So, one could make the case that the late January/early February drop of 2018 was more like October 2014 and this could be like August/October 2015. The time periods are eerily similar too; the 2014-2015 period was 10 months apart and we are currently about nine months removed from the early 2018 lows.

Source: stockcharts.com

While the shape of the top is very different now from 2015, it looks like the October 2014 swoon and the subsequent rebound to a higher high that ultimately failed to hold looks similar as does the weak rebound and resumption of selling into October 2015 to the early 2018 decline and rebound.

Source:Stockcharts.com

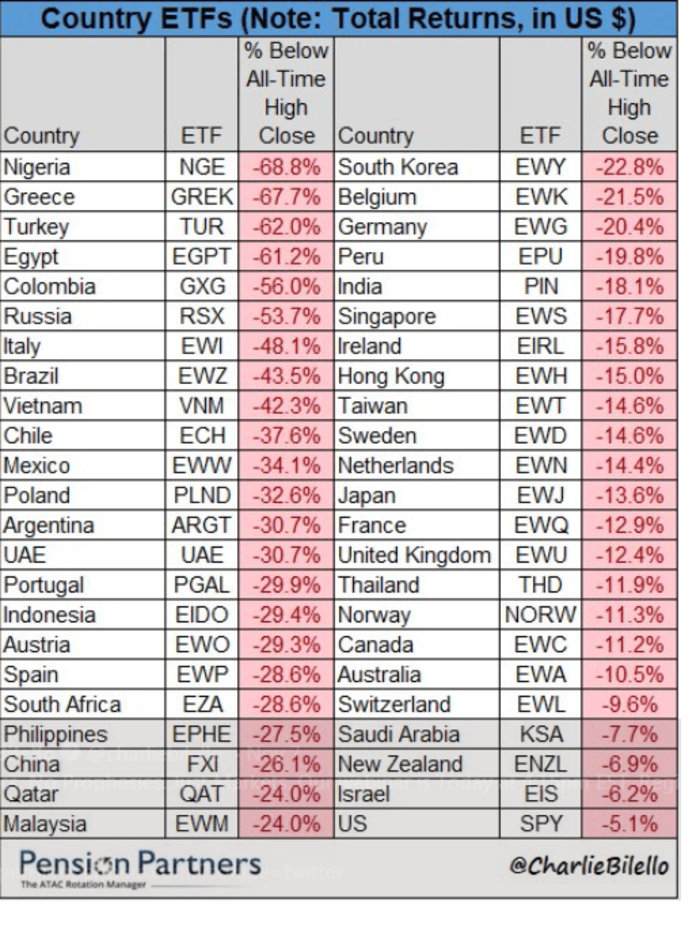

Other similarities include the decline in breadth which I characterized as a rolling bear market as numerous sectors have already declined by 25% or more.

All this is to say that if history is to repeat, or even rhyme, stocks could be in for very rough start to 2019.

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!