For years after the financial crisis, we keep hearing how we were experiencing “the most hated rally” ever, as both professionals and retail investors were licking their wounds and distrusting the extreme monetary policy that seemed to be artificially inflating asset prices.

Both groups eventually got (mostly) on board and market with a few hiccups stocks pushed onto all-time highs.

But, it seems that there is no divergence, Main Street is actually more positive than the ‘pros’ on Wall Street. This is highly unusual as the latter is typically the side pushing the former into being bullish and buying stocks.

So, what happened, and who will be right?

It seems that while the pain from last year’s December swoon is too fresh in their minds, according to money managers — it was viewed as a buying opportunity by retail investors.

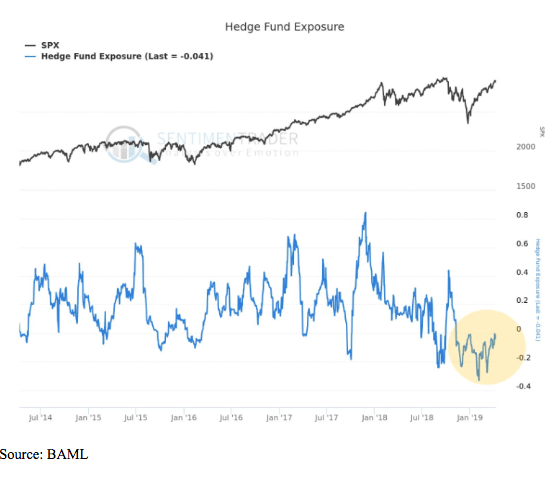

While brokerage firms such as Charles Schwab (SCHW) and Fidelity showed a net inflow in retail through the first 3 months of 2019. But, managed money and hedge funds have all taken down exposure, even as stocks have raced back to all-time highs.

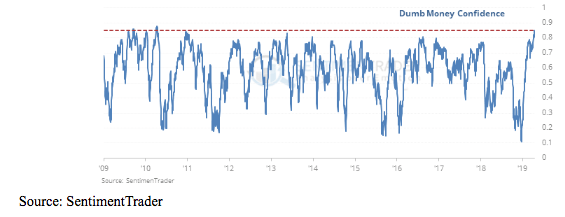

Meanwhile, retail investors have become increasingly confident. As Jason Goepfert on Sentiment Trader notes, his ‘dumb money’ reading is now at near all-time highs, writing, “Every date that saw this high of a reading in the past 20 years sported a negative return in the S&P 500 at some point between the next 2-8 weeks.”

On the other hand, BlackRock (BLK) CEO Larry Fink came on CNBC said: “We have a risk of a melt-up, not a meltdown here. Despite where the markets are in equities, we have not seen money being put to work.”

Today, we got the initial wave of earnings reports and with Dow names such as Coke (KO), United Technologies (UTX) and Procter & Gamble (PG) — all delivering better-than-expected numbers, as the major indices are right back at all-time highs.

If the good reports keep coming, Wall Street professional money managers will need to pile back into the market. And Main Street investors will already be there waiting to profit — what a change that would be if retail ended up selling to the pros at new highs.

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!