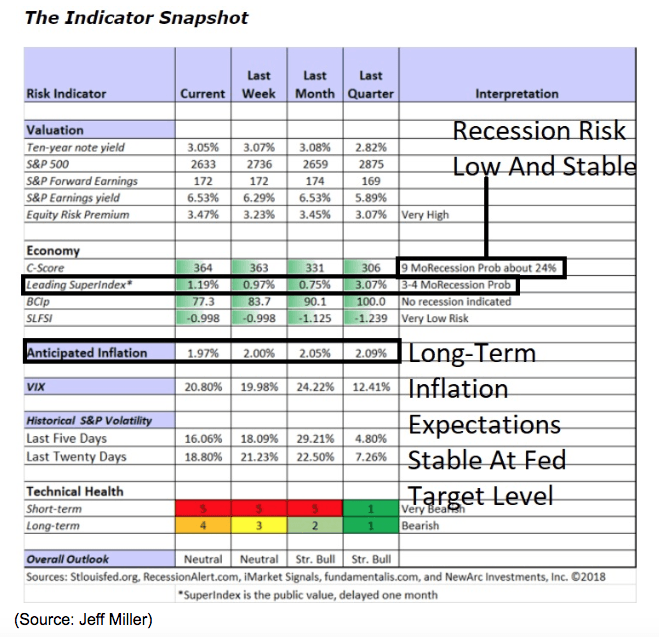

But won’t rising wages (from the tight job market) and tariffs cause inflation to increase in the future? Not according to the bond market’s long-term inflation expectations, which are currently running at just under 2.0% for the next decade and have actually been falling gradually over the last few months.

Inflation expectations are declining because US economic growth was expected to slow in 2019 and 2020. That’s precisely what’s happening, with leading economic indicators now pointing to steady but slower 2.6% growth in Q4 2018, and likely 2.5% growth in 2019 (2.0% expected in 2020).

Slower economic growth not just means less risk of inflation rising above the Fed’s target, but also now has the Fed worried above the economy. On November 14th Fed Chairman Jerome Powell said the following at a meeting at the Dallas Fed:

“So, you know, a good example is — a noneconomic example would be you’re walking through a room full of furniture and the lights go off. What do you do? You slow down. You stop, probably, and feel your way.” – Fed Chairman Jerome Powell

Specifically, Powell was talking about growing risks to the US economy, including the trade war, the fading of fiscal stimulus (tax cuts and increased government spending) in 2019 and beyond and the delayed effect of previous rate hikes (there have been eight so far).

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!