Texas Instruments yield has ranged from 0.9% to 3.5% and in March 2009 hit a peak of 3.2% when the market feared another global depression was imminent. Today’s yield of 3.2% is still a great time to add this wide-moat industry leader to your portfolio, as I did during the current correction. That’s because at current valuations Texas Instruments has very little potential downside, but massive upside (423% returns over the next decade).

BlackRock (BLK)

Yield: 3.1%

Fair Value Yield: 2.5%

Discount To Fair Value: 19%

Long-Term EPS/FCF Growth (Analyst Consensus): 13.7%

Valuation Adjusted Total Return Potential: 19%

BlackRock has fallen into a bear market along with other asset managers over fears that the rise of ever lower cost passive index funds will drive a race to the bottom that will gut the industry’s profitability. But the world’s largest asset manager ($6.44 trillion in assets under management) has precisely the kind of scale and vast financial resources to not just survive the continued growth of passive investing, but thrive in it, and continue delivering great long-term returns.

Thanks to the popularity of iShares, BlackRock commands 40% global passive ETF market share. It’s grown its AUM by 4.5% annually over the past five years, compared to just 0.7% for its 12 largest peers.

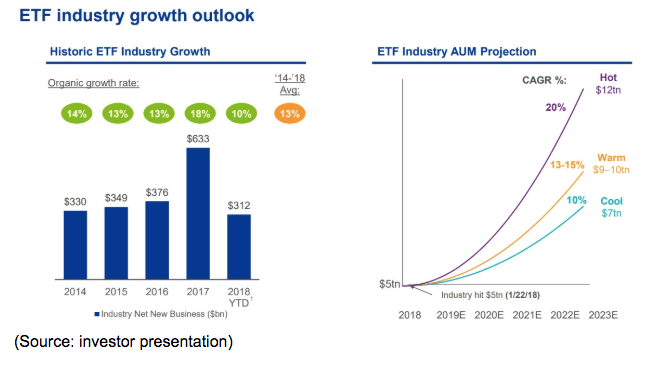

ETF AUM is expected to grow 10% to 20% annually over the next five years, and BlackRock has proven that its deep industry connections (with financial advisors and institutional money managers) mean that much of that industry growth will accrue to it. That’s courtesy of superior risk-management and data analysis software in its Aladdin platform.

This is an artificial intelligence-driven software platform that over 25,000 global fund managers already use and find essential. For example, according to Anthony Malloy, CEO of New York Life Investors ($238 billion AUM), “Aladdin is like oxygen. Without it, we wouldn’t be able to function”.

This lead in advanced risk-management technology is why, despite Fidelity launching zero expense ratio ETFs in recent months, iShares has actually seen the strongest asset inflows in five years. And the company continues to win major contracts with pension funds around the world, who are happy to pay its above-average fees (0.26% expense ratio) in exchange for working with the most trusted name in the industry and which can provide the best risk-management solutions.

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!