core PCE is coming out on Thursday, November 30th.

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!